Investing in pre-initial public offering (IPO) shares offers an exciting opportunity for investors to acquire stakes in companies before they go public. This investment strategy allows individuals to buy shares at potentially lower prices than what they may be once the company lists on a stock exchange. However, pre-IPO investing is not without its challenges and risks. Understanding the process, benefits, and potential pitfalls is crucial for anyone looking to navigate this investment landscape effectively.

Pre-IPO shares are typically available to a limited group of investors, including high-net-worth individuals (HNWIs), venture capitalists, and institutional investors. These shares are sold before the company officially lists on a public exchange, often at a discount to the anticipated IPO price. The allure of significant returns draws many investors to this space, especially as more companies seek to go public.

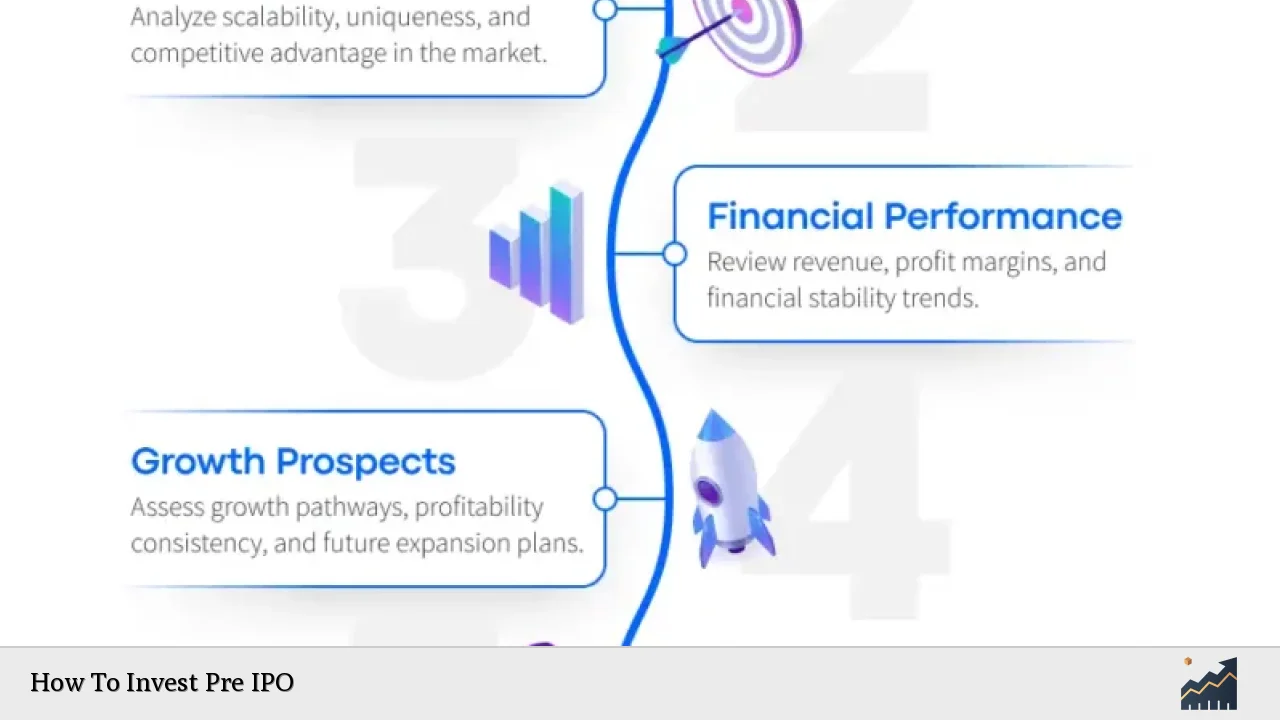

The process of investing in pre-IPO shares can be complex and requires thorough research and due diligence. Investors must evaluate the company’s financial health, growth potential, and industry position. Additionally, understanding the regulatory environment and market conditions can help mitigate risks associated with these investments.

| Aspect | Description |

|---|---|

| Pre-IPO Shares | Shares sold before a company goes public |

| Target Investors | High-net-worth individuals, venture capitalists, institutional investors |

Understanding Pre-IPO Investing

Pre-IPO investing involves purchasing shares in a company before it officially goes public. This investment strategy is appealing because it allows early access to potentially high-growth companies at lower prices than those available post-IPO. The main goal for investors is to capitalize on the anticipated increase in share value once the company lists on a stock exchange.

Investors often gain access to pre-IPO shares through private placements or venture capital funds. These investments typically require substantial capital and are generally limited to accredited investors who meet specific financial criteria set by regulatory bodies.

Investing in pre-IPO companies can be lucrative but comes with inherent risks. The lack of historical data on the company’s performance can make it challenging to assess its future potential accurately. Additionally, market conditions can change rapidly, impacting the company’s valuation and share price once it goes public.

Investors should also be aware of the lock-up periods that often accompany pre-IPO investments. These periods prevent investors from selling their shares immediately after the IPO, which can limit liquidity and impact investment strategies.

Steps to Invest in Pre-IPO Companies

To successfully invest in pre-IPO shares, follow these essential steps:

- Research Companies: Identify companies planning to go public and analyze their business models, financial health, and growth prospects.

- Accredited Investor Status: Ensure you meet the criteria for being an accredited investor as defined by regulatory authorities.

- Choose Investment Platforms: Select reputable platforms or brokers that provide access to pre-IPO shares. Some well-known platforms include equity crowdfunding sites and venture capital firms.

- Understand Terms: Familiarize yourself with the terms of investment, including pricing, lock-up periods, and any associated fees.

- Conduct Due Diligence: Thoroughly evaluate the company’s financial statements, management team, competitive landscape, and market conditions before making an investment decision.

Investing in pre-IPO shares requires careful planning and consideration of various factors that could influence your investment’s success.

Benefits of Pre-IPO Investing

Investing in pre-IPO companies presents several advantages that can enhance your portfolio:

- Potential for High Returns: Early investments in successful companies can yield substantial profits when these firms go public.

- Access to Innovative Companies: Pre-IPO investments often involve startups or firms developing groundbreaking technologies that may disrupt existing markets.

- Discounted Share Prices: Investors typically purchase shares at lower valuations compared to post-IPO prices, increasing potential profit margins.

- Diversification Opportunities: Including pre-IPO stocks in your portfolio allows for diversification beyond traditional equities and bonds.

While these benefits are enticing, it’s crucial to weigh them against the risks involved in pre-IPO investing.

Risks Associated with Pre-IPO Investing

Despite its potential rewards, pre-IPO investing carries significant risks that investors should consider:

- Illiquidity: Pre-IPO shares are not publicly traded until after the IPO, which can make it challenging to sell your investment if needed.

- Valuation Uncertainty: The valuation of pre-IPO companies is often based on projections rather than historical performance, increasing risk.

- Market Volatility: Economic downturns or unfavorable market conditions can negatively impact a company’s IPO success and subsequent stock performance.

Investors must conduct thorough due diligence and remain aware of these risks when considering pre-IPO opportunities.

How to Find Pre-IPO Investment Opportunities

Finding viable pre-IPO investment opportunities requires strategic research and networking:

- Networking: Connect with venture capitalists or angel investors who may have insights into upcoming IPOs or investment rounds.

- Investment Platforms: Utilize online platforms that specialize in connecting investors with pre-IPO opportunities. Some platforms allow smaller investments through pooled funds.

- Follow Market Trends: Stay informed about industry trends and emerging companies through financial news outlets and market analysis reports.

By actively seeking out opportunities and leveraging available resources, investors can position themselves favorably within the pre-IPO landscape.

FAQs About How To Invest Pre IPO

- What is a pre-IPO investment?

A pre-IPO investment involves purchasing shares in a company before it goes public. - Who can invest in pre-IPOs?

Typically high-net-worth individuals or accredited investors have access to pre-IPOs. - What are the risks of investing in pre-IPOs?

The main risks include illiquidity, valuation uncertainty, and market volatility. - How do I find pre-IPOs?

You can find pre-IPOs through networking with investors or using specialized online platforms. - Are there minimum investments for pre-IPOs?

Minimum investments vary by platform but are generally higher than traditional stock purchases.

Investing in pre-IPOs offers a unique opportunity for growth but requires careful consideration of various factors. By understanding how this market operates and conducting thorough research, you can make informed decisions that align with your financial goals.