Investing in Section 8 housing offers a unique opportunity for individual investors and real estate professionals to generate stable income while contributing to affordable housing solutions. The Section 8 program, officially known as the Housing Choice Voucher Program, is administered by the U.S. Department of Housing and Urban Development (HUD) and provides rental assistance to low-income families. This investment strategy not only promises consistent cash flow but also aligns with social responsibility by helping underserved communities secure stable housing.

| Key Concept | Description/Impact |

|---|---|

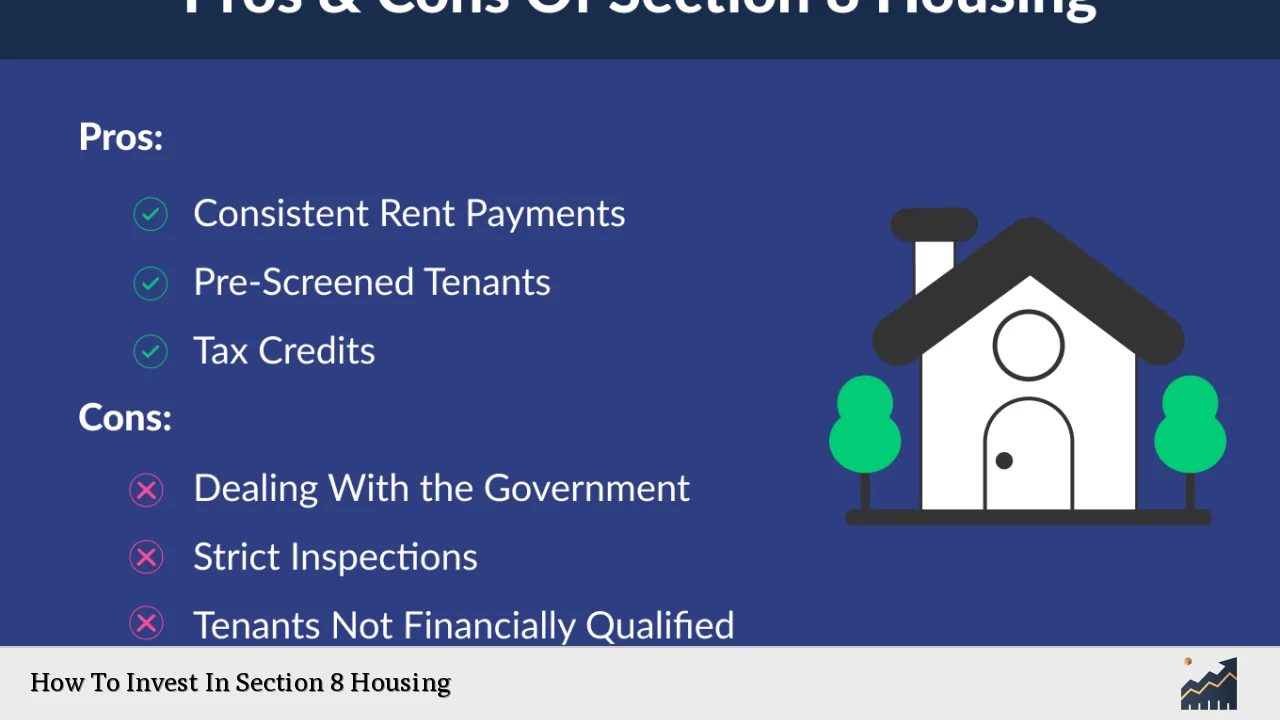

| Stable Income | Section 8 guarantees a substantial portion of rent payments, typically between 70% to 100%, directly from the government, reducing the risk of non-payment. |

| Lower Vacancy Rates | High demand for affordable housing leads to lower vacancy rates compared to traditional rental markets, ensuring steady occupancy. |

| Regulatory Compliance | Landlords must adhere to specific HUD regulations and property standards, which can involve regular inspections and maintenance requirements. |

| Tenant Screening | Tenants are pre-screened by Public Housing Authorities (PHAs), which can simplify the tenant selection process for landlords. |

| Long-Term Tenancies | Section 8 tenants often seek stability, resulting in longer lease durations and reduced turnover costs for landlords. |

| Community Impact | Investing in Section 8 housing helps address homelessness and provides low-income families with access to safe, affordable homes. |

Market Analysis and Trends

The demand for affordable housing continues to rise due to various economic factors, including increasing rental prices and stagnant wage growth. According to HUD reports, nearly 5 million households participate in the Section 8 program, with over 80% earning less than $20,000 annually. This demographic represents a significant market for investors willing to engage with the program.

Current Market Statistics

- The average Public Housing Authority (PHA) spends approximately $1,516 per unit on repairs and maintenance annually.

- As of late 2024, areas like Cleveland and Detroit have emerged as promising markets for Section 8 investments due to their affordable housing prices combined with strong local demand.

- The national vacancy rate for rental properties is around 6%, while Section 8 properties often experience rates below this average due to consistent demand.

Economic Indicators

- Rising interest rates have made traditional real estate investments less attractive, pushing investors toward Section 8 properties as a reliable alternative.

- The affordability index indicates that homeownership remains below historic norms, further highlighting the need for rental assistance programs like Section 8.

Implementation Strategies

Investing in Section 8 housing requires a strategic approach that includes understanding local market dynamics and compliance with federal regulations. Here are key steps for successful implementation:

- Research Local PHAs: Identify local PHAs and understand their specific requirements for landlords participating in the Section 8 program.

- Property Selection: Choose properties that meet HUD standards. Properties must pass inspections that assess health and safety compliance.

- Application Process: Submit an application to your local PHA detailing your property and intent to participate in the program.

- Marketing: Once approved, market your property as a Section 8 option. Utilize online platforms and local networks to reach potential tenants.

- Tenant Screening: While tenants are pre-screened by PHAs, conducting your own screening can help ensure compatibility.

- Ongoing Management: Regularly monitor property conditions and maintain compliance with HUD regulations through routine inspections and maintenance.

Risk Considerations

While investing in Section 8 housing can be lucrative, it is essential to understand the risks involved:

- Regulatory Changes: Changes in government policies or funding can impact the availability of vouchers or payment amounts.

- Property Maintenance Costs: Maintaining compliance with HUD standards may lead to increased costs for repairs and upgrades.

- Administrative Burden: Navigating the bureaucratic processes associated with PHAs can be time-consuming and complex.

- Market Sensitivity: Economic downturns may affect funding levels for housing assistance programs, potentially leading to reduced tenant numbers.

Regulatory Aspects

Understanding regulatory frameworks is crucial for successful investment in Section 8 housing:

- Eligibility Criteria: Tenants must meet income thresholds typically set at or below 50% of the area median income (AMI), with priority given to those earning less than 30% of AMI.

- Inspection Requirements: Properties must undergo regular inspections by PHAs to ensure compliance with HUD’s Housing Quality Standards (HQS).

- Lease Agreements: Landlords must sign contracts with PHAs outlining rental terms, including rent amounts that align with fair market values determined by HUD.

Future Outlook

The future of Section 8 housing investment appears promising due to several factors:

- Increased Demand: As economic pressures persist, more families will seek affordable housing options supported by government assistance.

- Investment Opportunities: Innovative investment models such as crowdfunding are emerging, allowing smaller investors to participate in larger Section 8 projects without extensive capital outlay.

- Community Engagement: Investors are increasingly recognizing the dual benefit of financial returns alongside positive community impact through affordable housing initiatives.

Overall, investing in Section 8 housing not only provides financial stability but also contributes significantly to addressing pressing social issues related to housing insecurity.

Frequently Asked Questions About How To Invest In Section 8 Housing

- What is Section 8 housing?

Section 8 is a federal program that provides rental assistance to low-income families by subsidizing a portion of their rent directly paid to landlords. - How do I qualify as a landlord for Section 8?

Landlords must apply through their local Public Housing Authority (PHA) and ensure their properties meet HUD’s safety standards. - What are the benefits of investing in Section 8?

Benefits include stable income from government-backed rent payments, lower vacancy rates, longer tenant durations, and contributing positively to community welfare. - Are there any downsides to investing in Section 8?

Challenges include regulatory compliance requirements, potential delays in rent payments due to administrative issues, and property maintenance costs. - How do I find properties suitable for Section 8 investment?

You can find suitable properties through real estate listings focused on affordable housing or by networking with local real estate agents familiar with Section 8 requirements. - Can I invest in Section 8 without owning property?

Crowdfunding platforms allow investors to participate in Section 8 projects without direct ownership responsibilities. - What should I consider before investing?

Consider local market conditions, potential regulatory changes, property management capabilities, and your financial goals before proceeding. - Is investing in Section 8 housing a good long-term strategy?

Yes, given the ongoing demand for affordable housing and stable income potential from government subsidies, it can be a sound long-term investment strategy.

Investing in Section 8 housing represents a compelling opportunity for those looking to achieve both financial returns and social impact. By understanding market dynamics, regulatory frameworks, and effective management strategies, investors can navigate this sector successfully while contributing positively to their communities.