Health Savings Accounts (HSAs) offer a unique opportunity to save for medical expenses while enjoying significant tax advantages. While many people use HSAs for current healthcare costs, investing your HSA funds can potentially lead to substantial long-term growth. This strategy can help you build a robust healthcare nest egg for retirement or future medical needs. Let’s explore how to effectively invest your HSA account to maximize its potential.

HSAs provide a triple tax advantage: contributions are tax-deductible, earnings grow tax-free, and withdrawals for qualified medical expenses are tax-free. By investing your HSA funds, you can leverage these benefits to potentially grow your savings at a faster rate than a traditional savings account.

| HSA Feature | Benefit |

|---|---|

| Tax-deductible contributions | Reduce current taxable income |

| Tax-free growth | Earnings compound without tax impact |

| Tax-free withdrawals for medical expenses | No taxes on qualified distributions |

Understanding HSA Investment Options

Before diving into HSA investments, it’s crucial to understand the available options. Most HSA providers offer investment opportunities once your account balance reaches a certain threshold, typically around $1,000 to $2,000. This minimum balance ensures you have sufficient funds for immediate medical needs while allowing you to invest the excess.

HSA investment options often mirror those found in retirement accounts like 401(k)s or IRAs. Common investment choices include:

- Mutual funds

- Exchange-traded funds (ETFs)

- Stocks

- Bonds

- Target-date funds

Each option comes with its own risk profile and potential return. Mutual funds and ETFs are popular choices as they offer diversification and professional management. For those comfortable with higher risk, individual stocks may provide greater growth potential. Bonds can offer stability and income, while target-date funds automatically adjust your asset allocation as you approach retirement.

Selecting the Right Investments

When choosing investments for your HSA, consider your risk tolerance, investment timeline, and overall financial goals. If you plan to use the funds for near-term medical expenses, a more conservative approach might be appropriate. However, if you’re treating your HSA as a long-term investment vehicle for retirement healthcare costs, a more aggressive strategy could be beneficial.

Here are some factors to consider when selecting HSA investments:

- Time horizon: How long until you plan to use the funds?

- Risk tolerance: How comfortable are you with market fluctuations?

- Diversification: Spread your investments across different asset classes to manage risk

- Fees: Look for low-cost investment options to maximize returns

- Performance: Review historical performance, but remember past results don’t guarantee future returns

Strategies for Maximizing HSA Investments

To make the most of your HSA investments, consider implementing these strategies:

1. Maximize Contributions

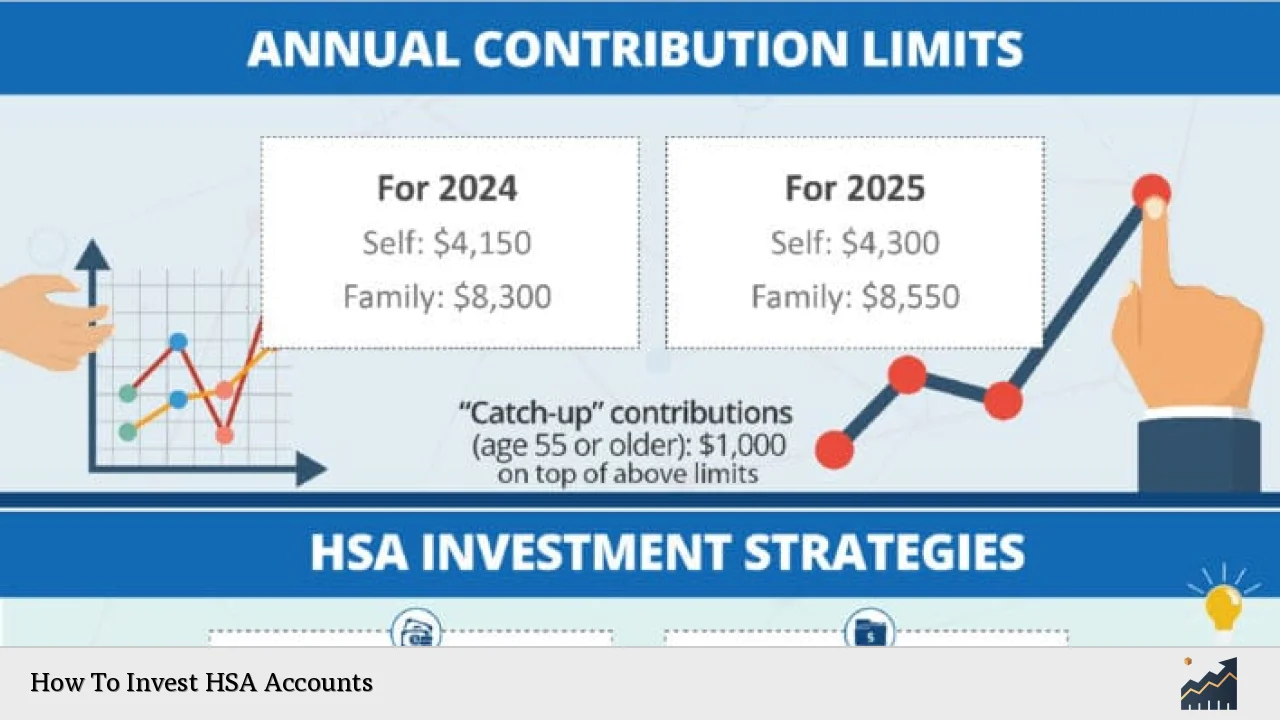

Contribute the maximum amount allowed by the IRS to your HSA each year. For 2024, the limits are $4,150 for individuals and $8,300 for families. If you’re 55 or older, you can make an additional $1,000 catch-up contribution. By maximizing your contributions, you increase the amount available for investment and potential growth.

2. Invest for the Long Term

Treat your HSA as a long-term investment account, similar to a retirement fund. By investing aggressively and allowing your funds to grow over time, you can potentially accumulate a significant sum for future healthcare expenses. This strategy works best if you can pay for current medical costs out-of-pocket, leaving your HSA investments untouched.

3. Utilize Automatic Investing

Set up automatic investments from your HSA cash balance to your investment account. This ensures consistent investing and takes advantage of dollar-cost averaging, potentially reducing the impact of market volatility over time.

4. Rebalance Regularly

Review and rebalance your HSA investments periodically, typically once or twice a year. This helps maintain your desired asset allocation and manage risk as market conditions change.

5. Consider a Two-Account Strategy

Some HSA holders maintain two accounts: one for current medical expenses and another for long-term investing. This approach allows you to keep a cash buffer for immediate needs while aggressively investing the rest for future healthcare costs.

Managing HSA Investments Effectively

Effective management of your HSA investments is crucial for long-term success. Here are some tips to help you manage your HSA investments:

- Monitor performance: Regularly review your investment performance and make adjustments as needed.

- Stay informed: Keep up with changes in HSA regulations and investment options offered by your provider.

- Coordinate with other accounts: Consider your HSA investments in the context of your overall investment portfolio, including retirement accounts.

- Keep records: Maintain detailed records of your HSA contributions, investments, and withdrawals for tax purposes.

- Plan for required minimum distributions (RMDs): Unlike IRAs, HSAs don’t have RMDs, allowing for continued tax-free growth throughout retirement.

Potential Pitfalls and How to Avoid Them

While investing your HSA can be highly beneficial, there are potential pitfalls to be aware of:

- Overinvesting: Ensure you maintain enough cash for current medical needs.

- High fees: Some HSA investment options come with high fees that can eat into returns. Look for low-cost alternatives.

- Lack of diversification: Avoid concentrating your investments in a single asset class or sector.

- Ignoring risk tolerance: Don’t invest aggressively if you’re uncomfortable with market volatility or may need the funds soon.

- Forgetting about the account: Regularly review and manage your HSA investments, just as you would with other investment accounts.

By being aware of these potential issues and taking proactive steps to avoid them, you can maximize the benefits of investing your HSA funds.

FAQs About How To Invest HSA Accounts

- Can I invest all of my HSA funds?

Most providers require a minimum cash balance before allowing investments, typically $1,000-$2,000. - What happens to my HSA investments if I change jobs?

Your HSA, including investments, remains yours regardless of employment changes. - Are there penalties for withdrawing HSA investments for non-medical expenses?

Yes, non-qualified withdrawals before age 65 incur a 20% penalty plus income tax. - Can I transfer my HSA to a different provider for better investment options?

Yes, you can transfer your HSA to another provider offering more suitable investment choices. - How often should I review my HSA investment strategy?

Review your HSA investments at least annually or when your financial situation changes significantly.

Investing your HSA funds can be a powerful strategy for building long-term wealth and preparing for future healthcare expenses. By understanding your investment options, implementing effective strategies, and managing your account diligently, you can maximize the potential of your HSA. Remember to consider your individual financial situation and consult with a financial advisor if needed to create an HSA investment plan that aligns with your overall financial goals. With careful planning and management, your HSA can become a valuable tool in your financial toolkit, providing both immediate tax benefits and long-term growth potential for your healthcare needs.