Investing cash money effectively is crucial for building wealth and achieving financial goals. In today’s fast-paced financial landscape, simply holding cash can lead to missed opportunities, especially with inflation eroding purchasing power. This guide will explore various investment options, strategies, and considerations for making your cash work for you.

Investing can seem daunting, but understanding your options and aligning them with your financial objectives is essential. Whether you’re looking to grow your wealth, save for retirement, or preserve capital, there are numerous avenues available.

The following table summarizes the investment options we’ll discuss:

| Investment Type | Description |

|---|---|

| Stocks | Equity investments in companies. |

| Bonds | Debt securities issued by governments or corporations. |

| Real Estate | Investments in property or real estate funds. |

| Mutual Funds | Pooled investment vehicles managed by professionals. |

| Certificates of Deposit (CDs) | Time deposits with fixed interest rates. |

| High-Yield Savings Accounts | Accounts offering higher interest rates than traditional savings accounts. |

Understanding Your Financial Goals

Before investing your cash, it’s essential to determine your financial goals. Are you looking for short-term gains, long-term growth, or a combination of both? Understanding your objectives will guide your investment choices.

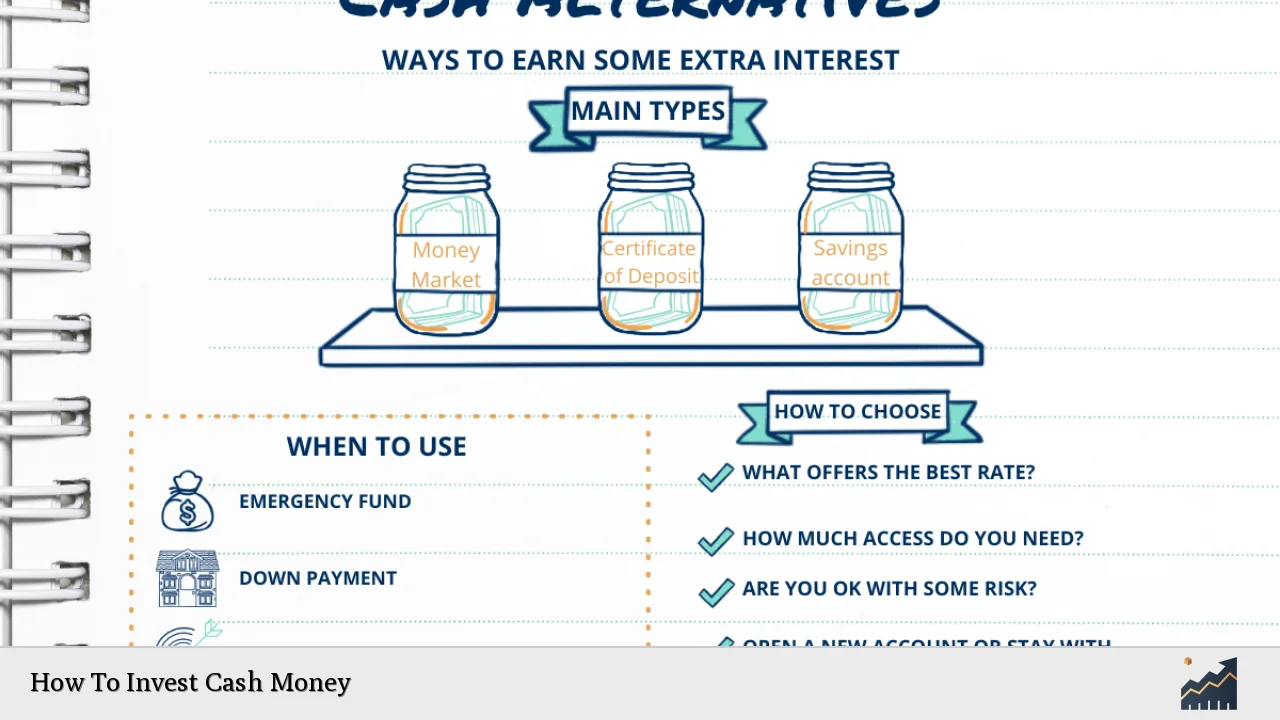

- Short-Term Goals: If you need access to your money within a few years, consider low-risk investments like high-yield savings accounts or certificates of deposit (CDs). These options provide safety and liquidity.

- Long-Term Goals: For goals that are several years away, such as retirement or buying a home, you might consider higher-risk investments like stocks or real estate. These can offer greater potential returns over time.

- Risk Tolerance: Assess how much risk you are willing to take. If you’re uncomfortable with market fluctuations, focus on safer investments. Conversely, if you’re open to risk for potentially higher returns, consider equities or real estate.

Exploring Investment Options

There are various investment options available for cash money. Each has its own characteristics, benefits, and risks. Understanding these can help you make informed decisions.

- Stocks: Investing in stocks means buying shares of companies. Stocks can offer high returns but come with significant volatility. Consider diversifying your stock investments across different sectors to mitigate risk.

- Bonds: Bonds are loans made to governments or corporations in exchange for periodic interest payments and the return of principal at maturity. They are generally considered safer than stocks but offer lower returns.

- Real Estate: Investing in real estate can provide rental income and appreciation potential. You can invest directly by purchasing properties or indirectly through real estate investment trusts (REITs).

- Mutual Funds: These funds pool money from multiple investors to purchase a diversified portfolio of stocks and bonds. They provide diversification and professional management but may charge fees that affect returns.

- Certificates of Deposit (CDs): CDs are time deposits that pay a fixed interest rate over a specified term. They are low-risk investments insured by the FDIC up to certain limits but typically offer lower returns compared to stocks.

- High-Yield Savings Accounts: These accounts offer better interest rates than traditional savings accounts while maintaining liquidity. They are suitable for emergency funds or short-term savings goals.

Diversification Strategies

Diversification is a critical strategy in investing that involves spreading your investments across various asset classes to reduce risk. By diversifying, you can protect yourself from significant losses if one investment performs poorly.

- Asset Allocation: Determine the right mix of stocks, bonds, real estate, and cash based on your goals and risk tolerance. A common approach is the 60/40 rule—60% in stocks and 40% in bonds—but this can vary widely based on individual circumstances.

- Sector Diversification: Within equities, invest in various sectors such as technology, healthcare, consumer goods, and energy. This helps mitigate risks associated with sector-specific downturns.

- Geographic Diversification: Consider investing in international markets to spread risk across different economies. Global diversification can enhance potential returns while reducing exposure to domestic economic fluctuations.

Monitoring Your Investments

Once you’ve invested your cash money, it’s crucial to monitor your investments regularly. This ensures they align with your financial goals and allows you to make adjustments as needed.

- Review Performance: Regularly check the performance of your investments against benchmarks or indices relevant to those assets. This helps identify underperforming investments that may need reevaluation.

- Rebalance Your Portfolio: Over time, some investments may grow faster than others, skewing your asset allocation. Rebalancing involves selling some assets and buying others to maintain your desired allocation.

- Stay Informed: Keep up with market trends and economic indicators that could impact your investments. This knowledge will help you make informed decisions about when to buy or sell assets.

Tax Considerations

When investing cash money, it’s essential to understand the tax implications associated with different investment types. Taxes can significantly affect overall returns.

- Capital Gains Tax: Profits from selling investments may be subject to capital gains tax. Holding investments for over a year typically qualifies for lower long-term capital gains rates compared to short-term rates applied to assets held for less than a year.

- Tax-Advantaged Accounts: Consider using tax-advantaged accounts like IRAs or 401(k)s for retirement savings. Contributions may be tax-deductible or grow tax-free until withdrawal.

- Tax Efficiency: Be mindful of the tax efficiency of different investments. For example, municipal bonds often provide tax-free interest income at the federal level and sometimes state levels.

FAQs About How To Invest Cash Money

- What is the best way to invest cash?

The best way depends on your financial goals and risk tolerance; consider stocks for growth or CDs for safety. - How much cash should I keep on hand?

A general rule is to have three to six months’ worth of living expenses saved as an emergency fund. - Is it better to pay off debt or invest?

If you have high-interest debt, paying it off typically provides better returns than most investments. - Can I invest cash in real estate?

Yes, you can invest directly by purchasing property or indirectly through REITs. - What are high-yield savings accounts?

These accounts offer higher interest rates than regular savings accounts while maintaining liquidity.

Investing cash money wisely requires careful planning and consideration of various factors including financial goals, risk tolerance, and market conditions. By exploring diverse investment options and employing effective strategies like diversification and regular monitoring, you can maximize the potential of your cash investments while minimizing risks associated with market fluctuations.