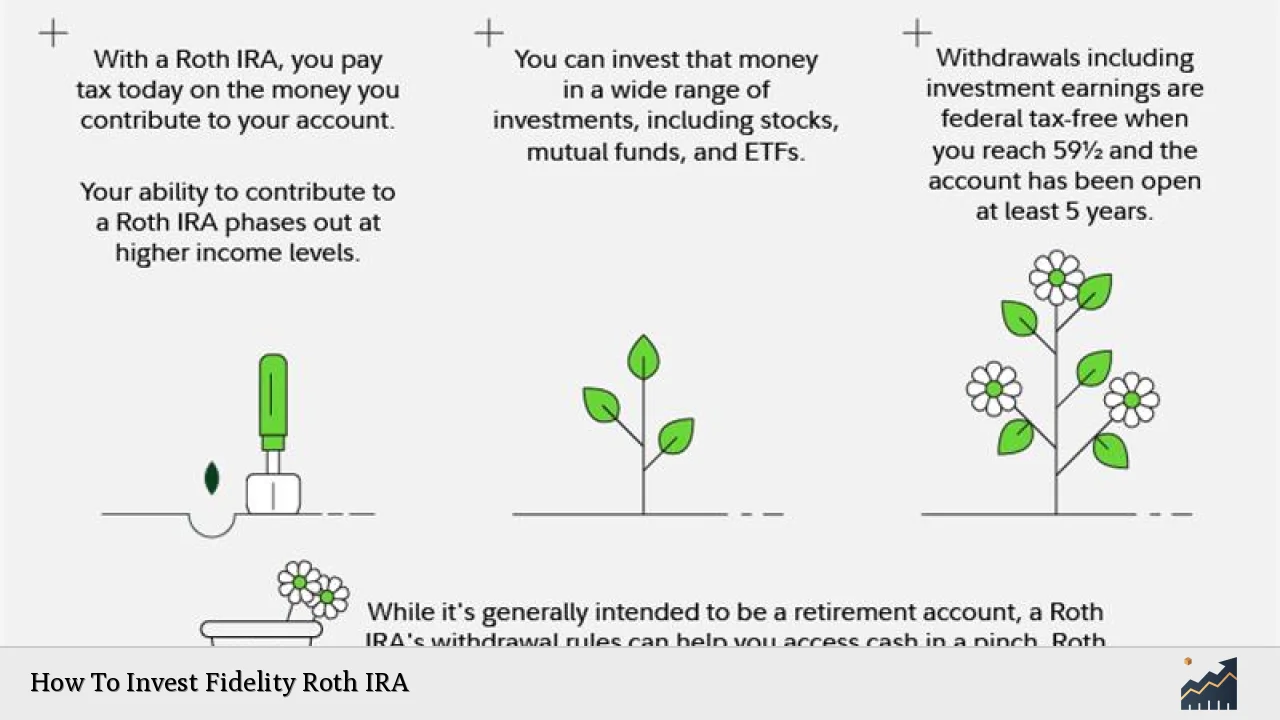

Investing in a Fidelity Roth IRA can be a strategic way to save for retirement while enjoying tax advantages. A Roth IRA allows individuals to contribute after-tax dollars, meaning that the money you invest grows tax-free and can be withdrawn tax-free in retirement, provided certain conditions are met. This account is particularly beneficial for younger investors who expect to be in a higher tax bracket later in life, as it locks in the current tax rate on contributions.

To get started with investing in a Fidelity Roth IRA, it’s essential to understand the steps involved, the types of investments available, and how to create a diversified portfolio that aligns with your financial goals. This guide will walk you through the process of opening and managing your Fidelity Roth IRA effectively.

| Step | Description |

|---|---|

| 1 | Determine Eligibility |

| 2 | Open a Fidelity Roth IRA Account |

| 3 | Fund Your Account |

| 4 | Select Investments |

| 5 | Monitor and Adjust Your Portfolio |

Determine Your Eligibility

Before you can invest in a Fidelity Roth IRA, you must first determine your eligibility. To contribute to a Roth IRA, you need to have earned income and meet specific income limits set by the IRS. For 2024, the contribution limit is $7,000 per year for individuals under 50 and $8,000 for those aged 50 or older.

To qualify for full contributions, your modified adjusted gross income (MAGI) must be below certain thresholds:

- Single filers: MAGI below $138,000

- Married filing jointly: MAGI below $218,000

If your income exceeds these limits, your contribution amount may be reduced or phased out entirely. Understanding these limits is crucial to ensure compliance with IRS regulations and to maximize your retirement savings.

Open a Fidelity Roth IRA Account

Once you’ve confirmed your eligibility, the next step is to open a Fidelity Roth IRA account. This process is straightforward and can be completed online or by contacting Fidelity’s customer service. You will need to provide personal information such as your Social Security number, employment details, and financial information.

Fidelity offers various account types tailored to different investment strategies. When selecting an account type, consider whether you want to manage your investments personally or prefer having them managed by professionals at Fidelity.

To open an account:

- Visit the Fidelity website.

- Navigate to the “Retirement” section and select “Roth IRA.”

- Follow the prompts to complete the application process.

Once your account is set up, you will receive confirmation and further instructions on how to fund it.

Fund Your Account

Funding your Fidelity Roth IRA is an essential step in starting your investment journey. You can fund your account through various methods:

- Direct deposit: Transfer funds directly from your bank account.

- Transfers: Move funds from another retirement account.

- Rollovers: Roll over funds from a previous employer’s retirement plan.

Keep in mind that contributions are limited annually. For 2024, ensure that you do not exceed the contribution limits mentioned earlier.

Setting up automatic contributions can help you reach these limits more easily. For example, if you aim to contribute $6,000 annually, consider setting up monthly transfers of $500 from your checking account.

Select Investments

After funding your Roth IRA, it’s time to select investments that align with your financial goals and risk tolerance. Fidelity provides a wide range of investment options within their Roth IRAs:

- Stocks: Individual company shares.

- Bonds: Debt securities issued by corporations or governments.

- Mutual Funds: Pooled investment vehicles managed by professionals.

- Exchange-Traded Funds (ETFs): Similar to mutual funds but traded like stocks.

- Target-Date Funds: Funds that automatically adjust their asset allocation based on a target retirement date.

For many investors, starting with a few core index funds can provide sufficient diversification at a low cost. Popular options include:

- Fidelity Total Market Index Fund (FSKAX): Offers exposure to the entire U.S. stock market.

- Fidelity U.S. Bond Index Fund (FXNAX): Provides access to U.S. investment-grade bonds.

- Fidelity ZERO Total Market Index Fund (FZROX): A no-fee option for broad market exposure.

Diversification is key; spreading investments across different asset classes can help mitigate risk while maximizing potential returns.

Monitor and Adjust Your Portfolio

Investing is not a one-time event; it requires ongoing monitoring and adjustments based on market conditions and personal financial goals. Regularly review your portfolio’s performance and make necessary adjustments to maintain alignment with your investment strategy.

Consider rebalancing your portfolio periodically—this involves selling some assets that have grown significantly while purchasing more of those that have underperformed relative to others in your portfolio. This practice helps maintain your desired asset allocation over time.

Additionally, stay informed about changes in market conditions and economic indicators that may affect your investments. Adjusting your strategy based on these factors can help optimize returns over the long term.

FAQs About How To Invest Fidelity Roth IRA

- What is a Fidelity Roth IRA?

A Fidelity Roth IRA is an individual retirement account where contributions are made with after-tax dollars, allowing for tax-free growth. - How do I open a Fidelity Roth IRA?

You can open a Fidelity Roth IRA online by providing personal information and selecting an investment strategy. - What are the contribution limits for 2024?

The contribution limit is $7,000 per year for those under 50 and $8,000 for those aged 50 or older. - What types of investments can I hold in my Roth IRA?

You can invest in stocks, bonds, mutual funds, ETFs, and target-date funds within a Fidelity Roth IRA. - Can I withdraw money from my Roth IRA anytime?

You can withdraw contributions at any time without penalties; however, earnings must meet specific criteria for tax-free withdrawal.

By following these steps and maintaining an informed approach to investing in your Fidelity Roth IRA, you can build a solid foundation for retirement savings while taking advantage of significant tax benefits. Starting early and diversifying effectively will enhance your potential for long-term growth and financial security in retirement.