Investing in Wagyu cattle has gained traction as a unique investment opportunity, appealing to those looking for alternatives to traditional assets. Wagyu beef, renowned for its exceptional quality and high market value, presents a compelling case for investors. This guide will delve into the intricacies of investing in Wagyu cattle, covering market trends, implementation strategies, risk considerations, regulatory aspects, and future outlook.

| Key Concept | Description/Impact |

|---|---|

| Market Demand | The global demand for Wagyu beef is projected to grow significantly, with market values expected to reach USD 42.3 billion by 2032. |

| Investment Costs | Initial investments can range from USD 10,000 for calves to upwards of USD 30,000 for high-quality breeding stock. |

| Return on Investment (ROI) | Potential ROI can be as high as 60% over a period of 21 months, depending on management practices and market conditions. |

| Breeding Practices | Successful investment requires specialized knowledge in breeding and animal husbandry to ensure quality meat production. |

| Market Competition | While Japan remains the primary supplier of authentic Wagyu, competition from countries like Australia and the USA is increasing. |

| Regulatory Considerations | Investors must comply with local agricultural regulations and standards regarding livestock management and food safety. |

Market Analysis and Trends

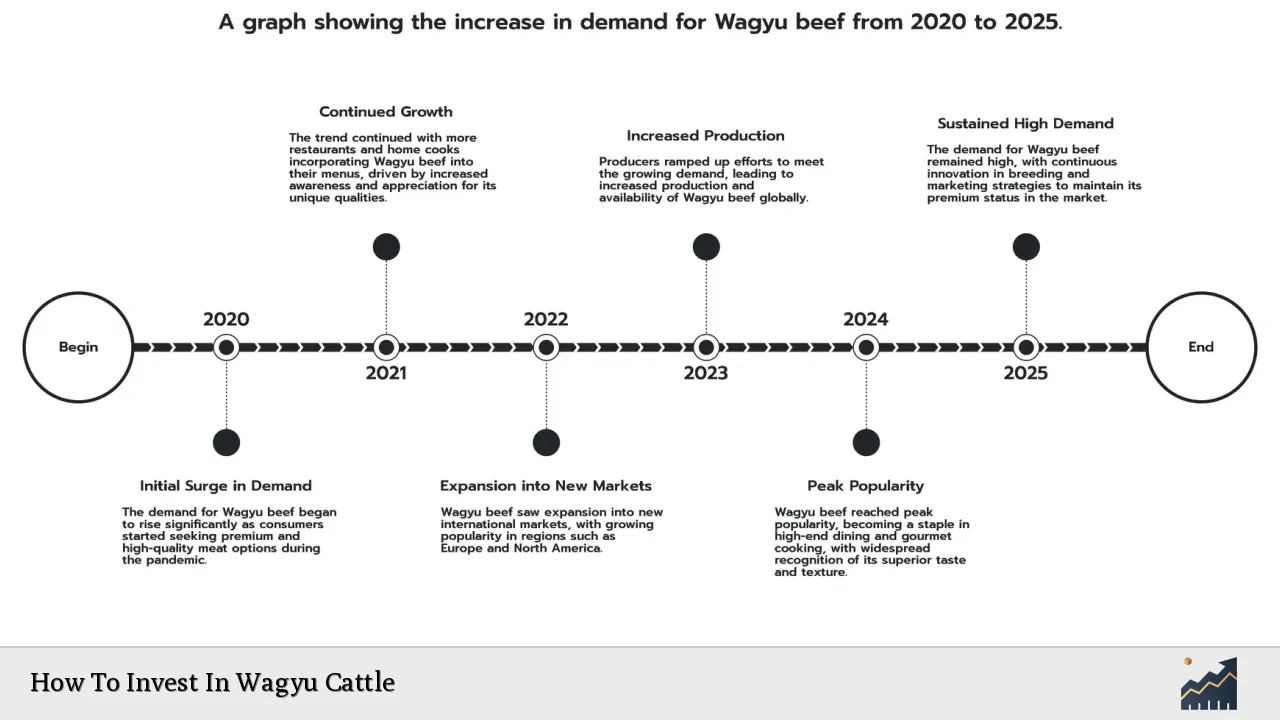

The global Wagyu beef market is experiencing robust growth driven by increasing consumer demand for premium-quality meat. As of 2023, the market was valued at approximately USD 24.2 billion and is projected to reach USD 42.3 billion by 2032, growing at a compound annual growth rate (CAGR) of around 6.4%. This surge is attributed to:

- Rising Affluence: As disposable incomes rise globally, particularly in developed nations, consumers are more willing to pay premium prices for high-quality products like Wagyu beef.

- Health Trends: The unique marbling and flavor profile of Wagyu beef cater to health-conscious consumers seeking better quality meat options rich in omega-3 and omega-6 fatty acids.

- Culinary Trends: The popularity of gourmet dining experiences has further fueled demand for Wagyu beef, making it a sought-after ingredient in high-end restaurants.

The competitive landscape is evolving as well. While Japan has historically dominated the market with its authentic Wagyu breeds, countries like Australia and the USA are increasingly producing their own high-quality variants. This competition may impact pricing strategies and market share distribution.

Implementation Strategies

Investing in Wagyu cattle requires a well-thought-out approach:

- Initial Investment: Investors can start with as little as USD 10,000 by purchasing young calves. However, high-quality breeding stock can cost between USD 4,000 to USD 30,000 depending on lineage.

- Contract Growing: Some investors opt for contract growing arrangements where they finance the raising of cattle through established farms that handle care and feeding. This model typically includes monthly fees for feed, veterinary care, and insurance.

- Breeding Programs: Engaging in breeding programs can enhance profitability. Investors should focus on acquiring genetics from reputable sources to ensure high-quality offspring that meet market demands.

- Management Practices: Successful investment hinges on effective management practices that prioritize animal welfare and optimal feeding strategies. Stress-free environments and proper nutrition are crucial for achieving the desired marbling in meat.

Risk Considerations

Like any investment, there are inherent risks associated with investing in Wagyu cattle:

- Market Volatility: Prices for Wagyu beef can fluctuate based on supply and demand dynamics. Economic downturns may reduce consumer spending on luxury items like premium beef.

- Operational Risks: Poor management practices can lead to health issues among cattle or suboptimal meat quality, adversely affecting profitability.

- Regulatory Risks: Compliance with agricultural regulations is essential. Changes in laws or standards can impact operational costs or market access.

- Environmental Factors: Natural disasters or pandemics can disrupt supply chains or affect livestock health, posing significant risks to investors.

Regulatory Aspects

Investors must navigate various regulatory frameworks when investing in livestock:

- Agricultural Regulations: Compliance with local agricultural laws regarding livestock management is mandatory. This includes animal welfare standards and food safety regulations.

- Import/Export Regulations: For those considering international trade of Wagyu beef or cattle, understanding import/export regulations is crucial to avoid legal pitfalls.

- Financial Regulations: Investors should be aware of any financial regulations that apply to agricultural investments in their jurisdiction.

Future Outlook

The future of investing in Wagyu cattle appears promising:

- Continued Growth: The global demand for Wagyu beef is expected to rise steadily as consumers increasingly seek premium quality products.

- Technological Advancements: Innovations in breeding technology and animal husbandry practices are likely to enhance productivity and profitability within the industry.

- Market Expansion: Emerging markets in Asia-Pacific are anticipated to drive significant growth due to rising affluence and changing dietary preferences.

Investors who are willing to engage deeply with the nuances of this sector—understanding both the agricultural practices involved and the market dynamics—stand to benefit from this lucrative investment opportunity.

Frequently Asked Questions About How To Invest In Wagyu Cattle

- What is the initial cost of investing in Wagyu cattle?

The initial investment can start at around USD 10,000 for young calves but can go up significantly depending on the quality and lineage of the cattle. - What factors affect the return on investment?

ROI is influenced by feed costs, health care expenses, farm management efficiency, and overall market conditions. - Is it necessary to have farming experience?

While not mandatory, having experience or knowledge about cattle farming significantly increases the chances of success in this investment. - What are the risks associated with this investment?

The main risks include market volatility, operational challenges related to livestock care, regulatory compliance issues, and environmental factors. - Are there financing options available?

Yes, some farms offer contract growing arrangements where investors finance cattle raising while experienced farmers manage operations. - How does one ensure compliance with regulations?

Investors should stay informed about local agricultural laws regarding livestock management and food safety standards. - What is the future outlook for Wagyu beef?

The demand for Wagyu beef is expected to grow due to rising consumer interest in premium products; technological advancements will likely enhance production efficiency. - Can I invest internationally?

Yes, but investors must understand international trade regulations concerning livestock before proceeding.

This comprehensive overview aims to equip potential investors with essential insights into investing in Wagyu cattle while addressing critical aspects such as market dynamics, implementation strategies, risk management, regulatory frameworks, and future trends.