Integrating API trading with FTX Holdings offers traders and investors a powerful way to automate their cryptocurrency trading strategies and access advanced features of the FTX exchange programmatically. By leveraging FTX’s robust API, users can execute trades, manage orders, access market data, and implement complex trading algorithms with precision and speed. This comprehensive guide will walk you through the process of integrating API trading with FTX Holdings, exploring key concepts, implementation strategies, and important considerations for successful automated trading.

| Key Concept | Description/Impact |

|---|---|

| API Integration | Allows programmatic access to FTX exchange features, enabling automated trading and data retrieval |

| Authentication | Secure API key and secret management for authorized access to FTX account |

| Order Execution | Ability to place, modify, and cancel orders programmatically |

| Market Data Access | Real-time retrieval of price, volume, and order book information |

| Risk Management | Implementing automated risk controls and position management |

Market Analysis and Trends

The cryptocurrency market has seen a surge in automated trading strategies, with API integration becoming increasingly crucial for serious traders and investors. FTX, as one of the leading cryptocurrency derivatives exchanges, has positioned itself at the forefront of this trend by offering a comprehensive and well-documented API.

Recent market data indicates that over 60% of trading volume on major cryptocurrency exchanges is now generated by algorithmic trading bots. This shift towards automation has been driven by the need for faster execution, 24/7 market monitoring, and the ability to capitalize on small price movements across multiple markets simultaneously.

FTX’s market share has grown significantly, with daily trading volumes often exceeding $10 billion. The exchange’s focus on innovative products like leveraged tokens and prediction markets has attracted a diverse user base, many of whom are looking to integrate API trading to take full advantage of these unique offerings.

Implementation Strategies

To successfully integrate API trading with FTX Holdings, follow these key implementation strategies:

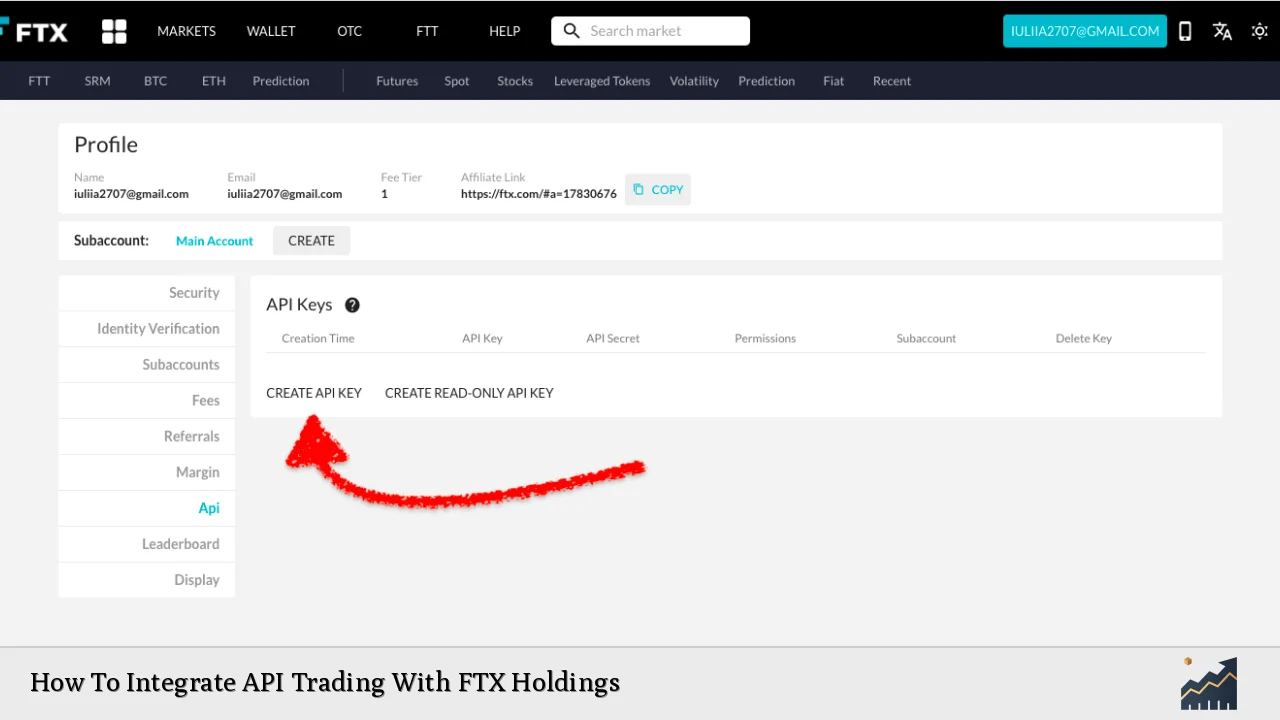

1. API Key Generation and Management

Begin by generating API keys through your FTX account settings. It’s crucial to manage these keys securely:

- Create separate API keys for different purposes (e.g., trading, data retrieval)

- Implement IP whitelisting for added security

- Regularly rotate API keys to minimize risk

2. Choose a Programming Language and Library

FTX supports multiple programming languages. Popular choices include:

- Python (using the ccxt library or FTX’s official Python client)

- JavaScript (Node.js with the ftx-api-ws library)

- Go (with the go-ftx library)

Select a language and library that aligns with your team’s expertise and project requirements.

3. Establish a Secure Connection

Implement secure WebSocket connections for real-time data and REST API calls for order management:

import ftx

client = ftx.FtxClient(api_key='your_api_key', api_secret='your_api_secret')4. Implement Order Execution Logic

Develop robust order execution functions that handle various order types:

def place_order(market, side, price, size, type='limit'):

try:

return client.place_order(market, side, price, size, type)

except Exception as e:

print(f"Error placing order: {e}")

return None5. Integrate Real-time Market Data

Set up WebSocket connections to receive live market data:

async def subscribe_to_ticker(market):

async with websockets.connect('wss://ftx.com/ws/') as websocket:

await websocket.send(json.dumps({

'op': 'subscribe',

'channel': 'ticker',

'market': market

}))

while True:

response = await websocket.recv()

print(response)6. Implement Risk Management Controls

Develop automated risk management features:

- Set maximum position sizes

- Implement stop-loss and take-profit orders

- Monitor account balance and margin levels

7. Backtesting and Optimization

Before live trading, thoroughly backtest your strategies using historical data available through the FTX API. Optimize parameters based on backtesting results to improve strategy performance.

Risk Considerations

When integrating API trading with FTX Holdings, it’s crucial to be aware of and mitigate various risks:

Market Risks: Cryptocurrency markets are highly volatile. Implement robust risk management strategies, including position sizing and stop-loss orders.

Technical Risks: API failures, network issues, or bugs in your trading algorithm can lead to unexpected losses. Implement error handling, logging, and alerting systems.

Security Risks: Protect your API keys and implement multi-factor authentication. Regularly audit your system for potential vulnerabilities.

Regulatory Risks: Stay informed about changing regulations in your jurisdiction regarding cryptocurrency trading and automated systems.

Liquidity Risks: Be cautious when trading illiquid markets or placing large orders that may significantly impact the market.

Regulatory Aspects

The regulatory landscape for cryptocurrency trading and API integration is complex and evolving. Key considerations include:

- Compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations

- Adherence to tax reporting requirements in your jurisdiction

- Awareness of restrictions on algorithmic trading in certain markets

- Understanding of the legal implications of operating an automated trading system

It’s advisable to consult with legal experts familiar with cryptocurrency regulations in your region to ensure compliance.

Future Outlook

The future of API trading with FTX Holdings looks promising, with several trends shaping the landscape:

Advanced AI Integration: Machine learning models are increasingly being used to optimize trading strategies and predict market movements.

Decentralized Finance (DeFi) Integration: FTX has shown interest in integrating with DeFi protocols, which could open up new opportunities for API traders.

Cross-Exchange Arbitrage: As FTX expands its offerings, API traders will likely develop more sophisticated arbitrage strategies across different products and exchanges.

Regulatory Technology: The development of RegTech solutions to help API traders comply with evolving regulations automatically.

Institutional Adoption: As more institutional investors enter the cryptocurrency space, we can expect increased demand for professional-grade API trading solutions.

In conclusion, integrating API trading with FTX Holdings offers significant opportunities for traders to automate and optimize their cryptocurrency trading strategies. By following best practices for implementation, managing risks effectively, and staying informed about regulatory requirements, traders can leverage FTX’s powerful API to potentially enhance their trading performance and efficiency in the dynamic cryptocurrency markets.

Frequently Asked Questions About How To Integrate API Trading With FTX Holdings

- What are the main benefits of using FTX’s API for trading?

FTX’s API offers benefits such as faster execution, the ability to automate complex trading strategies, access to real-time market data, and the potential for 24/7 trading without manual intervention. - How secure is API trading on FTX?

FTX implements robust security measures, including API key encryption, IP whitelisting, and withdrawal limits. However, users must also practice good security hygiene, such as protecting their API keys and implementing their own security measures. - Can I use FTX’s API for both spot and derivatives trading?

Yes, FTX’s API supports both spot and derivatives trading, allowing users to access a wide range of products including futures, options, and leveraged tokens. - What programming languages are supported for FTX API integration?

FTX’s API can be accessed using various programming languages, with popular choices including Python, JavaScript (Node.js), and Go. There are also community-developed libraries available for other languages. - Are there rate limits for API requests on FTX?

Yes, FTX implements rate limits to prevent abuse. These limits vary depending on the endpoint and the user’s account tier. It’s important to review the API documentation for specific rate limit information and implement appropriate handling in your code. - How can I test my API trading strategy before going live?

FTX offers a testnet environment where you can test your API integration and trading strategies using simulated funds. This allows for thorough testing without risking real capital. - What should I do if I encounter errors or unexpected behavior when using the FTX API?

If you encounter issues, first check the API documentation and ensure you’re using the latest version of the API. FTX also provides support channels where you can seek assistance for persistent problems. Additionally, implementing robust error handling and logging in your code can help diagnose and resolve issues quickly.