Health Savings Accounts (HSAs) offer a unique opportunity to invest for future medical expenses while enjoying significant tax advantages. Many HSA holders are unaware that they can invest their funds in stocks, potentially growing their savings at a faster rate than traditional savings accounts. This article will guide you through the process of investing your HSA funds in stocks, helping you maximize the potential of this powerful financial tool.

HSAs provide a triple tax benefit: contributions are tax-deductible, growth is tax-free, and withdrawals for qualified medical expenses are also tax-free. By investing your HSA funds in stocks, you can take advantage of these tax benefits while potentially earning higher returns over the long term.

| HSA Feature | Benefit |

|---|---|

| Tax-deductible contributions | Reduce current taxable income |

| Tax-free growth | Maximize investment returns |

| Tax-free withdrawals for medical expenses | Cover healthcare costs without tax burden |

Eligibility and Account Setup

Before you can start investing your HSA funds in stocks, you need to ensure you meet the eligibility requirements. To be eligible for an HSA, you must be enrolled in a high-deductible health plan (HDHP). Once you have an HSA, check with your provider to see if they offer investment options. Some HSA providers require a minimum balance in your cash account before you can start investing, typically around $1,000 to $2,000.

To set up your HSA investment account, follow these steps:

- Log in to your HSA provider’s online portal

- Navigate to the investment options section

- Complete any required questionnaires or forms

- Choose your investment strategy and select your desired stocks or funds

- Set up automatic investments if desired

It’s important to note that not all HSA providers offer the same investment options. Some may limit you to a selection of mutual funds, while others might provide access to individual stocks and exchange-traded funds (ETFs). If your current HSA provider doesn’t offer the investment options you want, consider transferring your HSA to a provider that does.

Choosing Your Investments

When investing your HSA funds in stocks, it’s crucial to consider your investment goals, risk tolerance, and time horizon. Here are some popular investment options for HSA accounts:

Individual Stocks

Investing in individual stocks allows you to have more control over your portfolio but requires more research and active management. If you choose this route, consider diversifying across different sectors and companies to minimize risk.

Index Funds

Index funds are a popular choice for HSA investors due to their low fees and broad market exposure. Funds that track the S&P 500 or total stock market can provide a diversified portfolio with a single investment.

Exchange-Traded Funds (ETFs)

ETFs offer the diversification benefits of mutual funds with the trading flexibility of individual stocks. Many HSA providers offer a range of ETFs covering various market sectors and asset classes.

Target Date Funds

For a hands-off approach, consider target date funds. These funds automatically adjust their asset allocation as you approach retirement age, becoming more conservative over time.

When selecting your investments, keep in mind the potential need for liquidity. While it’s beneficial to invest for long-term growth, you may need to access your HSA funds for medical expenses in the short term. Consider keeping a portion of your HSA in cash or low-risk investments for immediate healthcare needs.

Investment Strategies for HSA Funds

Developing a sound investment strategy for your HSA funds is crucial for long-term success. Here are some strategies to consider:

Asset Allocation

Determine an appropriate mix of stocks, bonds, and cash based on your risk tolerance and investment timeline. A common approach is to use a more aggressive allocation if you’re young and have a long time horizon, gradually becoming more conservative as you age.

Dollar-Cost Averaging

Implement a dollar-cost averaging strategy by regularly investing a fixed amount into your chosen stocks or funds. This approach can help reduce the impact of market volatility on your investments.

Rebalancing

Periodically review and rebalance your HSA investment portfolio to maintain your desired asset allocation. This typically involves selling investments that have performed well and buying those that have underperformed to return to your target allocation.

Tax-Efficient Investing

Take advantage of the tax-free growth in your HSA by focusing on investments that generate capital gains rather than dividends. This strategy can help maximize the tax benefits of your HSA.

Managing Your HSA Investments

Effective management of your HSA investments is key to long-term success. Here are some tips to help you manage your HSA stock investments:

- Regularly review your investments: At least once a year, review your HSA investment performance and make adjustments as needed.

- Keep track of contributions: Ensure you don’t exceed the annual HSA contribution limits set by the IRS.

- Maintain proper documentation: Keep records of all HSA contributions, investments, and withdrawals for tax purposes.

- Consider future medical expenses: While investing for growth is important, make sure you have enough liquid funds available for potential near-term medical costs.

- Utilize HSA investment tools: Many HSA providers offer investment calculators and educational resources to help you make informed decisions.

Remember that investing in stocks carries risk, and it’s possible to lose money. Consider consulting with a financial advisor to develop an HSA investment strategy that aligns with your overall financial goals and risk tolerance.

Maximizing HSA Benefits

To get the most out of your HSA investments in stocks, consider these strategies:

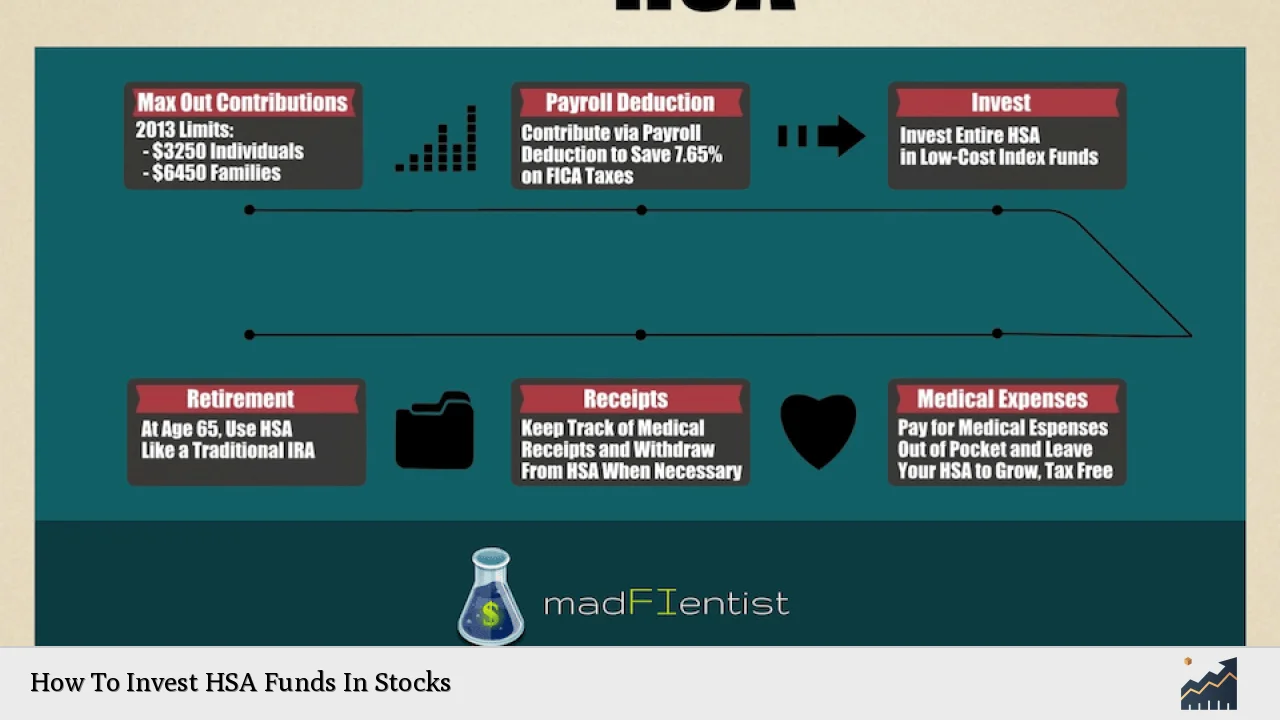

- Maximize contributions: Contribute the maximum amount allowed by the IRS each year to take full advantage of the tax benefits.

- Pay medical expenses out-of-pocket: If possible, pay for current medical expenses with after-tax dollars, allowing your HSA investments more time to grow tax-free.

- Use your HSA as a retirement account: If you can afford it, treat your HSA as an additional retirement account, letting the investments grow until retirement when you may have higher medical expenses.

- Reinvest dividends: Set up your account to automatically reinvest any dividends or capital gains distributions to compound your returns over time.

- Take advantage of catch-up contributions: If you’re 55 or older, you can make additional catch-up contributions to your HSA.

By following these strategies and carefully managing your HSA investments in stocks, you can potentially grow your healthcare savings significantly over time while enjoying valuable tax benefits.

FAQs About How To Invest HSA Funds In Stocks

- Can I invest all of my HSA funds in stocks?

Yes, but it’s generally recommended to keep some funds in cash for immediate medical needs. - What happens if I need to withdraw money from my HSA investments?

You can sell investments and withdraw funds for qualified medical expenses tax-free at any time. - Are there fees associated with investing my HSA funds?

Some HSA providers charge investment fees, so it’s important to compare providers and understand their fee structures. - Can I transfer my HSA to a different provider with better investment options?

Yes, you can transfer your HSA to a new provider that offers investment options that better suit your needs. - What happens to my HSA investments if I no longer have a high-deductible health plan?

You can keep your existing HSA and continue to invest, but you cannot make new contributions without an eligible HDHP.