Investing effectively requires a clear understanding of Key Performance Indicators (KPIs) that guide decision-making and measure success. KPIs are quantifiable metrics that help investors evaluate the performance of their investments and the overall health of their portfolios. By focusing on the right KPIs, investors can make informed decisions that align with their financial goals. This article will explore how to invest using KPIs, providing practical strategies and insights for both novice and experienced investors.

| Key Aspect | Description |

|---|---|

| What are KPIs? | Metrics used to assess the performance of investments. |

| Importance of KPIs | They provide insights for informed decision-making. |

Understanding KPIs in Investment

KPIs are essential tools for investors to gauge the effectiveness of their investment strategies. They offer a framework for measuring performance against specific objectives. Each KPI provides a different perspective on the investment’s potential, helping investors identify trends, strengths, and weaknesses.

Investors should focus on several types of KPIs, including financial metrics, operational metrics, and market metrics. Financial metrics, such as Return on Investment (ROI) and Earnings per Share (EPS), help assess profitability. Operational metrics, like Customer Acquisition Cost (CAC), evaluate efficiency in acquiring customers. Market metrics provide insights into competitive positioning and market share.

By regularly monitoring these indicators, investors can adjust their strategies based on real-time data, ensuring that they remain aligned with their financial objectives.

Selecting the Right KPIs

Choosing the right KPIs is crucial for effective investment management. Investors must first define their objectives clearly. Are they looking for growth, income, or capital preservation? Once objectives are established, relevant KPIs can be identified.

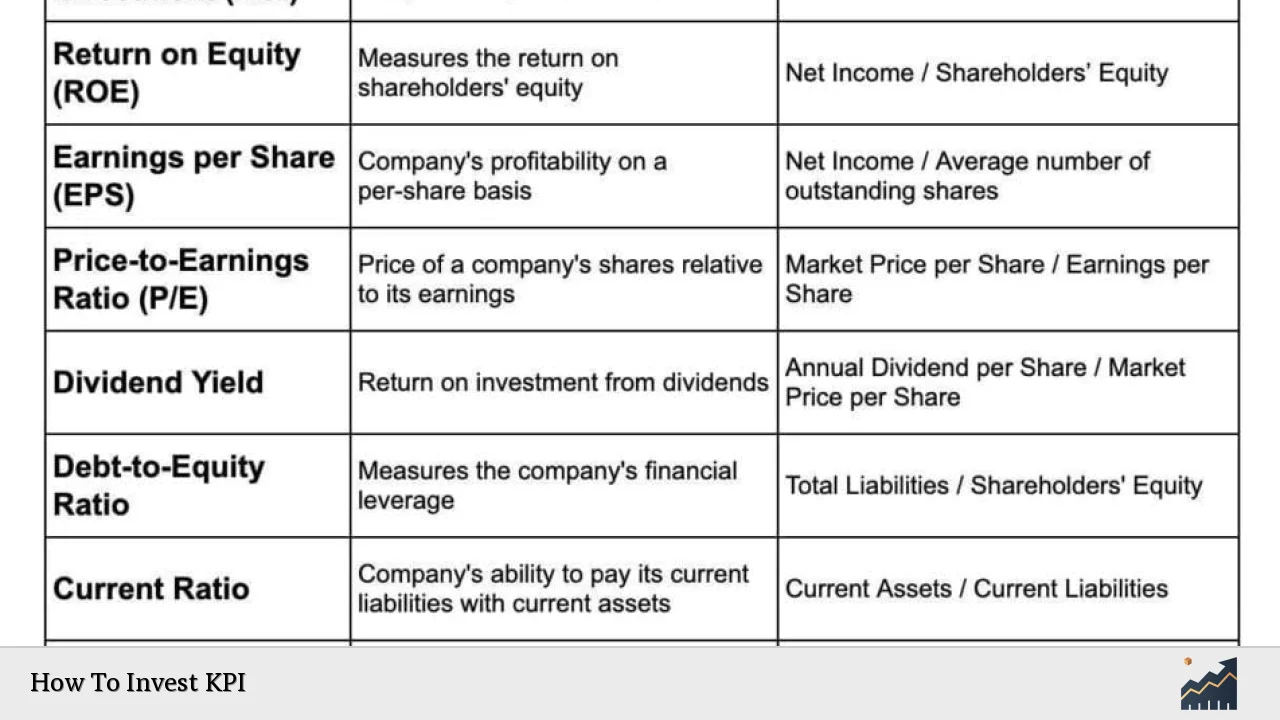

Some commonly used KPIs in investing include:

- Return on Investment (ROI): Measures profitability relative to investment costs.

- Return on Equity (ROE): Assesses how effectively a company uses equity to generate profits.

- Price-to-Earnings Ratio (P/E): Indicates how much investors are willing to pay per dollar of earnings.

- Dividend Yield: Shows the return on investment from dividends relative to share price.

- Debt-to-Equity Ratio: Evaluates financial leverage by comparing total liabilities to shareholders’ equity.

Selecting a balanced mix of these KPIs allows investors to gain a comprehensive view of their investments’ performance.

Implementing KPI Monitoring Systems

To effectively utilize KPIs, investors should implement robust monitoring systems. This involves setting up processes to collect and analyze data regularly. There are various tools available that can automate data collection and visualization, making it easier to track performance over time.

Investors should establish a routine for reviewing their KPIs. This could be monthly or quarterly, depending on their investment strategy. Regular reviews help identify trends early, allowing for timely adjustments to investment strategies.

Moreover, visualizing KPIs through dashboards can enhance understanding and facilitate quicker decision-making. A well-designed dashboard presents critical metrics at a glance, enabling investors to focus on areas needing attention.

Analyzing KPI Data

Once KPIs are established and monitored, the next step is analyzing the data collected. This analysis should focus on identifying patterns and correlations that inform investment decisions.

For example, if an investor notices a declining ROI over several quarters, it may indicate underlying issues within the portfolio or market conditions affecting performance. Conversely, an increasing EPS could signal strong company performance and potential for future growth.

Investors should also consider external factors that may impact their KPIs, such as economic conditions or industry trends. By understanding these influences, they can make more informed decisions about when to buy or sell assets.

Adjusting Investment Strategies Based on KPI Insights

The ultimate goal of monitoring KPIs is to adjust investment strategies based on insights gained from data analysis. If certain investments consistently underperform based on selected KPIs, it may be time to reassess those positions.

Investors should be proactive in making changes rather than reactive. This means not waiting for significant losses before taking action but rather continuously evaluating whether each investment aligns with overall goals.

For instance:

- If a stock’s P/E ratio becomes significantly higher than its historical average without justification from earnings growth, it might be prudent to sell.

- Conversely, if a company shows consistent revenue growth but has a low ROI due to high initial costs, it may warrant patience as it matures.

By being agile in response to KPI insights, investors can optimize their portfolios for better long-term performance.

The Role of Technology in KPI Management

Technology plays a vital role in managing KPIs effectively. Various software solutions can assist in tracking financial metrics and automating reporting processes. These tools not only save time but also improve accuracy in data collection.

Investors should look for platforms that offer customizable dashboards tailored to their specific needs. Features such as real-time data updates and alerts for significant changes in key metrics can enhance an investor’s ability to respond quickly to market shifts.

Additionally, leveraging technology allows investors to conduct deeper analyses through advanced analytics capabilities. This can uncover hidden trends within data that may not be immediately apparent through traditional methods.

Common Pitfalls in KPI Investment Strategies

While utilizing KPIs is essential for successful investing, there are common pitfalls that investors should avoid:

- Overemphasis on Short-Term Metrics: Focusing too much on short-term fluctuations can lead to hasty decisions that undermine long-term goals.

- Neglecting Qualitative Factors: Relying solely on quantitative data may overlook important qualitative aspects such as management effectiveness or market positioning.

- Ignoring Market Conditions: External economic factors can significantly impact KPI performance; thus, staying informed about broader market trends is crucial.

- Setting Unrealistic Targets: Establishing overly ambitious KPI targets can lead to frustration; it’s important to set achievable goals based on realistic assessments.

By being aware of these pitfalls, investors can create more resilient strategies that withstand market volatility while still achieving desired outcomes.

FAQs About How To Invest KPI

- What are the most important KPIs for investors?

The most important KPIs include Return on Investment (ROI), Earnings per Share (EPS), Price-to-Earnings Ratio (P/E), and Dividend Yield. - How often should I review my investment KPIs?

It is advisable to review your investment KPIs at least quarterly or monthly depending on your investment strategy. - Can technology help in managing investment KPIs?

Yes, technology can automate data collection and provide real-time insights through customizable dashboards. - What should I do if my investment KPI trends are declining?

If your investment KPI trends are declining, consider reassessing your portfolio positions or adjusting your strategy accordingly. - How do I choose the right KPIs for my investments?

You should choose KPIs based on your specific investment objectives and ensure they align with your overall financial goals.

In conclusion, investing using Key Performance Indicators is an effective way to ensure informed decision-making and strategic alignment with financial goals. By understanding what KPIs are essential for evaluating investments and implementing robust monitoring systems, investors can navigate the complexities of the market with confidence.