Investing $15,000 in real estate can be a strategic entry point into a lucrative market. While this amount may not be sufficient to purchase a property outright, it opens various avenues for investment. Understanding the current market landscape, available strategies, and potential risks is essential for maximizing returns. This guide provides a comprehensive overview of how to effectively invest $15,000 in real estate, incorporating market analysis, implementation strategies, risk considerations, regulatory aspects, and future outlooks.

| Key Concept | Description/Impact |

|---|---|

| Real Estate Crowdfunding | A platform allowing investors to pool funds for real estate projects, enabling access to larger investments with lower capital. |

| Rental Properties | Investing in single-family homes or multi-family units to generate rental income and benefit from property appreciation. |

| REITs (Real Estate Investment Trusts) | Companies that own or finance income-producing real estate across a range of property sectors, providing dividends and capital appreciation. |

| House Hacking | Purchasing a multi-unit property, living in one unit while renting out the others to cover mortgage costs. |

| Flipping Properties | Buying undervalued properties, renovating them, and selling at a profit; requires knowledge of market trends and renovation costs. |

| Partnerships | Joining forces with other investors to pool resources for larger investments that would be unattainable individually. |

Market Analysis and Trends

The real estate market is currently experiencing significant changes influenced by economic factors such as interest rates, inflation, and housing supply. As of late 2024:

- Home Prices: The median sale price for existing homes in the U.S. reached $404,500 in September 2024, marking a historical high. This reflects ongoing demand amidst low inventory levels.

- Interest Rates: The average 30-year mortgage rate was approximately 6.88% as of October 2024. Although this is lower than previous peaks, it remains high compared to historical averages, affecting buyer affordability and market activity.

- Market Dynamics: The U.S. real estate market is characterized by tight inventory (a 4.3-month supply) and strong seller leverage. Existing homeowners are hesitant to sell due to locked-in lower mortgage rates.

- Growth Projections: The global real estate market is projected to grow from $4 trillion in 2023 to $4.3 trillion in 2024, driven by urbanization and increased demand for affordable housing.

These trends indicate that while opportunities exist for investment with $15,000, investors must navigate a complex landscape influenced by economic conditions.

Implementation Strategies

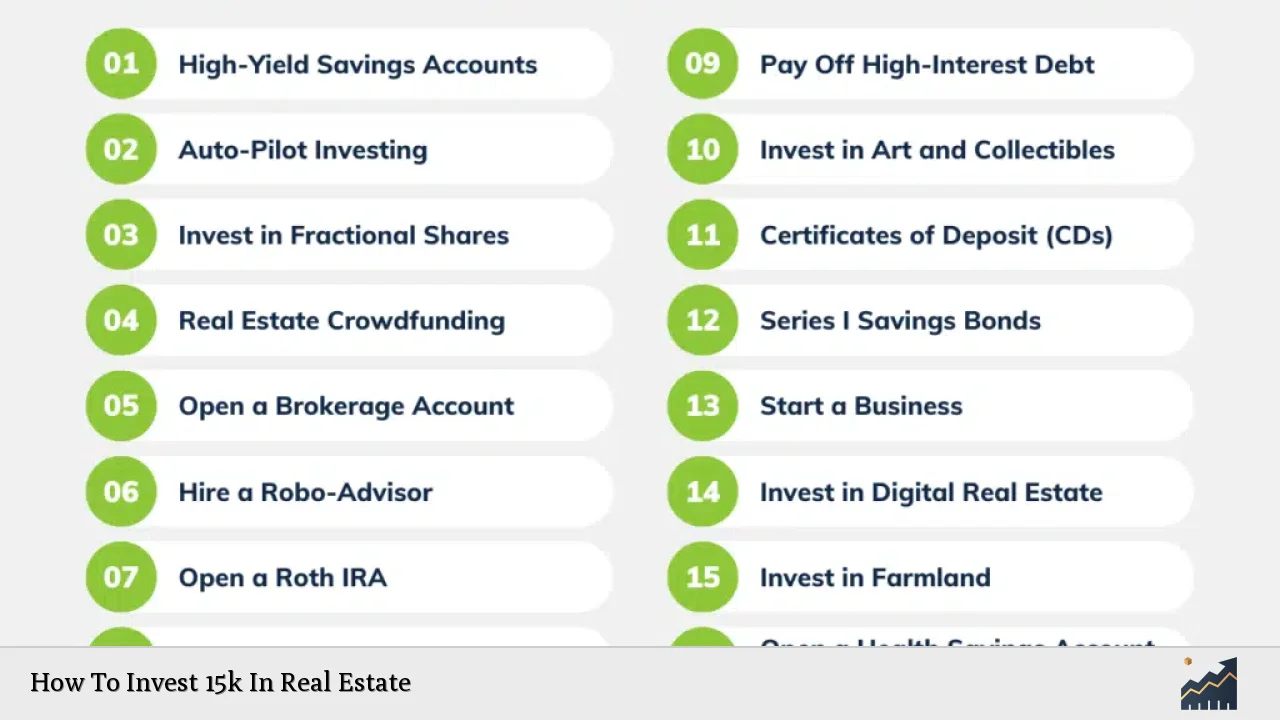

Investing $15,000 in real estate can be approached through various strategies:

- Real Estate Crowdfunding: Platforms like Fundrise allow individuals to invest in real estate projects without needing significant capital. Investors can start with as little as $10 and gain exposure to diversified portfolios of properties.

- Rental Properties: With careful selection and financing strategies (e.g., leveraging loans), investors can acquire rental properties. A down payment of $15,000 could cover the required percentage for properties priced around $75,000-$100,000.

- REITs: Investing in publicly traded REITs allows individuals to gain exposure to real estate markets without direct ownership responsibilities. This method provides liquidity and regular dividend income.

- House Hacking: Purchasing a duplex or triplex allows investors to live in one unit while renting out others. This can significantly reduce living expenses and generate income simultaneously.

- Flipping Properties: For those with renovation experience or connections with contractors, buying undervalued properties for quick resale can yield high returns. However, this strategy requires thorough market analysis and risk management due to potential cost overruns.

- Partnerships: Collaborating with other investors can amplify purchasing power and diversify investment portfolios. This approach can mitigate individual risk while allowing access to larger properties or developments.

Risk Considerations

Investing in real estate carries inherent risks that must be carefully assessed:

- Market Volatility: Real estate markets can fluctuate based on economic conditions. Investors should be prepared for potential downturns that could affect property values and rental income.

- Property Management Challenges: Owning rental properties requires effective management skills or hiring property managers. Poor management can lead to increased vacancies and reduced rental income.

- Financing Risks: Leveraging borrowed funds increases potential returns but also amplifies risks if property values decline or rental income fails to cover mortgage payments.

- Regulatory Changes: Changes in local laws regarding rental properties (e.g., rent control) can impact profitability. Investors should stay informed about regulatory environments affecting their investments.

Regulatory Aspects

Understanding the regulatory landscape is crucial for real estate investors:

- Zoning Laws: Local zoning regulations dictate how properties can be used (e.g., residential vs. commercial). Investors must ensure compliance when purchasing properties.

- Landlord-Tenant Laws: Familiarity with local landlord-tenant laws is essential for managing rental properties effectively and avoiding legal disputes.

- Tax Implications: Real estate investments come with various tax considerations including property taxes, capital gains taxes on sales, and potential deductions (e.g., depreciation). Consulting with a tax professional is advisable.

Future Outlook

The outlook for real estate investing remains promising despite current challenges:

- Continued Demand: Urbanization trends indicate sustained demand for housing across various sectors including multifamily units and affordable housing options.

- Technological Integration: Innovations such as blockchain technology are expected to enhance transaction efficiencies and transparency in property dealings.

- Potential Recovery: As interest rates stabilize or decrease over time, more buyers may enter the market, potentially increasing demand for properties and driving up prices again.

Investors should remain adaptable and informed about evolving market conditions while considering long-term strategies that align with their financial goals.

Frequently Asked Questions About How To Invest 15k In Real Estate

- What are the best ways to invest $15k in real estate?

Consider options like crowdfunding platforms, REITs, rental properties through partnerships or house hacking strategies. - Can I buy a rental property with $15k?

Yes, you can use this amount as a down payment on lower-priced properties or leverage it through financing options. - What are the risks associated with investing in real estate?

Risks include market volatility, management challenges, financing risks, and regulatory changes that may impact profitability. - How does real estate crowdfunding work?

Crowdfunding allows multiple investors to pool resources to fund real estate projects via online platforms; returns are generated through rental income or property appreciation. - What should I consider before investing in rental properties?

Evaluate location demand, potential cash flow from rentals versus expenses (mortgage payments, maintenance), and your capacity for property management. - Are REITs a good investment option?

Yes, they provide liquidity and regular dividends without the need for direct property management; however, like all investments they carry risks. - How important is market research before investing?

Conducting thorough market research is critical to understanding local trends that impact property values and rental demand. - Should I consult professionals before investing?

Yes, seeking advice from financial advisors or real estate professionals can help tailor your investment strategy according to your financial goals.

This comprehensive guide provides an overview of how to invest $15k in real estate effectively while navigating the associated risks and opportunities within the current market landscape.