Investing in wealth is a fundamental aspect of personal finance that involves strategically allocating resources to build and preserve financial assets over time. This process is not merely about accumulating money; it is about creating a sustainable financial future through informed decision-making and disciplined practices. Whether you are starting your investment journey or looking to refine your existing strategies, understanding the principles of wealth investment is crucial.

Wealth investment encompasses various strategies, including saving, investing in stocks, bonds, real estate, and other assets. The goal is to grow your wealth while managing risks effectively. This article provides a comprehensive guide on how to invest in wealth, detailing essential steps, strategies, and considerations.

| Key Concepts | Description |

|---|---|

| Investment Planning | Creating a roadmap for your financial goals. |

| Diversification | Spreading investments across various asset classes to reduce risk. |

Understanding Wealth Investment

Wealth investment is the process of using money to generate more money. It involves various financial instruments and strategies aimed at increasing your net worth over time. The foundation of effective wealth investment lies in understanding your financial goals, risk tolerance, and the types of investments available.

To begin investing in wealth, you must first establish clear financial goals. These can include saving for retirement, purchasing a home, funding education, or building an emergency fund. Each goal will have different time horizons and risk profiles that will influence your investment choices.

Another critical aspect is assessing your risk tolerance. This refers to how much risk you are willing to take with your investments. Understanding your comfort level with risk will help you choose appropriate investment vehicles that align with your financial objectives.

Creating an Investment Plan

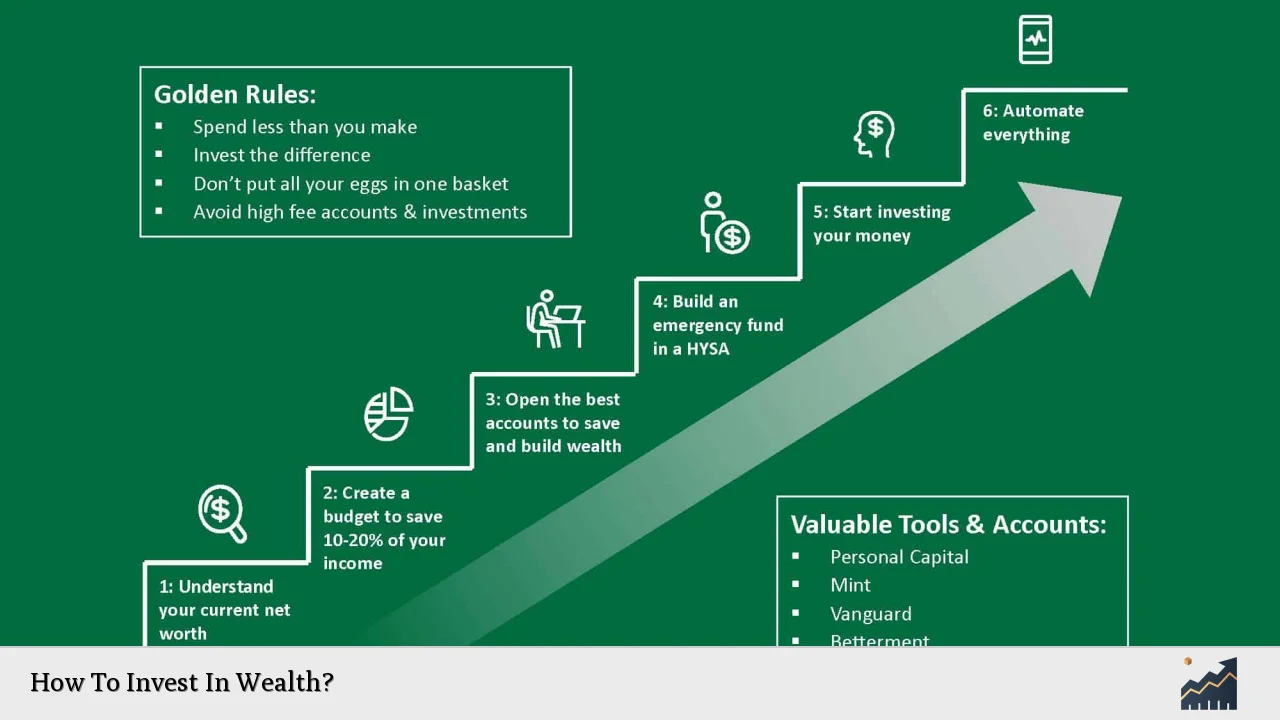

An investment plan serves as a blueprint for achieving your financial goals. It outlines how much money you need to invest, the types of investments you will make, and the timeline for achieving your goals. Here are key steps to create an effective investment plan:

- Define Your Goals: Clearly articulate what you want to achieve financially in both the short term and long term.

- Assess Your Financial Situation: Evaluate your current income, expenses, savings, and debts to understand your starting point.

- Determine Your Risk Tolerance: Use questionnaires or consult with a financial advisor to gauge how much risk you can handle.

- Select Investment Vehicles: Choose from stocks, bonds, mutual funds, ETFs, real estate, or other assets based on your goals and risk tolerance.

- Establish a Timeline: Set realistic timelines for when you want to achieve each goal.

- Review and Adjust Regularly: Periodically review your investment plan to ensure it remains aligned with your goals and market conditions.

Diversification: A Key Strategy

Diversification is a vital strategy in wealth investment that involves spreading investments across different asset classes to minimize risk. By diversifying your portfolio, you reduce the impact of a poor-performing asset on your overall financial health. Here are some important points about diversification:

- Asset Classes: Consider investing in various asset classes such as stocks, bonds, real estate, and commodities. Each class reacts differently to market conditions.

- Geographic Diversification: Invest in international markets alongside domestic ones to benefit from global growth opportunities.

- Sector Diversification: Within stock investments, spread your holdings across different sectors (e.g., technology, healthcare) to mitigate sector-specific risks.

- Regular Rebalancing: Periodically adjust your portfolio back to its target allocation as market conditions change.

Types of Investments

When it comes to investing in wealth, there are several types of investments available. Each type has its own characteristics and potential returns:

- Stocks: Ownership shares in companies that can provide capital appreciation and dividends.

- Bonds: Debt securities issued by governments or corporations that offer fixed interest payments over time.

- Mutual Funds: Pooled investment vehicles managed by professionals that allow investors to buy into a diversified portfolio.

- Exchange-Traded Funds (ETFs): Similar to mutual funds but traded on stock exchanges like individual stocks.

- Real Estate: Physical properties that can generate rental income and appreciate over time.

- Commodities: Physical goods like gold or oil that can serve as hedges against inflation.

Building an Emergency Fund

Before diving deep into investments, it’s crucial to build an emergency fund. This fund acts as a financial safety net for unexpected expenses such as medical emergencies or job loss. Here’s how to establish one:

- Aim for three to six months’ worth of living expenses saved in a high-yield savings account.

- Make regular contributions until you reach your target amount.

- Avoid using this fund for non-emergencies to ensure it remains intact when needed most.

Automating Your Investments

Automation can simplify the investment process significantly. By setting up automatic contributions from your paycheck or bank account into your investment accounts, you ensure consistent investing without the temptation to spend that money elsewhere. Here’s how automation helps:

- It encourages disciplined saving by making contributions automatic.

- It allows you to take advantage of dollar-cost averaging by consistently buying into investments regardless of market conditions.

- It reduces the emotional stress associated with investing decisions by removing the need for frequent manual transactions.

Managing Debt Wisely

Managing debt is crucial when investing in wealth. High-interest debt can significantly hinder your ability to save and invest effectively. Here are some strategies:

- Prioritize paying off high-interest debts like credit cards before focusing heavily on investments.

- Consider consolidating debts for lower interest rates if applicable.

- Use any windfalls (like bonuses or tax refunds) towards debt repayment instead of new investments.

Tax Considerations in Wealth Investment

Understanding tax implications is essential when investing in wealth. Different investments are taxed differently based on their nature and holding period:

- Long-term capital gains (on assets held for more than one year) are usually taxed at lower rates than short-term gains.

- Utilize tax-deferred accounts like IRAs or 401(k)s for retirement savings.

- Be aware of tax-efficient investing strategies such as holding growth assets in taxable accounts while keeping income-generating assets in tax-deferred accounts.

Staying Informed and Educated

The financial landscape is constantly evolving; thus, staying informed is vital for successful investing. Here are some ways to keep yourself educated:

- Follow reputable financial news sources and market analysts.

- Attend workshops or webinars focused on personal finance and investing.

- Read books on investing strategies written by respected authors in the field.

FAQs About How To Invest In Wealth

- What is the best way to start investing?

Begin by defining clear financial goals and creating a budget. - How much should I invest initially?

Start with an amount that fits within your budget while allowing room for growth. - Is it necessary to hire a financial advisor?

No, but consulting one can provide personalized guidance based on your situation. - What are high-risk investments?

High-risk investments include stocks of volatile companies or cryptocurrencies. - How often should I review my investment portfolio?

Review at least annually or whenever significant life changes occur.

Investing in wealth requires careful planning and ongoing management. By following these guidelines and remaining disciplined in your approach, you can build a robust financial future that aligns with your personal goals. Remember that patience and consistency are key components of successful wealth investment strategies.