Investing in the S&P 500 is a popular strategy for individuals seeking exposure to the U.S. stock market. The S&P 500 Index represents the 500 largest publicly traded companies in the United States, covering various sectors such as technology, healthcare, and finance. By investing in this index, you gain access to a diversified portfolio that reflects the overall performance of the U.S. economy.

The S&P 500 is often considered a benchmark for the stock market, making it a favored choice among investors for both long-term growth and stability. This guide will walk you through the steps to effectively invest in the S&P 500, including understanding your options and making informed decisions.

| Key Aspects | Description |

|---|---|

| Index Composition | Tracks 500 of the largest U.S. companies |

| Investment Vehicles | Index funds and ETFs are common methods |

Understanding the S&P 500

The S&P 500 Index was established in 1957 and is maintained by S&P Dow Jones Indices. It includes companies selected based on their market capitalization, liquidity, and industry representation. The index is weighted by market capitalization, meaning larger companies have a greater impact on its performance.

Investing in the S&P 500 provides several advantages:

- Diversification: By investing in an index fund or ETF that tracks the S&P 500, you gain exposure to a wide range of companies across various sectors.

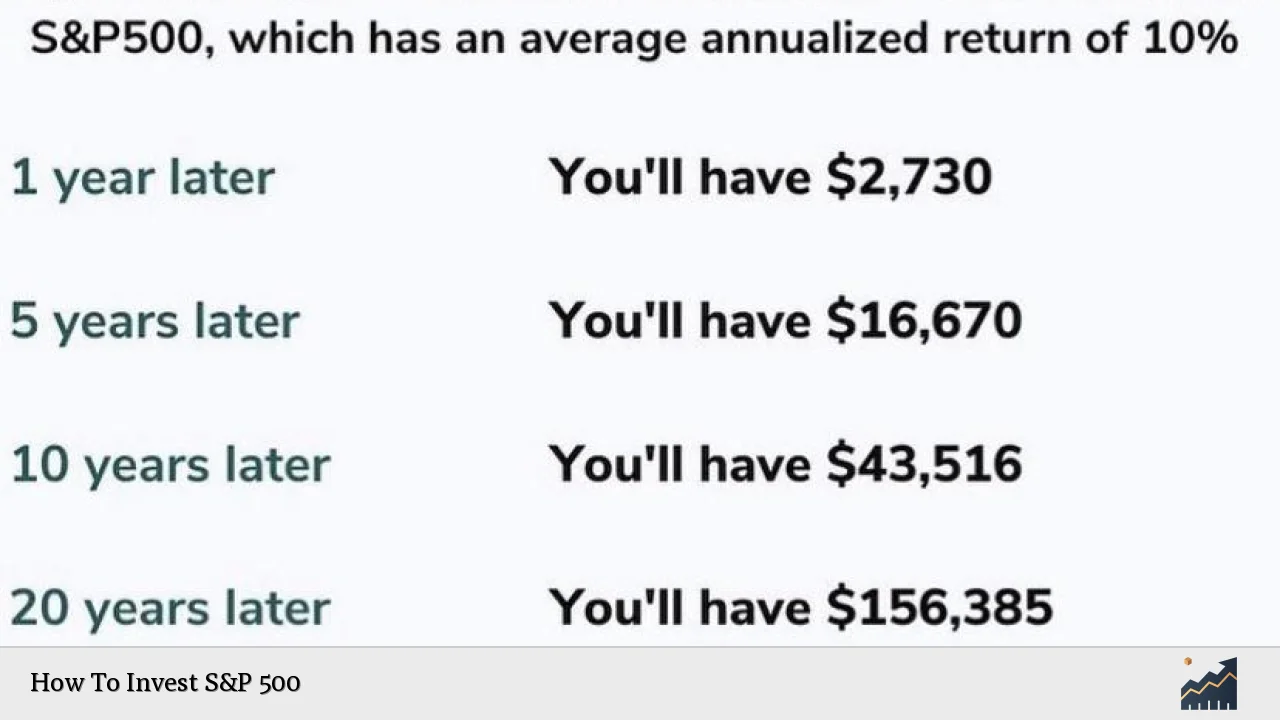

- Historical Performance: Historically, the S&P 500 has returned an average of about 10% annually, making it a solid long-term investment choice.

- Low Costs: Many S&P 500 index funds and ETFs have low expense ratios compared to actively managed funds.

However, it’s essential to be aware of potential downsides:

- Market Risk: Like all equity investments, investing in the S&P 500 carries risks associated with market volatility.

- Concentration in Large-Cap Stocks: The index is heavily weighted towards large-cap companies, which may limit exposure to smaller growth opportunities.

Choosing an Investment Vehicle

There are two primary ways to invest in the S&P 500:

- Index Funds: These mutual funds aim to replicate the performance of the S&P 500 by holding shares of all or most of its constituent stocks. They are typically passively managed and have lower fees than actively managed funds.

- Exchange-Traded Funds (ETFs): Similar to index funds, ETFs track the performance of the S&P 500 but trade like stocks on an exchange. This allows for more flexibility in buying and selling throughout the trading day.

When selecting an investment vehicle, consider factors such as:

- Expense Ratios: Lower fees can significantly impact your returns over time.

- Tracking Error: This measures how closely a fund’s performance matches that of its benchmark index. A lower tracking error indicates better performance alignment with the index.

- Investment Minimums: Some funds may require minimum investments that could affect your ability to invest.

Opening an Investment Account

To invest in the S&P 500, you’ll need to open an investment account. Here’s how:

1. Choose a Brokerage: Select a brokerage that offers access to S&P 500 index funds or ETFs. Look for features like user-friendly interfaces, low fees, and educational resources.

2. Complete Application Process: Fill out an application form with your personal information, financial details, and investment objectives.

3. Fund Your Account: Transfer money from your bank account into your brokerage account. Ensure you have enough capital for your intended investment.

4. Set Up Regular Contributions: Consider setting up automatic contributions to consistently build your investment over time.

Placing Your Order

Once your account is funded, you’re ready to invest:

1. Research Available Funds: Look for specific S&P 500 index funds or ETFs that fit your investment strategy.

2. Decide on Investment Amount: Determine how much you want to invest based on your financial situation and goals.

3. Place Your Order: Use your brokerage platform to place a buy order for your chosen fund or ETF. You can specify whether you want to buy at market price or set a limit order for a specific price point.

4. Monitor Your Investment: After purchasing, keep track of your investment’s performance and make adjustments as necessary based on market conditions or changes in your financial goals.

Strategies for Investing

When investing in the S&P 500, consider employing various strategies:

- Dollar-Cost Averaging: This involves investing a fixed amount regularly regardless of market conditions. It helps mitigate risks associated with market volatility.

- Long-Term Holding: Given its historical performance, holding onto your investments for several years can yield significant returns.

- Rebalancing Your Portfolio: Periodically review and adjust your portfolio to maintain your desired asset allocation and risk level.

Risks Associated with Investing

While investing in the S&P 500 can be lucrative, it’s crucial to understand associated risks:

- Market Volatility: Prices can fluctuate significantly due to economic changes or geopolitical events.

- Interest Rate Changes: Rising interest rates can negatively impact stock prices as borrowing costs increase for companies.

- Sector Concentration Risks: The index may be heavily influenced by specific sectors (like technology), which could lead to underperformance if those sectors decline.

FAQs About How To Invest S&P 500

- What is the best way to invest in the S&P 500?

The best way is through low-cost index funds or ETFs that track its performance. - Can I invest directly in the S&P 500?

No, you cannot invest directly; you must use an index fund or ETF that tracks it. - How much should I invest in the S&P 500?

Your investment amount should depend on your financial situation and goals. - Is investing in the S&P 500 safe?

While it offers diversification, it still carries risks associated with stock market volatility. - What are some popular ETFs for investing in the S&P 500?

Popular options include SPDR S&P 500 ETF Trust (SPY) and Vanguard S&P 500 ETF (VOO).

Investing in the S&P 500 can be a straightforward yet effective method for building wealth over time. By understanding how this index operates and following these practical steps, you can position yourself for potential long-term gains while managing risk effectively.