Investing through Cash App has become increasingly popular due to its user-friendly interface and accessibility, particularly for beginners. Cash App allows users to invest in stocks and Bitcoin, providing a simple platform to manage investments alongside everyday transactions. This guide will delve into the various aspects of investing on Cash App, including market analysis, implementation strategies, risk considerations, regulatory aspects, and future outlook.

| Key Concept | Description/Impact |

|---|---|

| Fractional Shares | Cash App enables users to purchase fractional shares, allowing investment with as little as $1. This lowers the barrier to entry for new investors. |

| Auto Invest | This feature allows users to automate their investments on a set schedule, which can help in dollar-cost averaging and consistent investment habits. |

| Market Hours | Investments can be made 24/7, but trades are executed only during U.S. market hours (9:30 AM – 4 PM ET). |

| Bitcoin Integration | Cash App provides a seamless way to buy and sell Bitcoin, which has become a significant revenue source for the platform. |

| User Growth | The app’s user base has grown significantly, reaching approximately 55 million monthly active users in 2023, indicating strong engagement and potential for future growth. |

Market Analysis and Trends

The landscape of digital finance is rapidly evolving, with Cash App emerging as a key player in the fintech sector. In 2023, Cash App reported a revenue of $14.3 billion, marking a 34.9% increase from the previous year. This growth is driven by an expanding user base and increased monetization strategies, particularly through Bitcoin transactions and stock trading features.

Current Market Statistics

- User Base: Over 55 million active users as of 2023.

- Revenue Growth: Cash App’s revenue has increased significantly over the past few years, from $0.4 billion in 2018 to $14.3 billion in 2023.

- Bitcoin Revenue: In 2023 alone, Cash App generated approximately $9.5 billion from Bitcoin transactions.

These statistics highlight not only the app’s popularity but also its ability to adapt to changing market demands by integrating diverse financial services.

Implementation Strategies

Investing on Cash App can be broken down into several straightforward steps:

- Create an Account: Download the app and set up your account by linking a bank account or debit card.

- Fund Your Account: Transfer funds into your Cash App balance to start investing.

- Explore Investment Options:

- Stocks: Search for stocks by company name or ticker symbol.

- Bitcoin: Buy or sell Bitcoin directly through the app.

- Choose Investment Amounts:

- Use the option to buy fractional shares if you want to invest smaller amounts.

- Set up Auto Invest for scheduled purchases.

- Monitor Your Portfolio: Regularly check your investments through the Investing tab to track performance and make adjustments as needed.

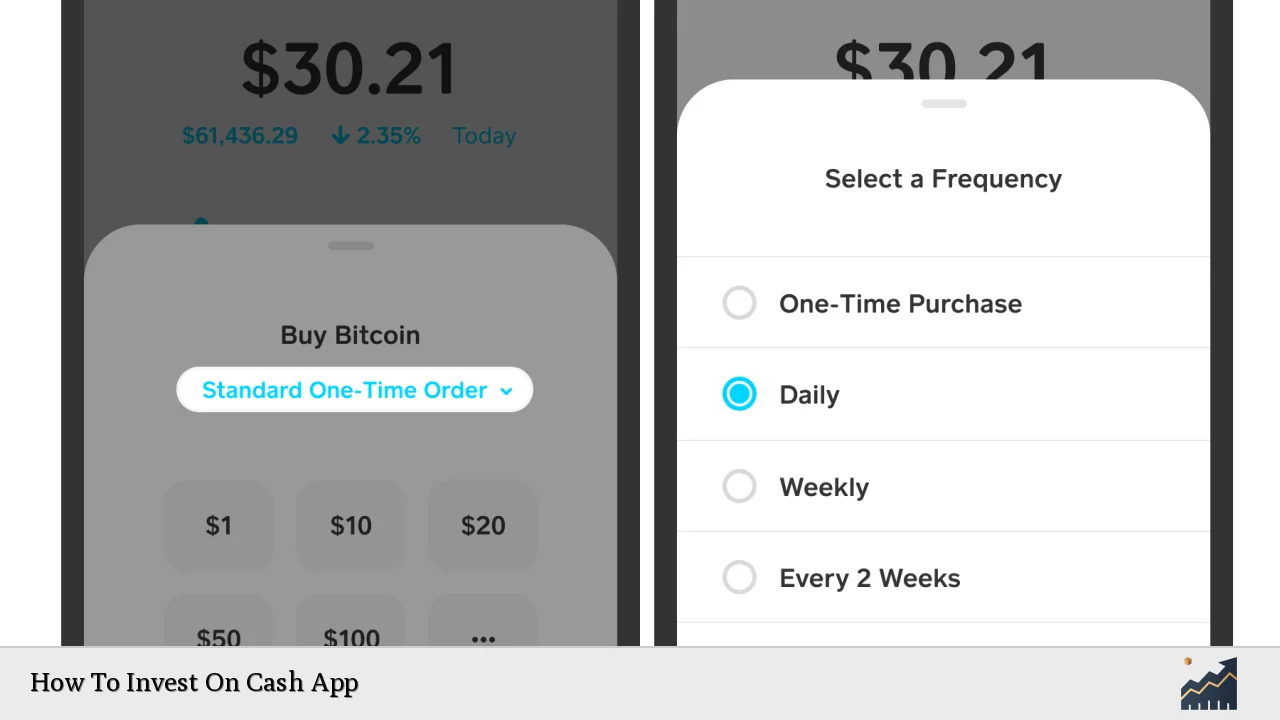

Auto Invest Feature

The Auto Invest feature allows users to set regular investment amounts at specified intervals (daily, weekly, or bi-weekly). This strategy promotes disciplined investing and helps mitigate market volatility effects through dollar-cost averaging.

Risk Considerations

While investing via Cash App offers numerous advantages, it is essential to understand the inherent risks involved:

- Market Volatility: Stock prices can fluctuate significantly; therefore, investments can lead to losses.

- Regulatory Risks: Changes in regulations affecting cryptocurrency or stock trading could impact operations.

- Security Risks: As with any digital platform, there is a risk of fraud or hacking incidents. Users should employ strong security measures such as two-factor authentication.

It is advisable for investors to conduct thorough research or consult with financial advisors before making significant investment decisions.

Regulatory Aspects

Cash App operates under various regulatory frameworks designed to protect consumers:

- Compliance with FinCEN: Cash App adheres to anti-money laundering (AML) laws and Know Your Customer (KYC) requirements.

- Securities Regulations: As an investment platform offering stocks and ETFs, Cash App must comply with SEC regulations governing trading practices.

Understanding these regulations can help investors navigate potential legal considerations when using the platform for investments.

Future Outlook

The future of investing on Cash App appears promising due to several factors:

- Expansion of Services: The integration of additional financial services (e.g., loans or savings accounts) could enhance user engagement and retention.

- Increased User Adoption: With ongoing marketing efforts and feature enhancements, Cash App is likely to attract more users, particularly younger demographics interested in digital finance solutions.

- Market Positioning: As competition intensifies among fintech platforms like Venmo and Robinhood, Cash App’s unique offerings (e.g., Bitcoin trading) may help maintain its competitive edge.

Frequently Asked Questions About How To Invest On Cash App

- What types of investments can I make on Cash App?

You can invest in stocks (including fractional shares) and Bitcoin. - Is there a minimum amount required to start investing?

You can start investing with as little as $1 due to fractional shares. - How does Auto Invest work?

You can set up automatic purchases of stocks at regular intervals (daily, weekly) using preset or custom amounts. - Are there fees associated with investing on Cash App?

Cash App does not charge commissions for stock trades; however, there may be fees related to Bitcoin transactions. - Can I sell my stocks anytime?

Yes, you can sell your stocks during market hours; proceeds will be credited back to your Cash App balance. - What security measures are in place on Cash App?

Cash App employs encryption technology and offers two-factor authentication for user accounts. - How do I track my investments?

You can monitor your portfolio through the Investing tab within the app. - Is it safe to invest in Bitcoin on Cash App?

While investing in Bitcoin carries inherent risks due to market volatility, Cash App implements security measures to protect user funds.

Investing on Cash App presents an accessible opportunity for individuals looking to enter the financial markets. By understanding market trends, implementing effective strategies, managing risks appropriately, and adhering to regulatory guidelines, investors can leverage this platform effectively while potentially achieving their financial goals.