Investing in hedge funds like the Citadel Wellington Fund can be an appealing option for individuals seeking higher returns and diversification in their investment portfolios. The Citadel Wellington Fund, managed by Citadel LLC, is known for its multi-strategy approach that combines various investment techniques to generate returns. This guide will provide a comprehensive overview of how to invest in the Citadel Wellington Fund, including market analysis, implementation strategies, risk considerations, regulatory aspects, and future outlook.

| Key Concept | Description/Impact |

|---|---|

| Citadel Wellington Fund Overview | The flagship fund of Citadel LLC, it employs a multi-strategy approach and has shown robust performance with an annualized return of 19.6% since its inception. |

| Investment Strategies | Utilizes long and short positions across equities, fixed income, macroeconomic trends, commodities, and quantitative strategies to optimize returns. |

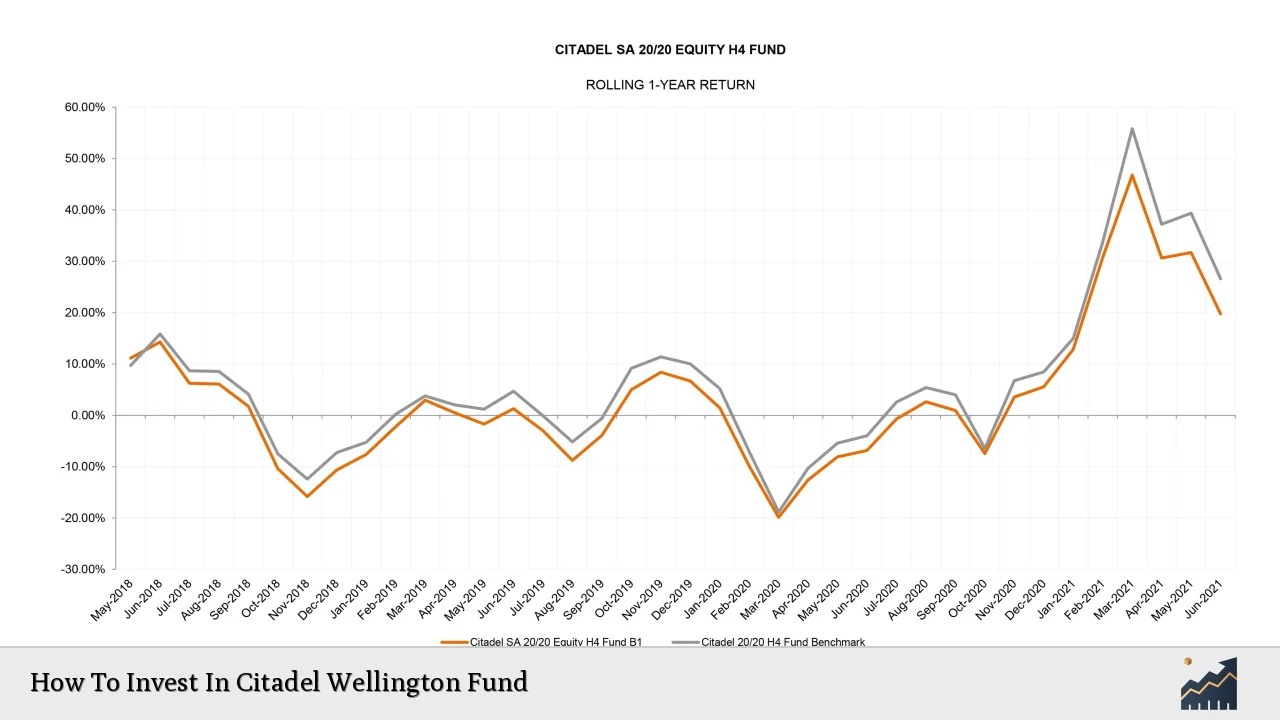

| Current Performance | The fund achieved a return of approximately 13.2% through November 2024, showcasing resilience even in fluctuating market conditions. |

| Assets Under Management (AUM) | The fund’s AUM has grown significantly, reaching over $14.5 billion as of late 2024, indicating strong investor confidence. |

| Risk Management | Employs sophisticated risk management techniques including stress testing and liquidity management to safeguard investments. |

| Regulatory Compliance | As a hedge fund registered with the SEC, it adheres to strict regulatory guidelines ensuring transparency and investor protection. |

Market Analysis and Trends

The investment landscape is continually evolving, influenced by economic indicators, market sentiment, and geopolitical events. The Citadel Wellington Fund operates within this dynamic environment:

- Economic Indicators: Current economic conditions such as inflation rates, interest rates, and GDP growth significantly influence market performance. In recent months, the Federal Reserve’s monetary policy adjustments have affected investor behavior and asset valuations.

- Market Sentiment: Investor confidence fluctuates based on market news and events. For instance, during periods of uncertainty or volatility, hedge funds like Citadel may attract more investors seeking stability through diversification.

- Trends in Hedge Funds: The hedge fund industry has seen a resurgence in popularity as investors look for alternatives to traditional asset classes. The Citadel Wellington Fund has benefited from this trend due to its strong historical performance and innovative strategies.

Implementation Strategies

Investing in the Citadel Wellington Fund requires careful consideration and strategic planning:

- Investment Minimums: Hedge funds typically have high minimum investment thresholds. For the Wellington Fund, potential investors should be prepared for significant initial capital outlays.

- Accredited Investor Status: Investors must qualify as accredited investors under SEC regulations. This generally means having a net worth exceeding $1 million (excluding primary residence) or an annual income over $200,000 for the last two years.

- Due Diligence: Conduct thorough research on the fund’s performance history, investment strategies, risk management practices, and fees. Request the Private Placement Memorandum (PPM) for detailed insights into the fund’s operations.

- Long-Term Perspective: Hedge funds are not typically suited for short-term trading. Investors should adopt a long-term perspective to align with the fund’s investment horizon.

Risk Considerations

Investing in hedge funds carries inherent risks that must be understood:

- Market Risk: The value of investments can fluctuate based on market conditions. While the Wellington Fund has demonstrated resilience, no investment is immune to market downturns.

- Liquidity Risk: Hedge funds often impose lock-up periods during which investors cannot withdraw their capital. Understanding these terms is crucial before investing.

- Operational Risk: Risks associated with the fund’s management practices can impact performance. Investors should evaluate the fund manager’s track record and operational integrity.

- Regulatory Risks: Changes in regulations can affect hedge fund operations and investor rights. Staying informed about regulatory developments is essential for informed decision-making.

Regulatory Aspects

The Citadel Wellington Fund is subject to stringent regulatory requirements:

- SEC Registration: As a registered hedge fund with the Securities and Exchange Commission (SEC), it must comply with reporting obligations that promote transparency.

- Disclosure Requirements: Investors receive regular updates on fund performance and strategy changes through quarterly reports and annual audits.

- Investor Protections: Regulatory frameworks are designed to protect investors from fraud and mismanagement. Understanding these protections can enhance investor confidence.

Future Outlook

Looking ahead, several factors will influence the trajectory of the Citadel Wellington Fund:

- Market Conditions: Ongoing economic shifts will dictate asset class performance. The ability of Citadel’s managers to adapt strategies in response to these changes will be crucial for sustained success.

- Technological Advancements: Continued investment in technology will enhance trading efficiency and data analytics capabilities within the fund.

- Global Economic Trends: As markets become increasingly interconnected, global economic trends will play a significant role in shaping investment opportunities for the Wellington Fund.

Frequently Asked Questions About How To Invest In Citadel Wellington Fund

- What is the minimum investment required for the Citadel Wellington Fund?

The minimum investment typically starts at several million dollars; specific amounts may vary based on individual negotiations. - How do I qualify as an accredited investor?

You need to meet certain financial criteria set by the SEC, including having a net worth over $1 million or an annual income exceeding $200,000. - What are the fees associated with investing in this fund?

Hedge funds usually charge management fees (around 2%) and performance fees (typically 20% of profits). Specific fees should be detailed in the PPM. - How often can I withdraw my investment?

Withdrawals are often subject to lock-up periods; you should review specific terms outlined in your agreement with the fund. - What strategies does the Wellington Fund employ?

The fund utilizes a multi-strategy approach including equities, fixed income, macroeconomic investments, commodities, and quantitative strategies. - How has the performance of the Wellington Fund been historically?

The fund has posted an annualized return of approximately 19.6% since its inception and achieved notable gains even during challenging market conditions. - What risks should I consider before investing?

Consider market risk, liquidity risk due to lock-up periods, operational risks associated with management practices, and regulatory risks from potential changes in laws. - How do I get started with investing in this hedge fund?

You should conduct thorough research, consult financial advisors if necessary, prepare your finances to meet minimum requirements, and request access to necessary documentation like the PPM.

Investing in hedge funds like the Citadel Wellington Fund can offer unique opportunities for growth but requires careful consideration of various factors including market conditions, personal financial goals, and risk tolerance. By understanding these elements thoroughly and conducting due diligence, investors can position themselves effectively within this complex investment landscape.