Investing in New Zealand can be a rewarding venture, whether you’re a local resident or an international investor. The country offers diverse opportunities across various sectors, including real estate, shares, managed funds, and more. Understanding the investment landscape is crucial for making informed decisions that align with your financial goals.

New Zealand’s economy is characterized by its stability, transparency, and robust regulatory framework. This environment attracts both domestic and foreign investments. The most common forms of investments among New Zealanders include KiwiSaver, shares, and property. KiwiSaver is particularly significant as it encourages long-term savings for retirement through a government-backed scheme.

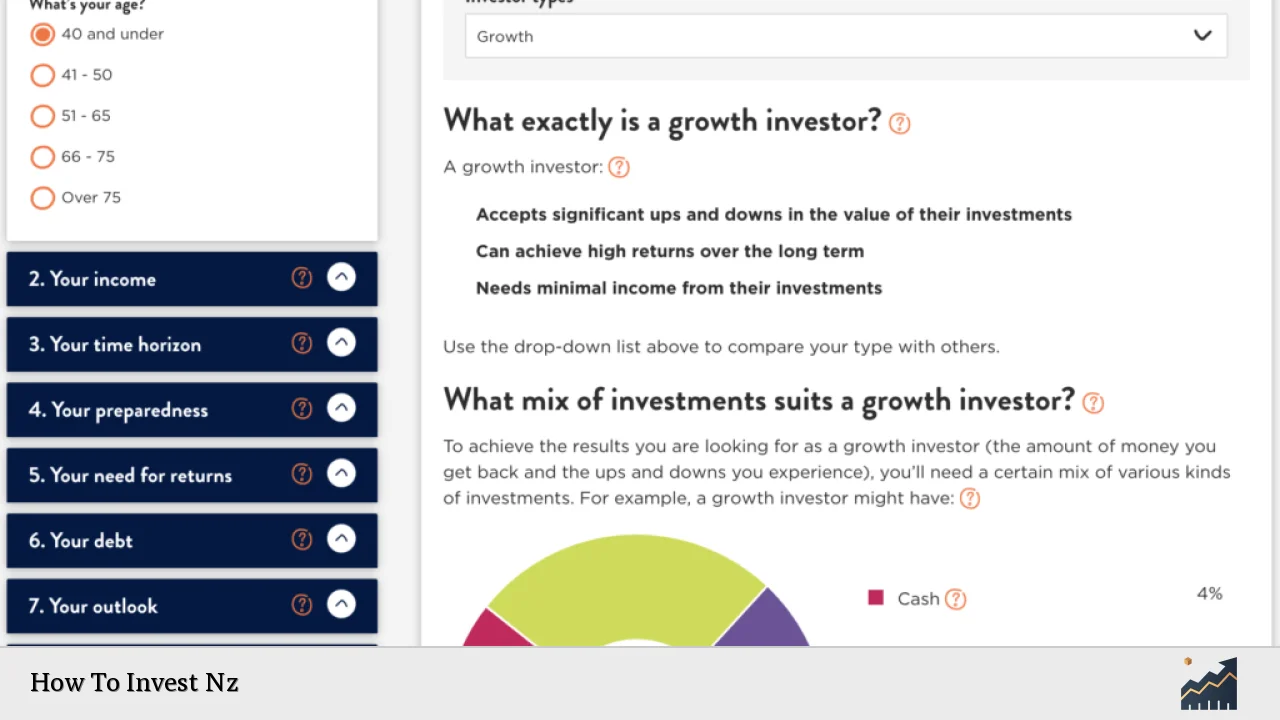

Investors should consider their risk tolerance, investment horizon, and the types of assets they wish to include in their portfolios. Diversification is a key strategy to mitigate risks while maximizing potential returns. Below is a table summarizing key investment types available in New Zealand.

| Investment Type | Description |

|---|---|

| KiwiSaver | A retirement savings scheme with government contributions. |

| Shares | Ownership in companies traded on the stock exchange. |

| Real Estate | Investment in residential or commercial properties. |

| Bonds | Loans to companies or governments for fixed returns. |

| Managed Funds | Pooled investments managed by professionals. |

Understanding Investment Options

Investors in New Zealand have access to various investment options that cater to different financial goals and risk appetites. Each option has its unique characteristics, potential returns, and associated risks.

KiwiSaver

KiwiSaver is a voluntary savings scheme designed to help New Zealanders save for retirement. It is widely popular due to government incentives such as matching contributions and tax benefits. Contributions can be made through payroll deductions or direct payments, and funds are typically invested in a mix of assets managed by fund providers.

- Benefits: Government contributions boost savings.

- Considerations: Funds are generally locked until retirement age.

Shares

Investing in shares means purchasing ownership stakes in publicly traded companies. This can be done through the New Zealand Stock Exchange (NZX) or via online trading platforms. Share prices fluctuate based on market conditions, making this option suitable for those willing to accept higher risks for potentially greater rewards.

- Benefits: Potential for high returns through capital gains and dividends.

- Considerations: Market volatility can lead to significant losses.

Real Estate

The real estate market remains a favored investment avenue in New Zealand. Investors can buy residential properties for rental income or capital appreciation. The market has shown resilience over time, although it requires substantial initial capital and ongoing management.

- Benefits: Tangible asset with potential for steady income.

- Considerations: Requires significant capital and involves maintenance costs.

Bonds

Bonds are fixed-income securities where investors lend money to corporations or governments in exchange for periodic interest payments plus the return of the bond’s face value at maturity. They are generally considered lower-risk investments compared to stocks.

- Benefits: Stable income with lower risk.

- Considerations: Lower returns compared to equities.

Managed Funds

Managed funds pool money from multiple investors to invest in a diversified portfolio of assets, managed by professional fund managers. This option is ideal for those who prefer a hands-off approach to investing.

- Benefits: Professional management and diversification.

- Considerations: Management fees can reduce overall returns.

Steps to Start Investing

Starting your investment journey in New Zealand involves several practical steps that can help you make informed choices tailored to your financial situation.

Step 1: Define Your Goals

Before investing, clearly define your financial goals. Are you saving for retirement, a major purchase, or simply looking to grow your wealth? Understanding your objectives will guide your investment decisions.

Step 2: Assess Your Risk Tolerance

Evaluate how much risk you are willing to take. Different investments come with varying levels of risk; knowing your comfort level will help you choose suitable options.

Step 3: Research Investment Options

Take time to research different investment types available in New Zealand. Consider factors such as historical performance, potential returns, and market conditions before making decisions.

Step 4: Create a Diversified Portfolio

To mitigate risks, create a diversified portfolio that includes various asset classes such as stocks, bonds, real estate, and managed funds. This strategy helps balance potential losses with gains from other investments.

Step 5: Start Small

If you are new to investing, consider starting with smaller amounts before committing larger sums. This allows you to gain experience without exposing yourself to significant risks.

Step 6: Monitor Your Investments

Regularly review your investment portfolio to ensure it aligns with your goals and market conditions. Adjustments may be necessary based on performance and changes in your financial situation.

Legal Considerations for Investors

Investing in New Zealand involves understanding the legal framework that governs various investment activities. Compliance with local laws ensures that investors operate within legal boundaries while protecting their interests.

Regulatory Bodies

The Financial Markets Authority (FMA) oversees the financial markets in New Zealand, ensuring fair practices and protecting investors from fraud. Familiarizing yourself with FMA regulations is essential for compliance.

Tax Implications

Understanding tax obligations related to your investments is crucial. Different investment types may have varying tax treatments; consulting a tax professional can provide clarity on how taxes may affect your returns.

Overseas Investment Regulations

For international investors looking to invest in New Zealand property or businesses, it’s essential to comply with the Overseas Investment Act (OIA). This legislation governs foreign investments and outlines specific requirements that must be met before proceeding with investments.

Common Mistakes to Avoid

Investing can be complex, and avoiding common pitfalls can enhance your chances of success. Here are some mistakes that new investors often make:

- Lack of Research: Failing to thoroughly research investment options can lead to poor decisions.

- Emotional Investing: Allowing emotions to dictate investment choices can result in impulsive actions that harm long-term strategies.

- Ignoring Fees: Overlooking management fees associated with certain investments can erode profits over time.

- Neglecting Diversification: Concentrating investments in one area increases risk; diversification helps mitigate this.

- Timing the Market: Trying to predict market movements often leads to missed opportunities; instead, focus on long-term strategies.

FAQs About How To Invest Nz

- What is the best way to start investing in New Zealand?

Begin by defining your financial goals and assessing your risk tolerance before exploring various investment options. - Is KiwiSaver a good investment?

Yes, KiwiSaver offers government contributions and tax benefits while promoting long-term savings for retirement. - Can foreigners invest in New Zealand?

Yes, but they must comply with the Overseas Investment Act regulations. - What are the risks associated with investing?

Risks vary by asset type; stocks tend to be more volatile while bonds offer more stability. - How important is diversification?

Diversification is crucial as it helps spread risk across different asset classes.

Investing in New Zealand offers numerous opportunities across various sectors. By understanding the available options and following strategic steps, investors can build robust portfolios that align with their financial aspirations while navigating the unique landscape of New Zealand’s economy effectively.