Investing in electric car charging stations represents a significant opportunity in the rapidly growing electric vehicle (EV) market. As global demand for electric vehicles surges, the need for robust charging infrastructure is becoming increasingly critical. This guide provides a comprehensive overview of the market dynamics, implementation strategies, risk considerations, regulatory aspects, and future outlook for investors interested in this burgeoning sector.

| Key Concept | Description/Impact |

|---|---|

| Market Growth | The global electric vehicle charging infrastructure market is projected to grow from $7.74 billion in 2023 to $34.17 billion by 2024, achieving a CAGR of approximately 25% through 2029. |

| Investment Models | Investors can choose between direct ownership of charging stations or purchasing stocks in companies involved in EV infrastructure development. |

| Government Incentives | Various government initiatives, including tax credits and grants, significantly lower the financial barriers for investors. |

| Technological Advancements | Innovations such as fast charging and wireless charging technology are enhancing the attractiveness of investing in EV infrastructure. |

| Environmental Impact | Investing in EV charging stations contributes to sustainability goals and offers a positive environmental impact. |

| Location Strategy | Strategically placing charging stations in high-traffic areas can maximize usage and profitability. |

| Market Demand | The demand for EVs is expected to rise sharply, with projections indicating that over 60% of global vehicle sales will be electric by 2030. |

Market Analysis and Trends

The electric vehicle market is experiencing unprecedented growth due to increasing consumer awareness of climate change, rising fuel prices, and advancements in battery technology. The International Energy Agency (IEA) predicts that by 2030, electric vehicles will account for over 60% of global vehicle sales. This shift necessitates a corresponding expansion in charging infrastructure.

Current Market Statistics

- Market Size: The global electric vehicle charging infrastructure market was valued at approximately $25.83 billion in 2023 and is projected to grow at a CAGR of 25.4%, reaching about $108.26 billion by 2029.

- Charging Station Growth: As of April 2024, there were over 61,232 public EV charging devices in the UK alone—a 53% increase from the previous year.

- Investment Opportunities: Major companies like ChargePoint, Tesla, and Blink are leading the charge in developing innovative charging solutions.

Key Trends

- Government Support: The U.S. Infrastructure Investment and Jobs Act allocated $7.5 billion for EV charging infrastructure development, providing significant financial support for new projects.

- Technological Innovations: The rise of fast-charging technologies and smart grid solutions enhances the efficiency and user-friendliness of EV charging stations.

- Sustainability Focus: There is a growing emphasis on integrating renewable energy sources into charging solutions, further aligning investments with sustainability goals.

Implementation Strategies

Investing in electric car charging stations can take various forms depending on your resources and objectives:

Direct Ownership

- Site Selection: Choose high-traffic locations such as shopping centers, office parks, or residential complexes to maximize visibility and usage.

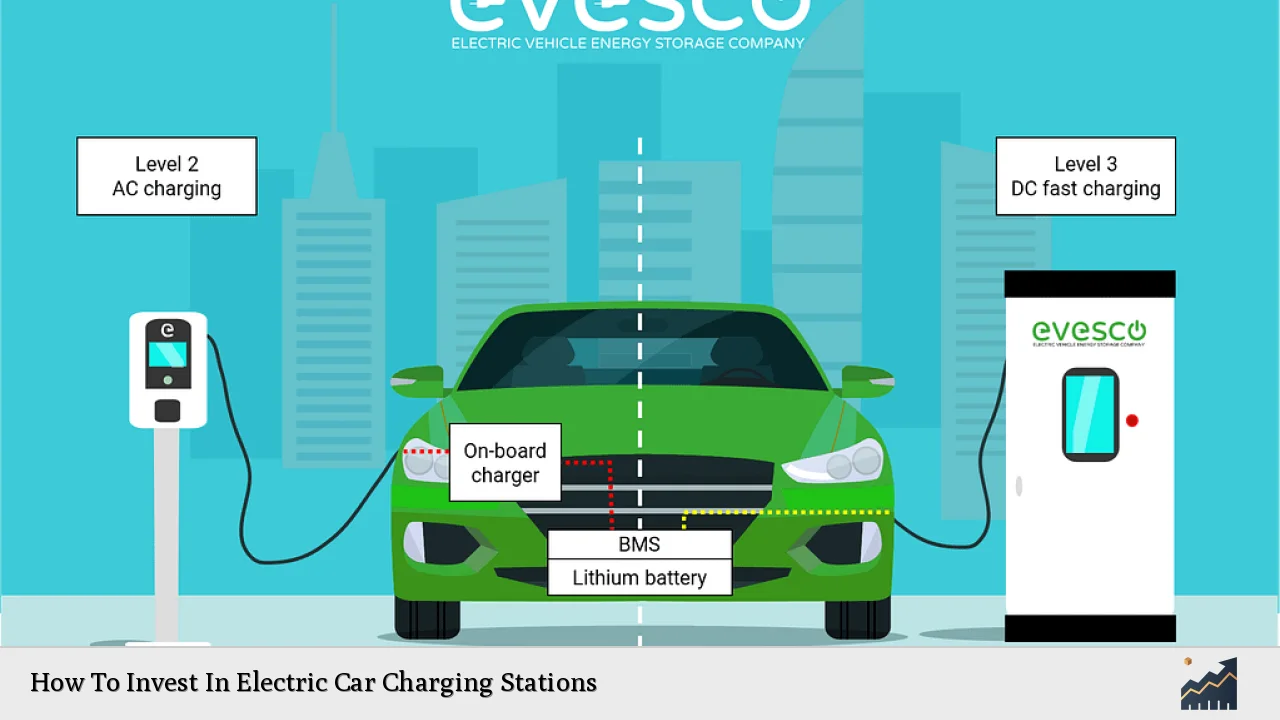

- Installation Costs: Initial costs can vary widely depending on the type of charger (Level 2 vs. DC fast chargers). Level 2 chargers typically cost between $2,000 to $5,000 per unit installed, while DC fast chargers can exceed $100,000.

- Revenue Models: Consider different pricing strategies:

- Pay-per-use fees (e.g., $0.20-$0.60 per kWh)

- Subscription models

- Advertising revenue from digital screens at charging stations

Indirect Investment

If direct ownership isn’t feasible:

- Stock Investments: Invest in publicly traded companies involved in EV infrastructure development (e.g., ChargePoint, Tesla).

- Real Estate Investment Trusts (REITs): Some REITs focus on properties that include EV charging stations as part of their portfolio.

Risk Considerations

While investing in EV charging stations presents lucrative opportunities, several risks must be considered:

- Market Volatility: The stock prices of companies involved in EV infrastructure can be highly volatile due to market conditions and technological advancements.

- Regulatory Changes: Changes in government policies or incentives could impact profitability.

- Technological Risks: Rapid advancements may render existing technologies obsolete or less competitive.

- Location Risks: Poor site selection may lead to underutilization of charging stations.

Regulatory Aspects

Understanding the regulatory landscape is crucial for potential investors:

- Federal Incentives: The U.S. government offers various incentives for installing EV chargers through tax credits and grants.

- State Programs: Many states have their own programs that provide financial assistance or rebates for installing EV infrastructure.

- Compliance Requirements: Investors must ensure compliance with local zoning laws and building codes when installing charging stations.

Future Outlook

The future of investing in electric car charging stations looks promising:

- Growing Demand: With projections indicating that millions more EVs will be on the road by 2030, the demand for accessible charging will continue to rise.

- Technological Advancements: Innovations such as vehicle-to-grid technology and wireless charging will likely enhance investment opportunities.

- Urbanization Trends: As urban areas expand, the need for convenient public charging solutions will become increasingly critical.

Frequently Asked Questions About How To Invest In Electric Car Charging Stations

- What are the main ways to invest in EV charging stations?

Investors can either directly own and operate charging stations or invest indirectly through stocks of companies involved in EV infrastructure. - What are the costs associated with setting up an EV charging station?

The costs can vary significantly based on charger type; Level 2 chargers may cost between $2,000-$5,000 each to install, while DC fast chargers can exceed $100,000. - Are there government incentives available for investing in EV infrastructure?

Yes, various federal and state programs offer tax credits and grants to reduce installation costs for EV chargers. - What are some revenue models for EV charging stations?

Common revenue models include pay-per-use fees based on kWh consumed, subscription services, and advertising revenue. - How do I choose a location for an EV charging station?

Select high-traffic areas such as shopping centers or business districts where potential users are likely to frequent. - What risks should I consider when investing?

Consider market volatility, regulatory changes, technological advancements that may affect existing equipment’s competitiveness, and site selection risks. - What is the expected growth rate for the EV charging market?

The global electric vehicle charging infrastructure market is projected to grow at a CAGR of approximately 25% through 2029. - How does investing in EV chargers contribute to sustainability?

By supporting the transition to electric vehicles and reducing reliance on fossil fuels, investments contribute positively to environmental sustainability goals.

Investing in electric car charging stations not only presents a lucrative financial opportunity but also aligns with broader environmental goals. By understanding market dynamics and strategically positioning investments within this growing sector, investors can capitalize on one of the most promising trends in modern transportation.