Venture capital (VC) investing offers exciting opportunities for those looking to support innovative startups and potentially reap significant returns. This high-risk, high-reward investment strategy requires careful planning, research, and a solid understanding of the VC landscape. Whether you’re an accredited investor, a high-net-worth individual, or simply curious about the world of venture capital, this guide will walk you through the essential steps to get started in VC investing.

Venture capital investments typically focus on early-stage companies with high growth potential, often in technology-driven sectors. These investments can yield substantial returns if successful, but they also carry a higher risk of failure compared to traditional investment options. Before diving into VC investing, it’s crucial to understand the basics and assess your risk tolerance.

| Pros of VC Investing | Cons of VC Investing |

|---|---|

| Potential for high returns | High risk of loss |

| Access to innovative startups | Illiquid investments |

| Diversification opportunities | Requires significant capital |

| Potential for active involvement | Long investment horizons |

Understanding Venture Capital

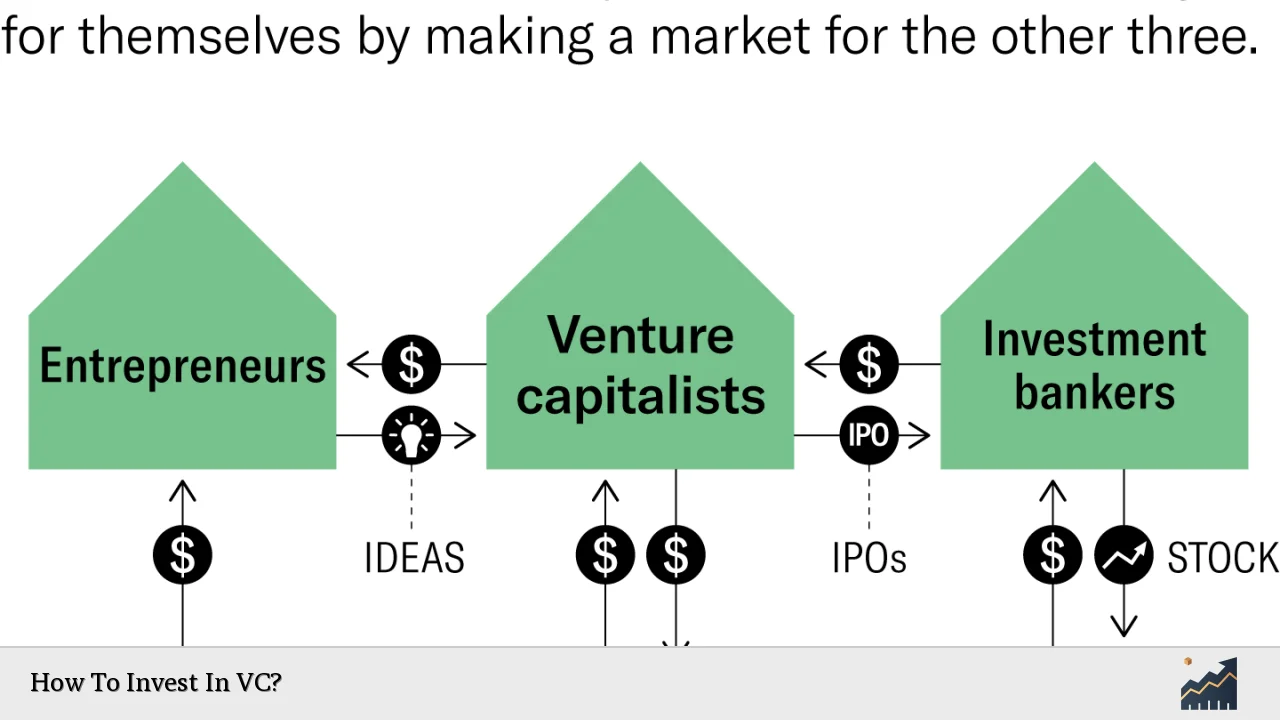

Venture capital is a form of private equity financing provided to startups and early-stage companies with high growth potential. VC firms raise funds from limited partners (LPs), such as institutional investors and high-net-worth individuals, and then invest this capital in promising startups in exchange for equity stakes.

The VC investment process typically involves several stages:

- Seed stage: Initial funding to help startups develop their product or service

- Early stage: Funding for companies with a viable product and some market traction

- Growth stage: Larger investments to help companies scale their operations

- Late stage: Funding for established companies preparing for an exit (IPO or acquisition)

Understanding these stages is crucial for investors, as each stage carries different levels of risk and potential returns. Seed-stage investments are generally the riskiest but can offer the highest potential returns, while late-stage investments tend to be less risky but may offer more modest returns.

Preparing for VC Investing

Before you start investing in venture capital, it’s essential to prepare yourself financially and mentally for the challenges ahead. Here are some key steps to take:

- Assess your financial situation: Ensure you have a solid financial foundation and can afford to tie up significant capital for extended periods.

- Educate yourself: Learn about the VC industry, investment strategies, and current market trends through books, online courses, and industry publications.

- Network: Attend startup events, join angel investor groups, and connect with experienced VC investors to gain insights and potential deal flow.

- Develop domain expertise: Focus on industries or technologies you understand well, as this knowledge will help you evaluate potential investments more effectively.

- Consider your risk tolerance: Be prepared for the possibility of losing your entire investment in some startups, and ensure you can handle the emotional stress of high-risk investing.

By taking these preparatory steps, you’ll be better equipped to make informed decisions and navigate the complex world of venture capital investing.

Investment Strategies for VC

When it comes to investing in venture capital, there are several strategies you can employ to maximize your chances of success:

Direct Investments

Direct investments involve investing your own capital directly into startups. This approach offers the highest potential returns but also requires the most time, expertise, and hands-on involvement. To make direct investments:

- Source deal flow through your network, startup events, and online platforms

- Conduct thorough due diligence on potential investments

- Negotiate terms and valuation with founders

- Provide ongoing support and guidance to portfolio companies

Venture Capital Funds

Investing in VC funds allows you to leverage the expertise and resources of professional fund managers. This approach offers diversification and requires less active involvement from investors. To invest in VC funds:

- Research and evaluate different VC firms and their track records

- Understand the fund’s investment thesis and target sectors

- Review the fund’s terms, including management fees and carried interest

- Meet minimum investment requirements, which can be substantial

Angel Groups and Syndicates

Joining angel groups or investment syndicates can provide access to deal flow, shared due diligence, and the ability to invest smaller amounts across multiple startups. This approach combines elements of direct investing and fund investing. To participate:

- Research and join reputable angel groups or online investment platforms

- Attend pitch events and review investment opportunities

- Collaborate with other investors on due diligence and deal terms

- Pool resources to make larger investments as a group

Due Diligence and Evaluation

Conducting thorough due diligence is crucial for successful VC investing. Here are key areas to focus on when evaluating potential investments:

- Team: Assess the founders’ experience, skills, and track record

- Market: Evaluate the size and growth potential of the target market

- Product: Understand the product’s unique value proposition and competitive advantage

- Traction: Review key metrics such as user growth, revenue, and customer acquisition costs

- Financials: Analyze the company’s financial projections and burn rate

- Legal: Review corporate documents, intellectual property, and any pending litigation

- Exit potential: Consider potential acquirers or IPO prospects

Remember that due diligence is an ongoing process, and you should continue to monitor your investments and provide support where needed.

Managing Your VC Portfolio

Effective portfolio management is essential for long-term success in VC investing. Here are some key strategies:

- Diversification: Spread your investments across multiple startups, sectors, and stages to mitigate risk

- Follow-on investments: Reserve capital for follow-on rounds in your best-performing companies

- Active involvement: Provide guidance, introductions, and support to help your portfolio companies succeed

- Regular monitoring: Stay informed about your investments’ progress and industry trends

- Exit planning: Work with founders and other investors to plan and execute successful exits

By actively managing your portfolio and staying engaged with your investments, you can increase your chances of success in the competitive world of venture capital.

FAQs About How To Invest In VC?

- What is the minimum amount required to invest in VC?

Minimum investments vary, but typically range from $50,000 for angel investments to $250,000 or more for VC funds. - How long does it take to see returns on VC investments?

VC investments typically have a 7-10 year horizon, with returns realized upon successful exits. - Can I invest in VC if I’m not an accredited investor?

While most VC opportunities require accredited investor status, some platforms offer limited options for non-accredited investors. - What are the typical returns for VC investments?

VC returns can vary widely, but top-performing funds aim for 3-5x returns over the fund’s lifetime. - How can I mitigate risks when investing in VC?

Diversify your portfolio, conduct thorough due diligence, and invest alongside experienced investors to mitigate risks.