Investing can be an intimidating endeavor for beginners, often filled with uncertainty and complexity. However, understanding the basics of investing is essential for building wealth over time. This guide will provide you with a clear pathway to start investing, focusing on practical steps, strategies, and the types of investments available.

Investing is essentially the act of allocating resources, usually money, in order to generate income or profit. It encompasses a variety of asset classes such as stocks, bonds, real estate, and mutual funds. Each investment type carries its own level of risk and potential return. For beginners, the key is to start with a solid foundation of knowledge and gradually build an investment portfolio that aligns with your financial goals.

To help you navigate this journey, here’s a concise overview of what you need to know before diving into the world of investing.

| Key Concepts | Details |

|---|---|

| Investment Goals | Define what you want to achieve with your investments. |

| Risk Tolerance | Understand how much risk you are willing to take. |

| Types of Investments | Familiarize yourself with stocks, bonds, mutual funds, etc. |

| Investment Accounts | Select the right account type for your needs. |

Understanding Investment Goals

Setting clear investment goals is crucial for guiding your investment decisions. These goals can be short-term or long-term and should reflect your financial aspirations. Short-term goals might include saving for a vacation or a new car, while long-term goals could involve retirement savings or funding a child’s education.

When defining your goals, consider the following:

- What amount do you need to achieve these goals?

- What is your timeline for achieving them?

- How much risk are you willing to take to reach these goals?

Having specific and measurable objectives will help you stay focused and motivated throughout your investment journey.

Assessing Your Risk Tolerance

Understanding your risk tolerance is essential before making any investment decisions. Risk tolerance refers to your ability and willingness to endure fluctuations in the value of your investments. Factors influencing risk tolerance include age, financial situation, investment knowledge, and personal comfort with uncertainty.

To assess your risk tolerance:

- Consider how you would react if your investments lost value.

- Determine how much time you have before needing access to your invested funds.

- Evaluate your overall financial stability; can you afford to take risks?

By accurately gauging your risk tolerance, you can build a portfolio that aligns with both your comfort level and financial objectives.

Choosing the Right Investment Account

Selecting an appropriate investment account is a foundational step in starting your investment journey. Different types of accounts serve various purposes and come with unique tax implications. Here are some common types:

- Brokerage Accounts: These accounts allow you to buy and sell various securities like stocks and bonds without tax advantages.

- Retirement Accounts: Accounts such as IRAs or 401(k)s offer tax benefits but come with restrictions on withdrawals until retirement age.

- Robo-Advisors: These platforms automatically manage a diversified portfolio based on your risk profile and goals.

Choosing the right account depends on your investment strategy and whether you’re looking for short-term gains or long-term growth.

Types of Investments for Beginners

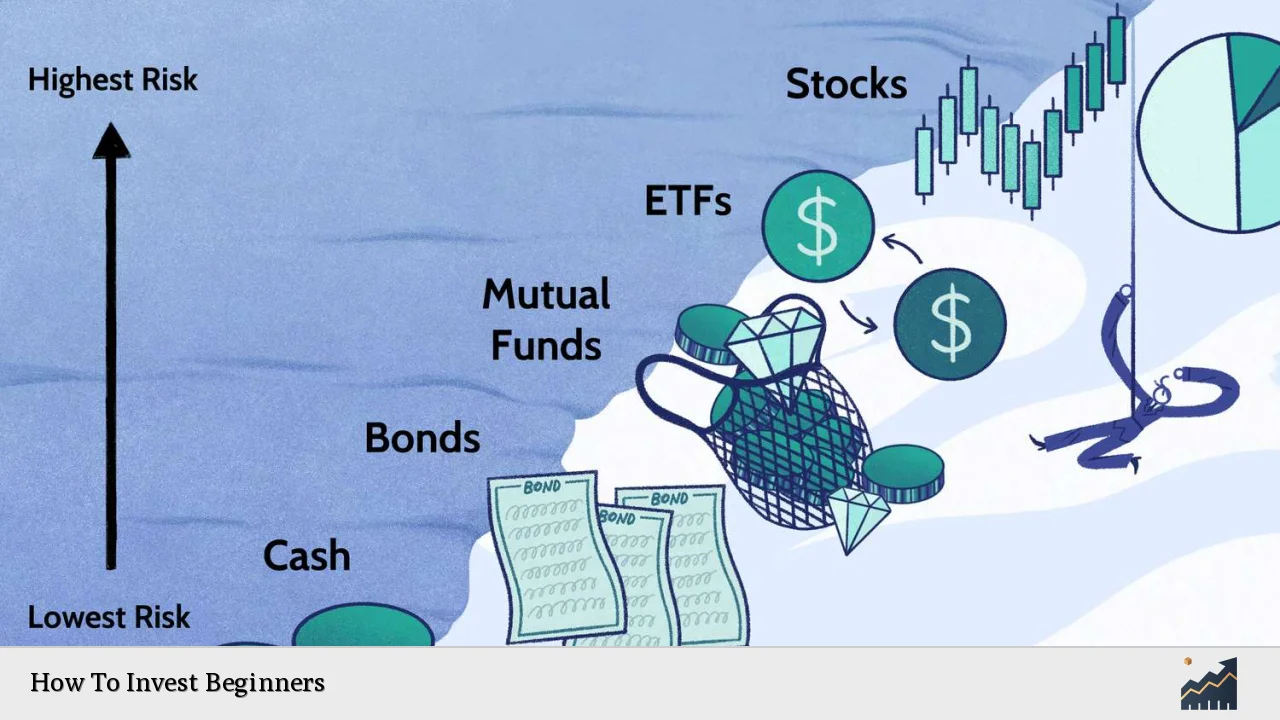

As a beginner investor, it’s vital to familiarize yourself with different types of investments available in the market. Each type has its own characteristics regarding risk and return potential:

- Stocks: Represent ownership in companies; they can offer high returns but also come with higher risks.

- Bonds: Debt securities issued by corporations or governments; generally considered lower-risk compared to stocks.

- Mutual Funds: Pooled investments managed by professionals; they provide diversification but may have fees associated with management.

- Exchange-Traded Funds (ETFs): Similar to mutual funds but traded like stocks; they typically have lower fees and provide instant diversification.

Understanding these options will help you make informed decisions about where to allocate your funds based on your risk tolerance and investment goals.

Investment Strategies for Beginners

Implementing effective investment strategies can significantly influence your success as an investor. Here are some popular strategies suitable for beginners:

- Buy-and-Hold Strategy: This involves purchasing stocks or funds and holding them over the long term regardless of market fluctuations. This strategy capitalizes on compounding returns over time.

- Dollar-Cost Averaging: This strategy involves investing a fixed amount regularly regardless of market conditions. It helps mitigate the impact of volatility by averaging out purchase prices over time.

- Index Fund Investing: Investing in index funds allows you to gain exposure to a broad market index like the S&P 500 without needing to pick individual stocks. This approach is often recommended for beginners due to its simplicity and lower costs.

By adopting one or more of these strategies, beginners can create a balanced approach that aligns with their investment philosophy while minimizing risks.

The Importance of Diversification

Diversification is a critical concept in investing that involves spreading investments across various asset classes to reduce risk. By diversifying your portfolio, you can mitigate losses from underperforming assets while benefiting from those that perform well.

Consider diversifying across:

- Different asset classes (stocks vs. bonds)

- Various sectors (technology vs. healthcare)

- Geographic regions (domestic vs. international markets)

A well-diversified portfolio can help stabilize returns over time and protect against significant losses during market downturns.

Monitoring Your Investments

Once you’ve made initial investments, it’s important to regularly monitor their performance. This doesn’t mean checking daily stock prices but rather reviewing your portfolio periodically—perhaps quarterly or semi-annually—to assess whether it aligns with your goals.

During these reviews:

- Adjust asset allocations if necessary based on performance.

- Reassess your financial goals and risk tolerance as life circumstances change.

- Stay informed about market trends that could impact your investments.

Regular monitoring ensures that you’re on track toward achieving your financial objectives while allowing for timely adjustments when needed.

FAQs About How To Invest Beginners

- What is the best way for beginners to start investing?

The best way is to set clear investment goals, understand risk tolerance, choose appropriate accounts, and start with diversified investments like index funds. - How much money do I need to start investing?

You can start investing with very little money thanks to platforms that allow fractional shares; some require no minimum investment. - What are index funds?

Index funds are mutual funds or ETFs designed to track specific market indexes, providing broad market exposure at lower costs. - Is it better to invest in stocks or bonds?

This depends on individual risk tolerance; stocks generally offer higher returns but come with more volatility compared to bonds. - How often should I review my investments?

You should review your investments at least quarterly or semi-annually to ensure they align with your financial goals.

By following these guidelines and understanding fundamental concepts about investing, beginners can confidently embark on their investment journey. Remember that patience is key—investing is often a long-term endeavor that rewards those who remain committed and informed over time.