Investing in the Vanguard Total Stock Market ETF (VTI) is a strategic choice for many investors seeking broad exposure to the U.S. stock market. VTI is designed to track the performance of the CRSP US Total Market Index, which includes a wide range of companies across various sectors and market capitalizations. This makes it an attractive option for both novice and experienced investors looking to diversify their portfolios.

VTI offers several advantages, including a low expense ratio of just 0.03%, which allows investors to retain more of their returns over time. Additionally, it provides exposure to over 3,800 stocks, encompassing large-, mid-, and small-cap equities. This diversification helps mitigate risks associated with individual stocks and sectors, making VTI a solid foundation for any investment strategy.

Investing in VTI can be done through several steps, which include selecting a brokerage, funding your account, and placing your order. Below is a concise overview of the process:

| Step | Description |

|---|---|

| 1. Choose a Broker | Select a brokerage that offers VTI trading. |

| 2. Open an Account | Complete the registration process and provide necessary documentation. |

| 3. Fund Your Account | Transfer funds into your brokerage account to enable trading. |

| 4. Place an Order | Submit a buy order for VTI through your broker’s platform. |

Choosing the Right Brokerage

Selecting the right brokerage is crucial when investing in VTI. Investors should consider factors such as fees, account minimums, and user experience. Many brokers offer commission-free trading for ETFs, including VTI, which can significantly reduce overall investment costs.

- Look for platforms that provide educational resources and tools for beginners.

- Ensure that the broker is regulated and has a good reputation in the industry.

- Check if they offer mobile trading options for convenience.

Once you have identified a suitable brokerage, proceed to open an account.

Opening and Funding Your Account

After choosing a brokerage, you will need to open an investment account. This process typically involves filling out an online application form where you provide personal information such as your name, address, Social Security number, and employment details.

- Be prepared to upload identification documents for verification.

- Once your account is approved, you can fund it through various methods such as bank transfer or wire transfer.

- Some brokers may allow you to fund your account using credit or debit cards.

It is essential to ensure that your account is adequately funded before placing any trades.

Placing Your Order for VTI

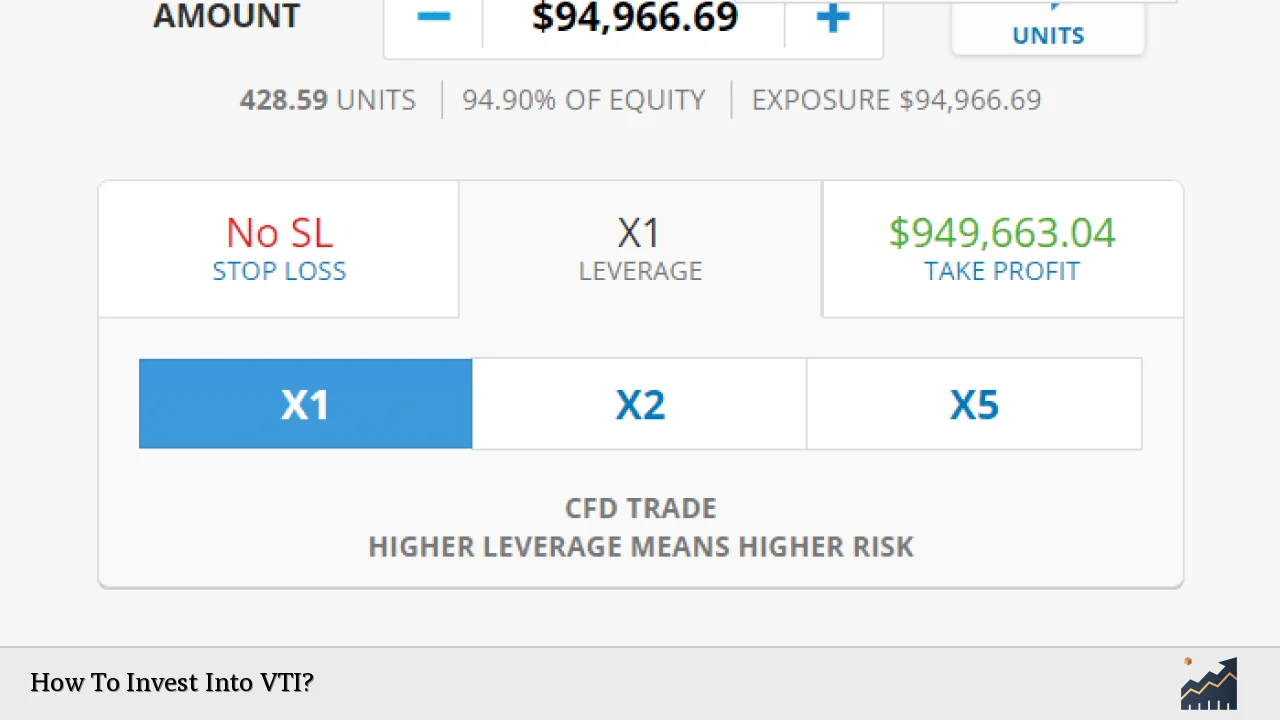

With your account funded, you can now place an order to buy VTI. This process varies slightly depending on the brokerage platform you are using but generally follows these steps:

- Log into your brokerage account and navigate to the trading section.

- Enter “VTI” in the search bar to locate the Vanguard Total Stock Market ETF.

- Choose whether you want to buy by dollar amount or by number of shares.

- Review the order details, including current market price and total cost.

- Submit your order.

Investors should be aware of different types of orders they can place:

- Market Order: Executes immediately at the current market price.

- Limit Order: Sets a specific price at which you want to buy; it will only execute if the market reaches that price.

Understanding VTI’s Performance and Dividends

VTI has historically provided strong returns due to its broad market exposure. The ETF includes companies from various sectors such as technology, healthcare, and finance. This diversification helps reduce volatility while capturing growth across different areas of the economy.

Additionally, VTI pays dividends quarterly. The dividend yield fluctuates based on market conditions but has averaged around 1.5% in recent years. Investors seeking income can benefit from these dividends while also enjoying potential capital appreciation as the underlying stocks grow in value.

It’s important to monitor VTI’s performance regularly and stay informed about economic indicators that may affect its value.

Risk Factors to Consider

While investing in VTI offers many benefits, it is essential to understand potential risks associated with this ETF:

- Market Risk: As with any investment in stocks, there is a risk that market fluctuations could lead to losses.

- Economic Factors: Changes in interest rates or economic downturns can negatively impact stock prices.

- Lack of International Exposure: Unlike some global ETFs, VTI focuses solely on U.S. companies, which may limit diversification opportunities in international markets.

Investors should assess their risk tolerance before committing funds to VTI or any other investment vehicle.

Monitoring Your Investment

After purchasing shares of VTI, it’s crucial to monitor your investment regularly. Keep track of:

- Performance Metrics: Review how VTI is performing relative to its benchmark index.

- Market Conditions: Stay informed about economic trends that could impact U.S. stocks.

- Rebalancing Needs: Depending on your overall portfolio strategy, consider rebalancing if VTI becomes too large a portion of your investments.

Utilizing financial news platforms or brokerage tools can help keep you updated on relevant information regarding VTI.

FAQs About How To Invest Into VTI

- What is VTI?

VTI is an exchange-traded fund that tracks the performance of the CRSP US Total Market Index. - How do I buy shares of VTI?

You can buy shares through a brokerage account by placing a market or limit order. - What are the benefits of investing in VTI?

VTI offers broad diversification across thousands of U.S. stocks with low fees. - Is there a minimum investment for VTI?

No minimum investment is required; you can buy as little as one share. - How often does VTI pay dividends?

VTI pays dividends quarterly based on its underlying holdings.

Investing in VTI is straightforward and offers an excellent way for individuals to gain exposure to the entire U.S. stock market while benefiting from low costs and diversification. By following these steps—choosing a broker, opening an account, funding it, placing an order—you can effectively add this ETF to your investment portfolio. Always remember to evaluate your financial goals and risk tolerance before making any investment decisions.