Identifying growth stocks in the current stock market requires a strategic approach that combines market analysis, financial metrics, and an understanding of industry trends. Growth stocks are shares in companies expected to grow at an above-average rate compared to their industry or the overall market. These stocks often reinvest earnings into expansion, research and development, or other growth initiatives rather than paying dividends. As of December 2024, the landscape for growth investing is shaped by various economic factors, including interest rates, inflation, and technological advancements.

| Key Concept | Description/Impact |

|---|---|

| Market Trends | Current trends indicate a shift towards technology and healthcare sectors as primary drivers of growth. |

| Financial Metrics | Key metrics for identifying growth stocks include revenue growth rates, earnings per share (EPS) growth, and price-to-earnings (P/E) ratios. |

| Risk Assessment | Growth stocks carry higher risks due to potential volatility and market fluctuations. |

| Regulatory Environment | Investors must be aware of regulations affecting specific sectors, especially technology and healthcare. |

| Future Outlook | The outlook for growth stocks remains positive with expected advancements in AI, biotech, and renewable energy. |

Market Analysis and Trends

The current stock market is characterized by significant volatility influenced by macroeconomic factors such as interest rates and inflation. In 2024, the technology sector has shown remarkable resilience, outperforming traditional sectors. The Nasdaq Composite has reached new heights, driven by innovations in artificial intelligence (AI) and other tech advancements. Notably, companies like Nvidia and Tesla have seen substantial stock price increases due to their leadership in AI and electric vehicles.

Key Industry Drivers

- Technology: The tech sector continues to dominate growth stock performance. Companies involved in cloud computing, AI, and cybersecurity are particularly well-positioned.

- Healthcare: With an aging population and increasing healthcare spending projected to reach 20% of U.S. GDP by 2028, biotech firms are also emerging as strong growth candidates.

- Renewable Energy: As global demand for sustainable solutions rises, companies focused on renewable energy technologies are gaining traction.

Implementation Strategies

To effectively identify growth stocks, investors should employ a systematic approach:

- Stock Screening: Utilize stock screeners available on platforms like Yahoo Finance or Google Finance to filter stocks based on specific criteria such as EPS growth rates above 15% and revenue growth exceeding 20%.

- Financial Health Assessment: Focus on companies with strong balance sheets. Look for low debt-to-equity ratios and positive cash flow metrics.

- Valuation Metrics: While growth stocks often trade at high P/E ratios, it’s crucial to consider the PEG ratio (Price/Earnings to Growth). A PEG ratio below 1 indicates that a stock may be undervalued relative to its growth potential.

- Market Sentiment Analysis: Monitor market sentiment through news articles and analyst reports to gauge investor confidence in potential growth stocks.

- Technical Analysis: Use technical indicators such as moving averages and relative strength index (RSI) to identify entry points for buying shares.

Risk Considerations

Investing in growth stocks comes with inherent risks:

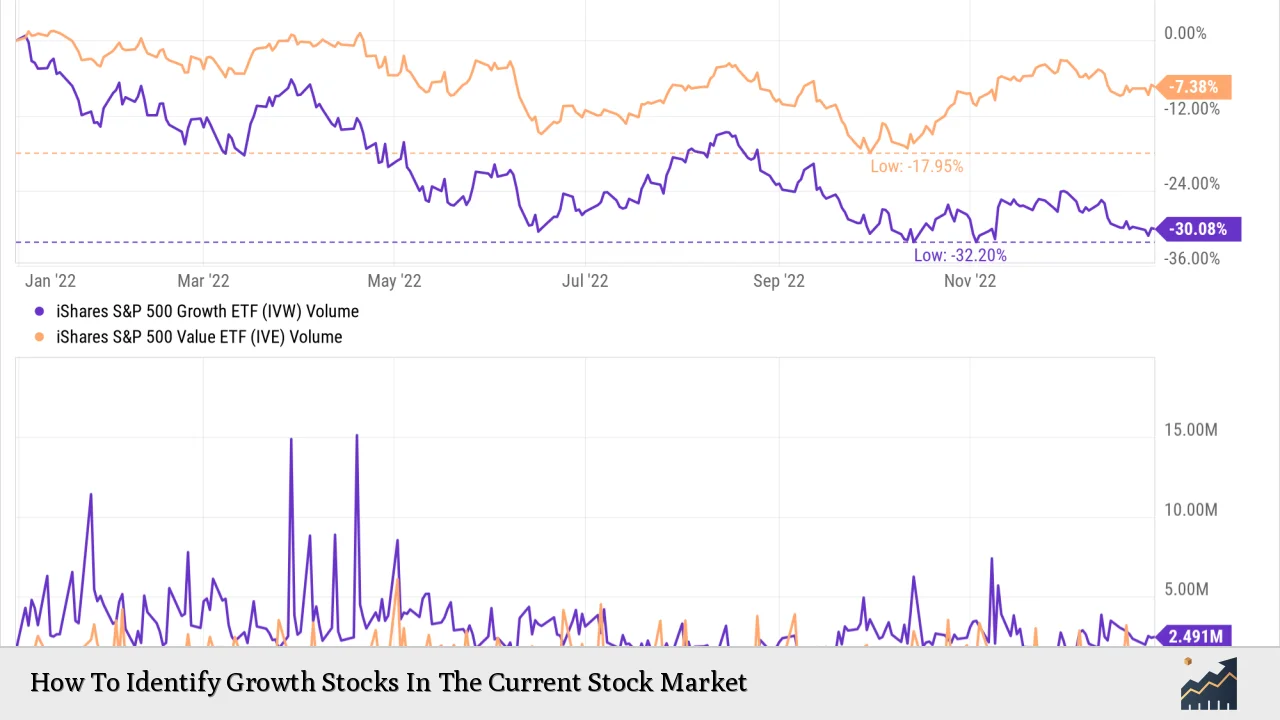

- Market Volatility: Growth stocks can be more volatile than value stocks. Sudden market downturns can lead to significant declines in stock prices.

- Overvaluation Risk: Many growth stocks trade at high valuations based on future earnings expectations. If these expectations are not met, it can lead to sharp corrections.

- Sector-Specific Risks: Regulatory changes can impact sectors like technology and healthcare significantly. Investors should stay informed about relevant legislation that could affect their investments.

Regulatory Aspects

Understanding the regulatory environment is essential for investors looking at growth stocks:

- Technology Regulations: Increased scrutiny from regulatory bodies regarding data privacy and antitrust issues can impact tech companies’ operations and profitability.

- Healthcare Regulations: Changes in healthcare policies or drug approval processes can affect biotech firms’ ability to bring products to market.

Investors should regularly review updates from regulatory bodies such as the SEC for insights into compliance requirements that could influence their investments.

Future Outlook

The outlook for growth stocks remains optimistic as several trends emerge:

- Technological Advancements: Continued innovation in AI, machine learning, and automation is expected to drive significant revenue growth for tech companies.

- Sustainability Initiatives: Companies focusing on green technologies are likely to benefit from increased investment as global awareness of climate change grows.

- Healthcare Innovations: The demand for advanced medical treatments will continue to rise, providing opportunities for biotech firms that can deliver effective solutions.

The combination of these factors suggests that while risks exist, the potential rewards from investing in well-selected growth stocks could be substantial.

Frequently Asked Questions About How To Identify Growth Stocks In The Current Stock Market

- What are the key indicators of a growth stock?

Key indicators include high revenue growth rates (typically over 20%), strong EPS growth (15% or more), low debt levels, and high P/E ratios relative to industry peers. - How do I screen for potential growth stocks?

You can use online stock screeners to filter stocks based on criteria like EPS growth rates, revenue increases, trading volume above 300,000 shares per day, and market capitalization above $300 million. - Are all high P/E ratio stocks considered growth stocks?

No, while many growth stocks have high P/E ratios due to anticipated earnings increases, not all high P/E ratio stocks are necessarily good investments; some may be overvalued. - What sectors currently offer the best opportunities for growth?

The technology sector (especially AI), healthcare (biotech), and renewable energy sectors are currently considered the most promising for growth investments. - How important is market sentiment when investing in growth stocks?

Market sentiment plays a crucial role; positive news or developments can significantly boost stock prices while negative sentiment can lead to declines. - What risks should I consider when investing in growth stocks?

The main risks include market volatility, overvaluation concerns, sector-specific regulatory risks, and economic downturns that could impact sales. - Should I invest in dividend-paying stocks instead of growth stocks?

This depends on your investment strategy; dividend-paying stocks provide income but may not offer the same capital appreciation potential as growth stocks. - When should I sell my growth stock?

You should consider selling if the company’s fundamentals deteriorate significantly or if it becomes overvalued compared to its peers without justifiable future earnings potential.

By leveraging these strategies and insights into current market dynamics, investors can enhance their ability to identify promising growth stocks amidst evolving economic conditions.