Investing in golf can be a lucrative opportunity for individual investors and finance professionals alike. The golf industry encompasses various sectors, including golf course ownership, equipment manufacturing, apparel, and even golfer endorsements. As the global golf market continues to expand, driven by increased participation and innovative investment models, understanding how to navigate this landscape is essential for maximizing returns. This guide explores current market trends, implementation strategies, risk considerations, regulatory aspects, and future outlooks to provide a comprehensive understanding of investing in golf.

| Key Concept | Description/Impact |

|---|---|

| Market Size | The global golf market was valued at approximately $82.8 billion in 2023 and is projected to grow at a CAGR of 4.8%, reaching $120.3 billion by 2030. |

| Golf Course Ownership | Investing in or purchasing golf courses can yield revenue from membership fees and events. However, it requires substantial capital and operational expertise. |

| Golf Stocks | Investors can buy shares in publicly traded companies like Callaway Golf and Acushnet Holdings, benefiting from the industry’s growth. |

| Golf Tourism | The golf tourism market is expected to grow significantly, driven by experiential travel trends and increasing demand for premium golf destinations. |

| Investment in Golfers | Platforms like Carry allow investors to fund aspiring golfers in exchange for a percentage of their future earnings, creating unique investment opportunities. |

| Franchise Opportunities | Investing in golf franchises such as Topgolf offers a way to enter the market with established business models and brand recognition. |

| Regulatory Considerations | Investors must navigate various regulations regarding securities when investing in golf-related ventures, particularly with golfer investments. |

| Risks and Returns | The potential for high returns exists but is accompanied by risks such as economic downturns affecting discretionary spending on golf. |

Market Analysis and Trends

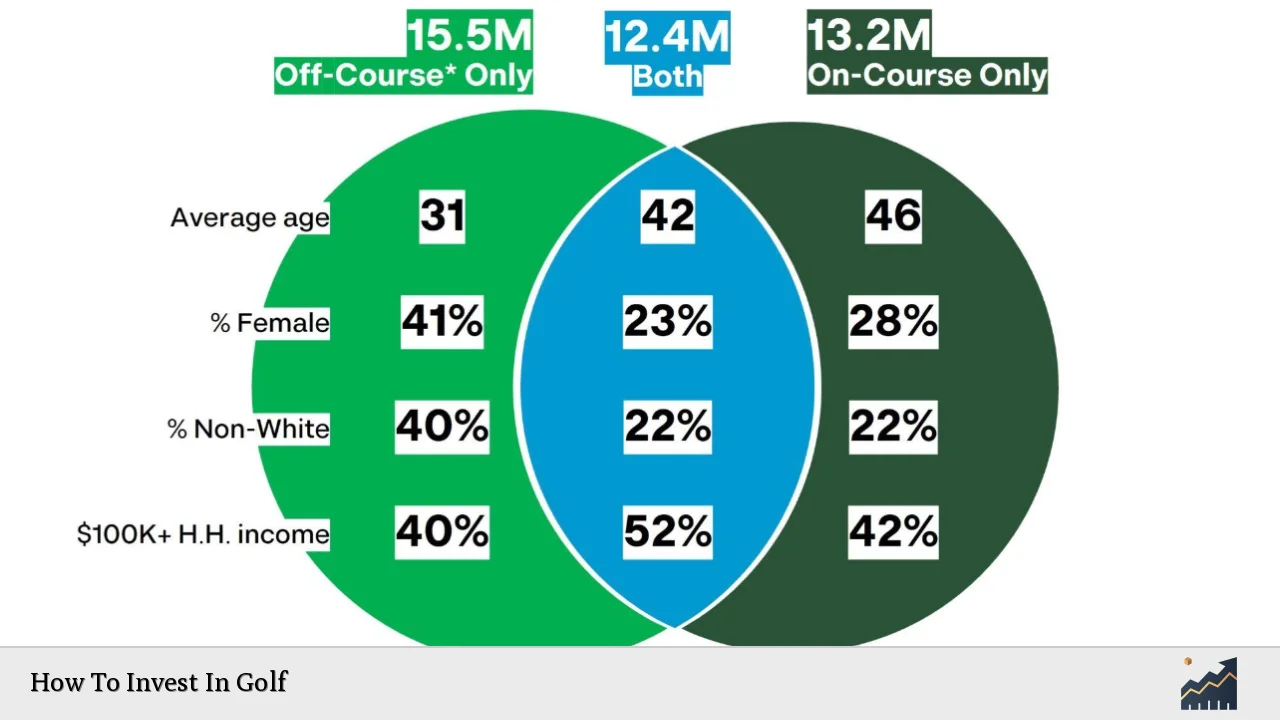

The golf industry has shown remarkable resilience and growth potential post-pandemic. According to recent reports, the number of rounds played has rebounded significantly since 2020, with an increase of 8% reported in early 2023 alone. This resurgence reflects a broader trend of increased participation across various demographics, particularly among younger players and women.

Key Market Statistics

- Global Market Valuation: The global golf market was valued at approximately $82.8 billion in 2023.

- Projected Growth: Expected to reach $120.3 billion by 2030 with a CAGR of 4.8%.

- Golf Tourism: The golf tourism sector is projected to grow from $24.22 billion in 2023 to approximately $46.05 billion by 2032.

- Investment Opportunities: The average sale price of golf courses increased by over 20% in 2023 due to rising demand.

Emerging Trends

- Experiential Travel: There is a growing interest in experiential travel among golfers, leading to an increase in demand for premium golfing experiences.

- Technology Integration: Advancements such as online booking platforms and virtual reality training are enhancing the golfing experience and attracting new players.

- Sustainability Initiatives: Many courses are adopting eco-friendly practices, appealing to environmentally conscious consumers.

Implementation Strategies

Investing in golf can take several forms:

Direct Investments

- Golf Course Ownership: Purchasing or developing a golf course requires significant capital but can yield high returns through memberships and events.

- Real Estate Investments: Investing in properties near popular golf courses or resorts can provide rental income and appreciation potential.

Indirect Investments

- Stock Market: Investing in publicly traded companies involved in the golf industry (e.g., Callaway Golf) allows investors to benefit from overall industry growth without direct ownership responsibilities.

- Franchising: Becoming a franchisee of established brands like Topgolf or GolfTEC provides access to proven business models with brand recognition.

Innovative Investment Models

- Investment Platforms: Companies like Carry allow fans to invest directly in professional golfers, sharing in their future earnings while supporting their careers.

Risk Considerations

Like any investment, entering the golf market comes with its risks:

- Economic Sensitivity: The golf industry is sensitive to economic downturns; discretionary spending on leisure activities can decline during recessions.

- High Initial Capital Requirements: Investments such as course ownership or franchising often require substantial upfront capital.

- Regulatory Risks: Investors must be aware of regulations governing securities when investing in golfer endorsements or partnerships.

Regulatory Aspects

Investors should be familiar with various regulations that may apply:

- Securities Regulations: When investing through platforms like Carry, compliance with SEC regulations is crucial as these investments may be classified as securities.

- Local Zoning Laws: For those considering real estate investments related to golf courses, understanding local zoning laws is essential for development projects.

Future Outlook

The future of investing in golf appears promising:

- Continued Growth: With increasing participation rates and evolving consumer preferences towards experiential travel, the industry is poised for sustained growth.

- Technological Advancements: As technology continues to enhance the golfing experience through innovations like simulators and online platforms, new investment opportunities will emerge.

- Increased Investor Interest: The trend toward private equity investments in the golf sector indicates strong confidence among investors regarding long-term profitability.

Frequently Asked Questions About How To Invest In Golf

- What are the best ways to invest in the golf industry?

Investors can consider direct investments like owning a course or real estate near courses, indirect investments through stocks of golfing companies, or innovative models like funding golfers via platforms like Carry. - Is investing in golfers a safe investment?

This type of investment carries inherent risks as it depends on the golfer’s success; however, it can yield significant returns if the athlete performs well. - What are the typical costs associated with owning a golf course?

The costs can range from millions for land acquisition and development to ongoing maintenance expenses; it’s essential to conduct thorough financial analysis before proceeding. - How has COVID-19 affected the golf investment landscape?

The pandemic initially caused disruptions but led to increased interest in outdoor activities like golfing; participation rates have rebounded significantly since then. - What trends are shaping the future of golf investments?

Key trends include rising interest in experiential travel, technological advancements enhancing player experiences, and sustainability initiatives within the industry. - Are there any regulatory considerations when investing?

Yes, investors should be aware of securities regulations when using platforms for golfer investments and local zoning laws for real estate ventures. - What is the outlook for golf tourism?

The outlook is positive; the sector is projected to grow significantly as more travelers seek unique golfing experiences globally. - Can I invest with limited capital?

Yes! There are lower-cost options such as purchasing shares of publicly traded companies or supporting emerging golfers through crowdfunding platforms.

This comprehensive guide aims to equip potential investors with knowledge about how to invest effectively within the dynamic landscape of the golfing industry while highlighting both opportunities and challenges present within this unique market segment.