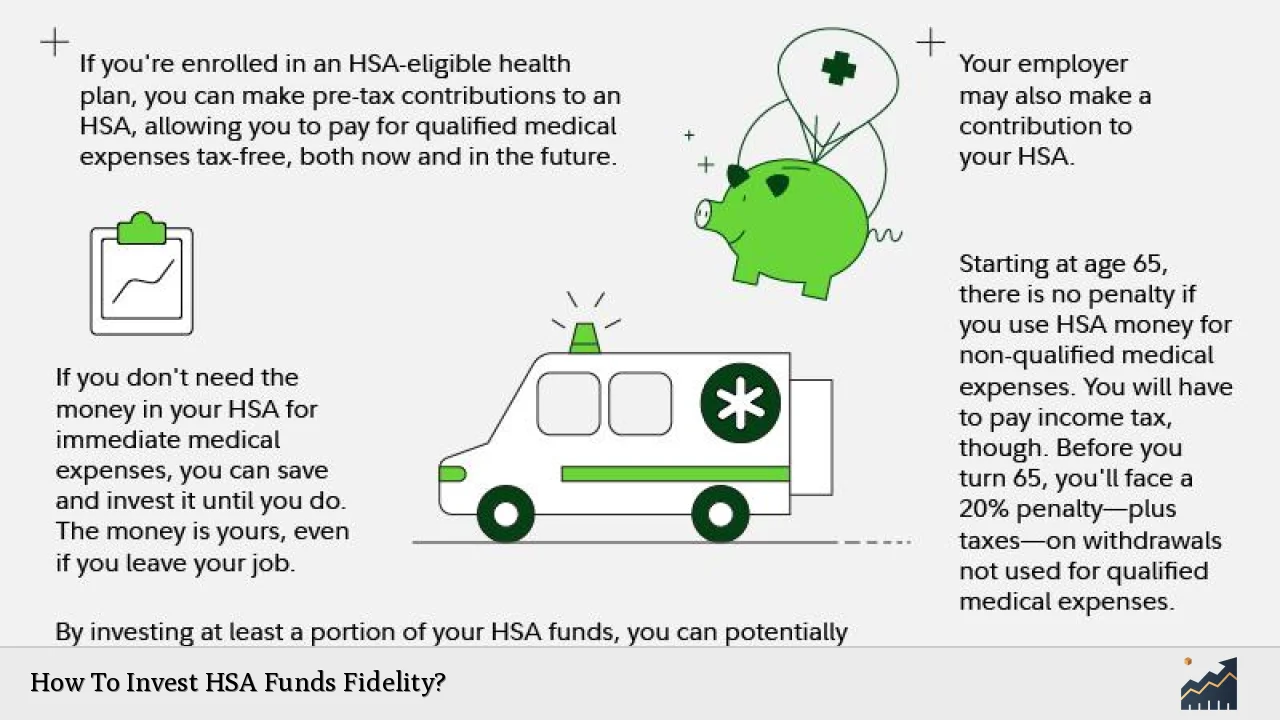

Investing Health Savings Account (HSA) funds through Fidelity can be a strategic way to grow your savings while preparing for future healthcare expenses. HSAs offer a unique triple tax advantage: contributions are tax-deductible, earnings grow tax-free, and withdrawals for qualified medical expenses are also tax-free. This makes them an attractive option for individuals looking to optimize their healthcare savings and potentially use the account as an additional retirement vehicle.

To invest HSA funds at Fidelity, you first need to open an HSA account if you haven’t done so already. Once your account is set up, you can begin contributing funds and choosing how to invest them. Fidelity provides various investment options, including mutual funds, exchange-traded funds (ETFs), stocks, bonds, and cash equivalents. Understanding the investment landscape and aligning it with your financial goals is crucial for maximizing the benefits of your HSA.

| Feature | Description |

|---|---|

| Tax Advantages | Contributions are tax-deductible; earnings grow tax-free; withdrawals for qualified expenses are tax-free. |

| Investment Options | Includes mutual funds, ETFs, stocks, bonds, and cash equivalents. |

Getting Started with Your Fidelity HSA

To begin investing your HSA funds at Fidelity, follow these straightforward steps:

1. Open Your HSA: If you don’t already have a Fidelity HSA, you can easily open one online. There’s no minimum balance required to open an account.

2. Make Contributions: You can contribute to your HSA through various methods such as direct deposit from your paycheck, bank transfers, or checks. Ensure that you stay within the annual contribution limits set by the IRS.

3. Check Eligibility for Investment: Before investing, verify if you meet the minimum balance requirement. Typically, you need at least $2,500 in your HSA before you can start investing in various options.

4. Choose Your Investments: Once eligible, navigate to the investment section of your HSA account on Fidelity’s website. Here you can select from a range of investment options tailored to your risk tolerance and financial goals.

5. Monitor and Adjust Your Portfolio: Regularly review your investments and make adjustments as necessary based on performance and changes in your financial situation or healthcare needs.

Understanding Investment Options

Fidelity offers a diverse array of investment options for HSA holders. Understanding these options is essential for making informed decisions about where to allocate your funds.

- Mutual Funds: These are professionally managed investment funds that pool money from multiple investors to purchase a diversified portfolio of stocks or bonds. They are suitable for those looking for diversification without having to manage individual stocks.

- Exchange-Traded Funds (ETFs): ETFs are similar to mutual funds but trade on stock exchanges like individual stocks. They often have lower expense ratios and offer flexibility in trading.

- Stocks: Investing in individual stocks can provide high returns but comes with higher risk due to market volatility. This option is best suited for those with a higher risk tolerance.

- Bonds: Bonds are fixed-income securities that can provide stability and regular interest payments. They are typically less risky than stocks and can be a good option for conservative investors.

- Cash Options: Keeping some funds in cash or money market accounts ensures liquidity for immediate healthcare expenses while earning some interest.

Setting Up Automatic Contributions

One effective strategy for managing your HSA investments is setting up automatic contributions. This approach allows you to regularly invest without having to manually transfer funds each time. Here’s how to set it up:

- Log into your Fidelity account.

- Navigate to the contributions section of your HSA.

- Choose the amount you wish to contribute regularly (e.g., monthly).

- Select the source of the funds (bank account or paycheck).

- Confirm and save your settings.

By automating contributions, you ensure that you’re consistently funding your HSA while taking advantage of dollar-cost averaging—investing a fixed amount regularly regardless of market conditions.

Evaluating Your Investment Strategy

As with any investment strategy, it’s important to evaluate your approach periodically. Consider the following factors:

- Risk Tolerance: Assess how much risk you are willing to take based on your financial situation and future healthcare needs. Younger individuals may opt for more aggressive investments, while those closer to retirement might prefer conservative options.

- Investment Goals: Define what you want to achieve with your HSA investments—whether it’s saving for immediate medical expenses or growing the account for retirement healthcare costs.

- Market Conditions: Stay informed about market trends that could impact your investments. This knowledge will help you make informed decisions about when to buy or sell assets within your HSA.

Utilizing Fidelity’s Resources

Fidelity provides numerous resources that can assist you in managing and investing your HSA funds effectively:

- Investment Research Tools: Use Fidelity’s research tools to analyze different investment options based on performance metrics such as historical returns and expense ratios.

- Educational Content: Access articles, webinars, and tutorials that explain various investment strategies tailored specifically for HSAs.

- Personalized Guidance: Consider consulting with a Fidelity representative or utilizing their robo-advisor services if you’re unsure about making investment decisions on your own.

FAQs About How To Invest HSA Funds Fidelity

- What is an HSA?

An HSA is a tax-advantaged savings account designed for individuals with high-deductible health plans (HDHPs) to save for medical expenses. - How do I start investing my HSA funds?

You must have at least $2,500 in your HSA before you can begin investing in various options offered by Fidelity. - What types of investments can I choose from?

You can invest in mutual funds, ETFs, stocks, bonds, and cash equivalents through Fidelity. - Can I automate my contributions?

Yes, you can set up automatic contributions from a bank account or paycheck directly into your Fidelity HSA. - How often should I review my investments?

You should regularly review your investments at least annually or whenever there are significant changes in your financial situation or market conditions.

Investing HSA funds at Fidelity presents an excellent opportunity to grow savings while preparing for future healthcare costs. By understanding the investment options available and aligning them with personal financial goals and risk tolerance levels, individuals can maximize the benefits of their HSAs effectively.