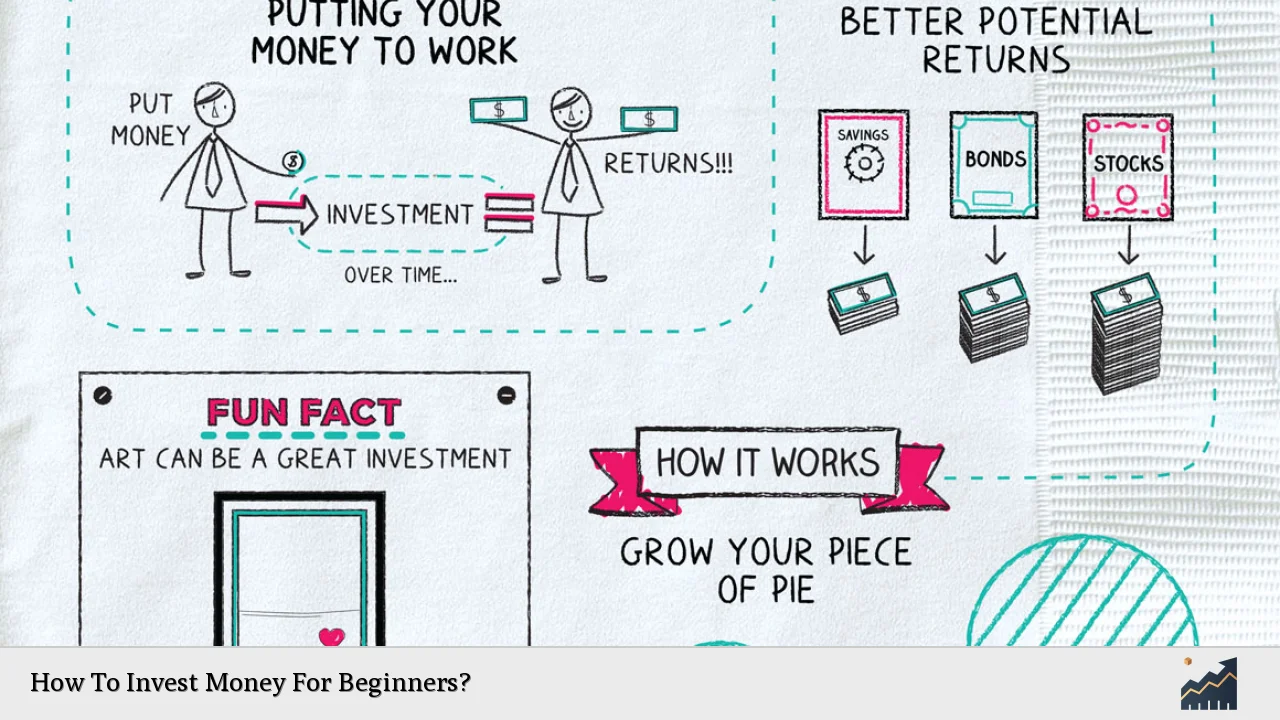

Investing money can seem daunting for beginners, but it is a crucial step toward achieving financial stability and growth. Understanding the basics of investing is essential for anyone looking to build wealth over time. Investing involves allocating resources, usually money, with the expectation of generating an income or profit. This guide will help you navigate the initial steps of investing, clarify your goals, and introduce you to various investment options.

Investing is not just for the wealthy; anyone can start with a small amount. The key is to educate yourself about the different types of investments available and to develop a strategy that aligns with your financial goals. By setting clear objectives and understanding your risk tolerance, you can make informed decisions that will benefit you in the long run.

| Investment Type | Description |

|---|---|

| Stocks | Ownership in a company, potential for high returns. |

| Bonds | Loans to companies or governments, generally lower risk. |

| Mutual Funds | Pools of money from many investors to buy a diversified portfolio. |

| ETFs | Exchange-traded funds that track indexes, traded like stocks. |

| Real Estate | Property investment for rental income or appreciation. |

Setting Investment Goals

The first step in investing is to set clear investment goals. This involves determining what you want to achieve with your investments and how much time you have to reach these goals. Here are some key points to consider:

- Specificity: Define what you are saving for—whether it’s retirement, a home purchase, or your child’s education.

- Measurable: Establish how much money you need to achieve these goals.

- Achievable: Set realistic targets based on your current financial situation.

- Relevant: Ensure your goals align with your overall life objectives.

- Time-bound: Determine when you need access to your funds. Short-term goals may require safer investments, while long-term goals can afford more risk.

By following the SMART criteria (Specific, Measurable, Achievable, Relevant, Time-bound), you can create a structured plan that guides your investment choices.

Understanding Your Risk Tolerance

Risk tolerance is an essential concept in investing. It refers to how much risk you are willing to take with your investments. Understanding your risk tolerance helps in selecting appropriate investment vehicles. Here are some factors that influence risk tolerance:

- Time Horizon: The longer you have until you need the money, the more risk you might be able to take since you have time to recover from market fluctuations.

- Financial Situation: Your current financial health plays a significant role; those with stable incomes may take on more risk than those without.

- Investment Knowledge: Familiarity with different investment types can affect comfort levels with riskier options.

Investors typically fall into three categories based on their risk tolerance: conservative (low risk), moderate (balanced approach), and aggressive (high risk). Knowing where you stand will help tailor your investment strategy accordingly.

Choosing the Right Investment Account

Selecting the right investment account is crucial for beginners. There are various types of accounts tailored for different needs:

- Brokerage Accounts: These accounts allow you to buy and sell various securities without restrictions on withdrawals. They are ideal for general investing.

- Retirement Accounts (401(k), IRA): These accounts offer tax advantages but come with restrictions on withdrawals until retirement age. They are designed specifically for long-term savings.

When choosing an account, consider factors such as fees, minimum balance requirements, and whether the account suits your investment strategy. Many online brokers offer no minimum deposit requirements and low fees, making it easier than ever for beginners to start investing.

Researching Investment Options

Once you’ve established your goals and selected an account, it’s time to research potential investments. Here are common investment options suitable for beginners:

- Stocks: Buying shares in companies can yield high returns but comes with higher risks. Look for established companies or consider index funds that track broader markets.

- Bonds: These are generally safer than stocks and provide fixed interest payments over time. They are suitable for conservative investors seeking stability.

- Mutual Funds: These funds pool money from multiple investors to purchase a diversified portfolio of stocks and bonds. They are managed by professionals and are great for beginners who prefer a hands-off approach.

- ETFs (Exchange-Traded Funds): Similar to mutual funds but traded like stocks on exchanges. ETFs typically have lower fees and provide instant diversification.

Understanding each option’s benefits and risks will empower you to make informed decisions that align with your financial objectives.

Developing an Investment Strategy

A well-defined investment strategy is essential for success. Here are some popular strategies that beginners can consider:

- Buy-and-Hold Strategy: This involves purchasing investments and holding them long-term regardless of market fluctuations. It’s effective for building wealth over time through compounding returns.

- Dollar-Cost Averaging: This strategy entails investing a fixed amount regularly, regardless of market conditions. It reduces the impact of volatility by averaging out purchase prices over time.

- Index Investing: Investing in index funds allows you to buy a broad market exposure without picking individual stocks. This approach minimizes risks while providing growth potential.

Each strategy has its advantages and drawbacks; choose one that fits your investment style and goals while considering how much time you want to dedicate to managing your portfolio.

Diversifying Your Portfolio

Diversification is a critical principle in investing that helps mitigate risks by spreading investments across various asset classes. A well-diversified portfolio may include:

- Stocks from different sectors (technology, healthcare, etc.)

- Bonds of varying maturities

- Real estate investments

- Commodities like gold or silver

By diversifying, you reduce the impact of poor performance from any single investment on your overall portfolio. Aim for a mix that aligns with your risk tolerance and investment objectives.

Monitoring Your Investments

Investing is not a one-time event; it requires ongoing monitoring and adjustments based on market conditions and personal circumstances. Regularly review your portfolio’s performance against your goals:

- Assess whether you’re on track to meet your objectives.

- Rebalance your portfolio if certain investments have grown disproportionately compared to others.

- Stay informed about market trends that could affect your investments.

Monitoring helps ensure that your strategy remains aligned with changing financial circumstances or shifts in market dynamics.

Seeking Professional Guidance

For beginners unsure about where to start or how to manage their investments effectively, seeking professional guidance can be beneficial. Financial advisors provide personalized advice based on individual circumstances:

- They help set realistic goals.

- They offer insights into complex financial products.

- They assist in developing tailored investment strategies.

While hiring an advisor involves costs, their expertise can lead to better long-term results by helping you avoid common pitfalls associated with investing.

FAQs About How To Invest Money For Beginners

- What is the best way for beginners to start investing?

The best way is by setting clear goals, choosing the right account type, and starting with low-cost index funds or ETFs. - How much money do I need to start investing?

You can start investing with as little as $1 thanks to many platforms offering fractional shares. - What should I invest in as a beginner?

Beginner-friendly options include index funds, ETFs, mutual funds, and blue-chip stocks. - How do I know my risk tolerance?

Your risk tolerance depends on factors like age, income stability, investment knowledge, and time horizon. - Is it necessary to hire a financial advisor?

No, but it can be helpful if you’re unsure about managing investments or need personalized guidance.

By following these guidelines and being proactive about learning more about investing, beginners can build a solid foundation for their financial future while working toward their specific financial goals.