Investing in Bitcoin has become a popular way for individuals to earn money in the cryptocurrency market. Bitcoin, being the first and most recognized cryptocurrency, offers numerous opportunities for investors looking to capitalize on its price fluctuations. This guide will explore various methods to invest in Bitcoin and strategies to potentially earn daily returns.

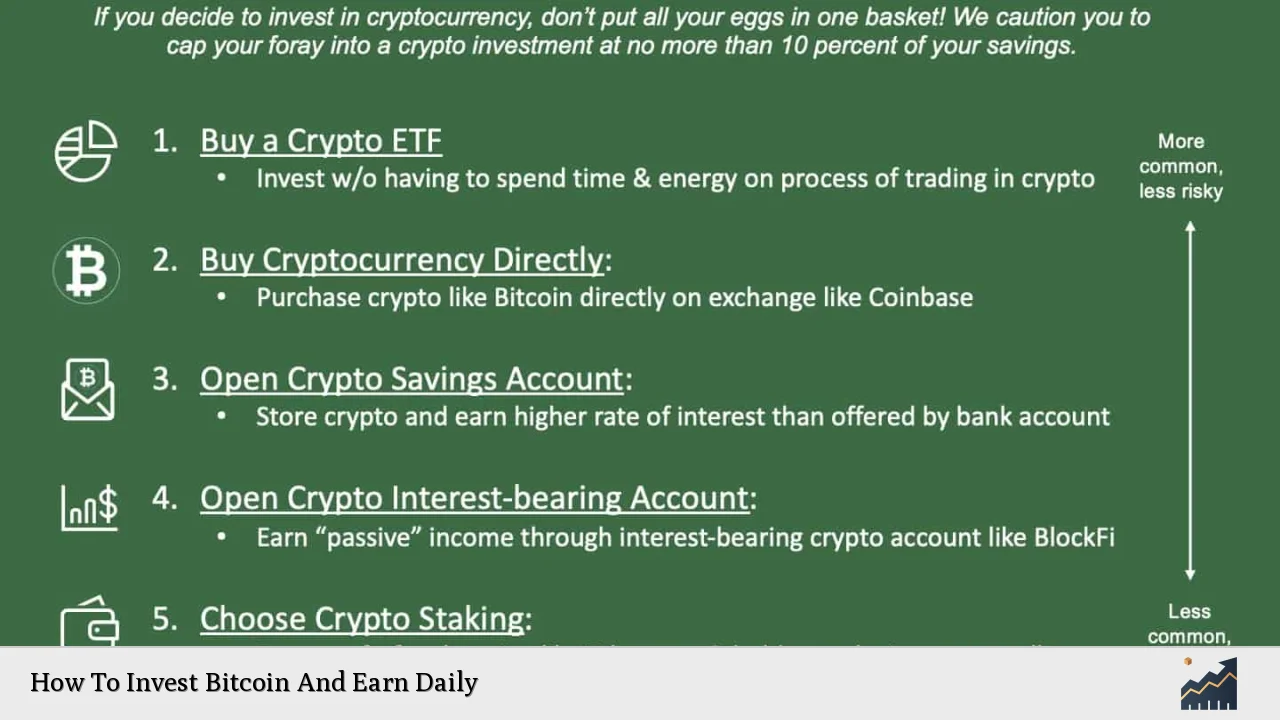

Investors can approach Bitcoin investment through several avenues, including buying and holding, trading, or using automated investment platforms. Each method has its own risk profile and potential for returns. Understanding these options is crucial for anyone looking to make informed investment decisions.

| Investment Method | Description |

|---|---|

| Buying and Holding | Long-term investment strategy where investors buy Bitcoin and hold it for an extended period. |

| Trading | Buying and selling Bitcoin frequently to take advantage of price fluctuations. |

| Automated Investment Platforms | Using platforms that automatically invest on behalf of the user based on predefined strategies. |

Understanding Bitcoin Investment Strategies

Investing in Bitcoin requires a clear understanding of different strategies. Each strategy has unique characteristics that can influence your potential earnings.

- Long-Term Holding (HODLing): This strategy involves purchasing Bitcoin and holding onto it for a long time, regardless of market volatility. Investors believe that the price will increase significantly over time, making it a low-effort way to earn returns.

- Day Trading: This method involves buying and selling Bitcoin within short time frames, often within the same day. Day traders capitalize on small price movements, but this approach requires a deep understanding of market trends and carries high risks.

- Dollar-Cost Averaging (DCA): DCA is an investment strategy where investors buy a fixed dollar amount of Bitcoin at regular intervals. This method helps mitigate the impact of volatility by averaging out the purchase price over time.

- Automated Trading Bots: These are software programs that execute trades on behalf of investors based on specific algorithms. They can help capitalize on market movements without requiring constant monitoring.

- Bitcoin ETFs: Exchange-Traded Funds (ETFs) that track the price of Bitcoin allow investors to gain exposure without directly owning the cryptocurrency. This method is particularly appealing for those who prefer traditional investment vehicles.

How To Buy Bitcoin

Before you can start investing in Bitcoin, you need to know how to buy it. Here’s a step-by-step guide:

1. Choose a Cryptocurrency Exchange: Select a reliable exchange such as Coinbase, Binance, or Kraken. Ensure it has a good reputation and robust security measures.

2. Create an Account: Sign up for an account on your chosen exchange. You may need to provide personal information for identity verification.

3. Fund Your Account: Link your bank account or credit card to deposit funds into your exchange account. Be aware of any fees associated with deposits.

4. Place an Order: Decide how much Bitcoin you want to purchase and place your order. You can choose between market orders (buying at current prices) or limit orders (setting a price at which you want to buy).

5. Store Your Bitcoin Safely: After purchasing, transfer your Bitcoin to a secure wallet. Hardware wallets are recommended for long-term storage due to their enhanced security features.

Risk Management in Bitcoin Investment

Investing in Bitcoin carries inherent risks due to its volatility. Here are some essential tips for managing these risks:

- Invest Only What You Can Afford to Lose: Never invest money that you cannot afford to lose. The cryptocurrency market can be unpredictable, leading to significant losses.

- Diversify Your Portfolio: Consider spreading your investments across different cryptocurrencies or asset classes to reduce risk exposure.

- Stay Informed: Keep up with market trends, news, and regulatory changes that may impact Bitcoin’s price.

- Use Stop-Loss Orders: These orders automatically sell your Bitcoin when it reaches a certain price, helping limit potential losses.

Earning Daily from Bitcoin Investments

While earning daily returns from Bitcoin investments is challenging due to market fluctuations, there are strategies that can help maximize your chances:

- Active Trading: Engage in day trading by analyzing market trends and making quick trades based on price movements. This requires constant monitoring and quick decision-making.

- Staking or Yield Farming: Some platforms allow you to earn interest on your Bitcoin holdings through staking or yield farming. These methods involve lending your assets or providing liquidity in exchange for rewards.

- Participate in Affiliate Programs: Many cryptocurrency exchanges offer affiliate programs where you can earn commissions by referring new users.

Common Mistakes to Avoid

When investing in Bitcoin, it’s essential to avoid common pitfalls:

- FOMO (Fear of Missing Out): Making impulsive decisions based on hype can lead to poor investment choices. Always conduct thorough research before acting.

- Neglecting Security: Failing to secure your investments can result in losses from hacks or scams. Use strong passwords and enable two-factor authentication on your accounts.

- Ignoring Market Research: Not staying informed about market conditions can lead to missed opportunities or unexpected losses.

FAQs About How To Invest Bitcoin And Earn Daily

- What is the best way to start investing in Bitcoin?

Start by choosing a reliable cryptocurrency exchange and creating an account. - Can I earn daily from my Bitcoin investments?

Yes, through active trading or participating in staking programs. - What are the risks associated with investing in Bitcoin?

The primary risks include high volatility and potential loss of capital. - How much should I invest in Bitcoin?

Invest only what you can afford to lose; many suggest no more than 10% of your total portfolio. - Is it better to hold or trade Bitcoin?

This depends on your risk tolerance; long-term holding is generally less risky than frequent trading.

Conclusion

Investing in Bitcoin offers various opportunities for earning returns, but it requires careful planning and strategy. By understanding different investment methods, managing risks effectively, and avoiding common mistakes, you can navigate the world of cryptocurrency more successfully. Whether you choose long-term holding or active trading, always stay informed and make decisions based on thorough research.