Investing in cryptocurrency has gained immense popularity over the past few years, attracting both seasoned investors and newcomers. Cryptocurrencies, such as Bitcoin and Ethereum, offer a unique investment opportunity due to their decentralized nature and potential for significant returns. However, navigating the cryptocurrency market can be daunting, especially for beginners. This guide will provide you with a comprehensive overview of how to invest in cryptocurrency, covering essential steps, strategies, and considerations.

| Step | Description |

|---|---|

| Select an Exchange | Choose a reputable platform to buy and sell cryptocurrencies. |

| Create an Account | Register and verify your identity on the exchange. |

| Deposit Funds | Fund your account using fiat currency or another cryptocurrency. |

| Choose Cryptocurrencies | Decide which cryptocurrencies you want to invest in. |

| Make Your Purchase | Buy your selected cryptocurrencies through the exchange. |

Understanding Cryptocurrency

Cryptocurrency is a form of digital or virtual currency that uses cryptography for security. Unlike traditional currencies issued by governments, cryptocurrencies operate on decentralized networks based on blockchain technology. This technology ensures transparency and security by recording all transactions across a network of computers.

Investing in cryptocurrencies can be highly rewarding but also comes with substantial risks. The market is known for its extreme volatility, which can lead to significant price fluctuations in short periods. Therefore, it is crucial for investors to conduct thorough research before committing any funds.

The most well-known cryptocurrency is Bitcoin, but there are thousands of alternatives known as altcoins. Each cryptocurrency operates on its unique protocol and serves different purposes within the digital economy. Understanding these differences is vital for making informed investment decisions.

Selecting a Cryptocurrency Exchange

Choosing the right cryptocurrency exchange is one of the most critical steps in investing. An exchange is a platform where you can buy, sell, and trade cryptocurrencies. When selecting an exchange, consider the following factors:

- Reputation: Look for exchanges with positive reviews and a history of security.

- Fees: Different exchanges charge various fees for transactions; compare them to find the most cost-effective option.

- Available Cryptocurrencies: Ensure the exchange supports the cryptocurrencies you wish to invest in.

- User Experience: A user-friendly interface can simplify your trading experience.

Some popular exchanges include Coinbase, Binance, and Kraken. These platforms are known for their ease of use and robust security measures.

Creating an Account

Once you have selected an exchange, you need to create an account. This process typically involves:

- Providing Personal Information: You will need to provide details such as your name, email address, and phone number.

- Verification: Most exchanges require identity verification to comply with regulations. This may involve uploading identification documents.

- Setting Up Security Features: Enable two-factor authentication (2FA) to enhance the security of your account.

Creating an account is usually straightforward but may take some time due to verification processes.

Depositing Funds

After your account is set up and verified, you can deposit funds into your exchange account. Most exchanges accept deposits in fiat currencies like USD or EUR through various methods:

- Bank Transfers: Direct transfers from your bank account are common but may take several days.

- Credit/Debit Cards: Many exchanges allow instant deposits via credit or debit cards.

- Cryptocurrency Transfers: If you already own cryptocurrencies, you can transfer them into your exchange wallet.

Be aware of any fees associated with deposits and choose the method that best suits your needs.

Choosing Cryptocurrencies

With funds in your account, it’s time to decide which cryptocurrencies to invest in. Conduct thorough research on different coins by considering:

- Market Capitalization: Higher market cap generally indicates stability.

- Use Case: Understand what problem the cryptocurrency aims to solve.

- Development Team: Research the team behind the project; experienced developers often lead successful projects.

- Community Support: A strong community can indicate potential longevity and growth.

It’s advisable not to put all your funds into one cryptocurrency; instead, consider diversifying across several assets to mitigate risk.

Making Your Purchase

Once you’ve decided on which cryptocurrencies to invest in, you can proceed with making your purchase. Here’s how:

1. Navigate to the trading section of your chosen exchange.

2. Select the cryptocurrency you wish to buy.

3. Choose the amount you want to purchase.

4. Review transaction details such as fees and total cost.

5. Confirm your purchase.

After completing your transaction, ensure that you keep track of your investments regularly.

Storage Options for Cryptocurrency

Storing your cryptocurrency securely is just as important as purchasing it. There are several storage options available:

- Exchange Wallets: While convenient for trading, keeping large amounts of crypto on exchanges poses risks due to potential hacks.

- Hot Wallets: These are online wallets that allow easy access but are less secure than cold storage options.

- Cold Wallets: Hardware wallets like Ledger or Trezor store your crypto offline and provide enhanced security against online threats.

Choosing the right storage solution depends on how frequently you plan to trade versus how long you intend to hold your investments.

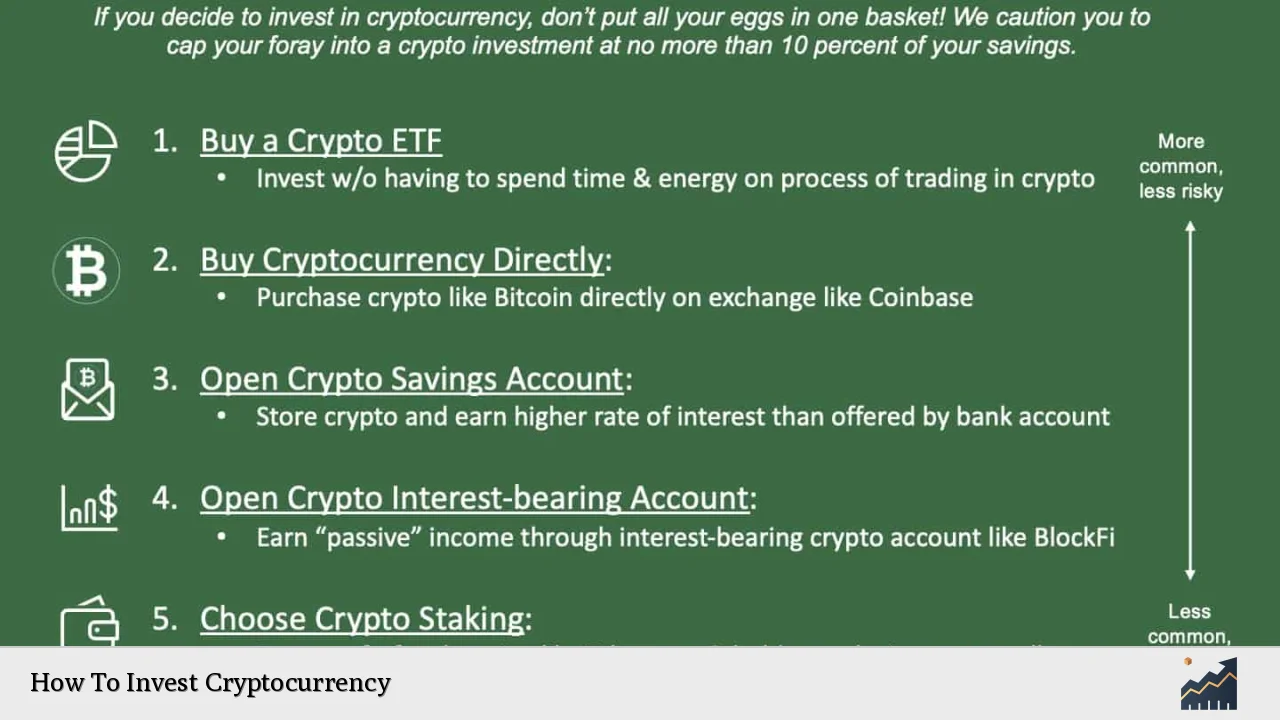

Developing an Investment Strategy

Having a clear investment strategy is crucial when investing in cryptocurrency. Here are some strategies that can help:

- Dollar-Cost Averaging (DCA): This strategy involves investing a fixed amount regularly regardless of price fluctuations, helping reduce the impact of volatility over time.

- Long-Term Holding (HODL): Many investors choose to buy cryptocurrencies and hold them for extended periods, betting on long-term price appreciation.

- Active Trading: For those willing to engage more frequently with the market, active trading strategies involve buying low and selling high based on market trends.

Regardless of the strategy chosen, it’s essential to remain disciplined and avoid emotional decision-making based on market hype or fear.

Understanding Risks Involved

Investing in cryptocurrency carries inherent risks that every investor should understand:

- Market Volatility: Prices can swing dramatically within short periods; be prepared for potential losses.

- Regulatory Changes: Governments worldwide are still developing regulations around cryptocurrencies; changes can impact prices significantly.

- Security Risks: Cybersecurity threats are prevalent; ensure proper security measures are in place for storing assets.

Being aware of these risks allows investors to make informed decisions and manage their investments more effectively.

Staying Informed

The cryptocurrency landscape evolves rapidly; staying informed about market trends and news is crucial for success. Regularly follow reputable news sources, join online communities, and participate in discussions related to cryptocurrency investments.

Understanding technological advancements and regulatory changes will help you adapt your investment strategy accordingly.

FAQs About How To Invest Cryptocurrency

- What is cryptocurrency?

Cryptocurrency is a digital currency that uses cryptography for security and operates on decentralized networks. - How do I choose a cryptocurrency exchange?

Select an exchange based on reputation, fees, available cryptocurrencies, and user experience. - What storage options are available for my crypto?

You can store crypto in exchange wallets, hot wallets (online), or cold wallets (offline hardware). - What investment strategies should I consider?

Dollar-cost averaging (DCA), long-term holding (HODL), or active trading are common strategies. - What risks should I be aware of when investing?

The main risks include market volatility, regulatory changes, and cybersecurity threats.

Investing in cryptocurrency requires careful consideration and research but offers exciting opportunities for growth. By following these steps and staying informed about market developments, you can navigate this dynamic landscape effectively while minimizing risks associated with this emerging asset class.