Investing is a powerful way to grow your wealth over time. By putting your money to work in various financial instruments, you can potentially earn returns that outpace inflation and build a secure financial future. Whether you are a beginner or have some experience, understanding the fundamentals of investing is crucial for making informed decisions. This guide will provide you with essential strategies, tips, and insights to help you invest wisely and make money.

| Investment Type | Description |

|---|---|

| Stocks | Ownership shares in companies that can appreciate in value and pay dividends. |

| Bonds | Loans to governments or corporations that pay interest over time. |

| Real Estate | Property investments that can generate rental income and appreciate in value. |

| Mutual Funds | Pooled investments managed by professionals that offer diversification. |

Understanding Investment Basics

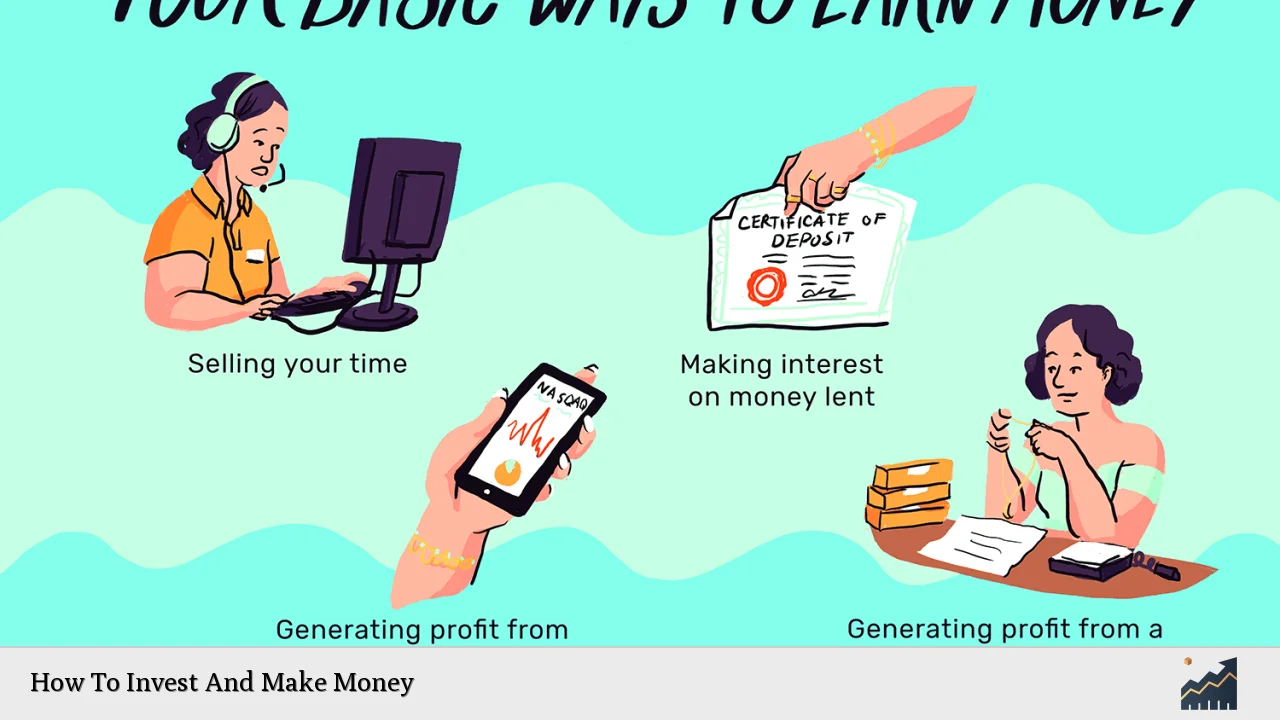

Before diving into specific investment strategies, it’s essential to grasp the basic concepts of investing. Investing involves allocating resources, usually money, with the expectation of generating an income or profit. The primary goal is to increase your wealth over time through various investment vehicles.

Risk and Return are two fundamental concepts in investing. Generally, higher potential returns come with higher risks. Understanding your risk tolerance—how much risk you are willing to take—is crucial in determining the types of investments that are right for you.

Another important principle is diversification, which involves spreading your investments across different asset classes to reduce risk. By diversifying, you minimize the impact of any single investment’s poor performance on your overall portfolio.

Types of Investments

There are several types of investments available, each with its own characteristics, risks, and potential returns. Here are some common investment options:

- Stocks: Buying shares in a company allows you to participate in its growth and profits. Stocks can be volatile but have historically provided high returns over the long term.

- Bonds: Bonds are fixed-income securities where you lend money to an issuer (government or corporation) in exchange for periodic interest payments plus the return of the bond’s face value when it matures.

- Real Estate: Investing in property can provide rental income and appreciation potential. Real estate investments can also serve as a hedge against inflation.

- Mutual Funds: These are professionally managed investment funds that pool money from many investors to purchase a diversified portfolio of stocks, bonds, or other securities.

- Exchange-Traded Funds (ETFs): Similar to mutual funds but traded on stock exchanges like individual stocks, ETFs offer diversification and lower fees.

Developing an Investment Strategy

Creating a solid investment strategy is vital for achieving your financial goals. Here are key steps to consider:

- Set Clear Goals: Define what you want to achieve through investing—whether it’s saving for retirement, buying a home, or funding education.

- Assess Your Risk Tolerance: Understand how much risk you can handle without losing sleep at night. This will guide your investment choices.

- Choose an Investment Account: Decide whether to use a brokerage account, retirement account (like a 401(k) or IRA), or other investment platforms based on your goals and tax considerations.

- Create a Diversified Portfolio: Allocate your investments across different asset classes and sectors to minimize risk while aiming for growth.

- Stay Informed: Keep up with market trends, economic indicators, and news that may impact your investments.

Popular Investment Strategies

Several strategies can help maximize your returns while managing risk:

- Buy and Hold: This long-term strategy involves purchasing stocks or other assets and holding them for years, allowing them to appreciate over time without frequent trading.

- Dollar-Cost Averaging: This method involves regularly investing a fixed amount of money regardless of market conditions. It helps reduce the impact of volatility by averaging out purchase prices.

- Value Investing: Focus on undervalued stocks that have strong fundamentals but are trading below their intrinsic value. This strategy requires thorough research and patience.

- Growth Investing: Invest in companies expected to grow at an above-average rate compared to their industry or the overall market. These companies often reinvest earnings rather than paying dividends.

- Income Investing: Focus on assets that provide regular income through dividends or interest payments, such as dividend-paying stocks or bonds.

Monitoring Your Investments

Once you’ve made your investments, regular monitoring is essential:

- Review Performance Regularly: Check how your investments are performing relative to your goals. Adjust your strategy if necessary based on performance and changing market conditions.

- Rebalance Your Portfolio: Periodically reassess your asset allocation to ensure it aligns with your risk tolerance and investment goals. Rebalancing involves selling some assets and buying others to maintain your desired allocation.

- Stay Disciplined: Avoid making impulsive decisions based on short-term market fluctuations. Stick to your long-term strategy unless significant changes occur in your financial situation or goals.

Common Mistakes to Avoid

Investing can be rewarding but also comes with pitfalls. Here are common mistakes to avoid:

- Chasing Trends: Avoid investing based solely on short-term trends or hype without proper research.

- Timing the Market: Trying to predict market movements can lead to missed opportunities; instead, focus on long-term growth.

- Neglecting Fees: Be aware of fees associated with different investment accounts and funds; high fees can erode returns over time.

- Ignoring Financial Goals: Always keep your financial objectives in mind when making investment decisions; this will help maintain focus amid market volatility.

FAQs About How To Invest And Make Money

- What is the best way to start investing?

Begin by setting clear financial goals and choosing an investment account that suits those goals. - How much money do I need to start investing?

You can start investing with any amount; many platforms allow small investments with no minimums. - Is it better to invest in stocks or bonds?

It depends on your risk tolerance; stocks generally offer higher returns but come with more volatility than bonds. - How often should I review my investments?

Regularly review your investments at least once a year or whenever significant life changes occur. - Can I lose money when investing?

Yes, all investments carry risks, including the potential loss of principal; it’s essential to understand these risks before investing.

Investing wisely requires knowledge, patience, and discipline. By understanding the basics of investing, developing a solid strategy, avoiding common mistakes, and staying informed about market trends, you can effectively grow your wealth over time. Remember that investing is not just about making money; it’s about building a secure financial future for yourself and achieving your long-term goals.