Investing $10,000 can be a significant step towards building wealth and achieving your financial goals. Whether you’re a beginner or an experienced investor, making smart decisions with this sum can set you on the path to long-term financial success. This guide will explore various strategies and options for investing $10,000, helping you make informed choices based on your financial situation and goals.

When considering how to invest $10,000, it’s crucial to assess your financial situation, risk tolerance, and investment timeline. Your investment strategy should align with your personal goals, whether they’re short-term objectives like saving for a down payment on a house or long-term aspirations like retirement planning.

Before diving into specific investment options, let’s look at a comparison of popular investment vehicles:

| Investment Type | Potential Return |

|---|---|

| Index Funds | 7-10% annually (historical average) |

| High-Yield Savings Account | 3-5% APY (as of 2024) |

| Real Estate Investment Trusts (REITs) | 8-12% annually (historical average) |

| Individual Stocks | Varies widely (potentially higher risk/reward) |

Diversify Your Portfolio

One of the most important principles in investing is diversification. By spreading your $10,000 across different asset classes, you can minimize risk and potentially increase returns. A well-diversified portfolio might include a mix of stocks, bonds, real estate, and cash equivalents.

For beginners, a simple way to achieve diversification is through index funds or exchange-traded funds (ETFs). These investment vehicles allow you to own a slice of hundreds or thousands of companies with a single purchase. Popular options include funds that track the S&P 500 or total stock market indexes.

Consider allocating your $10,000 investment as follows:

- 60% in a broad stock market index fund

- 30% in a bond index fund

- 10% in a real estate investment trust (REIT) fund

This allocation provides exposure to various sectors of the economy while balancing risk and potential returns.

Maximize Retirement Accounts

If you haven’t already, consider using part of your $10,000 to maximize contributions to tax-advantaged retirement accounts. These include:

- 401(k): If your employer offers a match, contribute at least enough to get the full match. This is essentially free money and an immediate return on your investment.

- Individual Retirement Account (IRA): Whether traditional or Roth, IRAs offer tax benefits that can significantly boost your long-term returns.

By prioritizing these accounts, you’re not only investing for the future but also potentially reducing your current tax burden.

Consider High-Yield Savings Accounts

While not traditionally considered an “investment,” high-yield savings accounts can be an excellent option for a portion of your $10,000, especially if you might need access to the funds in the near future. As of 2024, some online banks offer annual percentage yields (APYs) of 4% or higher, which is significantly better than traditional savings accounts.

This option is particularly suitable for:

- Emergency funds

- Short-term savings goals (1-3 years)

- A portion of your investment that you want to keep liquid and low-risk

Explore Real Estate Investments

Real estate can be an excellent way to diversify your portfolio beyond stocks and bonds. With $10,000, direct property investment might be challenging, but there are other options:

- Real Estate Investment Trusts (REITs): These allow you to invest in real estate without the need to buy or manage properties directly. REITs often offer higher dividend yields compared to stocks.

- Real Estate Crowdfunding Platforms: These platforms allow you to invest in real estate projects with smaller amounts of money, potentially offering higher returns but also carrying more risk.

Allocating a portion of your $10,000 to real estate investments can provide both income through dividends and potential for capital appreciation.

Invest in Individual Stocks

For those comfortable with higher risk and willing to do thorough research, investing in individual stocks can potentially offer higher returns. However, this strategy requires more time, knowledge, and risk tolerance.

If you choose this route:

- Diversify across different sectors and companies

- Focus on companies with strong fundamentals and growth potential

- Consider using a dollar-cost averaging strategy to reduce the impact of market volatility

Remember, investing in individual stocks carries more risk than diversified funds, so only allocate a portion of your $10,000 to this strategy if you’re comfortable with the potential for losses.

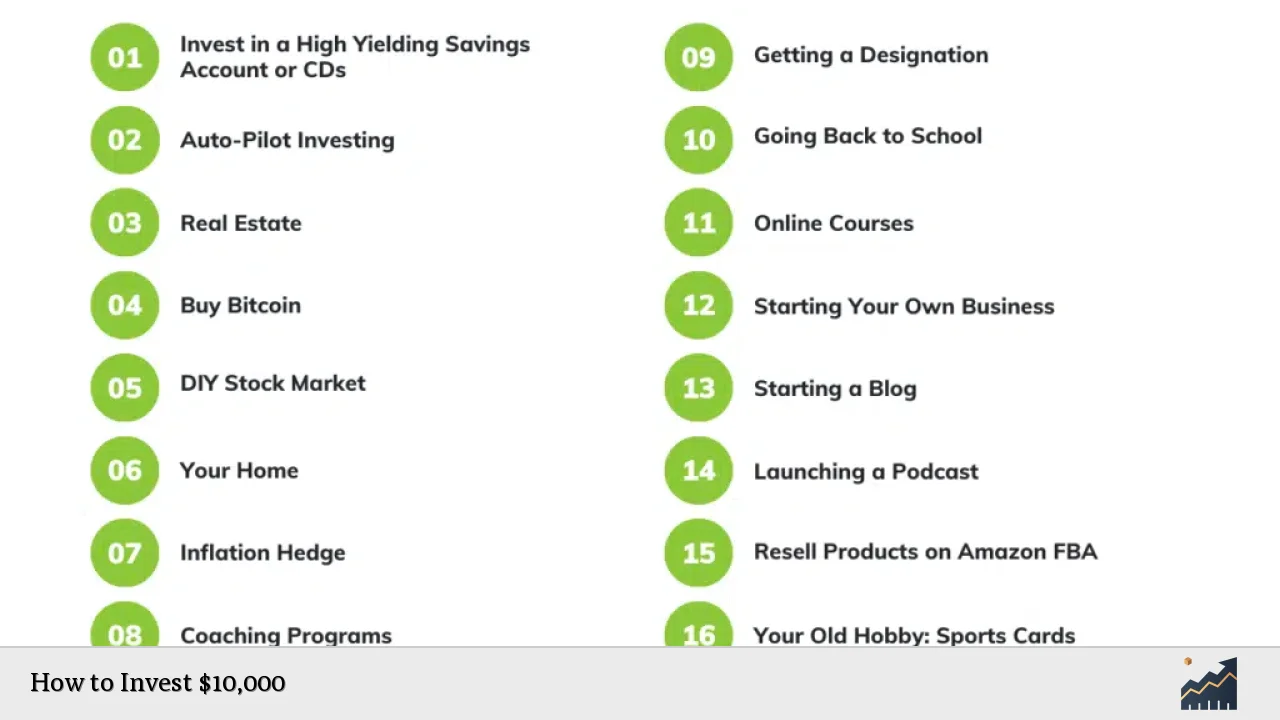

Invest in Yourself

While not a traditional investment, using some of your $10,000 to invest in yourself can yield significant returns. Consider:

- Professional development courses or certifications that could increase your earning potential

- Starting a side business or freelance work to create additional income streams

- Personal finance education to improve your overall financial literacy and decision-making

These investments in yourself can pay dividends throughout your career and financial life.

Implement Dollar-Cost Averaging

Rather than investing all $10,000 at once, consider using a dollar-cost averaging strategy. This involves investing a fixed amount regularly over time, regardless of market conditions. For example, you might invest $2,000 every month for five months.

Benefits of dollar-cost averaging include:

- Reducing the impact of market volatility

- Avoiding the stress of trying to “time the market”

- Building a disciplined investing habit

This strategy can be particularly beneficial for new investors or those hesitant about market fluctuations.

Seek Professional Advice

If you’re unsure about how to proceed or want personalized guidance, consider consulting a financial advisor. While there may be costs associated with professional advice, the insights and strategies provided can be invaluable, especially when dealing with a significant sum like $10,000.

A financial advisor can help you:

- Assess your risk tolerance and financial goals

- Create a personalized investment strategy

- Navigate complex financial products and tax implications

Remember, the best investment strategy for your $10,000 will depend on your individual circumstances, goals, and risk tolerance. It’s essential to do your research, consider multiple options, and make informed decisions aligned with your long-term financial objectives.

FAQs About Investing $10,000

- Is $10,000 enough to start investing?

Yes, $10,000 is a substantial amount to begin a diversified investment portfolio. - Should I pay off debt before investing $10,000?

It’s generally advisable to pay off high-interest debt before investing, but low-interest debt can be balanced with investing. - How can I minimize risk when investing $10,000?

Diversify your investments across different asset classes and consider low-risk options like index funds. - Can I invest $10,000 in real estate?

Yes, through REITs or real estate crowdfunding platforms, even if direct property purchase isn’t feasible. - How long should I plan to keep my $10,000 invested?

For optimal growth, aim to invest for at least 5-10 years, especially in stock-based investments.