Investing after retirement is a crucial aspect of ensuring financial security during your golden years. As retirees transition from accumulating wealth to managing their savings, their investment strategies must adapt to meet new financial needs. The primary goal shifts from growth to generating income while minimizing risks associated with market fluctuations and longevity. This article provides a comprehensive guide on how to invest effectively after retirement, focusing on various strategies, investment options, and essential considerations.

| Investment Focus | Description |

|---|---|

| Income Generation | Prioritize investments that provide regular income streams. |

| Risk Management | Minimize exposure to high-risk investments to protect savings. |

Understanding Your Financial Needs

Before diving into specific investment options, it’s vital to assess your financial situation and understand your needs. Retirement often lasts several decades, making it essential to plan for both expected and unexpected expenses.

Important info: Consider factors such as your monthly expenses, healthcare costs, lifestyle choices, and any potential emergencies. A well-structured budget will help you determine how much income you need from your investments.

Additionally, understanding your risk tolerance is crucial. As a retiree, you may have a lower risk appetite than younger investors. This means prioritizing safer investments that provide stability over high returns.

Liquidity is another important consideration. Ensure that your investment portfolio allows you access to cash when needed, especially for emergencies or unexpected expenses.

Investment Strategies for Retirees

Retirees should adopt a balanced investment strategy that combines income generation with moderate growth potential. Here are some effective strategies:

- Diversification: Spread your investments across various asset classes to mitigate risks. This can include stocks, bonds, real estate, and cash equivalents.

- Income-Generating Investments: Focus on assets that provide regular income, such as dividend-paying stocks, bonds, and real estate investment trusts (REITs). These can help cover living expenses without depleting your principal.

- Low-Risk Investments: Consider safer options like certificates of deposit (CDs), treasury bonds, and fixed-income securities. These investments typically offer lower returns but come with reduced risk.

- Systematic Withdrawal Plans: Implement a systematic withdrawal strategy from your investment accounts. This involves regularly withdrawing a set percentage or amount to ensure you don’t outlive your savings.

- Annuities: Explore annuity products that provide guaranteed income for life or a specified period. While they may have higher fees, they offer peace of mind regarding future income.

Investment Options for Retirees

Several investment options cater specifically to retirees looking for stability and income generation:

Dividend-Paying Stocks

Investing in dividend-paying stocks can provide a reliable income stream while allowing for potential capital appreciation. Look for companies with a consistent history of paying dividends and strong fundamentals.

Bonds

Bonds are typically less volatile than stocks and can provide steady interest payments. Consider government bonds or high-quality corporate bonds as part of your fixed-income allocation.

Mutual Funds

Mutual funds offer diversification and professional management. Opt for funds that focus on income generation or balanced funds that combine stocks and bonds.

Real Estate Investment Trusts (REITs)

REITs allow you to invest in real estate without the need to manage properties directly. They often pay attractive dividends and can be a good hedge against inflation.

Fixed Deposits

Fixed deposits (FDs) are low-risk investments offered by banks that provide guaranteed returns over a specified term. They are suitable for conservative investors seeking stable income.

Annuities

Annuities can be structured to provide fixed payments over time, making them an appealing option for retirees who want predictable income.

Managing Risks in Retirement Investing

Retirement investing comes with unique risks that need careful management:

- Market Risk: The risk of losing money due to market fluctuations is significant for retirees who rely on their portfolios for income. To mitigate this risk, consider allocating a larger portion of your portfolio to low-risk investments.

- Longevity Risk: The possibility of outliving your savings is a major concern for retirees. To counter this, ensure you have a diversified portfolio that balances growth and income-generating assets.

- Inflation Risk: Inflation can erode purchasing power over time. Investing in assets that historically outpace inflation, such as stocks or real estate, can help preserve your purchasing power.

Adjusting Your Portfolio Over Time

As you progress through retirement, it’s essential to periodically review and adjust your investment portfolio:

- Rebalance Regularly: Market fluctuations can alter the original asset allocation of your portfolio. Rebalancing ensures you maintain your desired risk level by adjusting the proportions of different asset classes.

- Adapt to Changing Needs: Your financial needs may change as you age or if unexpected expenses arise. Be flexible in adjusting your withdrawal strategy or reallocating assets as necessary.

- Consult Professionals: Working with a financial advisor can help tailor your investment strategy to fit your unique situation and goals.

Tax Considerations for Retirees

Tax implications play a significant role in retirement investing:

- Tax Efficiency: Choose investments with favorable tax treatment to maximize net returns. For example, municipal bonds often offer tax-free interest at the federal level.

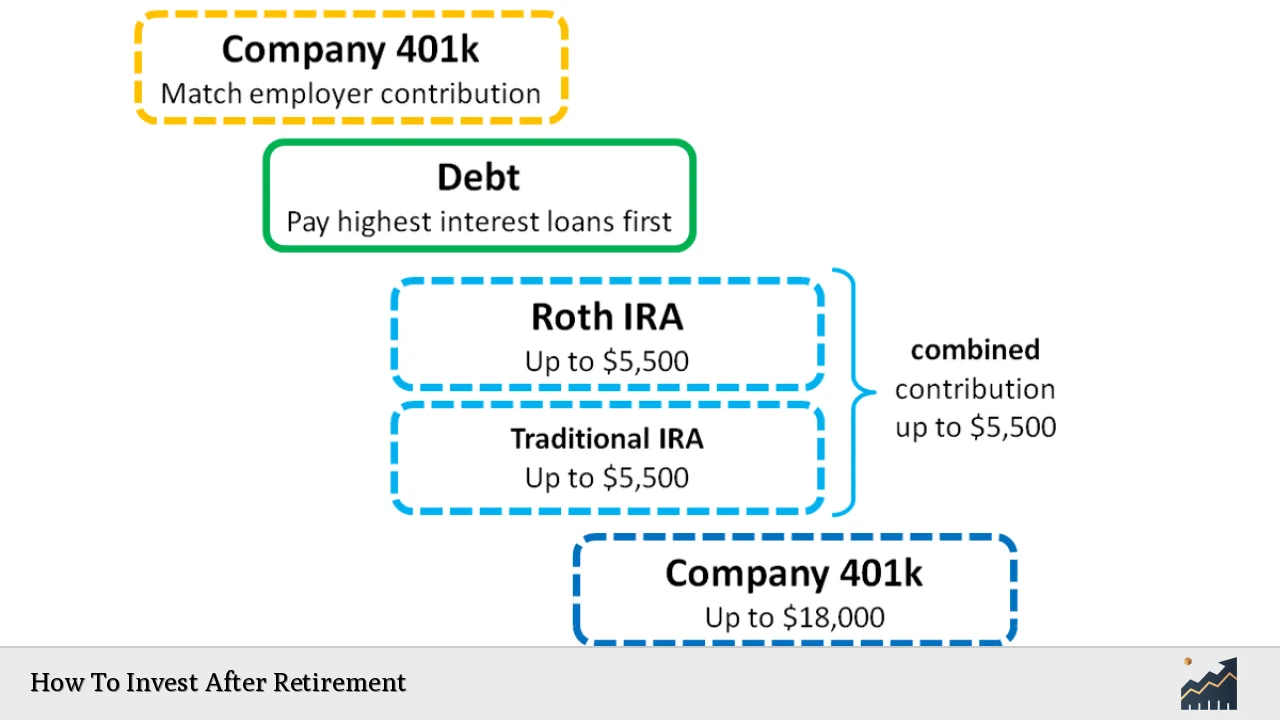

- Withdrawal Strategies: Be mindful of the tax implications when withdrawing funds from retirement accounts such as IRAs or 401(k)s. Strategically planning withdrawals can minimize tax burdens.

- Healthcare Costs: Consider setting aside funds in health savings accounts (HSAs) or similar vehicles to cover potential medical expenses in retirement while benefiting from tax advantages.

FAQs About How To Invest After Retirement

- What are the best investments for retirees?

Dividend-paying stocks, bonds, mutual funds, and real estate investment trusts (REITs) are popular choices. - How much risk should I take when investing after retirement?

Most retirees should adopt a conservative approach with lower-risk investments. - Is it necessary to continue investing after retirement?

Yes, continuing to invest helps protect against inflation and ensures long-term financial security. - What is the safest investment option for retirees?

Certificates of deposit (CDs) and government bonds are considered safe investment options. - How often should I review my retirement portfolio?

You should review your portfolio at least annually or whenever significant life changes occur.

Investing after retirement requires careful planning and consideration of various factors such as risk tolerance, liquidity needs, and financial goals. By adopting a balanced strategy focused on income generation while managing risks effectively, retirees can enjoy financial security throughout their retirement years.