Investing in the National Pension System (NPS) online is a straightforward process that allows individuals to secure their financial future through a structured retirement savings plan. NPS is a government-backed pension scheme in India that offers citizens the opportunity to invest in a diversified portfolio, including equities, government bonds, and corporate debt. This system is designed to provide old-age income and is open to all Indian citizens aged between 18 and 70 years.

To invest in NPS online, you need to have certain documents ready, including your PAN card, Aadhaar number, and bank account details. The online process is designed to be user-friendly, enabling you to complete your registration and start investing within minutes. Below is a summary of the key features of the NPS and the steps involved in investing online.

| Feature | Description |

|---|---|

| Eligibility | Indian citizens aged 18-70 years |

| Investment Options | Equities, Bonds, Corporate Debt |

| Tax Benefits | Tax deductions on contributions up to ₹1.5 lakh |

Steps to Invest in NPS Online

Investing in NPS online can be done through various platforms, including the official eNPS website or through various financial apps. Here are the steps you need to follow:

Step 1: Choose Your Platform

You can invest in NPS through:

- The official eNPS website

- Financial service apps like ET Money or Zerodha

- Bank websites that offer NPS services

Step 2: Register on the Platform

Once you have chosen your platform, you will need to register. This typically involves:

- Providing your basic personal details

- Entering your PAN and Aadhaar numbers

- Verifying your identity via OTP sent to your registered mobile number

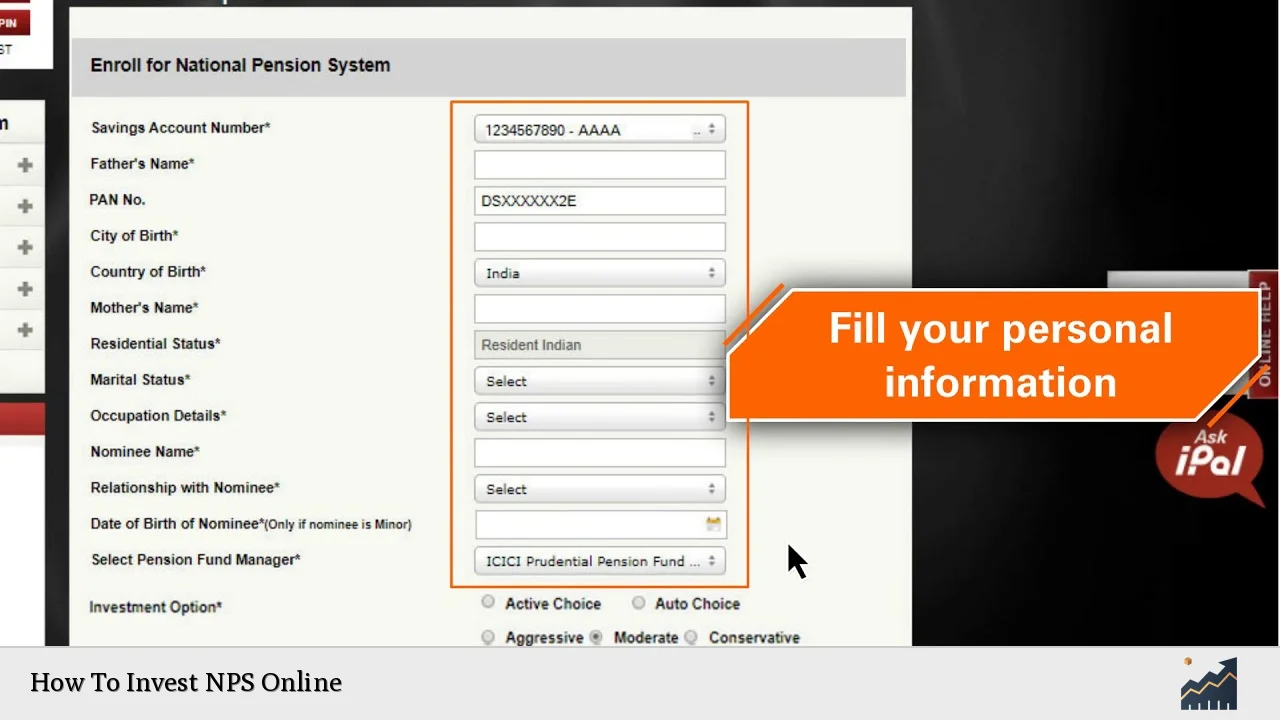

Step 3: Fill Out the Application Form

After registration, fill out the application form with necessary details such as:

- Name

- Date of birth

- Contact information

- Nominee details

Ensure that all information matches your official documents.

Step 4: Choose Your Investment Options

You will need to select your investment options based on your risk appetite. The options generally include:

- Aggressive: Higher equity exposure for potentially higher returns

- Moderate: Balanced exposure between equities and bonds

- Conservative: Lower risk with more investments in bonds

Step 5: Select a Pension Fund Manager

Choose from various Pension Fund Managers (PFMs) available on the platform. Each PFM has different performance metrics and fees associated with their funds.

Step 6: Make Your Initial Contribution

You are required to make an initial contribution to activate your NPS account. The minimum amount can vary by platform but typically starts at ₹500 for Tier I accounts.

Step 7: Complete KYC Verification

Complete the KYC (Know Your Customer) process by uploading necessary documents such as:

- PAN card

- Aadhaar card

- Bank statement or cancelled cheque for bank details verification

Step 8: Set Up Payment Method

Choose how you want to make contributions—either as a lump sum or through a Systematic Investment Plan (SIP). You can set up auto-debit instructions for regular contributions.

Step 9: Confirm Your Application

Review all details entered in your application form before confirming. After confirmation, you will receive an acknowledgment number which can be used for tracking your application status.

Step 10: Receive PRAN

Once your application is processed successfully, you will receive a Permanent Retirement Account Number (PRAN), which is essential for managing your NPS account.

Benefits of Investing in NPS Online

Investing in NPS online comes with several advantages:

- Convenience: You can invest from anywhere at any time without visiting a physical branch.

- Lower Costs: NPS has lower fund management charges compared to mutual funds, which can significantly enhance returns over time.

- Tax Benefits: Contributions made towards NPS qualify for tax deductions under Section 80C of the Income Tax Act up to ₹1.5 lakh per annum.

- Flexibility: You can choose how much and how often you want to contribute.

Important Considerations Before Investing

Before you start investing in NPS, consider these important factors:

- Lock-in Period: Funds invested in Tier I accounts are locked until retirement age (60 years), although partial withdrawals are allowed under specific circumstances.

- Investment Risk: While NPS offers various investment options, equity investments come with higher risks compared to fixed-income securities.

- Withdrawal Rules: Familiarize yourself with withdrawal rules as they differ between Tier I and Tier II accounts.

FAQs About How To Invest NPS Online

- What documents are required to open an NPS account?

You need your PAN card, Aadhaar number, and bank account details. - Can NRIs invest in NPS?

Yes, non-resident Indians can also open an NPS account. - What is the minimum investment amount for NPS?

The minimum initial contribution is typically ₹500 for Tier I accounts. - How can I check my NPS balance?

You can check your balance by logging into the eNPS portal or using financial service apps. - Is there any exit load for withdrawing from NPS?

No exit load is applicable; however, there are specific rules regarding withdrawals based on age.

Investing in the National Pension System online provides a secure way to plan for retirement while benefiting from tax incentives and market-linked returns. By following these steps and understanding the features of the system, you can effectively manage your retirement savings strategy.