Investing financially is a crucial step towards building wealth and securing your financial future. It involves allocating resources, usually money, in order to generate income or profit over time. Understanding how to invest effectively can help you achieve various financial goals such as saving for retirement, buying a home, or funding education. This guide will provide you with essential steps and strategies to navigate the investment landscape successfully.

Investing can seem daunting, especially for beginners. However, by following a structured approach and educating yourself about different investment options, you can make informed decisions that align with your financial objectives. The key is to start early, be consistent, and remain disciplined in your investment strategy.

| Key Concepts | Description |

|---|---|

| Investing | Allocating resources to generate income or profit. |

| Financial Goals | Objectives for saving and investing money. |

Assess Your Current Financial Situation

Before diving into investments, it is essential to assess your current financial situation. This includes evaluating your income, expenses, debts, and savings. Understanding where you stand financially will help you determine how much you can afford to invest.

Start by creating a budget that outlines your monthly income and expenses. This will allow you to identify any disposable income available for investment. Additionally, ensure that you have an emergency fund in place—ideally covering three to six months of living expenses—before committing funds to investments.

It’s also important to pay off high-interest debts, such as credit card balances, as these can significantly impact your financial health. Once your debts are managed and you have a solid savings base, you can confidently move forward with investing.

Define Your Financial Goals

Setting clear financial goals is a fundamental aspect of investing. Ask yourself what you want to achieve through your investments. Common goals include:

- Saving for retirement

- Buying a home

- Funding education

- Building wealth for future generations

Each goal should have a specific timeline and target amount. For instance, if you aim to retire in 30 years with a certain amount saved, this will influence your investment strategy and risk tolerance.

Categorizing your goals into short-term (1-3 years), medium-term (3-10 years), and long-term (10+ years) will help you prioritize your investments accordingly. This clarity will guide your decision-making process as you choose the right investment vehicles.

Determine Your Risk Tolerance

Understanding your risk tolerance is crucial when investing. Risk tolerance refers to the degree of variability in investment returns that you are willing to withstand in your investment portfolio. Factors influencing risk tolerance include:

- Age: Younger investors may afford to take more risks since they have time to recover from potential losses.

- Financial situation: Those with stable incomes may take on more risk compared to individuals with fluctuating earnings.

- Investment knowledge: Familiarity with market dynamics can affect comfort levels with riskier assets.

To assess your risk tolerance, consider taking an online quiz or consulting with a financial advisor. Knowing how much risk you can handle will help you select appropriate investments that align with your comfort level.

Choose an Investment Account

Selecting the right investment account is essential for managing your investments effectively. Common types of accounts include:

- Brokerage accounts: These allow you to buy and sell various securities like stocks, bonds, and mutual funds.

- Retirement accounts: Options such as 401(k)s or IRAs provide tax advantages for long-term savings.

- Robo-advisors: Automated platforms that create and manage diversified portfolios based on your risk profile.

When choosing an account, consider factors such as fees, available investment options, and ease of use. Opening an account that aligns with your investment strategy will facilitate better management of your assets.

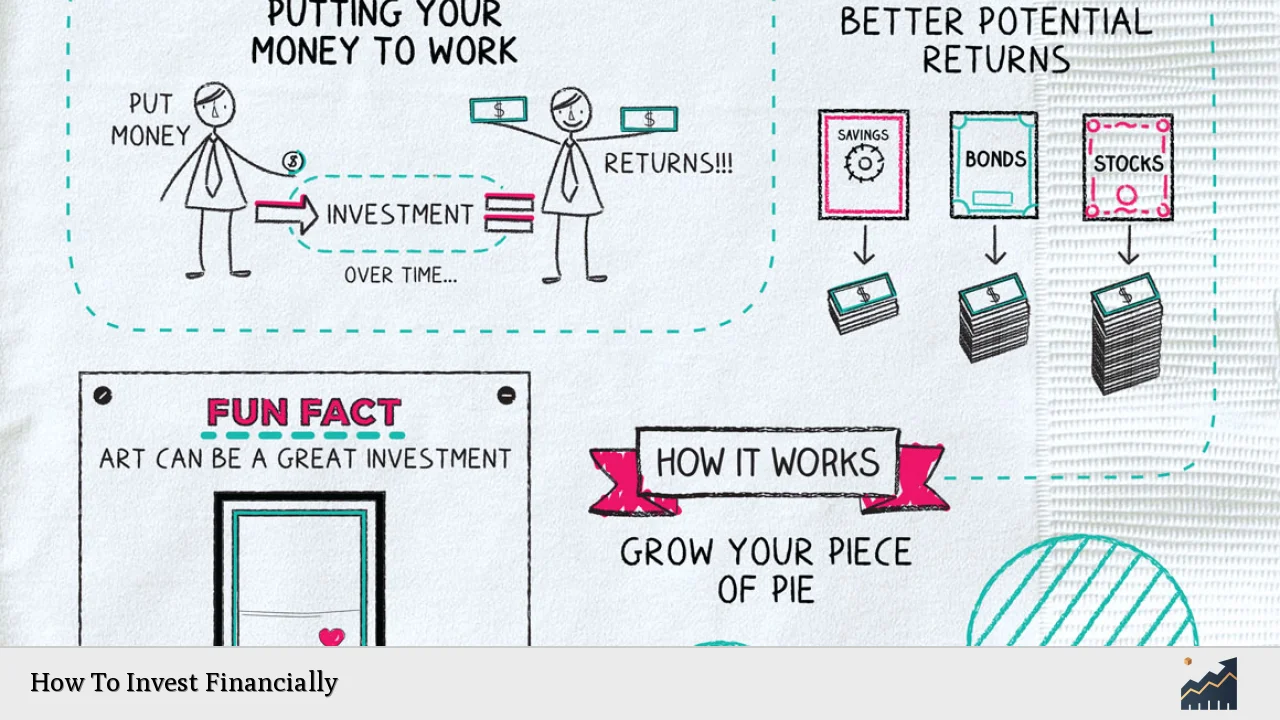

Understand Your Investment Options

Familiarizing yourself with various investment options is vital for making informed decisions. Here are some common types of investments:

- Stocks: Shares of ownership in companies that can provide capital appreciation and dividends.

- Bonds: Debt securities issued by governments or corporations that pay fixed interest over time.

- Mutual funds: Pooled investments managed by professionals that offer diversification across various securities.

- Exchange-traded funds (ETFs): Similar to mutual funds but traded on stock exchanges like individual stocks.

- Real estate: Physical properties that can generate rental income or appreciate in value over time.

Each option carries different levels of risk and potential returns. Understanding these characteristics will help you build a diversified portfolio tailored to your financial goals.

Develop an Investment Strategy

Creating a solid investment strategy is essential for achieving long-term success. Consider the following elements when developing your strategy:

- Asset allocation: Decide how much of your portfolio to allocate to different asset classes (stocks, bonds, etc.) based on your risk tolerance and goals.

- Diversification: Spread investments across various sectors or geographic locations to mitigate risk.

- Investment horizon: Align your strategy with the timeline of your financial goals—short-term strategies differ from long-term approaches.

Regularly review and adjust your strategy based on changes in market conditions or personal circumstances. Staying flexible allows you to respond effectively to economic shifts.

Monitor Your Investments

Once you’ve made investments, it’s crucial to monitor their performance regularly. Keeping track of how well each asset is performing helps ensure that you’re on track toward achieving your financial goals.

Reviewing your portfolio at least annually allows you to make necessary adjustments based on performance trends or changes in personal circumstances. If certain investments underperform consistently or no longer align with your goals, consider reallocating those funds into more promising opportunities.

Additionally, staying informed about market trends and economic indicators can provide insights into potential adjustments needed in your investment strategy.

Seek Professional Advice

If navigating the complexities of investing feels overwhelming, consider seeking professional advice from a financial advisor. Advisors can offer personalized guidance based on their expertise and experience in the field.

When choosing an advisor, look for someone who understands your financial situation and has a fiduciary duty—meaning they are obligated to act in your best interest. A good advisor can help clarify investment options and assist in developing a tailored investment plan aligned with your objectives.

FAQs About How To Invest Financially

- What is the best way to start investing?

The best way is to assess your financial situation, set clear goals, and choose an appropriate investment account. - How much money do I need to start investing?

You can start investing with any amount; many platforms allow small initial investments. - What are the risks associated with investing?

All investments carry risks including market volatility and potential loss of capital. - How often should I review my investments?

You should review them at least annually or whenever there are significant changes in the market or personal circumstances. - Is it necessary to hire a financial advisor?

No, but hiring one can provide valuable insights and personalized strategies tailored to your needs.

By following these steps and understanding key concepts related to investing financially, you’ll be well-equipped to make informed decisions that align with your goals. Remember that investing is not just about making money; it’s about building a secure financial future through careful planning and disciplined execution.