Investing your money wisely is essential for building wealth and achieving financial goals. Whether you’re a novice or have some experience, understanding the various investment options available can significantly enhance your financial future. This guide will provide you with practical strategies to grow your investments effectively.

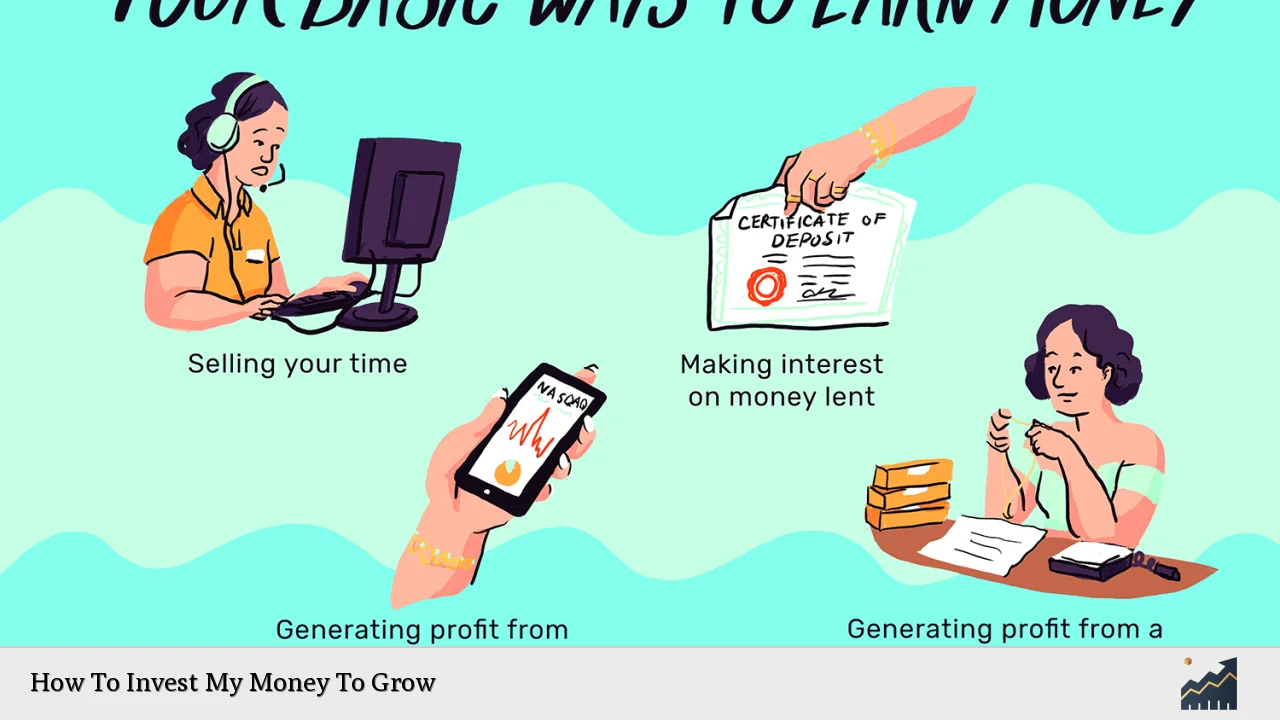

Investing involves allocating resources, usually money, in order to generate income or profit. The primary goal is to increase the value of your initial investment over time. There are numerous avenues for investment, including stocks, bonds, real estate, and mutual funds. Each option carries its own risk and return profile, making it crucial to choose investments that align with your financial objectives and risk tolerance.

To get started on your investment journey, it is vital to have a clear plan. This includes defining your financial goals, understanding your risk tolerance, and researching different asset classes. Additionally, diversification is key; spreading your investments across various sectors can help mitigate risks while maximizing potential returns.

| Investment Type | Risk Level |

|---|---|

| Stocks | High |

| Bonds | Medium |

| Real Estate | Medium to High |

| Mutual Funds | Varies |

| Savings Accounts | Low |

Understand Your Financial Goals

Before investing, it’s essential to clarify what you want to achieve financially. Are you saving for retirement, a home, or your children’s education? Your goals will dictate your investment strategy.

- Short-term goals (1-3 years): These may require safer investments like high-yield savings accounts or short-term bonds.

- Medium-term goals (3-10 years): Consider a mix of stocks and bonds to balance growth and security.

- Long-term goals (10+ years): Stocks and equity funds can be suitable for long-term growth due to their higher potential returns.

Establishing clear objectives will help you stay focused and disciplined in your investment approach.

Assess Your Risk Tolerance

Understanding your risk tolerance is crucial when selecting investments. This refers to how much risk you are willing to take with your investments based on your financial situation and emotional capacity.

- Conservative investors may prefer safer assets like bonds or savings accounts.

- Moderate investors might opt for a balanced portfolio with both stocks and bonds.

- Aggressive investors are often comfortable with high-risk investments like stocks or real estate in pursuit of higher returns.

Knowing your risk tolerance will guide you in creating a portfolio that fits your comfort level while still aiming for growth.

Diversification: A Key Strategy

Diversification involves spreading your investments across various asset classes to reduce risk. By not putting all your eggs in one basket, you can protect yourself from significant losses if one investment performs poorly.

- Asset classes: Include stocks, bonds, real estate, and commodities.

- Geographic diversification: Investing in international markets can also reduce risk.

A well-diversified portfolio typically has a mix of high-risk and low-risk assets. This balance allows you to capitalize on growth opportunities while minimizing potential losses.

Investment Options Explained

There are various investment vehicles available that cater to different needs and preferences. Here’s an overview of some popular options:

- Stocks: Buying shares of companies can offer high returns but comes with higher volatility. Consider investing in blue-chip stocks for stability or growth stocks for potential high returns.

- Bonds: These are loans made to corporations or governments that pay interest over time. Bonds are generally less risky than stocks but offer lower returns.

- Real Estate: Investing in property can provide rental income and capital appreciation. However, it requires significant capital and management effort.

- Mutual Funds/ETFs: These funds pool money from multiple investors to purchase a diversified portfolio of stocks or bonds. They offer an easy way to diversify without having to buy individual securities.

- Index Funds: These track a specific market index (like the S&P 500) and typically have lower fees than actively managed funds. They are ideal for passive investors seeking market returns.

Develop an Investment Plan

Creating an investment plan is essential for guiding your decisions over time. Your plan should include:

- Investment goals: Clearly define what you want to achieve.

- Time horizon: Determine how long you plan to invest before needing access to the funds.

- Asset allocation strategy: Decide how much of your portfolio will be allocated to different asset classes based on your risk tolerance and goals.

Regularly review and adjust your plan as needed based on changes in the market or personal circumstances.

Dollar-Cost Averaging

One effective strategy for investing is dollar-cost averaging, which involves investing a fixed amount of money at regular intervals regardless of market conditions. This approach helps mitigate the impact of market volatility by spreading out purchase prices over time.

Benefits include:

- Reducing the risk of making poor investment decisions based on market timing.

- Encouraging consistent investing habits that lead to wealth accumulation over time.

Consider setting up automatic contributions to investment accounts to simplify this process.

Monitor Your Investments

Once you’ve made investments, it’s crucial to monitor their performance regularly. This doesn’t mean checking daily prices but rather reviewing how each asset aligns with your overall financial goals periodically (e.g., quarterly or annually).

Key aspects to monitor include:

- Performance relative to benchmarks (e.g., stock indices).

- Changes in financial goals or personal circumstances that may require adjustments in asset allocation.

Regular monitoring helps ensure that you remain on track toward achieving your financial objectives while allowing you to make informed decisions about buying or selling assets as needed.

Seek Professional Advice

If you’re unsure about where to start or how to manage your investments effectively, consider seeking advice from a financial advisor. A professional can help you create a tailored investment strategy based on your unique financial situation and goals.

When choosing an advisor:

- Look for credentials such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA).

- Consider their fee structure—some charge flat fees while others earn commissions on products sold.

Professional guidance can provide valuable insights and help you navigate complex investment landscapes more confidently.

FAQs About How To Invest My Money To Grow

- What is the best way for beginners to start investing?

Begin by setting clear financial goals and considering low-cost index funds or ETFs. - How much money do I need to start investing?

You can start with any amount; many platforms allow fractional shares. - What is diversification?

Diversification is spreading investments across different asset classes to reduce risk. - How often should I review my investments?

You should review your investments at least once a year or whenever significant life changes occur. - Is it better to invest in stocks or bonds?

It depends on your risk tolerance; stocks typically offer higher returns but come with greater volatility.

Investing wisely requires careful planning, research, and an understanding of various options available. By following these guidelines, you can create a solid foundation for growing your wealth over time. Remember that investing is not just about making money; it’s about making informed decisions that align with your long-term financial goals.