Investing in stocks can be a powerful way to grow your wealth over time. For beginners, the stock market may seem intimidating, but understanding the basics can help simplify the process. This guide will provide a comprehensive overview of how to invest in stocks, including practical steps, strategies, and tips to navigate the market effectively.

To start investing in stocks, you need to understand what stocks are. Stocks represent ownership in a company, and when you buy shares, you become a part-owner of that company. Your goal as an investor is to buy low and sell high, profiting from the appreciation of stock prices over time. Additionally, some stocks pay dividends, which are distributions of a company’s earnings to shareholders.

Investing in stocks involves several steps. First, you need to open a brokerage account, which serves as a platform for buying and selling stocks. Next, you’ll need to fund your account and decide on your investment strategy. Whether you prefer individual stocks or diversified funds like ETFs (Exchange-Traded Funds), having a clear plan will guide your investment decisions.

| Step | Description |

|---|---|

| 1. Open a Brokerage Account | Choose a platform that suits your needs and allows you to trade stocks. |

| 2. Fund Your Account | Add money to your brokerage account to start making investments. |

| 3. Research Stocks | Analyze potential investments based on company performance and market trends. |

| 4. Buy Stocks or Funds | Execute trades based on your research and investment strategy. |

| 5. Monitor Your Investments | Regularly review your portfolio and adjust as necessary. |

Understanding the Stock Market

The stock market is where investors buy and sell shares of publicly traded companies. It operates through exchanges like the New York Stock Exchange (NYSE) and NASDAQ, where prices fluctuate based on supply and demand.

Important info: Stocks are categorized into different types:

- Common Stocks: These give shareholders voting rights but come with higher risk.

- Preferred Stocks: These offer fixed dividends but usually do not have voting rights.

- Growth Stocks: Companies expected to grow at an above-average rate compared to their industry.

- Value Stocks: Stocks that appear undervalued based on fundamental analysis.

Understanding these categories can help you make informed decisions about which types of stocks align with your investment goals.

Setting Investment Goals

Before diving into stock investing, it’s crucial to set clear investment goals. Consider what you want to achieve with your investments:

- Long-term growth: Are you saving for retirement or a major purchase?

- Income generation: Are you looking for regular income through dividends?

- Capital preservation: Do you want to protect your initial investment?

Your goals will influence your investment strategy and risk tolerance. For instance, if you’re investing for retirement in 30 years, you may opt for more aggressive growth stocks compared to someone nearing retirement who may prefer safer investments.

Choosing the Right Brokerage

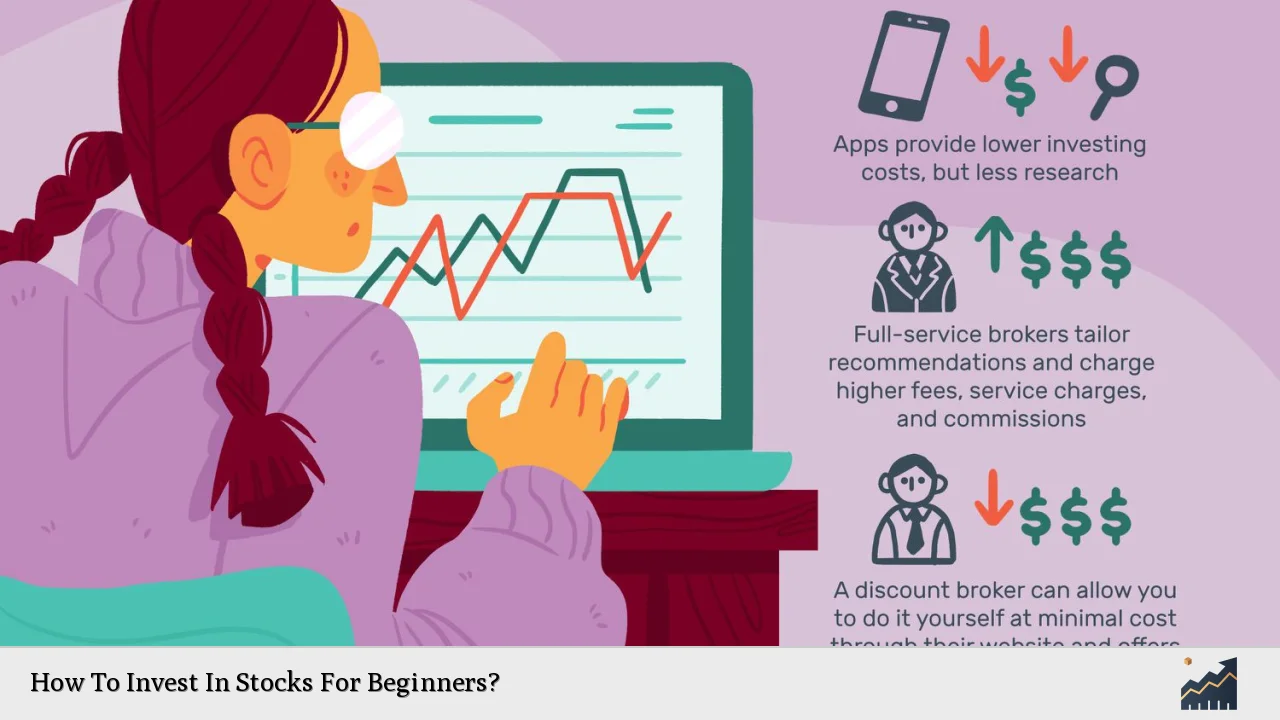

Selecting the right brokerage is essential for successful investing. Here are some factors to consider:

- Fees: Look for brokerages with low or no trading fees.

- Account minimums: Some platforms require a minimum deposit; choose one that fits your budget.

- Tools and resources: Ensure the brokerage offers research tools that can help you make informed decisions.

Popular options for beginners include platforms like Robinhood, E*TRADE, and Charles Schwab, which provide user-friendly interfaces and educational resources.

Researching Stocks

Conducting thorough research is vital before purchasing any stock. Here are some key aspects to analyze:

- Company fundamentals: Look at financial statements such as revenue, earnings per share (EPS), and debt levels.

- Industry trends: Understand how the industry is performing overall and what factors could affect future growth.

- Market conditions: Be aware of economic indicators that could impact stock prices.

Using tools like stock screeners can help filter potential investments based on specific criteria like growth rates or dividend yields.

Diversification Strategies

Diversification is a critical strategy for managing risk in your investment portfolio. By spreading your investments across various sectors and asset classes, you reduce the impact of poor performance from any single investment.

Consider these diversification strategies:

- Sector diversification: Invest in different industries such as technology, healthcare, and consumer goods.

- Asset class diversification: Include various asset types like stocks, bonds, and real estate in your portfolio.

- Geographic diversification: Consider international stocks alongside domestic investments.

This approach helps mitigate risks associated with market volatility while aiming for steady returns over time.

Investment Strategies for Beginners

As a beginner investor, consider adopting one or more of these strategies:

- Buy-and-hold strategy: Purchase stocks with the intention of holding them long-term regardless of market fluctuations.

- Dollar-cost averaging: Invest a fixed amount regularly over time rather than trying to time the market.

- Index funds or ETFs: These funds track specific indexes (like the S&P 500) and offer instant diversification at lower costs.

Each strategy has its advantages; choose one that aligns with your goals and risk tolerance.

Monitoring Your Investments

Once you’ve made investments, it’s crucial to monitor their performance regularly. Keep an eye on:

- Stock performance: Track how each stock is performing relative to its historical performance and market conditions.

- Economic indicators: Be aware of broader economic changes that could impact your investments.

- Portfolio balance: Periodically review your portfolio’s asset allocation to ensure it aligns with your risk tolerance and investment goals.

Adjustments may be necessary if certain stocks underperform or if market conditions change significantly.

Risks of Investing in Stocks

While investing in stocks can yield substantial returns, it’s essential to understand the risks involved:

- Market risk: The possibility that stock prices may decline due to economic downturns or other factors.

- Company-specific risk: Individual companies may face challenges leading to poor performance or bankruptcy.

- Liquidity risk: Some stocks may be harder to sell quickly without impacting their price significantly.

Being aware of these risks allows you to make informed decisions about how much capital you’re willing to invest in individual stocks versus diversified funds.

FAQs About How To Invest In Stocks For Beginners

- What is the best way for beginners to start investing?

The best way is by opening an online brokerage account and starting with low-cost index funds or ETFs. - How much money do I need to start investing in stocks?

You can start with as little as $0 with many brokerages; some allow fractional shares. - Should I invest in individual stocks or funds?

Beginners are often advised to start with diversified funds like ETFs before choosing individual stocks. - How often should I check my investments?

You should monitor them regularly but avoid making impulsive decisions based on short-term market fluctuations. - What is dollar-cost averaging?

This strategy involves investing a fixed amount regularly regardless of market conditions.

By following these guidelines and understanding the fundamentals of stock investing, beginners can navigate the stock market confidently. Remember that investing is a long-term endeavor; patience and continuous learning are key components for success in building wealth through stocks.