Investing in traction uranium has become an increasingly attractive option for investors seeking exposure to the growing nuclear energy sector. As global demand for clean, reliable energy continues to rise, uranium is poised to play a crucial role in meeting these needs. This comprehensive guide will explore the various strategies, risks, and opportunities associated with investing in traction uranium, providing you with the knowledge needed to make informed investment decisions.

| Key Concept | Description/Impact |

|---|---|

| Traction Uranium | Refers to uranium companies with strong growth potential and increasing market share in the uranium sector |

| Supply-Demand Dynamics | Growing demand for nuclear energy coupled with limited supply is driving uranium prices higher |

| Geopolitical Factors | Shifting global policies and tensions impact uranium production and trade |

| Investment Vehicles | Options include stocks, ETFs, futures, and physical uranium trusts |

Market Analysis and Trends

The uranium market has experienced significant volatility in recent years, with prices consolidating in 2024 after a strong rally in 2023. As of Q3 2024, uranium spot prices have settled around the US$80 per pound range, well above historical lows but still below the all-time high of US$136.22 reached in 2007.

Several key factors are driving the current market dynamics:

Growing Global Demand: The push for clean energy solutions has reignited interest in nuclear power. In December 2023, the United States and over 20 other countries committed to tripling nuclear power capacity by 2050 to achieve net-zero carbon emissions. This commitment signals a long-term increase in uranium demand.

Supply Constraints: Major producers like Cameco and Orano have faced production shortfalls, contributing to a tightening supply. Additionally, geopolitical tensions and potential disruptions in key producing countries like Kazakhstan add uncertainty to the supply outlook.

Utility Buying Patterns: Nuclear power plant operators, the primary consumers of uranium, are showing increased activity in the market. In 2023, U.S. civilian nuclear power reactors purchased 51.6 million pounds of uranium concentrate, a 27% increase from 2022.

Emerging Markets: Countries like China and India are expanding their nuclear power programs, creating new sources of demand for uranium.

Implementation Strategies

Investors have several options for gaining exposure to traction uranium:

1. Uranium Stocks

Investing in uranium mining companies offers direct exposure to the sector. Consider the following categories:

- Major Producers: Companies like Cameco (NYSE:CCJ), Kazatomprom (LSE:KAP), and BHP (NYSE:BHP) offer stability and established operations.

- Junior Miners: Smaller companies like Uranium Energy Corp (NYSE:UEC) and Ur-Energy (NYSE:URG) offer higher growth potential but come with increased risk.

- Exploration Companies: These offer the highest risk-reward profile, as successful discoveries can lead to significant returns.

2. Uranium ETFs

Exchange-traded funds provide diversified exposure to the uranium sector:

- Global X Uranium ETF (ARCA:URA)

- Sprott Uranium Miners ETF (ARCA:URNM)

- VanEck Uranium+Nuclear Energy ETF (ARCA:NLR)

These funds offer a mix of uranium miners, producers, and related companies, spreading risk across the sector.

3. Physical Uranium Trusts

The Sprott Physical Uranium Trust (TSX:U.UN) allows investors to gain exposure to physical uranium without the operational risks associated with mining companies.

4. Uranium Futures

For more sophisticated investors, CME Group offers UxC uranium U3O8 futures contracts, each representing 250 pounds of uranium.

Risk Considerations

Investing in traction uranium comes with several risks:

Price Volatility: Uranium prices can be highly volatile, impacting the profitability of mining companies and the value of uranium-related investments.

Regulatory Changes: Nuclear energy policies and regulations can significantly affect the uranium market. For example, the U.S. ban on Russian uranium imports starting in August 2024 could reshape supply chains.

Operational Risks: Mining companies face challenges related to exploration, development, and production that can impact their performance.

Geopolitical Factors: Uranium production is concentrated in a few countries, making the market susceptible to geopolitical tensions and supply disruptions.

Market Sentiment: Public perception of nuclear energy can influence government policies and investment in the sector.

Regulatory Aspects

The uranium market is subject to strict regulations due to its association with nuclear energy:

International Atomic Energy Agency (IAEA): Sets global standards for nuclear safety and security.

National Regulatory Bodies: In the U.S., the Nuclear Regulatory Commission (NRC) oversees the nuclear industry, including uranium mining and processing.

Export Controls: Many countries have restrictions on uranium exports and imports due to non-proliferation concerns.

Environmental Regulations: Uranium mining and processing are subject to stringent environmental regulations, which can impact project development and operational costs.

Investors should stay informed about regulatory changes that could affect the uranium market and individual companies.

Future Outlook

The outlook for traction uranium remains positive, driven by several factors:

Growing Energy Demand: The surge in electricity demand, particularly from data centers and AI applications, is creating a favorable environment for nuclear power.

Climate Change Mitigation: Nuclear energy’s role in reducing carbon emissions is gaining recognition, potentially leading to increased investment in the sector.

Technological Advancements: Development of small modular reactors (SMRs) and advanced nuclear technologies could expand the market for uranium.

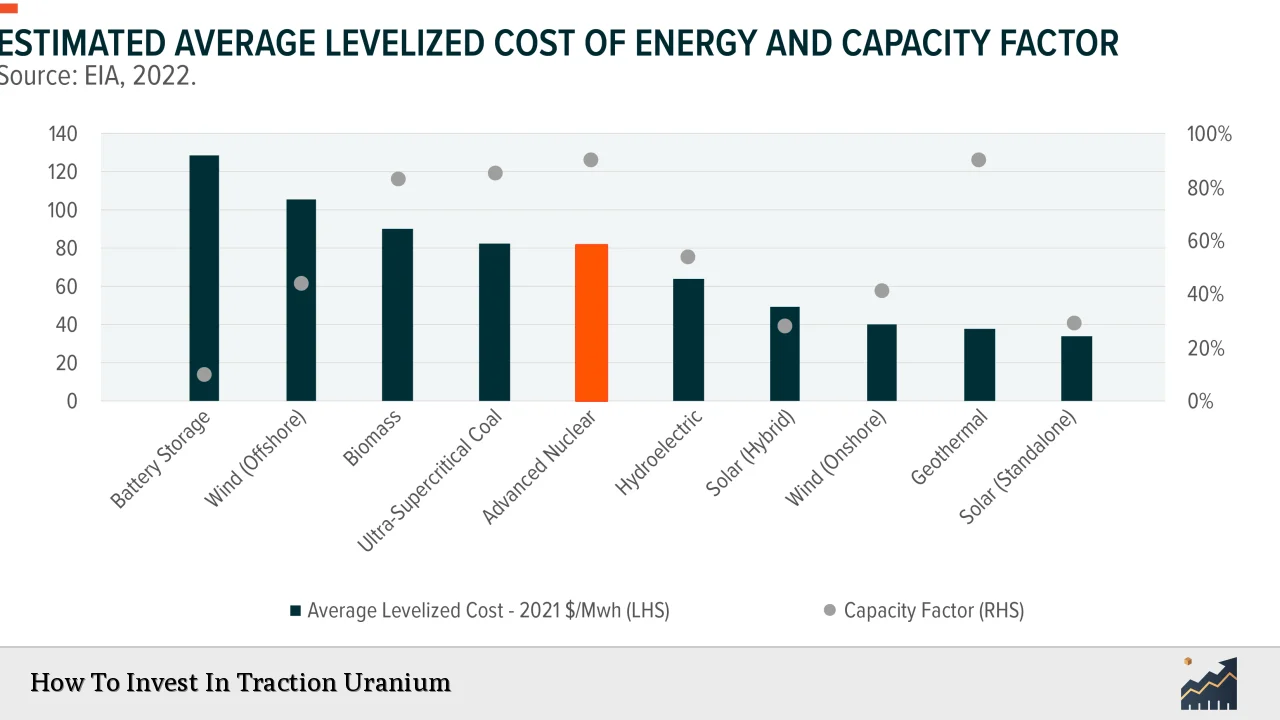

Supply-Demand Imbalance: Analysts predict that current uranium prices are still below levels needed to incentivize sufficient new production, suggesting potential for further price increases.

While short-term volatility is likely to persist, the long-term fundamentals for uranium appear strong. Investors should consider traction uranium as part of a diversified portfolio, keeping in mind the sector’s unique risks and opportunities.

Frequently Asked Questions About How To Invest In Traction Uranium

- What is the best way for a beginner to invest in traction uranium?

For beginners, investing in a uranium ETF like the Global X Uranium ETF (URA) or the Sprott Uranium Miners ETF (URNM) can provide diversified exposure to the sector with lower risk compared to individual stocks. - How much of my portfolio should I allocate to uranium investments?

The appropriate allocation depends on your risk tolerance and investment goals. Generally, speculative sectors like uranium should comprise a small portion of a diversified portfolio, typically no more than 5-10%. - Are there any uranium stocks that pay dividends?

Some larger, established uranium companies like Cameco (CCJ) pay dividends. However, many uranium stocks, especially junior miners, prioritize growth over dividend payments. - How do geopolitical events affect uranium investments?

Geopolitical events can significantly impact uranium investments. For example, sanctions on major producing countries or changes in nuclear energy policies can affect uranium prices and the performance of uranium-related stocks. - What are the risks of investing in junior uranium mining companies?

Junior miners carry higher risks, including exploration failure, financing challenges, and operational difficulties. However, they also offer potential for higher returns if successful. - How can I stay informed about developments in the uranium market?

Follow industry publications, subscribe to newsletters from reputable uranium market analysts, and monitor reports from organizations like the World Nuclear Association and the International Atomic Energy Agency. - Is physical uranium a good investment option?

While direct investment in physical uranium is challenging for individual investors, the Sprott Physical Uranium Trust offers a way to gain exposure to physical uranium. This can be a good option for those seeking to invest directly in the commodity without operational risks associated with mining.