Investing a lumpsum amount in mutual funds can be a powerful strategy for wealth creation, especially for those who have received a significant windfall, such as an inheritance, bonus, or proceeds from selling an asset. Unlike Systematic Investment Plans (SIPs), which involve regular investments over time, lumpsum investments allow you to put a large sum of money into a mutual fund in one go. This approach can potentially yield higher returns if timed correctly, but it also comes with its own set of risks.

When considering a lumpsum investment in mutual funds, it's essential to understand the market dynamics and your financial goals. This article will guide you through the process of investing a lumpsum in mutual funds, highlighting the benefits, risks, and key factors to consider.

| Aspect | Description |

|---|---|

| Lumpsum Investment | A one-time investment of a large sum in mutual funds. |

| SIP Investment | Regular investments of smaller amounts over time. |

Understanding Lumpsum Investments

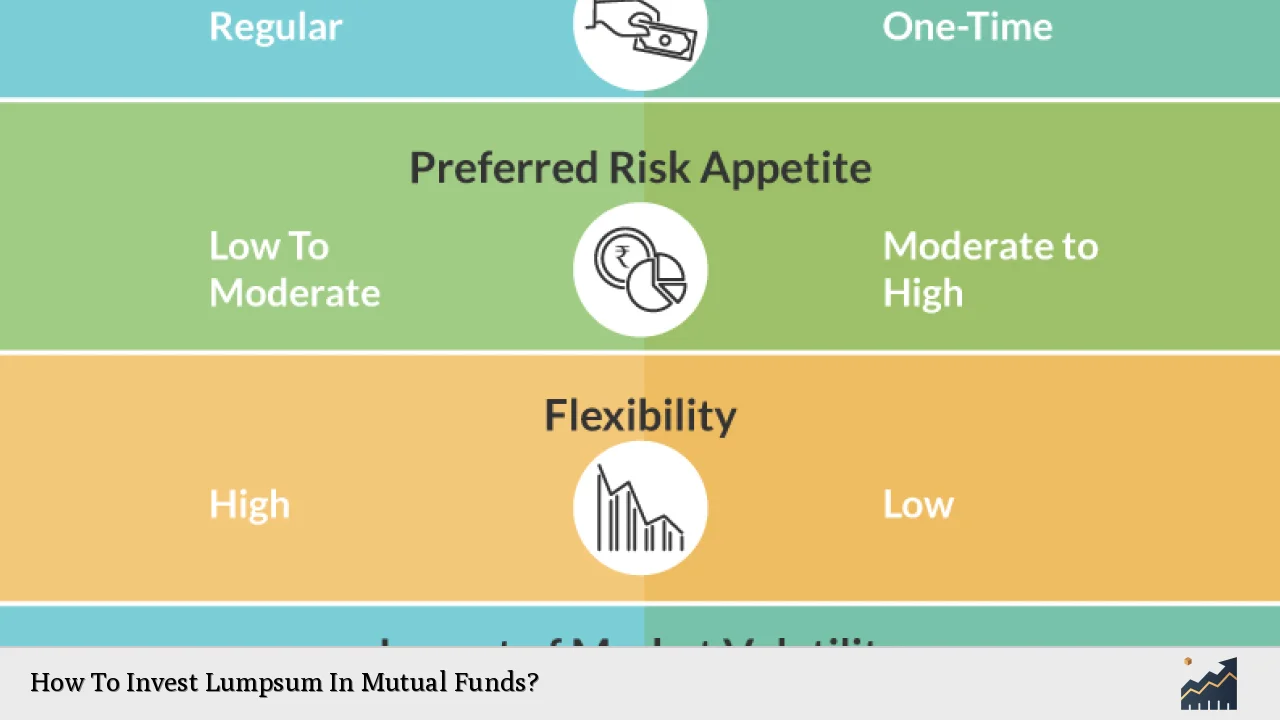

Lumpsum investment refers to the process of investing a significant amount of money at once into a mutual fund. This method is particularly appealing for investors who have accumulated substantial savings or received unexpected funds. The primary advantage of lumpsum investing is the potential for higher returns since the entire amount is exposed to market movements immediately.

However, this approach requires careful consideration of market conditions and timing. Investing when markets are high can lead to losses if the market subsequently declines. Therefore, understanding your risk tolerance and investment horizon is crucial before proceeding with a lumpsum investment.

Investors should also consider their financial goals. For instance, if you are investing for long-term growth, equity funds may be more suitable. Conversely, if your goals are short-term, debt or hybrid funds might be better options.

Benefits of Lumpsum Investments

Investing a lumpsum amount in mutual funds offers several advantages:

- Potential for Higher Returns: Since the entire amount is invested at once, you can benefit from immediate market exposure and compounding effects.

- Simplicity: Lumpsum investments require only one transaction, making them easier to manage compared to regular SIP contributions.

- Quick Entry and Exit: You can enter or exit the market swiftly without waiting for multiple transactions.

- Market Timing Opportunities: If you invest during market dips, you can acquire more units at lower prices, enhancing your potential returns when the market rebounds.

Risks Associated with Lumpsum Investments

Despite the benefits, lumpsum investments come with inherent risks:

- Market Timing Risk: The success of your investment heavily depends on when you enter the market. Poor timing can lead to significant losses.

- Higher Volatility: A lumpsum investment exposes your capital to immediate market fluctuations, which can be unsettling for risk-averse investors.

- Lack of Averaging Benefits: Unlike SIPs that average out costs over time, lumpsum investments do not provide this safety net against volatility.

Choosing the Right Mutual Fund for Lumpsum Investment

Selecting the appropriate mutual fund is critical for maximizing returns on your lumpsum investment. Here are some steps to guide your decision:

Define Your Investment Goals

Before investing, clearly outline your financial objectives. Are you looking for long-term growth or short-term gains? Your goals will influence the type of mutual fund you choose.

Assess Your Risk Tolerance

Understanding your comfort level with risk is essential. If you are willing to accept higher volatility for potentially greater returns, equity funds may be suitable. On the other hand, if you prefer stability, consider debt or hybrid funds.

Research Fund Performance

Evaluate the historical performance of potential mutual funds. Look at their returns over various time frames and compare them against benchmarks and similar funds.

Examine Costs and Fees

Be aware of the expense ratios and any entry or exit loads associated with the funds. Lower costs can enhance your overall returns over time.

Analyze Fund Composition

Consider what assets the fund invests in. A diversified portfolio can reduce risk while providing exposure to different sectors and asset classes.

How to Invest Your Lumpsum Amount

Investing a lumpsum in mutual funds involves several straightforward steps:

1. Choose an Investment Platform: Decide whether you want to invest directly through an Asset Management Company (AMC) or use an online platform that aggregates multiple fund options.

2. Complete KYC Requirements: Before making any investments, ensure that you complete all necessary Know Your Customer (KYC) formalities as mandated by regulatory authorities.

3. Select Your Mutual Fund: Based on your research and analysis, choose a mutual fund that aligns with your investment goals and risk profile.

4. Make Your Investment: Initiate the transaction by transferring your chosen amount into the selected mutual fund scheme.

5. Monitor Your Investment: After investing, regularly review your portfolio’s performance and make adjustments as necessary to stay aligned with your financial goals.

Strategies for Successful Lumpsum Investing

To enhance your chances of success when investing a lumpsum in mutual funds:

- Consider Staggering Your Investment: Instead of investing all at once, consider spreading it over several months to mitigate timing risks associated with market volatility.

- Stay Informed About Market Conditions: Keep abreast of economic indicators and market trends that could impact your investments.

- Consult Financial Advisors: If uncertain about where to invest or how much risk to take on, seek advice from financial professionals who can provide tailored guidance based on your situation.

FAQs About How To Invest Lumpsum In Mutual Funds

- What is a lumpsum investment?

A lumpsum investment refers to putting a large sum of money into a mutual fund all at once rather than through regular contributions. - Is lumpsum investment suitable for everyone?

This method is best suited for investors with a high-risk tolerance and those who have significant capital available. - What are the risks of lumpsum investing?

The primary risks include market timing risk and exposure to immediate volatility. - Can I switch from SIP to lumpsum investment?

Yes, investors can transition from SIPs to lumpsum investments based on their financial strategy. - How do I choose a mutual fund for lumpsum investment?

Select based on performance history, fees, risk profile alignment, and asset composition.

Conclusion

Investing a lumpsum in mutual funds can be an effective way to grow wealth if approached strategically. By understanding the benefits and risks involved and carefully selecting suitable funds based on personal financial goals and risk tolerance, investors can optimize their returns while navigating potential challenges associated with market fluctuations. Always remember that thorough research and possibly consulting with financial advisors will enhance your investment experience and outcomes significantly.