Investing money is a crucial step toward achieving financial stability and building wealth over time. It involves allocating resources, usually money, with the expectation of generating an income or profit. The process can seem daunting, especially for beginners, but understanding the fundamentals can simplify it significantly.

Successful investing requires a clear strategy, knowledge of different asset classes, and an understanding of your financial goals and risk tolerance. By following a structured approach, you can make informed decisions that align with your financial aspirations.

| Key Concepts | Description |

|---|---|

| Investment Goals | Define what you want to achieve through investing. |

| Risk Tolerance | Understand how much risk you are willing to take. |

| Diversification | Spread investments across various asset classes to minimize risk. |

Understanding Investment Goals

The first step in investing is to define your investment goals. Knowing what you want to achieve will guide your investment decisions. Common goals include saving for retirement, purchasing a home, funding education, or building wealth for future generations.

- Long-term goals typically span five years or more and may include retirement savings or wealth accumulation.

- Short-term goals are generally within five years and might involve saving for a vacation or an emergency fund.

Establishing clear goals helps in selecting the right investment strategies and vehicles that align with your timeline and objectives.

Assessing Your Risk Tolerance

Understanding your risk tolerance is essential in the investment process. Risk tolerance refers to how much volatility in investment returns you can withstand without selling your investments in a panic.

- Conservative investors prefer safer investments with lower returns, such as bonds or savings accounts.

- Aggressive investors are willing to take on higher risks for the potential of higher returns, often investing in stocks or real estate.

Your risk tolerance should reflect not only your financial situation but also your emotional comfort with market fluctuations.

Choosing the Right Investment Account

Once you've established your goals and assessed your risk tolerance, the next step is to choose an investment account. Different types of accounts serve various purposes:

- Brokerage accounts allow you to buy and sell stocks, bonds, ETFs, and mutual funds without tax advantages.

- Retirement accounts, like 401(k)s or IRAs, provide tax benefits but come with restrictions on withdrawals.

Selecting the appropriate account type is crucial for optimizing your investment strategy and ensuring it aligns with your financial objectives.

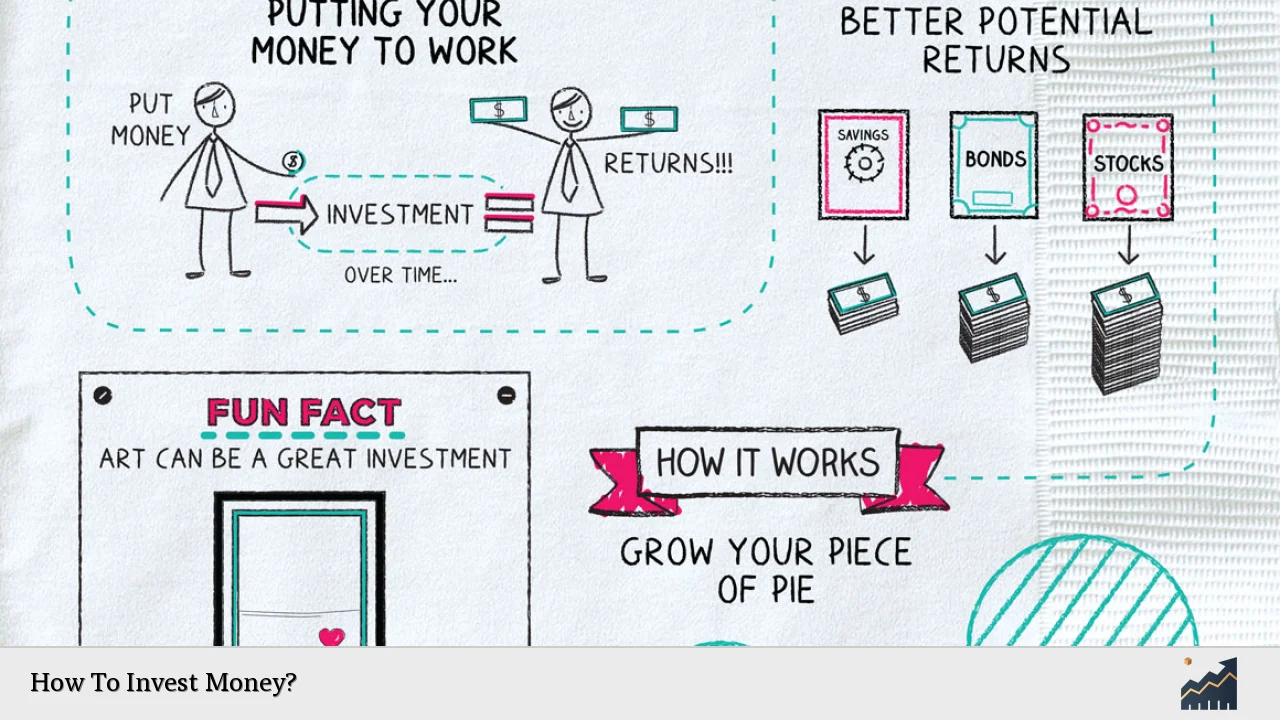

Types of Investments

Investing involves various asset classes, each with its own characteristics and risk profiles. Understanding these can help you build a diversified portfolio:

- Stocks: Represent ownership in companies and offer potential for high returns but come with higher volatility.

- Bonds: Debt securities that provide fixed interest payments; generally considered safer than stocks.

- Mutual Funds/ETFs: Pooled investments that allow you to invest in a diversified portfolio managed by professionals.

- Real Estate: Investing in property can provide rental income and appreciation but requires significant capital and management.

Diversifying across these asset classes helps mitigate risk while pursuing growth opportunities.

Developing an Investment Strategy

Creating a solid investment strategy is vital for achieving your financial goals. This strategy should outline how much money to invest, where to invest it, and when to adjust your portfolio based on market conditions or personal circumstances.

- Start by determining an appropriate asset allocation based on your risk tolerance—this dictates how much of your portfolio will be in stocks versus bonds versus other assets.

- Regularly review and adjust your portfolio as needed to ensure it remains aligned with your goals and market conditions.

A well-thought-out strategy will help you navigate the complexities of investing while keeping you focused on long-term results.

The Importance of Diversification

Diversification is a key principle in investing that involves spreading investments across different asset classes to reduce overall risk. By diversifying:

- You minimize the impact of any single investment's poor performance on your overall portfolio.

- Different asset classes often react differently to market conditions; when one goes down, another might go up.

To effectively diversify:

- Consider including various types of investments such as stocks from different sectors, bonds of varying maturities, and alternative assets like real estate or commodities.

A diversified portfolio is more resilient against market volatility and can enhance long-term returns.

Monitoring Your Investments

After making investments, it’s crucial to monitor their performance regularly. Keeping track allows you to make informed decisions about when to buy more, hold, or sell based on performance trends and changes in market conditions.

- Set specific intervals (e.g., quarterly) to review your investments' performance against benchmarks or goals.

- Adjust your strategy as necessary if certain investments consistently underperform or if market conditions change significantly.

Regular monitoring ensures that you remain proactive rather than reactive in managing your investments.

Seeking Professional Advice

For many investors, especially beginners, seeking professional advice can be beneficial. Financial advisors can offer tailored guidance based on individual financial situations and goals. They can help:

- Develop a comprehensive investment plan that considers all aspects of personal finance.

- Provide insights into complex investment products and strategies that may not be easily understood by novice investors.

While hiring an advisor comes with costs, their expertise can lead to better-informed decisions and potentially higher returns over time.

Common Investment Mistakes

Avoiding common pitfalls is essential for successful investing. Here are some mistakes to watch out for:

- Failing to set clear goals: Without defined objectives, it's easy to lose focus on what you're trying to achieve.

- Chasing past performance: Investing based solely on past returns can lead to poor decisions; always consider current market conditions.

- Neglecting diversification: Concentrating too much on one type of investment increases risk; ensure a balanced approach across asset classes.

By recognizing these mistakes early on, you can avoid them and enhance your chances of achieving financial success through investing.

FAQs About How To Invest Money

- What is the best way for beginners to start investing?

Beginners should start by defining their investment goals and choosing simple investment vehicles like index funds or ETFs. - How much money do I need to start investing?

You can start investing with as little as $100 depending on the platform; many brokers offer low minimums. - What are the risks involved in investing?

Investment risks include market volatility, loss of principal, liquidity risks, and inflation risks that can erode returns. - How often should I review my investments?

You should review your investments at least quarterly to ensure they align with your goals. - Is it better to invest in stocks or bonds?

This depends on your risk tolerance; stocks typically offer higher potential returns but come with greater volatility compared to bonds.

Investing money wisely requires careful planning and continuous education about market dynamics. By setting clear goals, understanding different types of investments, diversifying effectively, and monitoring performance regularly, anyone can build a solid foundation for financial growth through investing.