Investing your Health Savings Account (HSA) can be a powerful strategy for maximizing your healthcare savings and preparing for future medical expenses. An HSA is a tax-advantaged account designed to help individuals save for medical costs. Contributions to an HSA are tax-deductible, the growth of the account is tax-free, and withdrawals for qualified medical expenses are also tax-free. This triple tax advantage makes HSAs an attractive option for many individuals looking to save for healthcare costs now and in the future.

Many people are unaware that they can invest their HSA funds similarly to other investment accounts, such as IRAs or 401(k)s. Once your HSA balance exceeds a certain threshold, typically around $2,000, you can start investing in various options like stocks, bonds, and mutual funds. This can significantly enhance the growth potential of your savings over time.

Understanding how to effectively invest your HSA funds is crucial for anyone looking to leverage this financial tool. In this article, we will explore the steps involved in investing your HSA, the various investment options available, and strategies to optimize your investment for long-term growth.

| Key Feature | Description |

|---|---|

| Tax Advantages | Contributions are tax-deductible; growth is tax-free; withdrawals for qualified expenses are tax-free. |

Understanding Your HSA Investment Options

Before diving into how to invest your HSA, it’s essential to understand the different investment options available. The choice of investments will largely depend on your risk tolerance, investment goals, and how soon you anticipate needing access to these funds.

- Cash and Money Market Funds: These are low-risk options that provide liquidity and stability. They are suitable if you anticipate needing funds in the short term.

- Stocks and Stock Funds: Investing in individual stocks or stock-based mutual funds can provide higher returns but comes with increased risk. This option is ideal for those who do not expect significant medical expenses in the near future.

- Bonds and Fixed Income Funds: These investments tend to be less volatile than stocks and can provide a steady income stream. They are suitable for individuals with a lower risk tolerance.

- Robo-Advisors: Some HSA providers offer robo-advisory services that automatically manage your investments based on your risk profile and investment goals. This option is convenient for those who prefer a hands-off approach.

When selecting investments, consider factors such as your age, health status, and financial goals. For instance, if you are younger and healthy, you might lean towards more aggressive investments like stocks. Conversely, if you are nearing retirement or have imminent medical expenses, conservative investments may be more appropriate.

Steps to Start Investing Your HSA

Investing your HSA funds involves several key steps that ensure you’re making informed decisions about where to allocate your money.

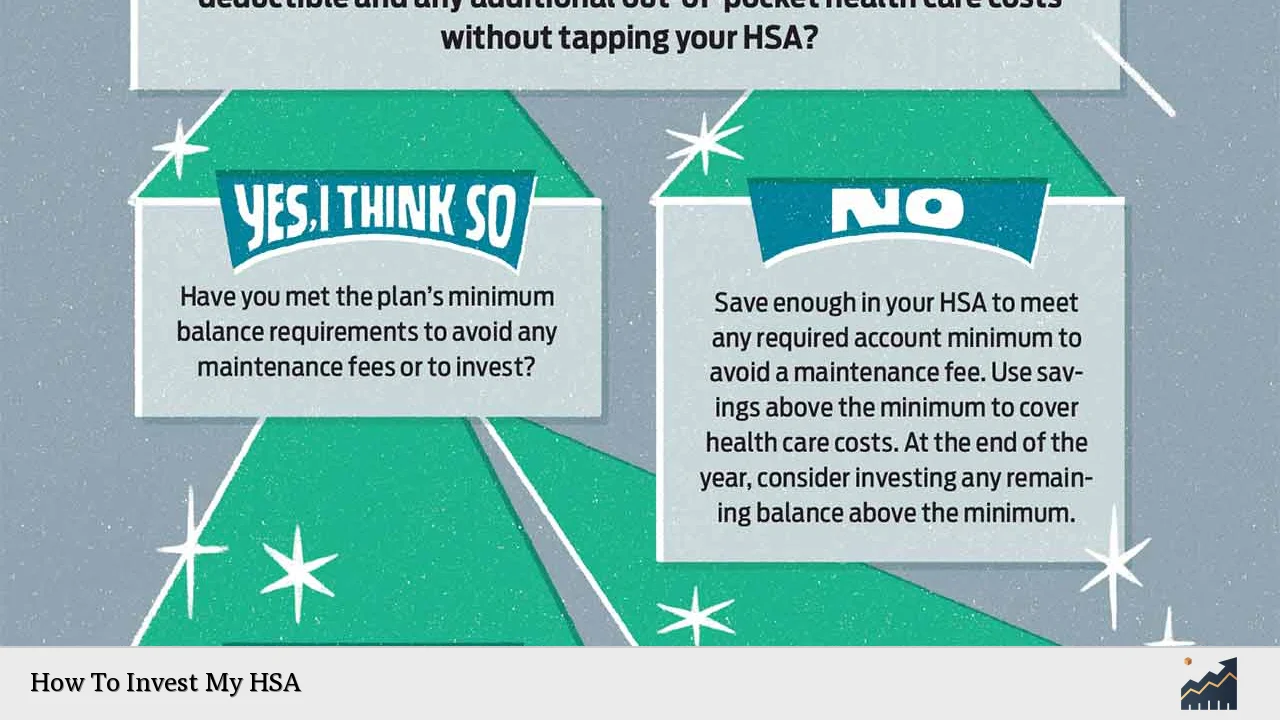

1. Check Eligibility: Ensure that your HSA balance meets the minimum threshold required by your provider (usually around $2,000) before you can start investing.

2. Review Investment Options: Log into your HSA account and review the available investment options provided by your HSA administrator. This could include mutual funds, ETFs, or individual stocks.

3. Set a Cash Target: Determine how much cash you want to keep in your HSA for immediate medical expenses. A common strategy is to set aside enough cash to cover expected healthcare costs while investing any excess funds.

4. Choose Your Investments: Based on your risk tolerance and investment horizon, select the appropriate mix of investments. Consider diversifying across different asset classes to mitigate risk.

5. Monitor Your Investments: Regularly review your investment performance and make adjustments as needed based on changes in market conditions or personal circumstances.

6. Consider Automatic Transfers: Many providers allow you to set up automatic transfers from your cash account to your investment account once you exceed a certain balance. This can simplify the process of investing excess funds.

7. Stay Informed: Keep yourself updated on changes in healthcare laws or tax regulations that may impact HSAs and their benefits.

By following these steps, you can effectively manage and grow your HSA investments over time.

Investment Strategies for Your HSA

Choosing the right investment strategy is crucial for maximizing the benefits of your HSA. Here are some effective strategies:

- Long-Term Growth Focus: If you’re using your HSA primarily as a retirement account or long-term savings vehicle, consider investing heavily in stocks or stock mutual funds for higher growth potential over time.

- Balanced Approach: For those who may need access to funds sooner but still want some growth potential, consider a balanced portfolio that includes both stocks and bonds.

- Regular Contributions: Continue contributing to your HSA regularly. The more you contribute now, the more you’ll have available for future medical expenses or retirement savings.

- Rebalance Periodically: As market conditions change or as you approach retirement age, rebalance your portfolio to align with your current risk tolerance and financial goals.

- Utilize Tax Benefits: Remember that all earnings within an HSA grow tax-free. Use this advantage by reinvesting dividends or interest earned within the account rather than withdrawing them.

Implementing these strategies can help ensure that you’re not only protecting but also growing your healthcare savings effectively over time.

Common Mistakes to Avoid When Investing Your HSA

While investing an HSA can be beneficial, there are common pitfalls that investors should be aware of:

- Neglecting Cash Needs: Failing to keep enough cash in the account for immediate medical expenses can lead to difficulties when unexpected healthcare costs arise.

- Overlooking Fees: Some investment options may carry high fees that can erode returns over time. Always review fee structures before committing to any investment.

- Ignoring Risk Tolerance: Investing aggressively without considering personal risk tolerance can lead to significant losses during market downturns.

- Failing to Diversify: Concentrating too much on one type of investment increases risk exposure. Diversification across asset classes helps mitigate this risk.

- Not Reviewing Investments Regularly: Markets change constantly; failing to review and adjust investments periodically may lead you away from achieving optimal returns based on current conditions.

By being aware of these mistakes and actively managing your investments, you can enhance the effectiveness of your HSA as a financial tool.

FAQs About How To Invest My HSA

- What types of investments can I make with my HSA?

You can invest in stocks, bonds, mutual funds, ETFs, or utilize robo-advisors depending on what your provider offers. - How much do I need in my HSA before I can start investing?

Most providers require a minimum balance of around $2,000 before you can begin investing. - Are there any tax implications when I invest my HSA funds?

No; contributions are tax-deductible, growth is tax-free, and withdrawals for qualified medical expenses are also tax-free. - Can I withdraw invested funds from my HSA at any time?

Yes; however, ensure you maintain enough cash in the account for immediate medical needs. - How often should I review my HSA investments?

You should review them at least once a year or whenever there are significant changes in market conditions or personal circumstances.

By understanding how to invest effectively within an HSA framework and avoiding common mistakes, you can turn this account into a powerful tool for managing healthcare costs both now and in retirement.