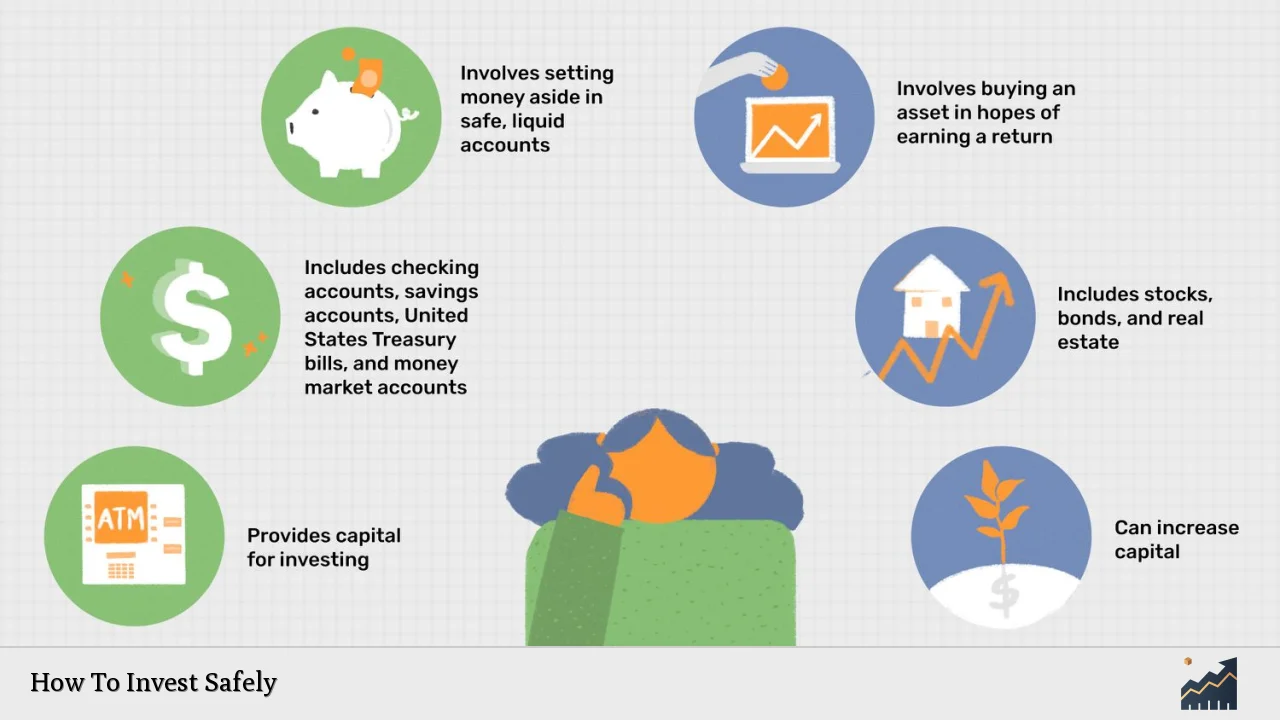

Investing safely is crucial for individuals looking to grow their wealth while minimizing the risk of loss. It involves understanding various investment options, assessing their risk levels, and making informed decisions that align with personal financial goals. The key to safe investing lies in diversification, research, and a clear understanding of one’s risk tolerance. By following a structured approach, investors can build a portfolio that not only aims for growth but also protects their capital.

Safe investing is particularly important in today’s economic climate, where market volatility can pose significant risks. Investors must be aware of the different types of investments available and how to choose those that offer stability and security. This guide will explore various strategies and options for safe investing, providing practical steps to help you navigate the investment landscape effectively.

| Investment Type | Risk Level |

|---|---|

| U.S. Treasury Securities | Very Low |

| High-Yield Savings Accounts | Low |

| Certificates of Deposit (CDs) | Low |

| Bond Funds | Moderate |

| Index Funds | Moderate |

Understanding Risk Tolerance

Understanding your risk tolerance is a fundamental step in safe investing. Risk tolerance refers to your ability and willingness to endure fluctuations in the value of your investments. It is influenced by factors such as age, income, financial goals, and investment experience.

Younger investors may have a higher risk tolerance because they have more time to recover from potential losses. In contrast, older investors or those nearing retirement typically prefer safer investments to preserve capital and generate steady income.

To assess your risk tolerance, consider the following:

- Your financial goals: Are you investing for long-term growth or short-term gains?

- Your investment timeline: How long can you leave your money invested?

- Your emotional response to market fluctuations: How would you react if your investments lost value?

By evaluating these factors, you can determine an appropriate investment strategy that aligns with your comfort level regarding risk.

Diversification: The Key to Safety

Diversification is one of the most effective strategies for reducing investment risk. It involves spreading your investments across various asset classes, sectors, and geographical regions. By diversifying, you minimize the impact of poor performance in any single investment on your overall portfolio.

Here are some key points about diversification:

- Asset Classes: Include a mix of stocks, bonds, real estate, and cash equivalents in your portfolio.

- Sectors: Invest in different industries such as technology, healthcare, consumer goods, and utilities.

- Geographical Regions: Consider international investments to reduce exposure to domestic market risks.

A well-diversified portfolio can provide more stable returns over time and reduce the likelihood of significant losses during market downturns.

Low-Risk Investment Options

For those prioritizing safety, several low-risk investment options are available. These investments typically offer lower returns but come with reduced risk:

- U.S. Treasury Securities: These are government-backed bonds considered one of the safest investments available.

- High-Yield Savings Accounts: These accounts offer higher interest rates than traditional savings accounts while keeping funds easily accessible.

- Certificates of Deposit (CDs): CDs provide fixed interest rates over specific terms and are insured by the FDIC up to certain limits.

- Bond Funds: These funds invest in a diversified portfolio of bonds, providing steady income with moderate risk.

- Index Funds: These funds track specific market indices and offer broad market exposure with lower fees than actively managed funds.

By incorporating these low-risk options into your investment strategy, you can achieve a balance between safety and growth potential.

Creating an Investment Plan

Developing a comprehensive investment plan is essential for successful investing. This plan should outline your financial goals, risk tolerance, and strategies for achieving those goals. Here are some steps to create an effective investment plan:

1. Define Your Goals: Identify what you want to achieve through investing—whether it’s saving for retirement, buying a home, or funding education.

2. Assess Your Financial Situation: Take stock of your current assets, liabilities, income sources, and expenses to understand how much you can invest.

3. Determine Your Time Horizon: Establish how long you plan to invest before needing access to your funds.

4. Choose an Investment Strategy: Based on your goals and risk tolerance, decide on an appropriate mix of assets that aligns with your objectives.

5. Monitor and Adjust Your Plan: Regularly review your investments and make adjustments as necessary based on changes in your financial situation or market conditions.

By following these steps, you can create a solid investment plan that helps you stay focused on your financial goals while managing risks effectively.

Importance of Research

Conducting thorough research before making any investment decisions is crucial for safe investing. This research should include analyzing potential investments’ historical performance, fees, risks, and market conditions.

Here are some research strategies:

- Read Financial News: Stay informed about market trends and economic developments that could impact your investments.

- Utilize Investment Rating Tables: These tables provide insights into various investments based on performance metrics and ratings from reputable agencies.

- Consult Financial Advisors: If you’re unsure about specific investments or strategies, consider seeking advice from qualified financial professionals who can provide personalized guidance.

By being diligent in your research efforts, you can make informed decisions that enhance the safety of your investment portfolio.

Monitoring Your Investments

Once you’ve made investments, it’s essential to regularly monitor their performance. This involves reviewing both individual assets and the overall portfolio’s alignment with your financial goals.

Key aspects of monitoring include:

- Performance Evaluation: Compare actual returns against benchmarks or expected performance metrics.

- Rebalancing: Adjust your asset allocation periodically to maintain alignment with your original investment strategy as market conditions change.

- Staying Informed: Keep abreast of any changes in the economic landscape or specific sectors that could affect your investments.

Regular monitoring ensures that you remain proactive in managing risks while maximizing opportunities for growth.

FAQs About How To Invest Safely

- What is the safest type of investment?

The safest types of investments include U.S. Treasury securities and high-yield savings accounts. - How can I assess my risk tolerance?

You can assess your risk tolerance by considering factors like age, financial goals, and emotional responses to market fluctuations. - What does diversification mean?

Diversification means spreading investments across different asset classes to reduce overall risk. - Why is research important before investing?

Research helps investors understand potential risks and rewards associated with different investment options. - How often should I monitor my investments?

You should monitor your investments regularly—at least quarterly—to ensure they align with your financial goals.

Investing safely requires careful planning and consideration of various factors that influence both risks and returns. By understanding your risk tolerance, diversifying effectively, choosing low-risk options wisely, creating a solid investment plan, conducting thorough research, and monitoring performance regularly, you can build a secure financial future while minimizing potential losses.