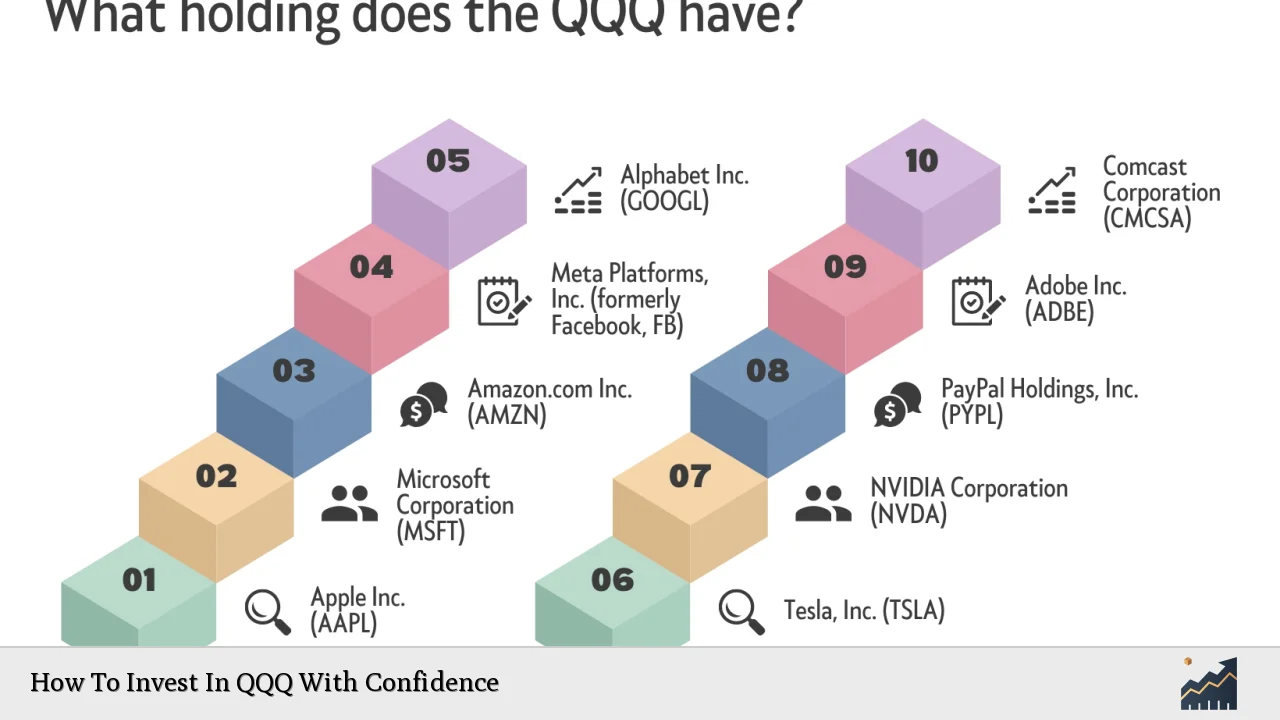

Investing in the QQQ ETF can be an excellent strategy for those looking to gain exposure to the technology sector and other growth industries. The QQQ, or Invesco QQQ Trust, tracks the performance of the Nasdaq-100 Index, which consists of 100 of the largest non-financial companies listed on the Nasdaq stock exchange. This ETF is particularly appealing due to its focus on major tech players like Apple, Microsoft, and Amazon, which have historically delivered strong returns.

Investors are often drawn to QQQ for its potential for capital appreciation and liquidity. However, it’s essential to approach this investment with a clear understanding of the risks and strategies involved. This article will provide a comprehensive guide on how to invest in QQQ with confidence, covering everything from choosing a brokerage to implementing effective investment strategies.

| Aspect | Details |

|---|---|

| Type of Investment | Exchange-Traded Fund (ETF) |

| Tracks | Nasdaq-100 Index |

| Expense Ratio | 0.20% |

| Dividend Yield | Approximately 0.8%-1.0% |

Understanding QQQ

The QQQ ETF is designed to provide investors with a way to invest in a diversified portfolio of large-cap growth stocks, primarily in the technology sector. This ETF includes companies from various sectors such as consumer discretionary, healthcare, and communication services, but its heavy weighting towards technology makes it particularly attractive for those bullish on tech innovations.

Investing in QQQ allows individuals to participate in the growth potential of leading companies without needing to buy individual stocks. This diversification can help mitigate risks associated with investing in single stocks while still providing exposure to high-growth sectors.

However, it is crucial to recognize that investing in QQQ also comes with risks. The concentration in technology means that any downturn in this sector can significantly impact the ETF’s performance. Moreover, while QQQ has historically outperformed broader market indices during bull markets, it can also experience sharper declines during bear markets.

Choosing a Brokerage

Before you can invest in QQQ, you need to select a brokerage platform that suits your needs. Several online brokerages offer access to ETFs like QQQ:

- Robinhood: Known for its user-friendly interface and commission-free trading.

- E*TRADE: Offers robust research tools and educational resources.

- TD Ameritrade: Provides a comprehensive trading platform with extensive market analysis tools.

When choosing a brokerage, consider factors such as fees, available resources, and ease of use. Opening an account typically requires providing personal information and linking a bank account for funding your investments.

Determining Your Investment Amount

Once you’ve selected a brokerage, the next step is deciding how much money you want to invest in QQQ. It’s essential to assess your financial goals and risk tolerance before making this decision. Here are some guidelines:

- Assess Your Risk Tolerance: Understand how much risk you are willing to take on based on your financial situation.

- Investment Horizon: Consider how long you plan to hold your investment; longer horizons can generally accommodate more risk.

- Diversification: Ensure that your investment in QQQ fits within a broader diversified portfolio.

Investing should always align with your financial capacity; never invest more than you can afford to lose.

Buying Shares of QQQ

After determining how much you want to invest, you can proceed to buy shares of the QQQ ETF through your brokerage’s trading platform. Here’s how:

1. Log into Your Brokerage Account: Access your account through the brokerage’s website or app.

2. Search for QQQ: Enter the ticker symbol “QQQ” in the search bar.

3. Place an Order: Specify the number of shares you wish to purchase and review your order details before confirming.

It’s advisable to monitor market conditions when placing orders. You may choose between market orders (buying at current market prices) or limit orders (setting a specific price at which you’re willing to buy).

Monitoring Your Investment

After purchasing shares of QQQ, it’s vital to monitor your investment regularly. Keeping track of market trends and news related to the companies within the ETF can help you make informed decisions about when to buy more shares or sell existing ones.

Consider setting alerts for significant price movements or news updates that could impact the tech sector or the broader market. Regularly reviewing your portfolio will ensure that your investment strategy remains aligned with your financial goals.

Implementing Investment Strategies

To maximize your investment in QQQ, consider employing various strategies tailored to your risk tolerance and investment horizon:

Long-Term Growth Strategy

Investing in QQQ for the long term allows you to benefit from compounding returns over time. This strategy is particularly effective if you believe in the continued growth of technology and innovation:

- Buy-and-Hold Approach: Purchase shares and hold them through market fluctuations.

- Regular Contributions: Consider setting up automatic contributions to consistently invest over time.

Dollar-Cost Averaging

Dollar-cost averaging involves investing a fixed amount at regular intervals regardless of market conditions. This method helps reduce the impact of volatility by averaging out purchase prices over time:

- Consistency: Stick to a schedule for buying shares (e.g., monthly).

- Emotional Discipline: Avoid making impulsive decisions based on short-term market movements.

Risk Management

Diversifying your investment portfolio by combining QQQ with other asset classes can help mitigate risks associated with market volatility:

- Asset Allocation: Determine an appropriate mix of stocks, bonds, and other investments based on your risk profile.

- Regular Rebalancing: Periodically adjust your portfolio back to your target allocation as market conditions change.

Understanding Risks Associated with QQQ

While investing in QQQ offers numerous benefits, it is essential also to understand its risks:

- Sector Concentration Risk: A significant portion of QQQ’s holdings is concentrated in technology stocks; downturns in this sector can lead to substantial losses.

- Volatility Risk: The tech sector is often more volatile than other sectors; be prepared for price fluctuations that may impact your investment value.

- Market Timing Risks: Attempting to time purchases or sales based on market predictions can lead to missed opportunities or losses.

Being aware of these risks allows you to make informed decisions about managing your investment effectively.

FAQs About How To Invest In QQQ With Confidence

- What is QQQ?

QQQ is an exchange-traded fund that tracks the Nasdaq-100 Index. - How do I buy shares of QQQ?

You can buy shares through an online brokerage by searching for its ticker symbol “QQQ.” - What are the risks associated with investing in QQQ?

The main risks include sector concentration risk and volatility risk due to its heavy focus on technology stocks. - Is it better to invest in QQQ for short-term or long-term?

Long-term investing is generally recommended due to potential compounding returns from growth-oriented companies. - Can I use dollar-cost averaging with QQQ?

Yes, dollar-cost averaging is an effective strategy for investing consistently over time.

Investing in QQQ can be a rewarding endeavor if approached thoughtfully and strategically. By understanding what this ETF represents, selecting an appropriate brokerage, determining how much to invest, and employing sound investment strategies while being mindful of associated risks, you can invest in QQQ with confidence and potentially achieve significant financial growth over time.