The sport of pickleball is rapidly gaining popularity, making it an attractive investment opportunity for individuals and businesses alike. With its unique blend of tennis, badminton, and table tennis, pickleball appeals to a diverse demographic, from young adults to seniors. As the market for this sport expands, so do the avenues for investment. This article explores various strategies for investing in pickleball, current market trends, risk considerations, regulatory aspects, and future outlooks to help potential investors navigate this growing sector.

| Key Concept | Description/Impact |

|---|---|

| Market Growth | The global pickleball market is projected to grow from USD 1.5 billion in 2023 to USD 4.4 billion by 2033, at a CAGR of 11.3%. |

| Investment Avenues | Investments can be made in equipment manufacturing, facility ownership, coaching services, media partnerships, and sports betting. |

| Demographics | Pickleball attracts players across all age groups; however, the largest demographic is players aged 18-34. |

| Regulatory Environment | Investors must be aware of local regulations regarding sports facilities and gambling laws as they pertain to pickleball. |

| Risk Factors | Market saturation and competition from other sports can pose risks to investments in pickleball-related ventures. |

Market Analysis and Trends

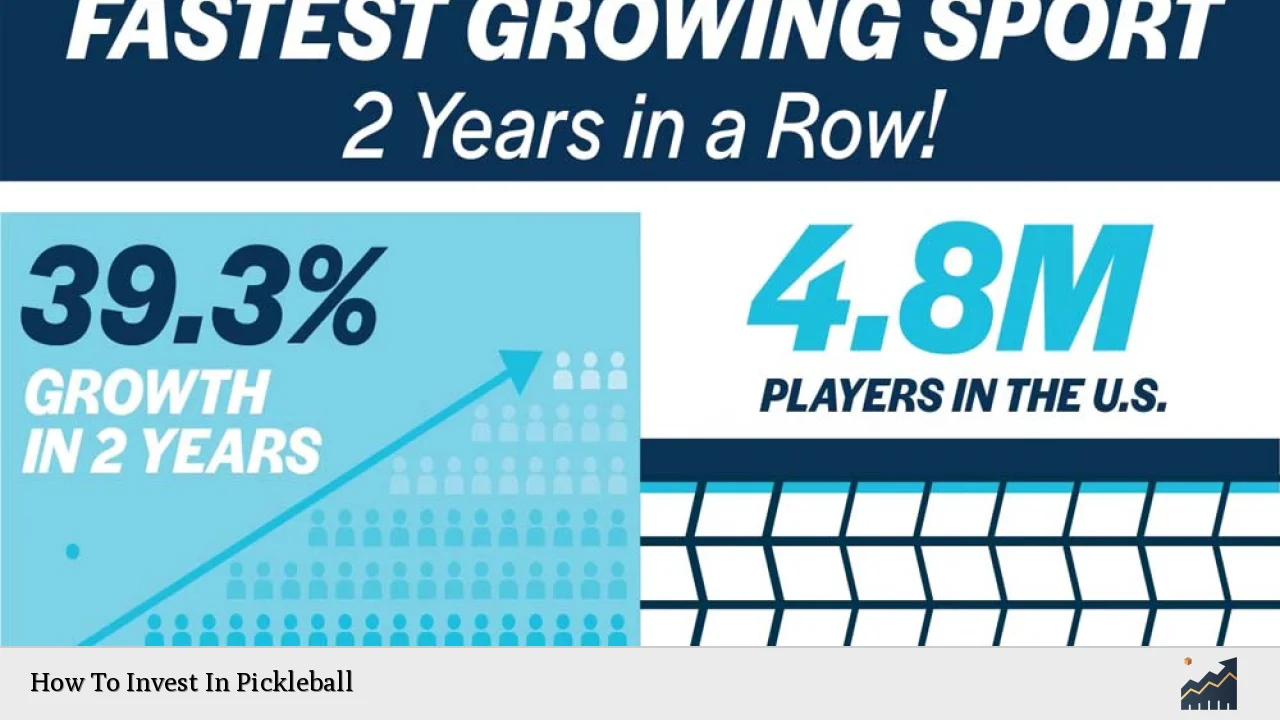

The pickleball market is experiencing unprecedented growth, driven by its increasing popularity across various demographics. According to recent reports, the number of pickleball players in the United States has surged to approximately 48.3 million, reflecting a staggering 223.5% growth over the past three years. This trend is expected to continue as more recreational facilities add pickleball courts and organizations promote the sport.

Current Market Statistics

- Market Value: The global pickleball market was valued at USD 1.5 billion in 2023 and is projected to reach USD 4.4 billion by 2033.

- CAGR: The market is expected to grow at a compound annual growth rate (CAGR) of 11.3% from 2024 to 2033.

- Demographic Appeal: Players aged 18-34 represent the largest segment of participants at 28.8%.

Major Growth Drivers

- Increased Participation: The sport’s accessibility and social nature make it appealing for all ages.

- Facility Development: More indoor and outdoor facilities are being built specifically for pickleball.

- Media Exposure: Increased coverage on platforms like ESPN has raised awareness and interest in the sport.

Implementation Strategies

Investors looking to capitalize on the pickleball boom have several avenues available:

- Investing in Equipment: Companies producing paddles, balls, and other gear are seeing increased demand. The paddle market alone was estimated at USD 152.8 million in 2022.

- Owning Facilities: Establishing or investing in dedicated pickleball courts or clubs can yield significant returns as participation grows.

- Coaching Services: Offering coaching or training programs can be lucrative; experienced coaches can charge upwards of $50 per hour.

- Media Ventures: Partnering with media outlets or creating content related to pickleball can attract sponsorships and advertising revenue.

- Franchising Opportunities: Brands like Life Time Fitness are expanding their offerings by incorporating pickleball into their facilities.

Risk Considerations

While investing in pickleball presents numerous opportunities, potential investors should also consider several risks:

- Market Saturation: As more players enter the field, competition among equipment manufacturers and facility owners may increase.

- Economic Factors: Economic downturns could affect discretionary spending on recreational activities like pickleball.

- Regulatory Changes: Changes in local regulations regarding sports facilities or gambling could impact investments in these areas.

Regulatory Aspects

Investors must navigate various regulatory frameworks depending on their investment type:

- Facility Ownership: Local zoning laws will dictate where new facilities can be built and operated.

- Sports Betting Regulations: As legal sports betting expands across states, investors interested in this area must comply with specific state laws.

Future Outlook

The outlook for investing in pickleball remains positive. With projections indicating continued growth in participation rates and market value, investors have a unique opportunity to engage with a burgeoning industry.

Key Trends to Watch

- Community Engagement Initiatives: As more communities embrace active lifestyles, opportunities for local leagues and tournaments will expand.

- Technological Innovations: Advances in equipment technology may lead to new product offerings that could capture consumer interest.

- International Expansion: Markets outside North America are beginning to show interest in pickleball, particularly in regions like Asia-Pacific.

Frequently Asked Questions About How To Invest In Pickleball

- What are the best ways to invest in pickleball?

Investing can be done through equipment manufacturing, owning facilities, coaching services, media partnerships, or engaging with sports betting platforms. - What is the current size of the pickleball market?

The global pickleball market was valued at approximately USD 1.5 billion in 2023 and is projected to grow significantly over the next decade. - Who participates in pickleball?

The sport appeals to a wide range of demographics but has seen significant participation among individuals aged 18-34. - Are there risks associated with investing in pickleball?

Yes, risks include market saturation, economic downturns affecting discretionary spending, and regulatory changes. - What role does media play in the growth of pickleball?

Media exposure has increased awareness and interest in the sport, leading to higher participation rates. - How can I start a business related to pickleball?

You can start by offering coaching services, selling equipment online or at local events, or establishing a facility dedicated to the sport. - Is it advisable to invest in publicly traded companies involved with pickleball?

Yes, investing in companies that are expanding their offerings related to pickleball can be a viable strategy. - What trends should I watch for future investments?

Look for community engagement initiatives, technological innovations in equipment, and international expansion opportunities.

In conclusion, investing in pickleball offers diverse opportunities across various sectors as the sport continues its upward trajectory. By staying informed about market trends and understanding potential risks and regulations, investors can strategically position themselves within this exciting industry.