Investing in Femtech, a burgeoning sector focused on women’s health technology, offers a unique opportunity for investors to engage with a market that addresses significant health disparities and unmet needs. The Femtech industry encompasses a wide range of products and services designed to improve women’s health, including reproductive health solutions, digital health apps, wearable devices, and telehealth services. As awareness of women’s health issues grows, so does the potential for innovation and investment in this space.

With the global Femtech market valued at approximately $6.9 billion in 2023 and projected to reach $26.1 billion by 2033, growing at a compound annual growth rate (CAGR) of 15.2%, the sector presents compelling investment opportunities that align financial returns with social impact.

| Key Concept | Description/Impact |

|---|---|

| Market Growth | The Femtech market is expected to grow significantly, driven by increasing awareness of women’s health issues and technological advancements. |

| Investment Sources | Femtech attracts venture capital, private equity, public markets, government grants, and recoverable grants from nonprofits. |

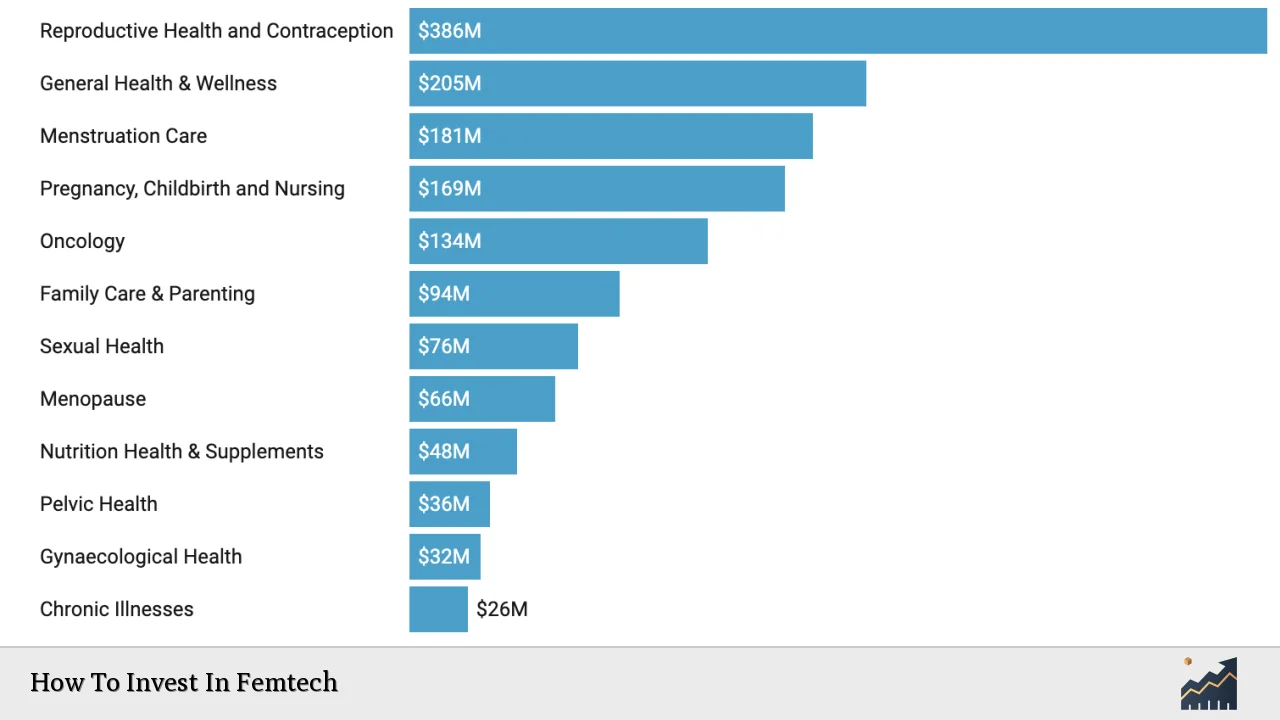

| Key Segments | Main segments include reproductive health, pregnancy care, menstrual health, and wellness technologies. |

| Challenges | Despite its potential, Femtech faces challenges such as funding disparities, societal stigma, and regulatory hurdles. |

| Future Trends | Emerging trends include AI-driven solutions, personalized healthcare technologies, and increased corporate investment. |

Market Analysis and Trends

The Femtech market is experiencing rapid growth fueled by several factors:

- Increased Awareness: There is a growing recognition of women’s unique health needs, leading to higher demand for tailored healthcare solutions.

- Technological Advancements: Innovations in AI, machine learning, and mobile technology are enhancing the development of Femtech products. For instance, AI-driven fertility trackers are becoming more prevalent.

- Investment Surge: Venture capital investments in Femtech have increased significantly; for example, funding for Femtech companies with female founders grew by 121% between 2018 and 2023.

- Market Segmentation: The market is diversifying beyond reproductive health to include areas like menopause management and chronic disease management specific to women.

- Global Reach: While North America currently dominates the market share (approximately 52.91% in 2023), regions like Asia Pacific are expected to experience the fastest growth due to rising awareness and increased female entrepreneurship.

Current Market Statistics

- The global Femtech market was valued at $6.9 billion in 2023.

- It is projected to reach $26.1 billion by 2033, growing at a CAGR of 15.2% from 2024 to 2033.

- The pregnancy and nursing care segment accounted for 17.72% of the market share in 2024.

Implementation Strategies

Investors looking to enter the Femtech space should consider the following strategies:

- Diversification Across Segments: Investing across various sub-sectors within Femtech can mitigate risks associated with market volatility. Key areas include reproductive health apps, menopause solutions, and wearable devices.

- Focus on Early-stage Startups: Many successful Femtech innovations come from early-stage companies that address niche markets. Engaging with incubators or accelerators focused on women’s health can provide access to promising startups.

- Collaboration with Established Firms: Partnering with established healthcare companies can enhance credibility and provide additional resources for growth.

- Utilizing Data Analytics: Investors should leverage data analytics tools to assess market trends and consumer behaviors within the Femtech industry effectively.

Risk Considerations

While investing in Femtech presents opportunities, it also comes with inherent risks:

- Regulatory Risks: The healthcare sector is heavily regulated. Changes in regulations can impact product development timelines and market entry strategies.

- Market Acceptance: Societal stigma surrounding women’s health issues can affect product adoption rates. Marketing strategies must be sensitive to cultural attitudes toward women’s health.

- Funding Disparities: Historically underfunded compared to male-focused health issues (e.g., erectile dysfunction), Femtech may struggle against biases in traditional funding sources.

Regulatory Aspects

Investors must navigate various regulatory frameworks when investing in Femtech:

- Healthcare Regulations: Products must comply with regulations set by bodies such as the FDA in the U.S. or EMA in Europe regarding safety and efficacy.

- Data Privacy Laws: Given that many Femtech solutions involve sensitive personal data (e.g., menstrual tracking), compliance with data privacy regulations like GDPR is essential.

- Government Initiatives: Awareness of government programs supporting women’s health research can provide funding opportunities for innovative projects within the sector.

Future Outlook

The future of Femtech looks promising:

- Increased Investment Opportunities: As more investors recognize the potential for financial returns alongside social impact, funding for Femtech is expected to grow.

- Technological Integration: The integration of AI and IoT into Femtech products will likely enhance user experience and expand market reach.

- Global Expansion: Emerging markets are becoming increasingly important as societal attitudes shift towards acceptance of women’s health issues.

Investors should remain vigilant about emerging trends such as telehealth services expansion and personalized medicine’s role in women’s healthcare management.

Frequently Asked Questions About How To Invest In Femtech

- What is Femtech?

Femtech refers to technology-based solutions that address women’s health needs across various domains such as reproductive health, menstrual care, pregnancy support, and menopause management. - Why should I invest in Femtech?

The sector is rapidly growing due to increased awareness of women’s health issues and technological advancements that cater specifically to these needs. - What are the main challenges facing Femtech investments?

Challenges include regulatory hurdles, societal stigma around women’s health topics, and historical funding disparities compared to male-focused healthcare sectors. - How can I identify promising Femtech startups?

Look for startups addressing specific unmet needs within women’s health that demonstrate strong leadership teams and innovative product offerings. - What role do government initiatives play in Femtech?

Government programs supporting research into women’s health can provide critical funding opportunities for startups within the sector. - What are some successful examples of Femtech companies?

Notable examples include Flo Health (a menstruation tracking app) which achieved unicorn status after significant venture capital investment. - How do I assess risk when investing in Femtech?

Consider regulatory risks, market acceptance challenges, funding disparities, and conduct thorough due diligence on potential investments. - What trends should I watch for in the future of Femtech?

Watch for advancements in AI-driven solutions, increased corporate investment into femtech startups, and broader acceptance of women’s health technologies.

Investing in Femtech not only offers potential financial rewards but also contributes positively towards addressing critical gaps in women’s healthcare globally. With careful consideration of strategies and risks involved, investors can play a significant role in shaping the future landscape of women’s health technology.