Investing in TQQQ, the ProShares UltraPro QQQ ETF, can be an enticing opportunity for those looking to leverage their exposure to the Nasdaq-100 Index. This ETF aims to provide three times the daily returns of the Nasdaq-100, making it a popular choice among traders seeking short-term gains. However, it is crucial to understand the complexities and risks associated with leveraged ETFs before diving in.

TQQQ is designed for experienced investors who can handle significant volatility and are willing to actively manage their investments. Unlike traditional ETFs, TQQQ’s leveraged nature means that while it can amplify gains during bullish market conditions, it can also lead to substantial losses in downturns. Therefore, having a solid strategy and understanding market dynamics is essential.

| Feature | Description |

|---|---|

| Type | Leveraged ETF aiming for 3x daily returns of Nasdaq-100 |

| Expense Ratio | Approximately 0.95% |

Understanding TQQQ and Its Mechanics

TQQQ operates by using financial derivatives such as swaps and futures contracts to achieve its leveraged exposure. This means that if the Nasdaq-100 Index rises by 1%, TQQQ aims to increase by 3%. Conversely, if the index falls by 1%, TQQQ could drop by 3%. This daily reset of leverage is a fundamental characteristic of leveraged ETFs and is vital for investors to grasp.

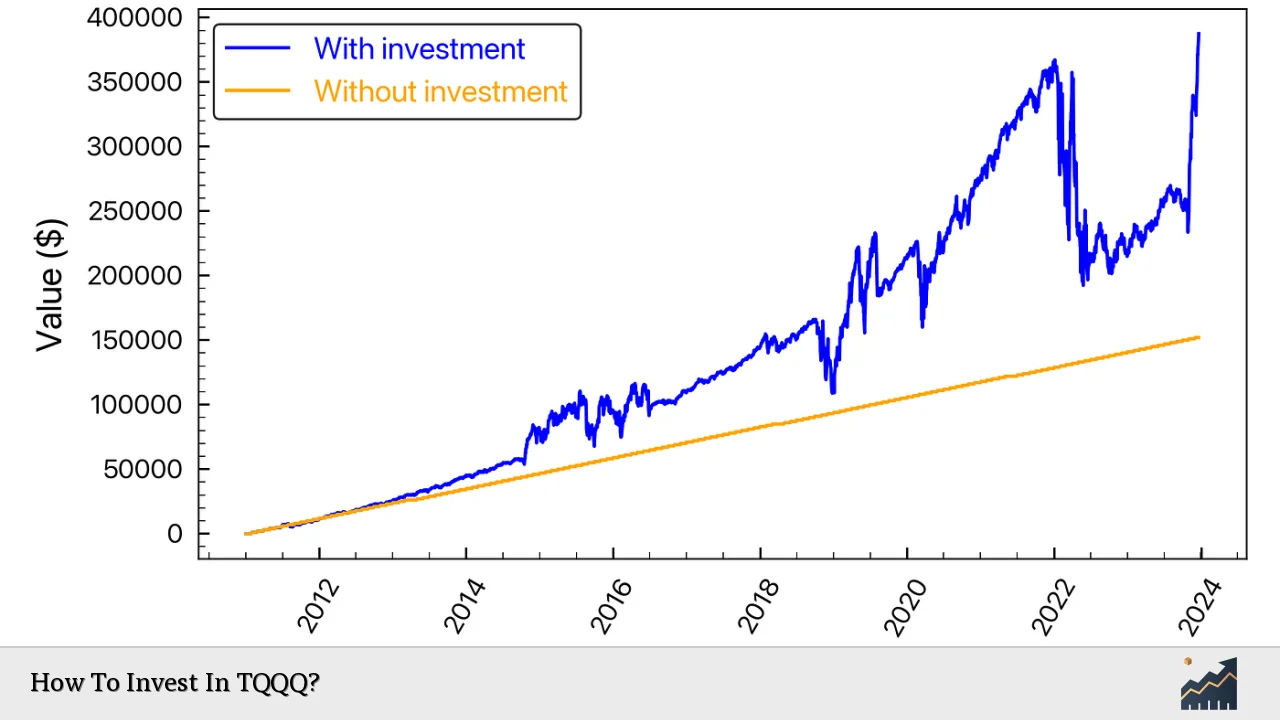

The important info here is that TQQQ is not suitable for long-term holding due to a phenomenon known as volatility decay. This occurs when the ETF’s performance diverges from the expected multiple over longer periods, especially in fluctuating markets. For example, if the Nasdaq-100 experiences both gains and losses over several days, TQQQ may underperform compared to simply holding the index.

Investors should also be aware of the high expense ratio associated with TQQQ. At approximately 0.95%, this fee is significantly higher than that of traditional ETFs like QQQ, which has an expense ratio around 0.20%. The higher costs can eat into returns over time, making it essential for investors to consider their investment horizon carefully.

Strategies for Investing in TQQQ

When investing in TQQQ, having a well-defined strategy is essential. Here are some effective approaches:

- Short-term Trading: Since TQQQ is designed for daily trading, many investors use it for short-term strategies, capitalizing on quick market movements.

- Hedging: Investors can use TQQQ in conjunction with other assets to hedge against market downturns. For instance, pairing TQQQ with treasury bonds or options on QQQ can provide some downside protection.

- Dollar-Cost Averaging (DCA): This strategy involves regularly investing a fixed amount into TQQQ regardless of its price. DCA can help mitigate some risks associated with market volatility.

- Portfolio Diversification: Instead of allocating all funds into TQQQ, consider diversifying your portfolio with other assets like bonds or commodities to balance risk.

It’s crucial to monitor your investments closely when using these strategies. The high volatility associated with TQQQ means that prices can fluctuate dramatically within short periods.

Risks Associated with TQQQ

Investing in TQQQ comes with several risks that potential investors must consider:

- High Volatility: The leveraged nature of TQQQ means that it can experience significant price swings. This volatility can lead to rapid losses if the market moves against your position.

- Market Timing: Successfully investing in TQQQ often requires precise market timing. Investors must be able to predict short-term movements in the Nasdaq-100 accurately.

- Long-Term Holding Risks: Holding TQQQ over extended periods can lead to underperformance compared to traditional ETFs due to volatility decay and compounding effects.

- Liquidity Risk: While TQQQ typically has high trading volume, liquidity can vary during extreme market conditions, potentially making it harder to execute trades at desired prices.

Understanding these risks is essential for anyone considering investing in TQQQ. It’s advisable only to invest funds that you can afford to lose and to conduct thorough research before making any decisions.

How to Buy TQQQ

Investing in TQQQ involves several straightforward steps:

1. Choose a Brokerage: Select a brokerage platform that offers access to ETFs like TQQQ. Ensure that the platform provides competitive fees and good customer service.

2. Open an Account: Complete the account opening process by providing necessary personal information and funding your account.

3. Research Market Conditions: Before purchasing shares of TQQQ, analyze current market conditions and trends related to the Nasdaq-100 Index.

4. Decide on Investment Amount: Determine how much you want to invest in TQQQ based on your overall investment strategy and risk tolerance.

5. Execute Your Trade: Place an order for TQQQ through your brokerage platform. You can choose between a market order (buying at current market price) or a limit order (setting a specific price at which you want to buy).

6. Monitor Your Investment: After purchasing shares of TQQQ, keep a close eye on performance and be prepared to adjust your strategy as needed based on market movements.

By following these steps, you can effectively invest in TQQQ while managing your risk exposure appropriately.

FAQs About How To Invest In TQQQ

- What is TQQQ?

TQQQ is a leveraged ETF designed to provide three times the daily returns of the Nasdaq-100 Index. - Is investing in TQQQ suitable for long-term holding?

No, due to volatility decay and high expense ratios, it’s generally not recommended for long-term holding. - How does leverage work in TQQQ?

TQQQ uses financial derivatives to amplify its exposure, aiming for three times the daily performance of its underlying index. - What strategies can I use when investing in TQQQ?

Common strategies include short-term trading, hedging with other assets, dollar-cost averaging, and portfolio diversification. - What are the main risks of investing in TQQQ?

Main risks include high volatility, market timing challenges, long-term holding risks, and potential liquidity issues.

In conclusion, investing in TQQQ offers potential rewards but comes with significant risks that require careful consideration and active management. By understanding how this leveraged ETF operates and implementing effective strategies, investors can navigate its complexities successfully while aiming for substantial returns from their investments in the tech-heavy Nasdaq-100 Index.