Investing in stocks has become increasingly accessible, especially with the rise of mobile applications like Cash App. This platform not only facilitates peer-to-peer payments but also allows users to invest in stocks and ETFs with minimal barriers to entry. With features such as fractional shares and a user-friendly interface, Cash App is particularly appealing to new investors looking to dip their toes into the stock market. This guide will provide a comprehensive overview of how to invest in stocks using Cash App, including market analysis, implementation strategies, risk considerations, regulatory aspects, and future outlook.

| Key Concept | Description/Impact |

|---|---|

| Fractional Shares | Allows users to invest in stocks with as little as $1, making high-value stocks accessible. |

| No Commission Fees | Cash App does not charge fees for buying or selling stocks, enhancing profitability for small investors. |

| Market Alerts | Users can set alerts for price changes and market trends, aiding in informed decision-making. |

| Investment Portfolio Tracking | Cash App provides tools to monitor investments and track performance over time. |

| SIPC Protection | Securities are protected up to $500,000 under SIPC, ensuring a level of safety for investors. |

Market Analysis and Trends

The stock market has shown resilience and growth potential in recent years. As of December 2024, major indices like the S&P 500 and Nasdaq have experienced significant rallies, driven by strong performances from technology and financial sectors. For instance, the S&P 500 was up approximately 0.7%, while the Nasdaq Composite surged above 20,000 points recently due to favorable economic indicators and expectations of interest rate cuts by the Federal Reserve.

Current trends indicate:

- Increased Retail Participation: Platforms like Cash App have democratized access to investing, leading to a surge in retail investors.

- Focus on Technology Stocks: Technology companies continue to dominate market performance, with firms like Apple and Nvidia leading gains.

- Market Volatility: Investors should be aware of potential fluctuations driven by economic data releases and geopolitical events.

Understanding these trends is crucial for investors using Cash App as they navigate their investment choices.

Implementation Strategies

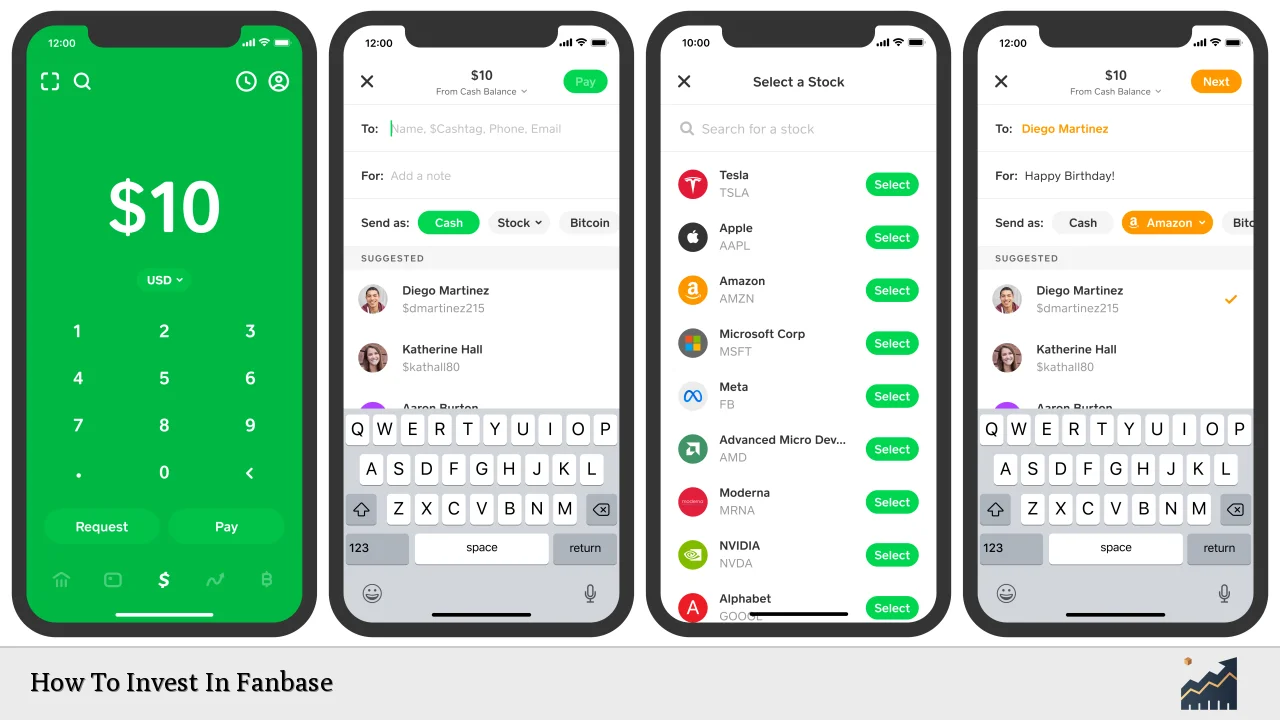

Investing on Cash App involves several straightforward steps:

- Download and Set Up: Users must download the app and create an account. Linking a bank account or debit card is essential for funding investments.

- Funding Your Account: Users can transfer funds into their Cash App account from their bank or directly deposit money from their earnings.

- Researching Stocks: Utilize Cash App’s built-in tools to research stocks. The app provides analyst opinions and earnings reports which can guide investment decisions.

- Buying Stocks:

- Search for the desired stock by its name or ticker symbol.

- Choose the amount to invest (as little as $1).

- Confirm the purchase.

- Monitoring Investments: Regularly check your portfolio through the Investing tab to track performance and make adjustments based on market conditions.

- Setting Alerts: Users can set price alerts for specific stocks to stay informed about market movements.

By following these steps, investors can effectively utilize Cash App for stock trading.

Risk Considerations

While investing in stocks through Cash App offers numerous benefits, there are inherent risks:

- Market Risk: Stock prices can fluctuate significantly due to market conditions, economic changes, or company performance.

- Liquidity Risk: Some stocks may not be easily sellable without incurring significant losses during downturns.

- Regulatory Risks: Changes in regulations can impact stock performance and investor rights.

- Lack of Advanced Features: Compared to traditional brokerages, Cash App may lack advanced trading tools that seasoned investors might prefer.

Investors should assess their risk tolerance before engaging in stock trading on this platform.

Regulatory Aspects

Cash App Investing is regulated under U.S. securities laws. Here are key regulatory considerations:

- SIPC Membership: Cash App Investing LLC is a member of the Securities Investor Protection Corporation (SIPC), which protects securities customers up to $500,000.

- Tax Implications: Gains from stock sales are subject to capital gains tax. Since Cash App does not offer retirement accounts like IRAs, users must consider tax liabilities when cashing out profits.

- Compliance with SEC Regulations: Cash App adheres to regulations set forth by the Securities and Exchange Commission (SEC), ensuring that it operates within legal frameworks designed to protect investors.

Understanding these regulations is essential for responsible investing on the platform.

Future Outlook

The future of investing via platforms like Cash App looks promising due to several factors:

- Technological Advancements: Continued improvements in mobile technology will likely enhance user experience and accessibility in investing.

- Market Growth Potential: With increasing retail investor participation, especially among younger demographics, platforms like Cash App could see significant growth in user engagement.

- Regulatory Developments: As regulations evolve, there may be new opportunities for investment products that could be offered through Cash App.

Investors should remain informed about these trends as they shape the landscape of mobile investing.

Frequently Asked Questions About How To Invest In Stocks On Cash App

- What is Cash App?

Cash App is a mobile payment service that allows users to send money, receive payments, and invest in stocks and Bitcoin. - How do I start investing on Cash App?

To start investing on Cash App, download the app, create an account, fund it from your bank account or debit card, then search for stocks or ETFs you wish to buy. - Can I buy fractional shares on Cash App?

Yes, Cash App allows you to buy fractional shares with investments starting as low as $1. - Are there any fees associated with trading on Cash App?

No commission fees are charged for buying or selling stocks on Cash App. - How does Cash App protect my investments?

Your investments are protected up to $500,000 by SIPC insurance through Cash App Investing LLC. - What types of investments can I make on Cash App?

You can invest in individual stocks and exchange-traded funds (ETFs) using Cash App. - What should I know about taxes when investing through Cash App?

You will need to pay capital gains taxes on any profits made from selling stocks since Cash App does not offer tax-deferred accounts. - Can I sell my stocks anytime?

Yes, you can sell your stocks at any time during market hours; however, it may take up to two business days for proceeds from sales to appear in your balance.

Investing through Cash App offers a unique opportunity for individuals looking to enter the stock market with ease. By understanding how to navigate this platform effectively—alongside awareness of market trends and regulatory considerations—investors can make informed decisions that align with their financial goals.