Investing is a crucial step towards building wealth and securing your financial future. For beginners, the world of investing can seem daunting, but with the right knowledge and approach, anyone can start their investment journey. This guide will walk you through the essential steps to begin investing, helping you make informed decisions and grow your wealth over time.

Investing for beginners involves understanding key concepts, setting clear goals, and choosing appropriate investment vehicles. By following a systematic approach, you can minimize risks and maximize potential returns. Remember, successful investing is a long-term process that requires patience, discipline, and continuous learning.

| Key Investment Concepts | Description |

|---|---|

| Risk tolerance | Your ability to handle financial losses |

| Diversification | Spreading investments across different assets |

| Compound interest | Earning returns on your returns |

| Asset allocation | Balancing different types of investments |

Set Clear Financial Goals

Before you start investing, it’s crucial to define your financial objectives. Are you saving for retirement, a down payment on a house, or your child’s education? Your goals will determine your investment strategy, including the types of investments you choose and the level of risk you’re willing to take.

Start by listing your short-term (1-3 years), medium-term (3-10 years), and long-term (10+ years) financial goals. Be specific about the amount of money you need and the timeframe for each goal. This clarity will help you create a focused investment plan that aligns with your objectives.

Remember that different goals may require different investment approaches. For example, short-term goals might be better served by more conservative investments, while long-term goals can potentially withstand higher risk for greater returns.

Consider using the SMART criteria when setting your financial goals:

- Specific: Clearly define what you want to achieve

- Measurable: Set concrete numbers and deadlines

- Achievable: Ensure your goals are realistic given your resources

- Relevant: Align your goals with your overall financial plan

- Time-bound: Set a specific timeframe for achieving each goal

By setting clear, well-defined goals, you’ll have a better understanding of how much you need to invest and what types of returns you should aim for.

Understand Your Risk Tolerance

Risk tolerance is a crucial factor in determining your investment strategy. It refers to your ability to withstand fluctuations in the value of your investments. Understanding your risk tolerance helps you choose investments that align with your comfort level and financial goals.

Factors that influence risk tolerance include:

- Age: Younger investors generally have more time to recover from market downturns

- Income stability: A stable income may allow for higher risk investments

- Financial responsibilities: Dependents or large debts may lower risk tolerance

- Investment knowledge: More experienced investors might be comfortable with higher risk

To assess your risk tolerance, consider how you would react to a significant drop in your investment value. Would you panic and sell, or stay calm and hold on? Be honest with yourself about your emotional and financial capacity to handle investment volatility.

Remember that higher risk often correlates with higher potential returns, but also comes with a greater chance of losses. As a beginner, it’s generally advisable to start with a more conservative approach and gradually increase your risk exposure as you gain experience and knowledge.

Start with a Solid Foundation

Before diving into investments, it’s essential to build a strong financial foundation. This includes:

Emergency Fund

Establish an emergency fund with 3-6 months of living expenses. This safety net will help you avoid tapping into investments during unexpected financial challenges.

Debt Management

Pay off high-interest debts, particularly credit card balances. The interest saved by paying off debt often outweighs potential investment returns, especially for beginners.

Retirement Accounts

Take advantage of employer-sponsored retirement plans like 401(k)s, especially if your employer offers matching contributions. This is essentially free money that can significantly boost your long-term savings.

Education

Invest time in learning about different investment options, financial markets, and economic principles. The more you understand, the better equipped you’ll be to make informed investment decisions.

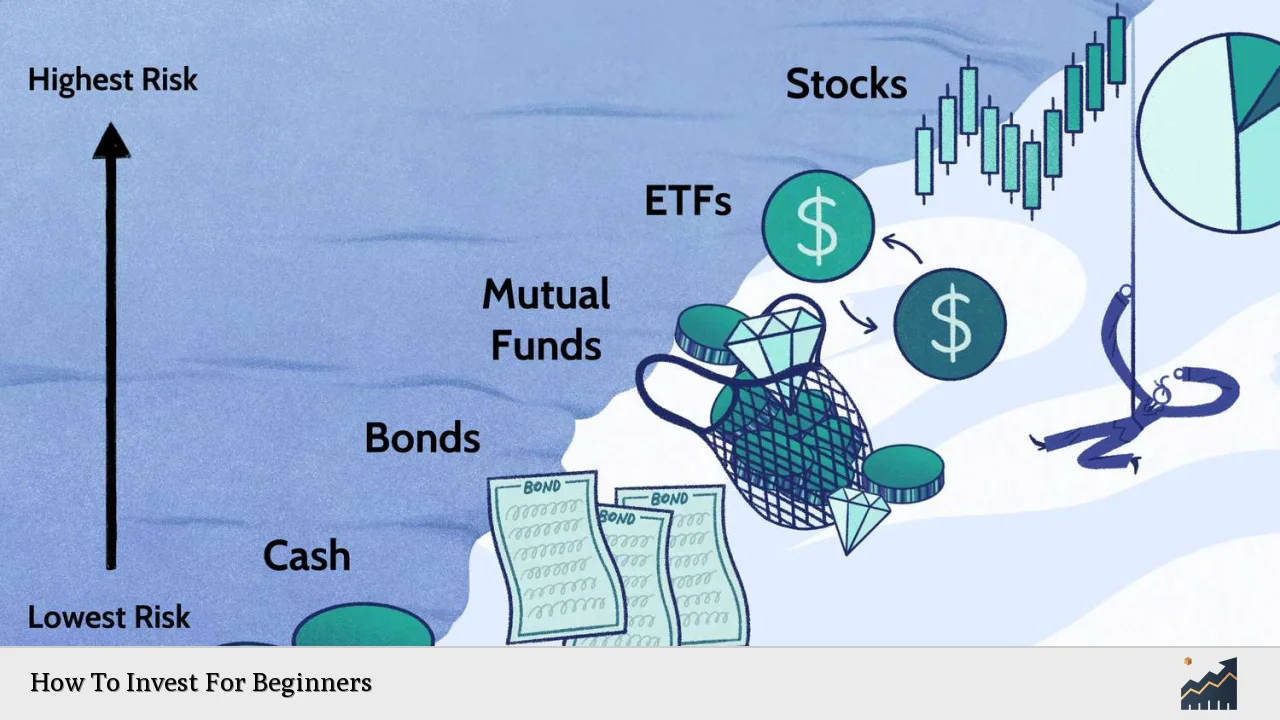

Choose the Right Investment Vehicles

As a beginner investor, it’s important to start with investment vehicles that offer simplicity, diversification, and low costs. Here are some popular options:

Index Funds

Index funds are a type of mutual fund that tracks a specific market index, such as the S&P 500. They offer broad market exposure, low fees, and built-in diversification, making them an excellent choice for beginners.

Exchange-Traded Funds (ETFs)

Similar to index funds, ETFs offer diversification and low costs. They trade like stocks, providing more flexibility than traditional mutual funds. Many ETFs track specific market indices or sectors.

Robo-Advisors

Robo-advisors use algorithms to create and manage a diversified portfolio based on your risk tolerance and goals. They offer a hands-off approach to investing, ideal for beginners who prefer automated management.

Individual Stocks

While riskier than diversified funds, investing in individual stocks can be a way to learn about the market. Start small and focus on well-established companies in industries you understand.

Bonds

Bonds are generally lower-risk investments that provide regular income. They can help balance a portfolio and reduce overall volatility.

Remember to diversify your investments across different asset classes and sectors to spread risk and potentially improve returns.

Develop an Investment Strategy

Creating a solid investment strategy is crucial for long-term success. Here are key elements to consider:

Asset Allocation

Determine the right mix of stocks, bonds, and other assets based on your risk tolerance and goals. A common rule of thumb is to subtract your age from 110 to get the percentage of your portfolio that should be in stocks.

Regular Contributions

Set up automatic contributions to your investment accounts. This practice, known as dollar-cost averaging, helps smooth out market fluctuations and builds the habit of consistent investing.

Rebalancing

Periodically review and rebalance your portfolio to maintain your desired asset allocation. This typically involves selling some of your best-performing assets and buying more of the underperforming ones.

Long-Term Perspective

Adopt a long-term mindset and avoid making emotional decisions based on short-term market fluctuations. Successful investing requires patience and discipline.

Tax Efficiency

Consider the tax implications of your investments. Utilize tax-advantaged accounts like IRAs and 401(k)s to optimize your after-tax returns.

Monitor and Adjust Your Investments

While it’s important not to obsess over daily market movements, regularly reviewing your investments is crucial. Set a schedule to review your portfolio, perhaps quarterly or semi-annually.

During these reviews:

- Assess your portfolio’s performance against relevant benchmarks

- Check if your investments still align with your goals and risk tolerance

- Look for opportunities to rebalance or make strategic changes

- Consider seeking professional advice for complex situations

Remember, investing is a learning process. As you gain experience and your financial situation evolves, you may need to adjust your strategy. Stay informed about market trends and economic news, but avoid making impulsive decisions based on short-term events.

FAQs About How To Invest For Beginners

- How much money do I need to start investing?

You can start investing with as little as $100 through many online platforms or robo-advisors. - What’s the best investment for beginners?

Index funds or ETFs are often recommended for beginners due to their low costs and built-in diversification. - How often should I check my investments?

Quarterly or semi-annually is generally sufficient for most long-term investors. - Should I invest all my savings?

No, keep an emergency fund and only invest money you won’t need in the short term. - Can I lose all my money investing?

While all investments carry risk, diversification and proper asset allocation can significantly reduce the risk of total loss.