Investing in xAI, Elon Musk’s artificial intelligence venture, has garnered significant interest from investors seeking exposure to cutting-edge AI technology. While xAI is not yet publicly traded, there are several strategies potential investors can explore to gain a stake in this promising company. This comprehensive guide will walk you through the current investment landscape for xAI and provide actionable steps for those looking to invest.

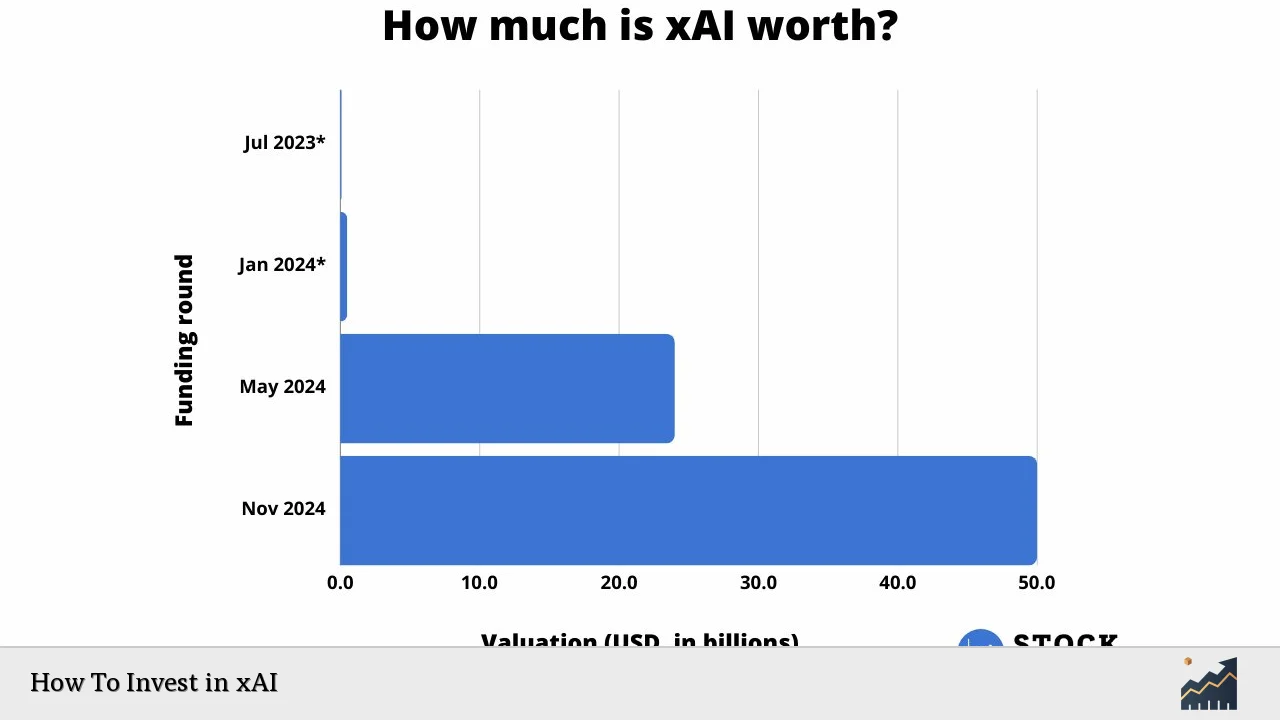

xAI, founded in 2023, has quickly established itself as a major player in the AI industry. The company’s focus on developing advanced AI systems and its association with tech visionary Elon Musk have contributed to its rapid rise in valuation. Recent funding rounds have valued xAI at over $50 billion, reflecting strong investor confidence in its potential to compete with established AI firms.

| xAI Valuation | Latest Funding Round |

|---|---|

| $50 billion | $6 billion |

Current Investment Options for xAI

As xAI is still a private company, direct investment opportunities are limited for most retail investors. However, there are several avenues that interested parties can explore to gain exposure to xAI:

Pre-IPO Investing Platforms

Some pre-IPO investing platforms have offered opportunities to invest in xAI before its public listing. Linqto, for example, has previously made xAI shares available to accredited investors with a minimum investment of $2,500-$5,000. However, these offerings are often limited and can sell out quickly.

ARK Venture Fund

The ARK Venture Fund, managed by Cathie Wood’s ARK Invest, has purchased a stake in xAI. This presents an indirect way for retail investors to gain exposure to xAI. The fund is accessible to U.S.-based individual investors aged 18 and up, with a minimum investment of $500. This option is particularly attractive as it doesn’t require accredited investor status.

Wait for the IPO

While there’s no official announcement regarding an xAI IPO, many investors are eagerly anticipating a potential public offering. When the IPO does occur, retail investors will have the opportunity to purchase shares through their brokerage accounts. It’s important to note that IPO allocations can be limited, and not all investors may receive shares at the initial offering price.

Strategies for Investing in xAI

Given the current limitations on direct investment, potential xAI investors should consider the following strategies:

Research and Monitor

Stay informed about xAI’s developments, funding rounds, and any announcements regarding a potential IPO. Follow reputable financial news sources and xAI’s official communications channels. This will help you make timely decisions when investment opportunities arise.

Prepare Your Brokerage Account

If you’re planning to invest during the IPO, ensure your brokerage account is set up and funded. Some brokers require “settled” cash for IPO investments, which can take a few days to process. Popular brokers for IPO access include Fidelity, Charles Schwab, and Robinhood.

Consider Indirect Investment

Investing in the ARK Venture Fund can provide immediate, albeit indirect, exposure to xAI. This option allows you to benefit from xAI’s potential growth while also gaining exposure to other promising pre-IPO companies in the fund’s portfolio.

Diversify Your Investment

While xAI’s potential is exciting, it’s crucial to maintain a balanced investment portfolio. Consider allocating only a portion of your investment capital to high-risk, high-reward opportunities like xAI. Diversification can help mitigate risk and ensure long-term financial stability.

Risks and Considerations

Investing in pre-IPO or newly public companies like xAI comes with significant risks that potential investors should carefully consider:

- Valuation Uncertainty: Private company valuations can be volatile and may not reflect true market value upon public listing.

- Limited Financial Information: Pre-IPO companies often have limited public financial disclosures, making it challenging to assess their financial health.

- Regulatory Risks: The AI industry faces potential regulatory challenges that could impact xAI’s operations and valuation.

- Competition: xAI operates in a highly competitive field, with established players like OpenAI and Google’s DeepMind vying for market share.

- Liquidity Concerns: Pre-IPO investments may have lock-up periods or limited opportunities for selling shares.

Future Outlook for xAI Investors

As xAI continues to develop its AI technologies and expand its operations, the company’s investment landscape is likely to evolve. Here are some potential developments investors should watch for:

- Public Listing: An eventual IPO could provide broader access to xAI shares for retail investors.

- Strategic Partnerships: Collaborations with major tech companies or research institutions could boost xAI’s value proposition.

- Product Launches: The release of innovative AI products or services could significantly impact xAI’s market position and valuation.

- Regulatory Developments: Changes in AI regulation could affect xAI’s operations and investor sentiment.

Investors should remain vigilant and adaptable as the xAI investment story unfolds. Staying informed about company developments and industry trends will be crucial for making sound investment decisions.

FAQs About Investing in xAI

- When will xAI go public?

There is currently no official announcement regarding an xAI IPO date. - Can I invest in xAI if I’m not an accredited investor?

Yes, through indirect methods like the ARK Venture Fund, which is open to all U.S. investors. - What is the minimum investment required for xAI?

Minimum investments vary by platform, ranging from $500 for the ARK Venture Fund to $2,500-$5,000 for some pre-IPO platforms. - How can I stay updated on xAI investment opportunities?

Follow financial news, xAI’s official channels, and set up alerts with your broker for IPO notifications. - Is investing in xAI risky?

Yes, investing in pre-IPO or newly public AI companies carries significant risks and should be approached cautiously.

In conclusion, while direct investment opportunities in xAI are currently limited, interested investors have several options to consider. Whether through pre-IPO platforms, indirect investment vehicles like the ARK Venture Fund, or waiting for a potential public offering, it’s crucial to approach xAI investment with a well-informed and balanced strategy. As with any investment, particularly in the fast-paced and volatile world of AI technology, thorough research, careful consideration of risks, and a long-term perspective are essential for success. By staying informed about xAI’s progress and the broader AI industry landscape, investors can position themselves to capitalize on potential opportunities while managing the inherent risks associated with investing in cutting-edge technology companies.