Quant investing, or quantitative investing, is a systematic approach that utilizes mathematical models, algorithms, and extensive data analysis to make investment decisions. This method significantly reduces emotional biases that often impact human decision-making, allowing for more objective and consistent investment strategies. As financial markets become increasingly complex, quant investing offers investors the ability to navigate these challenges using advanced technology and statistical techniques.

Investing in quant strategies can be an attractive option for those looking to leverage data-driven insights for better returns. This article will guide you through the essential steps to invest in quant, discuss various strategies, and highlight important considerations.

| Aspect | Description |

|---|---|

| Definition | A systematic investment approach using mathematical models and algorithms. |

| Benefits | Reduces emotional bias, enhances consistency, and improves risk management. |

Understanding Quant Investing

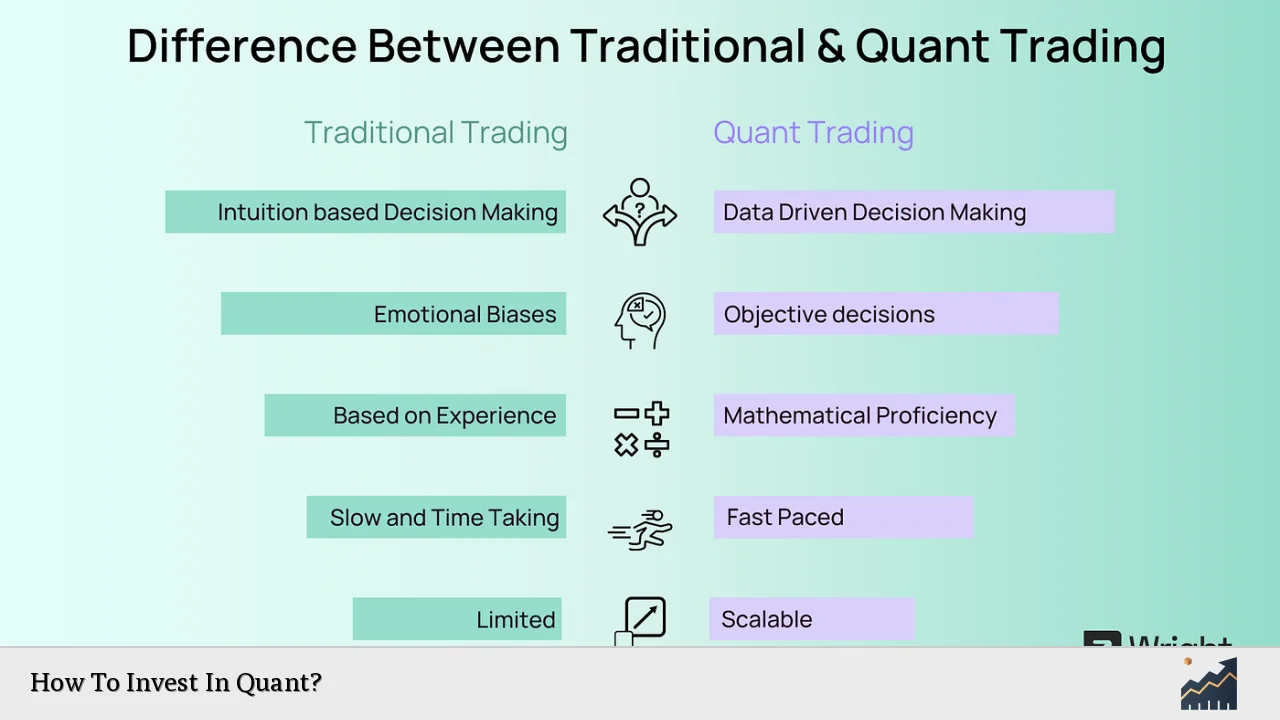

Quant investing relies heavily on data analysis and mathematical modeling to identify market trends and make informed investment decisions. Unlike traditional investing methods that may depend on subjective judgment, quant strategies utilize historical data to forecast future price movements.

The process typically involves several stages:

- Data Collection: Gathering large datasets from various sources.

- Model Development: Creating algorithms based on statistical techniques to analyze data.

- Backtesting: Testing models against historical data to evaluate their effectiveness.

- Execution: Implementing trades based on the model’s recommendations.

This structured approach allows quant investors to systematically exploit market inefficiencies while minimizing risks associated with human error.

Types of Quant Strategies

There are several types of quant strategies that investors can consider. Each strategy has its unique characteristics and risk profiles:

- Statistical Arbitrage: This strategy seeks to capitalize on price discrepancies between related financial instruments through statistical methods.

- Factor Investing: This involves targeting specific factors such as value, momentum, or quality that are believed to drive returns.

- Risk Parity: Aims to balance risk across various asset classes rather than simply allocating capital based on expected returns.

- Machine Learning Techniques: Utilizes advanced algorithms to analyze vast datasets and identify patterns that can inform trading decisions.

- Artificial Intelligence: Extends machine learning capabilities by simulating human-like decision-making processes for more adaptive trading strategies.

Each of these strategies can be tailored to meet individual investment goals and risk tolerances.

Steps to Invest in Quant

Investing in quant requires a clear understanding of the process and the necessary tools. Here are the key steps:

1. Educate Yourself: Familiarize yourself with the principles of quantitative investing. Understanding key concepts such as statistical analysis, algorithm development, and risk management is crucial.

2. Choose a Strategy: Determine which quant strategy aligns with your investment objectives. Consider factors like your risk tolerance, investment horizon, and market conditions.

3. Select a Platform or Fund: Depending on your expertise, you may choose to invest directly in quant funds or use platforms that offer algorithmic trading services. Research available options thoroughly.

4. Develop or Adopt Models: If you have programming skills, consider developing your own quantitative models. Alternatively, you can adopt existing models from reputable sources or funds.

5. Backtest Your Strategy: Before committing capital, backtest your strategy using historical data to assess its performance under various market conditions.

6. Monitor Performance: Regularly review your investments’ performance against benchmarks and adjust your strategy as necessary based on changing market dynamics.

7. Stay Informed: Keep up with advancements in technology and changes in market conditions that could impact your quant strategy’s effectiveness.

Important Considerations

When investing in quant strategies, several important factors should be taken into account:

- Model Risk: Quantitative models are based on historical data; if market conditions change drastically, past performance may not predict future results accurately.

- Overfitting: Be cautious of creating models that perform well on historical data but fail in live markets due to excessive complexity or reliance on noise rather than signal.

- Data Quality: Ensure that the data used for analysis is accurate and reliable. Poor-quality data can lead to misleading conclusions and poor investment decisions.

- Market Conditions: Understand how different strategies perform under varying market conditions. Some may excel during bull markets but struggle in bear markets.

- Costs and Fees: Be aware of any fees associated with investing in quant funds or platforms, as these can impact overall returns.

FAQs About How To Invest In Quant

- What is quant investing?

Quant investing uses mathematical models and algorithms to make investment decisions based on data analysis. - What are the benefits of quant investing?

It reduces emotional bias, enhances consistency in decision-making, and improves risk management. - How do I choose a quant strategy?

Select a strategy based on your investment goals, risk tolerance, and market conditions. - Can I develop my own quant models?

Yes, if you have programming skills; otherwise, you can adopt existing models from reputable sources. - What risks are associated with quant investing?

Risks include model risk, overfitting issues, data quality concerns, and changing market conditions.

The Future of Quant Investing

The future of quant investing looks promising as advancements in technology continue to evolve. The integration of artificial intelligence (AI) and machine learning (ML) into quantitative strategies is expected to enhance predictive capabilities significantly. As more alternative data sources become available—such as social media sentiment or satellite imagery—quant investors will have access to richer datasets for analysis.

Moreover, the rise of cloud computing will facilitate faster processing of large datasets, enabling more sophisticated modeling techniques. As these technologies advance further, they will likely lead to increased efficiency in trading operations and improved risk management practices within the quant space.

Investors should remain agile and adaptable as the landscape evolves. By staying informed about technological advancements and emerging trends within quantitative finance, they can position themselves effectively for future opportunities.

In conclusion, investing in quant offers a structured approach to navigating financial markets through data-driven insights. By understanding the principles behind quantitative strategies and following a systematic process for implementation, investors can potentially achieve superior returns while managing risks effectively.