Investing for grandchildren is a meaningful way to contribute to their financial future and help them achieve their goals. Whether it’s for education, a first home, or simply to build a nest egg, understanding the various investment options available is crucial. Grandparents can play a significant role in shaping their grandchildren’s financial literacy and security through thoughtful investments. This article will explore different investment avenues, their benefits, and how to get started.

| Investment Option | Description |

|---|---|

| Junior ISA | A tax-efficient savings account for children that allows grandparents to contribute up to £9,000 annually. |

| Custodial Accounts | Accounts managed by an adult until the child reaches adulthood, allowing for flexible investments. |

Why Investing for Grandchildren is Important

Investing for grandchildren is not just about accumulating wealth; it’s about providing them with financial security and a strong foundation for their future. One of the primary reasons to invest is the potential for compound interest, which allows money to grow exponentially over time. Starting early can significantly increase the amount available when they reach adulthood.

Moreover, investing creates a legacy that can be passed down through generations. By saving and investing wisely, grandparents can help alleviate future financial burdens such as college tuition or home purchases. This proactive approach not only benefits the grandchildren financially but also teaches them valuable lessons about saving and investment strategies.

In addition, it fosters a sense of responsibility and financial literacy. Children who learn about managing finances from an early age are more likely to make informed decisions as adults. This knowledge can lead to better financial habits and greater success in managing their own money.

Types of Investment Accounts for Grandchildren

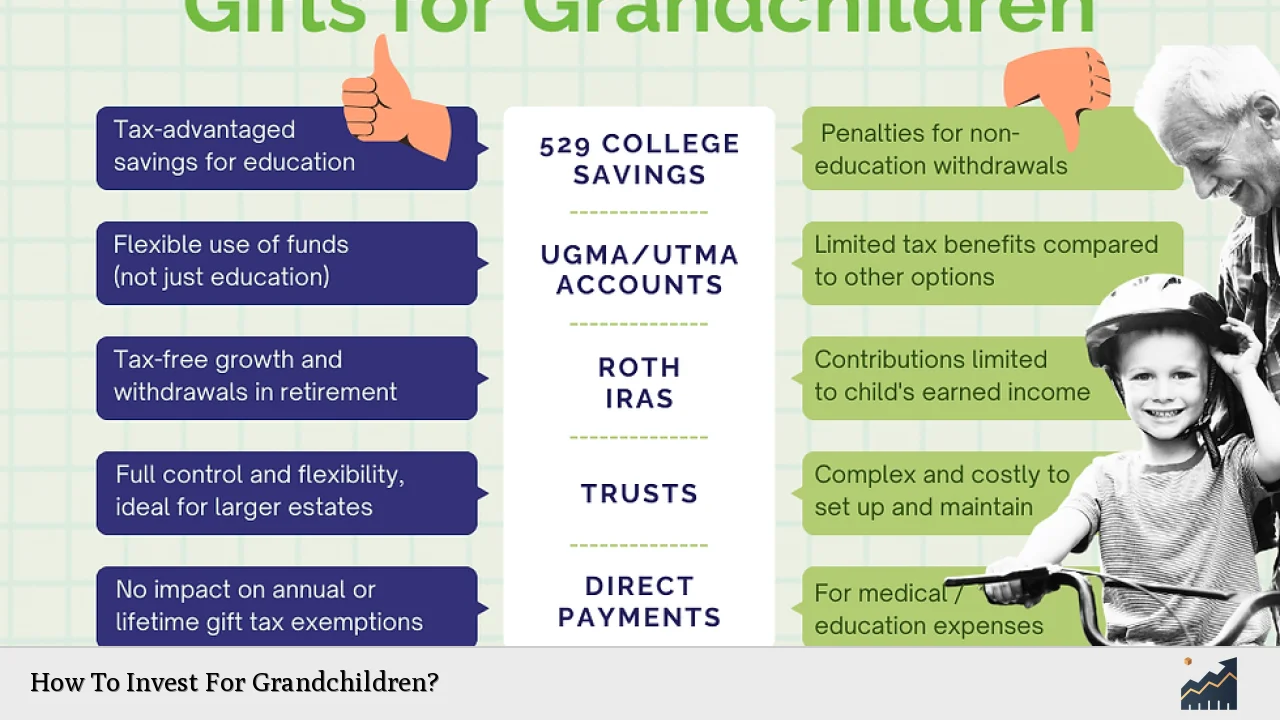

There are several types of investment accounts available for grandparents looking to invest in their grandchildren’s futures. Each option has unique features and benefits.

Junior ISA

A Junior ISA is one of the most popular options for investing in grandchildren’s futures. It allows parents or guardians to open an account, but anyone can contribute up to £9,000 annually. The funds grow tax-free, making it an attractive option for long-term savings. Once the child turns 18, the account converts into an adult ISA, allowing continued tax benefits.

Custodial Accounts

Custodial accounts such as UGMA (Uniform Gifts to Minors Act) or UTMA (Uniform Transfers to Minors Act) are excellent options for grandparents who want more control over investments until the child reaches adulthood. These accounts allow grandparents to invest on behalf of their grandchildren while retaining control until they turn 18 or 21, depending on state laws.

529 College Savings Plans

For those specifically looking to save for educational expenses, 529 plans are designed for this purpose. Contributions grow tax-free when used for qualified education expenses. These plans offer flexibility as they can be used at any accredited institution.

Premium Bonds

Another unique investment option is Premium Bonds, which are government-backed savings products that offer a chance to win cash prizes instead of earning interest. While there’s no guaranteed return, the thrill of potentially winning large sums can be appealing.

Stocks and Shares

Investing directly in stocks or mutual funds is another way to build wealth over time. This approach requires more knowledge and risk tolerance but has historically provided higher returns than traditional savings accounts.

Common Mistakes When Investing for Grandchildren

While investing can be rewarding, there are common pitfalls that grandparents should avoid:

- Choosing the Wrong Account Type: Selecting an inappropriate investment account can hinder growth potential. It’s essential to research options thoroughly.

- Lack of Diversification: Failing to diversify investments can lead to increased risk. Spreading investments across various asset classes reduces exposure to market volatility.

- Ignoring Tax Implications: Not considering tax consequences can diminish returns. Understanding the tax implications of different investment vehicles is crucial.

Steps to Start Investing for Your Grandchildren

Starting an investment plan for your grandchildren involves several key steps:

1. Set Clear Goals: Determine what you want to achieve with your investments—whether it’s saving for college or providing a financial cushion.

2. Choose the Right Investment Vehicle: Based on your goals, select an appropriate account type that aligns with your financial strategy.

3. Make Regular Contributions: Consistency is vital in building wealth over time. Set up automatic contributions if possible.

4. Monitor Investments: Regularly review your investment portfolio to ensure it aligns with your goals and make adjustments as needed.

5. Educate Your Grandchildren: Involve them in discussions about money management and investment strategies to foster financial literacy from a young age.

FAQs About Investing For Grandchildren

- What is a Junior ISA?

A Junior ISA is a tax-free savings account specifically designed for children where anyone can contribute up to £9,000 annually. - Can I open an investment account in my grandchild’s name?

Yes, you can open custodial accounts or other types of accounts with parental consent. - What are Premium Bonds?

Premium Bonds are government-backed savings products that offer chances to win cash prizes instead of earning interest. - How much should I invest monthly?

Even small amounts can add up over time; consider starting with what you can comfortably afford. - Is it better to invest in stocks or bonds?

Stocks generally offer higher returns but come with more risk; bonds are safer but typically yield lower returns.

Investing for grandchildren is not only a gift but also an opportunity to instill valuable lessons about finance and responsibility. By selecting appropriate investment vehicles and making informed decisions, grandparents can significantly contribute to their grandchildren’s financial futures while fostering a legacy of financial literacy and security.