Investing retirement money is a crucial step in securing your financial future. As you approach retirement, it’s essential to develop a strategy that balances growth potential with risk management. This article will guide you through the key aspects of investing your retirement savings effectively, helping you make informed decisions to achieve your long-term financial goals.

Retirement investing requires a different approach compared to other types of investing. Your focus should be on preserving capital while generating steady income to support your lifestyle during retirement years. The right investment strategy depends on various factors, including your age, risk tolerance, and financial objectives.

Here’s a quick overview of some popular retirement investment options:

| Investment Type | Risk Level |

|---|---|

| Stocks | Higher |

| Bonds | Lower |

| Mutual Funds | Varies |

| Real Estate | Moderate |

| Annuities | Lower |

Diversification: The Key to Retirement Investing

One of the most important principles in retirement investing is diversification. By spreading your investments across different asset classes, you can minimize risk and potentially increase returns. A well-diversified portfolio typically includes a mix of stocks, bonds, and other investment vehicles.

Stocks offer the potential for higher returns but come with greater volatility. They can be an essential component of your retirement portfolio, especially if you have a longer time horizon. Blue-chip stocks from established companies often provide stable dividends, which can be reinvested to compound your returns over time.

Bonds, on the other hand, offer more stability and regular income. They’re generally considered lower-risk investments, making them attractive for retirees or those nearing retirement. Government bonds are typically the safest, while corporate bonds may offer higher yields with slightly more risk.

Mutual funds and exchange-traded funds (ETFs) can provide instant diversification by pooling money from many investors to purchase a variety of stocks, bonds, or other securities. These can be excellent options for retirement investors who want professional management and diversification without the need to select individual securities.

The Role of Asset Allocation

Asset allocation is the process of dividing your investments among different asset categories. The right allocation depends on your risk tolerance, investment timeline, and financial goals. A common rule of thumb is to subtract your age from 100 to determine the percentage of your portfolio that should be in stocks, with the remainder in bonds and cash equivalents.

However, this rule may be too conservative for many investors, especially given increased life expectancies. A more nuanced approach might involve:

- Maintaining a higher allocation to stocks in early retirement years to support long-term growth

- Gradually shifting towards more conservative investments as you age

- Keeping a portion of your portfolio in cash or cash equivalents for short-term needs and emergencies

Retirement Account Options

When investing for retirement, it’s crucial to understand the various account options available and their tax implications. Here are some popular retirement account types:

- 401(k) Plans: Employer-sponsored retirement accounts that often come with matching contributions

- Traditional IRAs: Individual retirement accounts that offer tax-deductible contributions and tax-deferred growth

- Roth IRAs: After-tax contributions with tax-free withdrawals in retirement

- SEP IRAs: Simplified Employee Pension plans for self-employed individuals and small business owners

Each of these accounts has its own contribution limits, withdrawal rules, and tax treatment. It’s often beneficial to maximize contributions to tax-advantaged accounts before investing in taxable brokerage accounts.

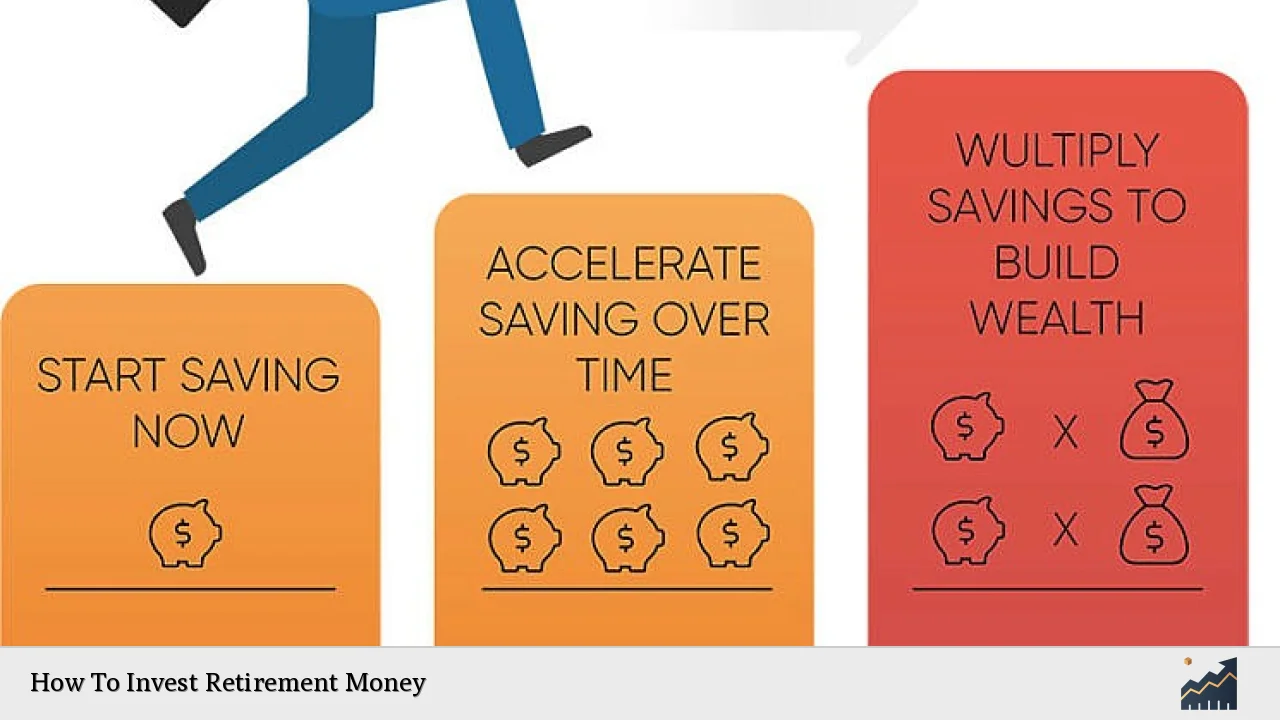

The Power of Compound Interest

One of the most powerful tools in retirement investing is compound interest. This occurs when you earn returns not just on your initial investment, but also on the accumulated interest over time. The earlier you start investing, the more time your money has to compound and grow.

For example, if you invest $10,000 at age 25 with an average annual return of 7%, it could grow to over $100,000 by age 65 without any additional contributions. This demonstrates the importance of starting to invest for retirement as early as possible.

Strategies for Different Life Stages

Your retirement investment strategy should evolve as you progress through different life stages:

Early Career (20s-30s)

- Focus on aggressive growth with a higher allocation to stocks

- Take advantage of employer-sponsored retirement plans and maximize contributions

- Consider opening a Roth IRA for tax-free growth potential

Mid-Career (40s-50s)

- Begin to shift towards a more balanced portfolio with a mix of stocks and bonds

- Increase contributions to catch up on retirement savings if needed

- Consider additional investment vehicles like real estate or annuities for diversification

Near Retirement (Late 50s-60s)

- Shift towards more conservative investments to protect your wealth

- Focus on income-generating assets like dividend stocks and bonds

- Consider long-term care insurance to protect your retirement savings

In Retirement

- Maintain a diversified portfolio with a focus on income and capital preservation

- Implement a withdrawal strategy that balances your income needs with long-term growth

- Regularly review and adjust your investments to ensure they align with your changing needs

Managing Risk in Retirement Investing

While seeking growth is important, managing risk becomes increasingly crucial as you approach and enter retirement. Here are some strategies to help mitigate risk:

- Dollar-cost averaging: Invest a fixed amount regularly to smooth out market fluctuations

- Rebalancing: Periodically adjust your portfolio to maintain your desired asset allocation

- Bucket strategy: Divide your portfolio into short-term, medium-term, and long-term buckets to match your income needs

- Inflation protection: Include investments that can keep pace with inflation, such as Treasury Inflation-Protected Securities (TIPS) or real estate

Remember that while reducing risk is important, being too conservative can also be risky. Inflation can erode the purchasing power of overly conservative investments over time.

The Importance of Professional Advice

Investing for retirement can be complex, and the stakes are high. Consider working with a financial advisor who can help you develop a personalized retirement investment strategy. They can provide valuable insights on:

- Optimizing your investment portfolio

- Tax-efficient investing strategies

- Estate planning and wealth transfer

- Adjusting your strategy as your life circumstances change

Look for advisors who are fiduciaries, meaning they are legally obligated to act in your best interest. Be sure to understand their fee structure and credentials before engaging their services.

FAQs About How To Invest Retirement Money

- How much should I be saving for retirement?

Aim to save at least 15% of your income, including any employer contributions. - Is it too late to start investing for retirement in my 50s?

It’s never too late, but you may need to save more aggressively and consider working longer. - Should I pay off debt before investing for retirement?

Focus on high-interest debt first, but try to balance debt repayment with retirement savings. - How often should I review my retirement investments?

Review your portfolio at least annually and rebalance as needed to maintain your target asset allocation. - Can I withdraw from my retirement accounts before age 59½?

Early withdrawals often incur penalties, but there are some exceptions for specific circumstances.

Investing for retirement requires careful planning and ongoing management. By understanding the principles of diversification, asset allocation, and risk management, you can create a robust investment strategy that supports your retirement goals. Remember to start early, stay consistent, and seek professional advice when needed. With the right approach, you can build a retirement portfolio that provides financial security and peace of mind for your golden years.