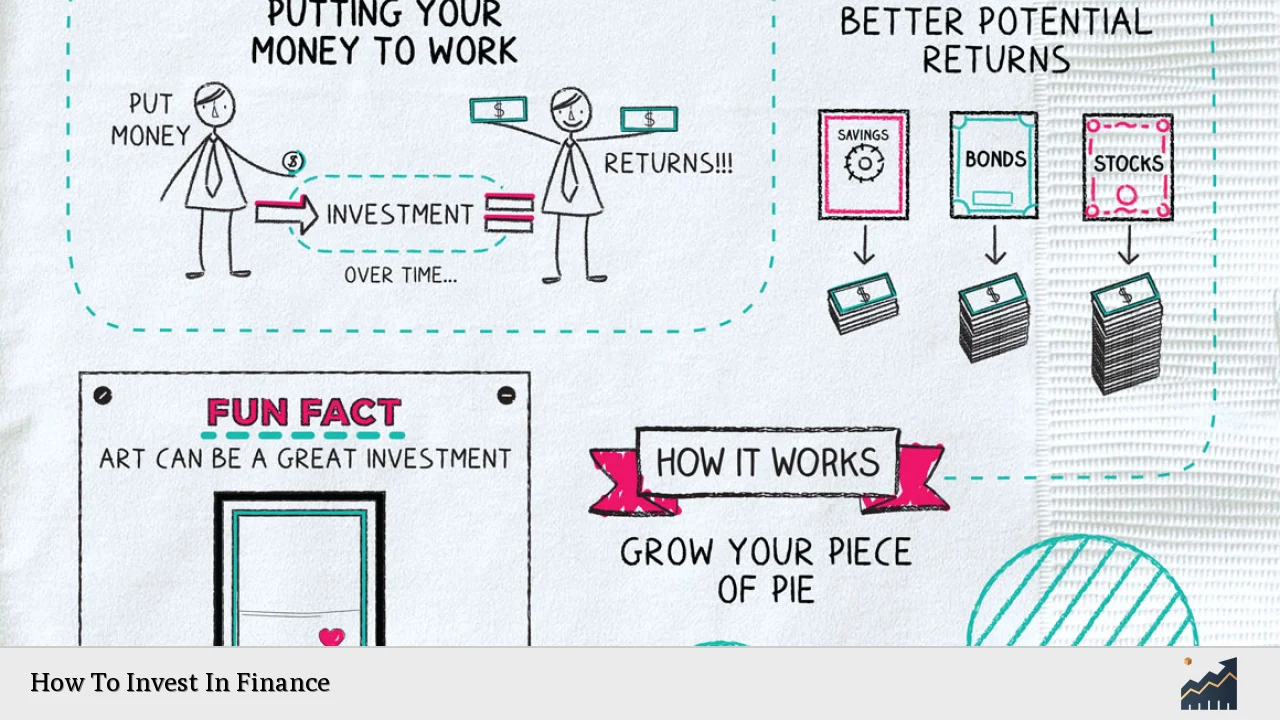

Investing in finance is a crucial step toward achieving financial independence and wealth accumulation. It involves allocating resources, usually money, into various financial instruments with the expectation of generating a return. The world of investing can be complex, but understanding the basics can empower individuals to make informed decisions that align with their financial goals. This article will guide you through the essential steps and strategies for effective investing.

| Key Concepts | Description |

|---|---|

| Investing | Allocating resources to generate returns over time. |

| Financial Instruments | Assets like stocks, bonds, and mutual funds available for investment. |

Understanding Your Financial Goals

Before diving into investing, it is vital to define your financial goals. These goals will guide your investment strategy and help determine the types of investments that are suitable for you.

- Short-term goals: These might include saving for a vacation or a new car within the next few years. Investments for short-term goals should be relatively low-risk to ensure that your funds are available when needed.

- Long-term goals: These typically involve saving for retirement or funding a child’s education. For long-term investments, you can afford to take on more risk since you have time to recover from market fluctuations.

Establishing clear goals also involves assessing your risk tolerance, which is your ability to endure potential losses in your investment portfolio. Understanding your risk tolerance will help you choose appropriate investment vehicles.

Preparing to Invest

Once your goals are defined, the next step is preparation. This involves several key actions:

- Pay off debts: Prioritize paying off high-interest debts, such as credit cards, before investing. The interest on these debts often outweighs potential investment returns.

- Build an emergency fund: Aim to have savings that cover at least three months of living expenses. This ensures that you won’t need to liquidate investments in case of unexpected expenses.

- Develop an investing plan: Outline your financial objectives, risk tolerance, and time horizon for investments. A well-thought-out plan will keep you focused and disciplined.

- Research asset classes: Familiarize yourself with different types of investments, such as stocks, bonds, real estate, and mutual funds. Each asset class has its own risk and return characteristics.

Choosing Investment Accounts

Selecting the right investment account is crucial for effective investing. Here are some common types:

- Brokerage accounts: These allow you to buy and sell various securities like stocks and bonds. They can be either taxable or tax-advantaged accounts like IRAs.

- Retirement accounts: Accounts such as 401(k)s and IRAs offer tax benefits but come with restrictions on withdrawals until retirement age.

- Robo-advisors: These automated platforms create and manage a diversified portfolio based on your risk tolerance and investment goals.

Choosing the right account depends on your specific needs and investment strategy.

Types of Investments

Understanding the various types of investments available is essential for building a diversified portfolio:

- Stocks: Buying shares in companies allows you to participate in their growth. Stocks can be volatile but offer high potential returns over time.

- Bonds: These are loans made to governments or corporations in exchange for periodic interest payments plus the return of principal at maturity. Bonds are generally considered safer than stocks but offer lower returns.

- Mutual Funds: These funds pool money from multiple investors to purchase a diversified portfolio of stocks or bonds. They provide instant diversification but often come with management fees.

- Exchange-Traded Funds (ETFs): Similar to mutual funds but traded on stock exchanges like individual stocks. ETFs usually have lower fees than mutual funds.

- Real Estate: Investing in property can provide rental income and potential appreciation in value over time.

Diversification Strategies

One of the most effective ways to manage risk in investing is through diversification. This means spreading your investments across various asset classes to reduce exposure to any single investment’s poor performance.

- Asset allocation: Determine what percentage of your portfolio will be allocated to different asset classes based on your risk tolerance and investment horizon.

- Sector diversification: Within stocks, invest across different sectors (e.g., technology, healthcare) to mitigate risks associated with economic downturns affecting specific industries.

- Geographic diversification: Consider investing in international markets as well as domestic ones to further spread risk.

Monitoring Your Investments

Investing is not a set-it-and-forget-it endeavor; it requires ongoing monitoring:

- Regular reviews: Periodically assess your portfolio’s performance against your financial goals and make adjustments as necessary.

- Stay informed: Keep up with market trends and economic indicators that could impact your investments.

- Rebalance when necessary: If certain investments perform significantly better than others, rebalancing may be needed to maintain your desired asset allocation.

Investment Strategies

There are several strategies investors can adopt based on their goals:

- Buy and hold: This long-term strategy involves purchasing securities and holding them regardless of market fluctuations, allowing time for growth.

- Dollar-cost averaging: Invest a fixed amount regularly regardless of market conditions. This strategy helps mitigate the impact of volatility by averaging out purchase prices over time.

- Growth investing: Focus on companies expected to grow at an above-average rate compared to their industry or the overall market.

- Value investing: Look for undervalued companies whose stock prices do not reflect their true worth, aiming for long-term gains as their value increases.

Seeking Professional Advice

If you’re unsure about navigating the complexities of investing, consider seeking professional advice:

- Financial advisors: They can provide personalized guidance based on your financial situation and help develop an investment strategy tailored to your needs.

- Robo-advisors: For those who prefer a more hands-off approach, these automated services offer low-cost investment management based on algorithms tailored to individual risk profiles.

FAQs About How To Invest In Finance

- What is the best way to start investing?

Begin by defining your financial goals and risk tolerance before choosing appropriate investment vehicles. - How much money do I need to start investing?

You can start with small amounts due to low or no minimums offered by many platforms. - What are the risks associated with investing?

Investing carries risks including market volatility, loss of principal, and liquidity issues. - How often should I review my investments?

It’s advisable to review your portfolio at least annually or whenever there are significant life changes. - Is it necessary to hire a financial advisor?

No, but professional guidance can be beneficial if you’re unsure about making investment decisions.

Investing in finance requires careful planning and informed decision-making. By understanding your goals, preparing adequately, choosing the right accounts and investments, diversifying wisely, monitoring progress regularly, and considering professional advice when needed, you can build a successful investment portfolio that aligns with your financial aspirations.