Investing directly in mutual funds can be a rewarding way to grow your wealth while minimizing costs. Mutual funds pool money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other securities. By investing directly, you can avoid paying commissions to intermediaries, which can significantly enhance your returns over time. This guide will walk you through the steps to invest directly in mutual funds, the benefits of doing so, and some important considerations to keep in mind.

| Key Aspects | Details |

|---|---|

| Definition | A mutual fund is an investment vehicle that pools money from multiple investors. |

| Types | Direct and Regular mutual funds. |

Understanding Direct Mutual Funds

Direct mutual funds allow investors to buy shares directly from the Asset Management Company (AMC) without involving any middlemen. This means you save on commission fees that would typically be paid to distributors or agents. The absence of these fees can lead to higher returns on your investment over time. For instance, if a regular mutual fund has an expense ratio of 1.5%, a direct mutual fund might have an expense ratio of only 1%. This difference can accumulate significantly over the years.

Investors benefit from professional management as AMCs employ skilled managers who make informed investment decisions based on market conditions and trends. However, investing in direct mutual funds requires a good understanding of your financial goals and risk tolerance.

Steps to Invest Directly in Mutual Funds

Step 1: Complete KYC Formalities

Before you start investing, it is essential to complete the Know Your Customer (KYC) process. This is a regulatory requirement in many countries, including India. You will need to provide identification documents such as:

- PAN card

- Address proof

- Passport-sized photographs

This process ensures that all investors are verified and helps prevent fraud.

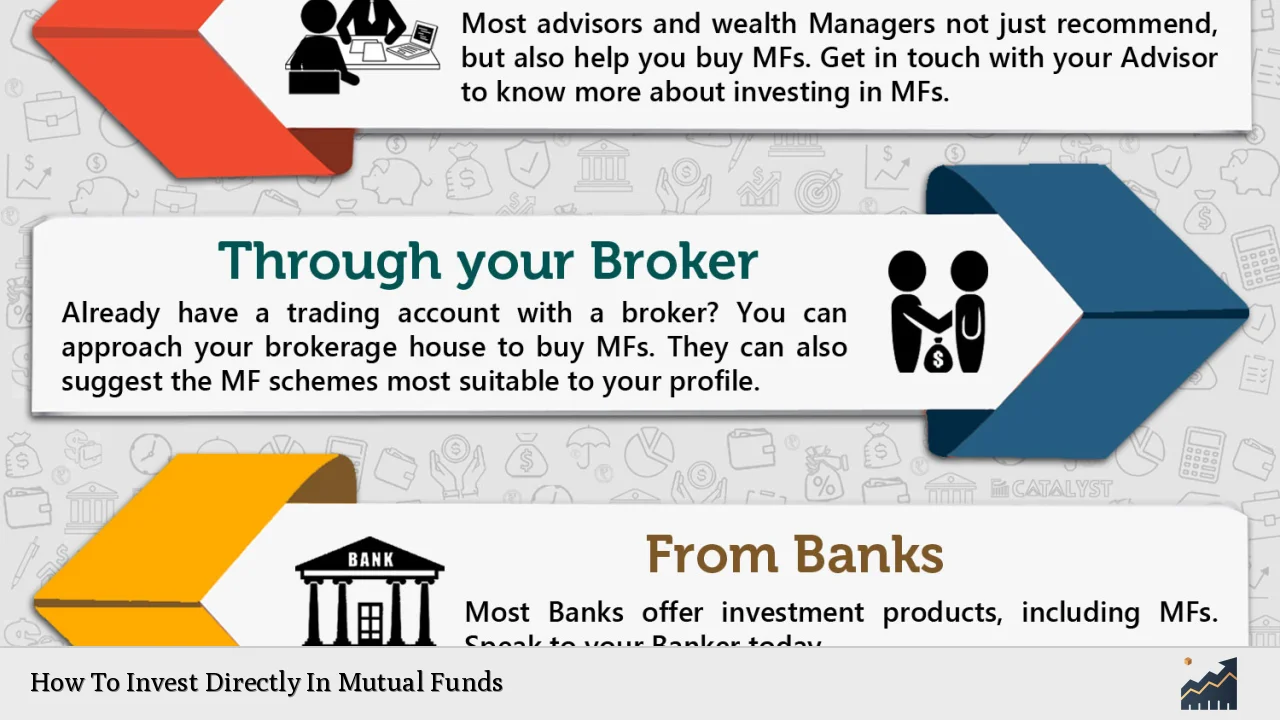

Step 2: Choose an Investment Method

You can invest in direct mutual funds through two primary methods: online and offline.

- Online Method: This is the most convenient way to invest. You can visit the official website of the AMC or use online investment platforms that offer access to various AMCs.

- Offline Method: If you prefer a traditional approach, you can visit the nearest AMC branch or Investor Service Centre (ISC) and fill out the necessary forms.

Step 3: Select Your Mutual Fund Scheme

Choosing the right mutual fund scheme is crucial. You should consider factors such as:

- Your investment goals (e.g., retirement, wealth creation)

- Risk tolerance (e.g., conservative, moderate, aggressive)

- Historical performance of the fund

- Asset allocation strategy (e.g., equity, debt)

Research different schemes offered by various AMCs and compare their performance metrics.

Step 4: Open an Account with the AMC

If you are investing online, you will need to create an account on the AMC’s website or through an online platform. The registration process typically involves filling out personal details and verifying your KYC documents.

If you are investing offline, you will need to fill out an application form at the AMC branch along with your KYC documents.

Step 5: Make Your Investment

Once your account is set up and your KYC is complete, you can proceed with making your investment. You will have options such as:

- Lump Sum Investment: Invest a one-time amount.

- Systematic Investment Plan (SIP): Invest a fixed amount regularly (monthly or quarterly).

Choose the option that aligns with your financial strategy.

Step 6: Monitor Your Investment

After investing, it’s important to monitor your investments regularly. Keep track of the fund’s performance and make adjustments as needed based on market conditions or changes in your financial goals.

Advantages of Direct Mutual Funds

Investing directly in mutual funds offers several benefits:

- Lower Costs: Direct plans have lower expense ratios compared to regular plans due to no intermediary commissions.

- Higher Returns: Over time, lower costs can lead to significantly higher returns on investments.

- Transparency: You have direct access to information about your investments without relying on intermediaries.

- Control Over Investments: Investors can make decisions based on their research without external influence.

Important Considerations When Investing

While direct mutual funds offer many advantages, there are also some important considerations:

- Knowledge Requirement: Investors should have a good understanding of market dynamics and fund performance metrics.

- Time Commitment: Managing investments directly requires regular monitoring and research.

- Risk Awareness: Different funds come with varying levels of risk; it’s crucial to choose funds that align with your risk tolerance.

FAQs About How To Invest Directly In Mutual Funds

- What are direct mutual funds?

Direct mutual funds are schemes that allow investors to buy shares directly from AMCs without paying commissions. - How do I complete KYC for mutual fund investment?

You need to submit identification documents like PAN card and address proof for KYC verification. - Can I invest in direct mutual funds online?

Yes, you can invest online through AMC websites or registered investment platforms. - What is SIP in mutual funds?

SIP stands for Systematic Investment Plan, allowing you to invest a fixed amount regularly. - Why choose direct plans over regular plans?

Direct plans have lower expense ratios leading to potentially higher returns over time.

Investing directly in mutual funds is an excellent way for individuals looking to maximize their returns while minimizing costs associated with intermediaries. By following these steps and considering the advantages and risks involved, investors can build a robust investment portfolio tailored to their financial goals.