Health Savings Accounts (HSAs) are powerful financial tools that offer unique tax advantages for individuals saving for medical expenses. Investing HSA money can significantly enhance your savings potential, allowing your funds to grow over time, much like a retirement account. However, many account holders miss out on this opportunity, often keeping their funds in cash instead of exploring investment options. This article will guide you through the process of investing your HSA money effectively.

| Aspect | Details |

|---|---|

| Tax Benefits | Contributions are tax-deductible, earnings grow tax-free, and withdrawals for qualified medical expenses are also tax-free. |

Understanding Your HSA Investment Options

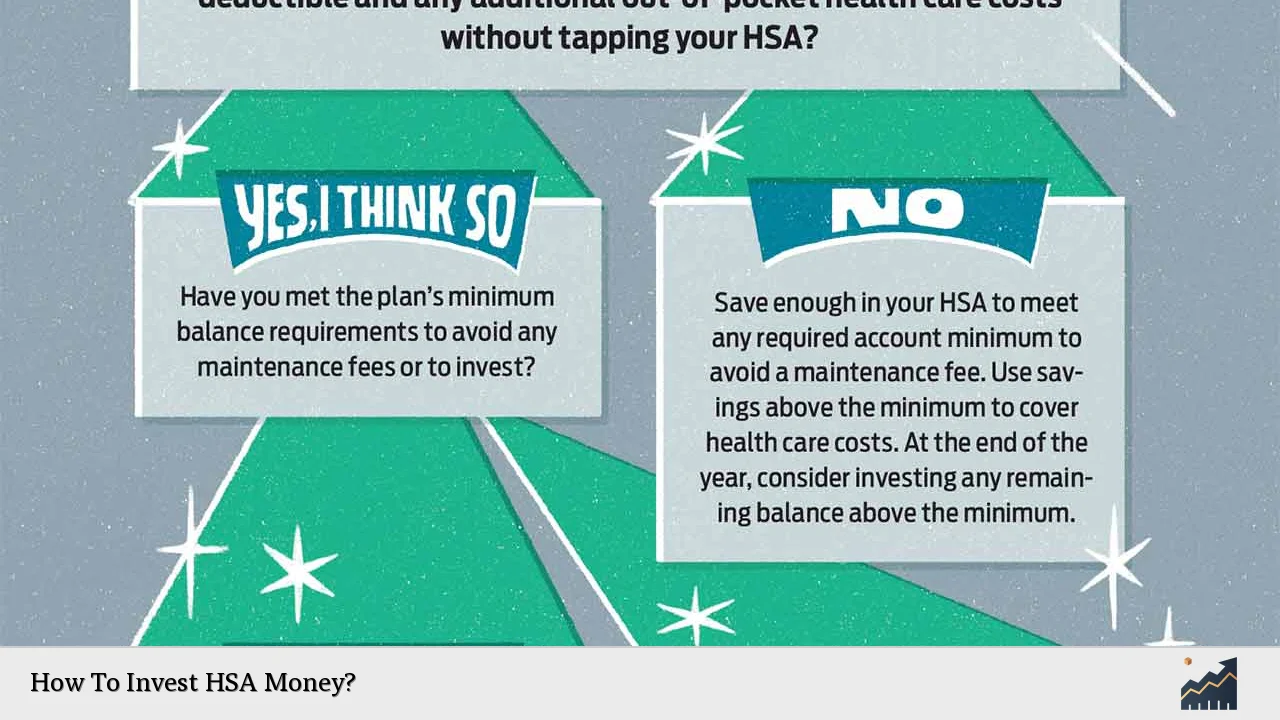

Investing your HSA funds requires a clear understanding of the various investment options available to you. Most HSAs allow you to invest in a range of assets once you meet a minimum balance requirement, typically around $2,000. Here are some common investment avenues:

- Stocks and ETFs: Investing in individual stocks or exchange-traded funds (ETFs) can yield high returns, but they come with higher risk. Choose stocks based on thorough research and consider diversifying across sectors.

- Mutual Funds: These funds pool money from multiple investors to purchase a diversified portfolio of stocks and bonds. They often come with management fees but can be a good option for those looking for professional management.

- Target Date Funds: These funds automatically adjust their asset allocation as you approach a specific target date, making them suitable for long-term investors who prefer a hands-off approach.

- Bonds: For those with lower risk tolerance, investing in bonds or bond funds can provide more stability and regular income.

Understanding your risk tolerance is crucial when selecting investments. If you anticipate needing your HSA funds soon, consider safer options like money market accounts or short-term bonds.

Setting Up Your HSA Investment Account

To start investing your HSA money, follow these steps:

1. Check Your HSA Provider: Ensure that your HSA provider allows investments and understand their specific requirements and fees.

2. Meet Minimum Balance Requirements: Most providers require you to maintain a minimum cash balance before you can invest. This is usually around $2,000.

3. Select Investment Options: Review the available investment options offered by your provider. Choose those that align with your financial goals and risk tolerance.

4. Transfer Funds: Decide how much of your HSA balance you want to invest. Many providers allow you to set up automatic transfers when your balance exceeds a certain amount.

5. Monitor Your Investments: Regularly review your investment performance and make adjustments as necessary to stay aligned with your goals.

Investing requires ongoing attention; ensure you’re aware of market conditions and adjust your portfolio as needed.

The Importance of Diversification

Diversification is a key strategy in investing that helps mitigate risk. By spreading your investments across various asset classes, you reduce the impact of any single investment’s poor performance on your overall portfolio. Here’s how to achieve diversification within your HSA:

- Asset Allocation: Determine the right mix of stocks, bonds, and cash based on your age, risk tolerance, and investment horizon.

- Variety of Investments: Include different types of investments such as large-cap stocks, small-cap stocks, international equities, and fixed-income securities.

- Regular Rebalancing: Periodically review and adjust your portfolio to maintain your desired asset allocation as market conditions change.

Diversification not only helps in managing risk but also positions you for potential growth over time.

Understanding Tax Advantages

One of the most compelling reasons to invest through an HSA is the triple tax advantage it offers:

- Tax-Deductible Contributions: Contributions made to an HSA are tax-deductible, reducing your taxable income for the year.

- Tax-Free Growth: Any earnings generated from investments within the HSA grow tax-free, allowing compounding without tax implications.

- Tax-Free Withdrawals: Withdrawals used for qualified medical expenses are not taxed at all, making HSAs one of the most tax-efficient savings vehicles available.

These benefits can significantly enhance the overall growth potential of your savings when compared to traditional savings accounts or other investment vehicles subject to taxes.

Risks Associated with HSA Investments

While investing in an HSA can yield substantial benefits, it is essential to be aware of the risks involved:

- Market Volatility: Investments in stocks or mutual funds can fluctuate significantly in value. If you need access to cash for medical expenses during a market downturn, you may have to sell at a loss.

- Liquidity Concerns: Some investments may not be readily accessible without penalties or delays. Ensure that you keep enough liquid assets in cash or low-risk options for immediate medical costs.

- Investment Fees: Be mindful of any management fees associated with mutual funds or other investment products. High fees can erode returns over time.

Understanding these risks will help you make informed decisions about how much of your HSA to invest versus keeping liquid for immediate needs.

Strategies for Long-Term Growth

To maximize the potential growth of your HSA investments, consider these strategies:

- Start Early: The earlier you begin investing in your HSA, the more time your money has to grow through compound interest.

- Regular Contributions: Make consistent contributions to take advantage of dollar-cost averaging, which can reduce the impact of volatility over time.

- Long-Term Focus: Treat your HSA as a long-term investment vehicle rather than a short-term savings account. This mindset allows you to weather market fluctuations without panic selling.

By adopting these strategies, you can significantly increase the likelihood of achieving substantial growth in your HSA over time.

FAQs About How To Invest HSA Money

- What types of investments can I make with my HSA?

You can invest in stocks, bonds, mutual funds, ETFs, and sometimes even real estate. - Are there minimum balance requirements for investing?

Yes, most HSAs require a minimum balance—typically around $2,000—before allowing investments. - How do I choose investments for my HSA?

Consider factors like risk tolerance, time horizon, and whether you’ll need access to funds soon. - What are the tax benefits of an HSA?

HSAs offer tax-deductible contributions, tax-free growth on earnings, and tax-free withdrawals for qualified medical expenses. - Can I withdraw invested funds from my HSA anytime?

You can withdraw funds anytime but may incur penalties if used for non-qualified expenses.

Investing your HSA money wisely can lead to significant financial benefits over time. By understanding the various investment options available and implementing sound strategies tailored to your financial goals and circumstances, you can effectively leverage this powerful savings tool for both current and future medical needs.